Market Overview

The Malaysia Anti-Inflammatory Topical Creams Market is valued at USD ~ million, based on a five-year historical analysis of the topical therapeutics and OTC dermatology segment. Growth is supported by rising sales of pain-relief formulations, with IQVIA reporting an increase from USD 132 million to USD 143 million in topical analgesic and anti-inflammatory sales between 2023 and 2024. Demand is driven by higher musculoskeletal disorder cases, increased sports participation, and growing consumer preference for non-oral pain-management alternatives.

Kuala Lumpur, Selangor, Penang, and Johor dominate the Malaysia Anti-Inflammatory Topical Creams Market due to higher urban income levels, strong retail pharmacy penetration, and larger concentrations of hospitals and sports medicine centers. These regions also house the country’s largest private healthcare networks and physiotherapy clinics, which drive higher prescriptions for both NSAID-based and corticosteroid topical products. Their dense populations and strong consumer health awareness reinforce their leadership in demand and product adoption.

Market Segmentation

By Drug Class

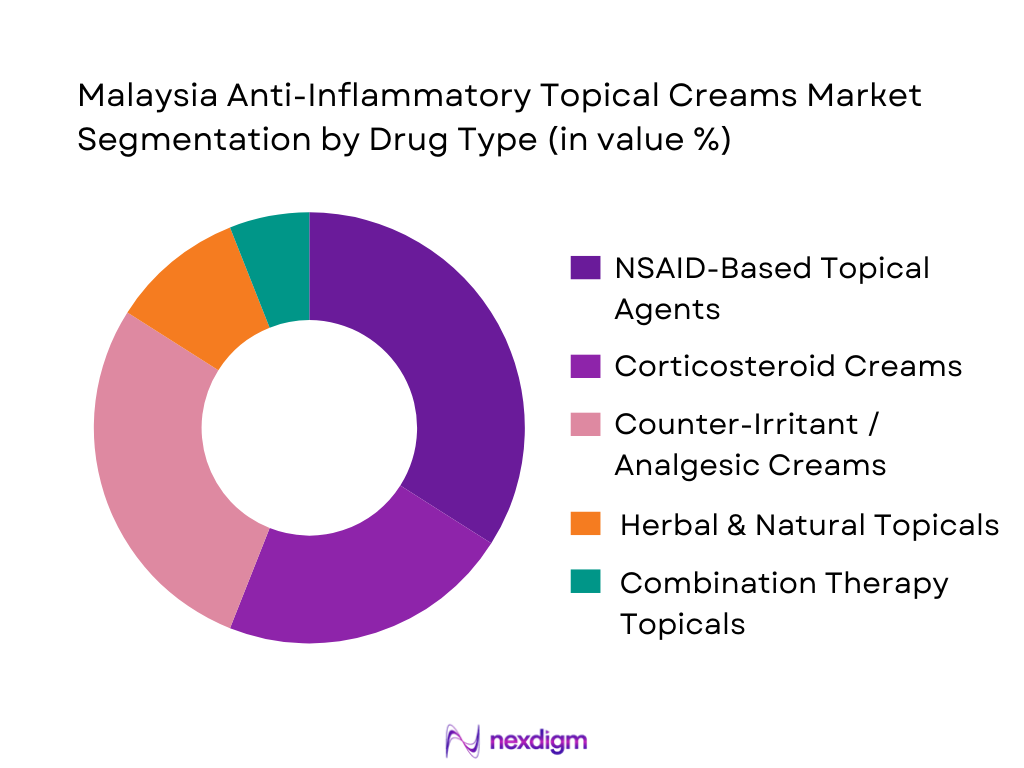

NSAID-based topical agents form the dominant drug class in the Malaysia Anti-Inflammatory Topical Creams Market due to their wide therapeutic relevance, especially for acute pain, sports injuries, and musculoskeletal inflammation. These formulations—such as diclofenac and ketoprofen—are frequently recommended by physiotherapists and general practitioners due to their proven clinical efficacy and strong safety profile compared to oral NSAIDs. Their OTC availability at retail pharmacies like Watsons, Caring, and Guardian ensures high accessibility, particularly in urban regions with busy lifestyles. Additionally, Malaysia’s rising participation in recreational sports has increased demand for fast-acting topical NSAIDs, with NPRA records showing higher product registrations in this category over the past three years. The combination of strong clinical preference, widespread acceptance, and versatile application drives this segment’s leading position.

By Application Area

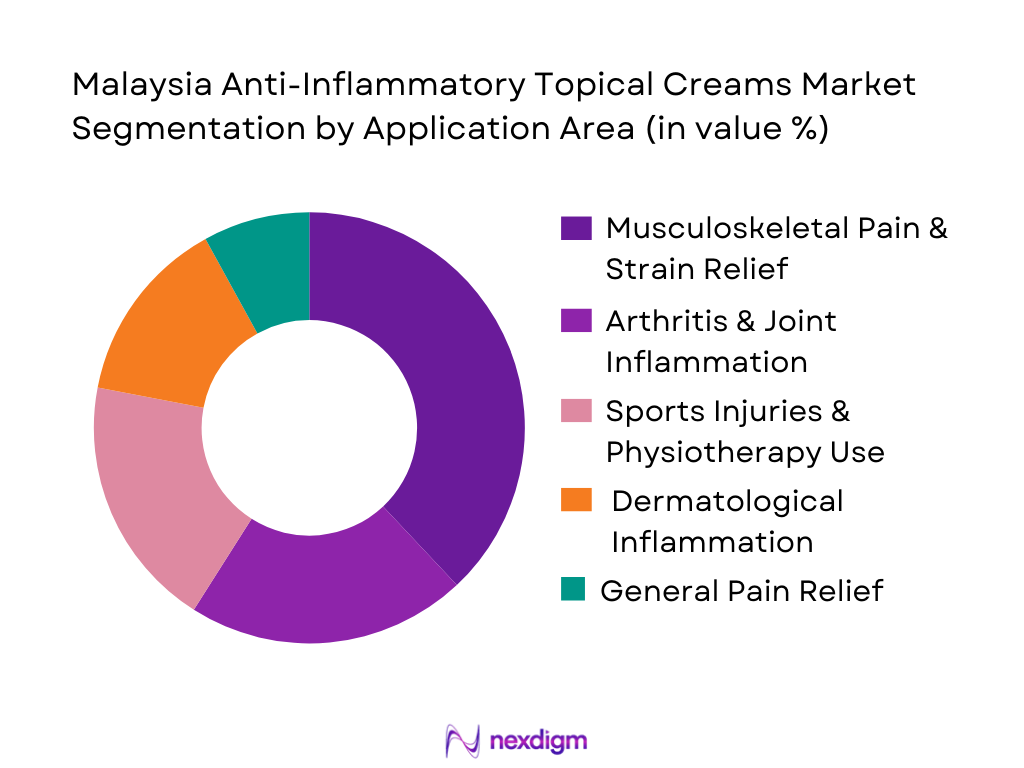

Musculoskeletal pain and strain relief remains the leading application segment in the Malaysia Anti-Inflammatory Topical Creams Market driven by high prevalence of occupational strain injuries and lifestyle-related disorders. Malaysia’s labor force includes over 8.8 million working individuals engaged in physically intensive jobs such as manufacturing, logistics, and construction, contributing to frequent muscle and joint discomfort. WHO South-East Asia health statistics also indicate rising sedentary lifestyle patterns, increasing the incidence of back and neck pain among office workers. As a result, fast-relief topical formulations—NSAIDs, counter-irritants, and analgesic creams—are widely preferred as first-line interventions. Extensive retail pharmacy presence in key cities further supports the segment’s accessibility, making musculoskeletal pain management the dominant use-case across the country.

Competitive Landscape

The Malaysia Anti-Inflammatory Topical Creams Market is characterized by strong competition among global pharmaceutical companies and established regional brands. Multinationals such as GSK, Bayer, and Johnson & Johnson retain significant influence due to their physician-trusted formulations and extensive distribution networks, while local players like Hovid and Kotra Pharma leverage affordability and herbal alternatives to penetrate rural and mid-income markets. This multi-tiered structure creates a balanced competitive environment with both premium and value-based product offerings.

| Company | Year of Establishment | Headquarters | Key Parameters 1 | Key Parameters 2 | Key Parameters 3 | Key Parameters 4 | Key Parameters 5 | Key Parameters 6 |

| GSK | 2000 (Malaysia ops) | Selangor | ~ | ~ | ~ | ~ | ~ | ~ |

| Bayer Healthcare | 1995 (MY ops) | Kuala Lumpur | ~ | ~ | ~ | ~ | ~ | ~ |

| Johnson & Johnson | 1986 (MY ops) | Selangor | ~ | ~ | ~ | ~ | ~ | ~ |

| Hovid Berhad | 1945 | Perak | ~ | ~ | ~ | ~ | ~ | ~ |

| Kotra Pharma | 1982 | Malacca | ~ | ~ | ~ | ~ | ~ | ~ |

Malaysia Anti-inflammatory Topical Creams Market Analysis

Growth Drivers

Rising Musculoskeletal Disorders & Occupational Injuries

Malaysia’s anti-inflammatory topical creams demand is structurally underpinned by a large and physically active workforce exposed to repetitive strain and acute injuries. National occupational accident statistics report over 21,500 recorded occupational injuries in one year, with manufacturing, services, construction and wholesale/retail among the most affected sectors, reflecting the physical nature of many Malaysian jobs.At the same time, Malaysia’s population has reached about 35.6 million people, expanding the absolute base of workers and older adults at risk of chronic musculoskeletal pain. These structural factors translate into steady, recurring demand for topical anti-inflammatory creams used for sprains, back pain, tendonitis and joint discomfort in both blue-collar and service occupations.

Growing Sports & Fitness Activity Participation

Malaysia’s expanding sports and fitness culture is a direct volume driver for anti-inflammatory topical creams used for muscle soreness, sports injuries and post-workout recovery. The Malaysian Sports Culture Index 2022 (MSCI’22) score of 52.0 shows a “moderate” but broad-based sports culture, while survey data indicate 48% of Malaysians engage in sports, exercise and recreation, with 52% still inactive.When this participation is applied to a national population of around 35.6 million people, it implies millions of active individuals who are routinely exposed to minor sprains, strains and soft-tissue injuries, sustaining demand for OTC topical anti-inflammatory gels, creams and sprays around gyms, futsal courts, running clubs and school sports.

Market Challenges

Increasing Competition from Low-Cost Generics

Price competition is intense as Malaysia has a dense base of local manufacturers focused on generics and traditional medicines. Investment and industry briefs indicate more than 275 licensed pharmaceutical manufacturers, of which 176 (about two-thirds) produce traditional medicines and health supplements, while 88 are conventional pharmaceutical producers and 11 manufacture veterinary products.Many of these companies prioritise generic formulations, including non-branded topical anti-inflammatory creams, creating downward pressure on prices and margins for branded multinational products. The availability of low-cost generics in community pharmacies and klinik runcit, often bundled with aggressive discounts and doctor-dispensing practices, forces premium brands to differentiate via superior evidence, faster onset of action, skin-friendly excipients and halal credentials rather than purely on price.

Product Safety and Skin-Sensitivity Compliance Requirements

Stringent safety and skin-sensitivity compliance is a rising barrier, especially for products positioned as cosmetics or quasi-medicinal topical preparations. Malaysia’s pharmacovigilance centre processed 30,491 ADR/AEFI reports in a single year, with 26,064 reports originating from public facilities, illustrating how closely regulators and hospitals monitor safety signals across all dosage forms, including topical preparations. Parallel cosmetic surveillance shows the National Pharmaceutical Regulatory Agency (NPRA) receiving 1,041 complaints about cosmetic products in one recent year, reflecting ongoing issues with irritation, undeclared active ingredients and non-compliance. For anti-inflammatory topical creams, this means tight scrutiny of corticosteroid potency, NSAID concentrations, preservatives, fragrances and prohibited ingredients under updated cosmetic and drug guidelines, increasing compliance costs and registration lead times, particularly for multi-herb or combination formulations.

Market Opportunities

Halal-Certified Anti-Inflammatory Topical Products

Malaysia’s demographic and trade profile creates a powerful runway for halal-certified anti-inflammatory topical creams. Muslims account for about 63.5% of the population, with recent estimates indicating around 22.4 million Muslim adherents in a national population of roughly 35.6 million people. At the same time, Malaysia’s halal exports reached USD 24.4 billion, underscoring the scale of demand for halal-compliant food, pharmaceuticals and personal-care products across global markets.With established national standards for halal pharmaceuticals and cosmetics and strong promotion from agencies like JAKIM and HDC, companies that develop halal-certified anti-inflammatory creams with compliant excipients, animal-free ingredients and syariah-approved manufacturing have a structural opportunity to serve both domestic Muslim consumers and export markets across the Organisation of Islamic Cooperation (OIC) and beyond.

Plant-Based & Natural Anti-Inflammatory Innovations

Strong cultural acceptance of traditional medicine and the rapid expansion of Malaysia’s halal and natural products industries create fertile ground for plant-based anti-inflammatory topical innovations. The Ministry of Health reports 27,533 registered traditional medicines, with NPRA approving 600–700 additional traditional products each year, signalling sustained consumer trust in herbal remedies. Industry analyses of new health supplements show 527 supplements registered in one year, of which 322 (61%) are manufactured locally, reinforcing Malaysia’s capabilities in botanical extraction, formulation and contract manufacturing. In parallel, Malaysia’s halal industry recorded USD 24.4 billion in halal exports, reflecting strong global appetite for Shariah-compliant, “clean-label” products. For topical anti-inflammatory creams, this opens opportunities to develop clinically-validated formulations based on local botanicals (e.g., tongkat ali, centella, turmeric) that combine modern dermatological science with traditional knowledge, differentiated by safety profiles, minimal preservatives and clear halal and natural positioning.

Future Outlook

Over the next five years, the Malaysia Anti-Inflammatory Topical Creams Market is expected to demonstrate steady expansion driven by increasing adoption of non-invasive pain management solutions, rising musculoskeletal and sports-related injuries, higher healthcare spending, and a growing elderly population. In addition, the shift toward herbal, steroid-sparing, and fast-absorption formulations is likely to stimulate product innovation. Retail pharmacies and e-commerce platforms will continue to strengthen product accessibility, supporting demand across both urban and semi-urban regions.

Major Players

- GSK

- Novartis

- Bayer Healthcare

- Pfizer

- Johnson & Johnson

- Sanofi

- Himalaya Wellness

- Tiger Balm (Haw Par Corporation)

- Mentholatum Malaysia (Rohto)

- Hovid Berhad

- Cosmoderm Malaysia

- Apex Pharma Malaysia

- SM Pharmaceuticals

- DKSH Malaysia

- Kotra Pharma

Key Target Audience

- Pharmaceutical Manufacturers

- OTC Healthcare Product Companies

- Retail & Hospital Pharmacy Chains

- Sports Medicine Centers & Physiotherapy Clinics

- Consumer Healthcare Product Importers

- Investment and Venture Capitalist Firms

- Government & Regulatory Bodies (NPRA, Ministry of Health Malaysia)

- E-Commerce Healthcare Retail Platforms

Research Methodology

Step 1: Identification of Key Variables

The research process begins with mapping all relevant stakeholders in the Malaysia Anti-Inflammatory Topical Creams Market, including manufacturers, importers, retail chains, dermatology clinics, and regulatory bodies. Using secondary data from WHO, World Bank, NPRA, and IQVIA, core market variables are identified, such as drug class performance, consumer usage frequency, and therapeutic demand patterns.

Step 2: Market Analysis and Construction

Historical market data for topical pain-relief and anti-inflammatory products is consolidated from retail audits, NPRA product registration archives, and OTC sales dashboards. Key parameters evaluated include product penetration, the ratio of OTC to prescription sales, and pharmacy-level stocking intensity. These insights support the construction of a bottom-up market size model aligned with consumption trends and distribution volumes.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses related to market growth, therapeutic preference, and pricing sensitivity are validated through CATI interviews with dermatologists, physiotherapists, and retail pharmacy managers. Their operational insights help refine the demand estimation for NSAIDs, corticosteroids, and herbal formulations. These consultations also highlight real-world product selection behavior and consumer purchasing patterns.

Step 4: Research Synthesis and Final Output

The final step synthesizes all validated data into a coherent market model, incorporating product-level performance, consumer behavior trends, and competitive benchmarks. Multiple cross-checks with manufacturer disclosures ensure accuracy. This triangulated approach produces a reliable and holistic understanding of the Malaysia Anti-Inflammatory Topical Creams Market and establishes a credible foundation for forecasting and strategic recommendations.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, In-Depth Interviews with Dermatologists & Retail Pharmacy Chains, Primary Research Framework, Data Triangulation, Limitations and Future Considerations)

- Definition and Scope

- Market Genesis and Evolution

- Regulatory Environment & Classification Pathway (NPRA registration, OTC vs Rx segmentation)

- Therapy Line Progression (First-line, Second-line, Adjunct Topical Therapies)

- Supply Chain & Value Chain Mapping (APIs → Manufacturers → Importers → Local Brands → Retail Pharmacies → Hospitals → Consumers)

- Ecosystem Mapping (Dermatology clinics, pharmacies, FMCG crossover players, e-commerce platforms)

- Pricing Architecture Overview (OTC, prescription, combination formulas)

- Growth Drivers

Rising Musculoskeletal Disorders & Occupational Injuries

Growing Sports & Fitness Activity Participation

High Prevalence of Chronic Conditions (Arthritis, Dermatitis)

Preference for Non-Oral Pain Relief Solutions - Market Challenges

Increasing Competition from Low-Cost Generics

Product Safety and Skin-Sensitivity Compliance Requirements

Quality Variations Among Herbal/Traditional Products

Limited Awareness of Correct Topical Usage Patterns - Market Opportunities

Halal-Certified Anti-Inflammatory Topical Products

Plant-Based & Natural Anti-Inflammatory Innovations

Sports-Focused Topical Pain Management Solutions

Digital Pharmacy Penetration & Telehealth Integration - Market Trends

Shift Toward Steroid-Sparing Formulations

Rapid Growth of Herbal & Ayurveda-Inspired Topicals

Clinical Preference for NSAID-Based Topicals Over Oral NSAIDs

Demand for Fast-Absorption, Non-Greasy Formulas - Regulatory Framework

NPRA Product Registration Guidelines

Import Licensing & GMP Compliance

OTC Dermatology Labeling & Advertising Rules - SWOT Analysis

- Stakeholder Ecosystem (Dermatologists, physiotherapists, sports centers, retail chains)

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price (OTC creams, prescription anti-inflammatory creams, combination formulations), 2019-2024

- By Drug Class (In Value %)

Non-Steroidal Anti-Inflammatory Agents (NSAIDs topicals)

Corticosteroid Topical Creams

Counter-Irritant / Analgesic Creams

Herbal & Natural Anti-Inflammatory Formulations

Combination Anti-Inflammatory Therapies - By Application Area (In Value %)

Musculoskeletal Pain & Strain Relief

Arthritis & Joint-Related Inflammation

Sports Injury & Physiotherapy Care

Dermatitis, Eczema & Skin Inflammation

General Pain Relief & Daily Use - By End-User (In Value %)

Individual Consumers / Household Use

Hospitals & Clinics

Dermatology Centers

Sports Medicine & Physiotherapy Facilities

OTC Retail Consumers through Pharmacy Chains - By Distribution Channel (In Value %)

Retail Pharmacies

Hospital Pharmacies

Independent Medical Stores

E-Commerce & Online Pharmacies

Supermarket / Hypermarket Personal Care Aisles - By Formulation Type (In Value %)

Creams

Gels

Ointments

Sprays & Roll-Ons

Patches & Novel Delivery Systems

- Market Share of Major Players (Value/Volume)

- Cross-Comparison Parameters (Formulation Innovation Score, Therapeutic Breadth, Retail Pharmacy Penetration Depth, Herbal/Natural Portfolio Strength, Sports Medicine & Physiotherapy Partnerships, Brand Trust Index Among Dermatologists, Digital/E-Commerce Share, Regulatory Compliance Strength (NPRA Readiness & Filing Speed))

- SWOT Analysis of Major Players

- SKU-Level Pricing Analysis (Creams, gels, sprays, ointments)

- Detailed Profiles of 15 Major Companies

GSK

Novartis

Bayer Healthcare

Pfizer

Johnson & Johnson

Sanofi

Himalaya Wellness

Tiger Balm / Haw Par Corporation

Mentholatum Malaysia (Rohto)

Hovid Berhad

Cosmoderm Malaysia

Apex Pharma Malaysia

SM Pharmaceuticals Malaysia

DKSH Malaysia (Imported Brands Portfolio)

Kotra Pharma

- Demand Drivers & Usage Frequency

- Budget Allocation & Purchase Motivation

- Preference for OTC vs Prescription

- End-User Awareness & Information Journey

- Decision-Making Process Mapping

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030