Market Overview

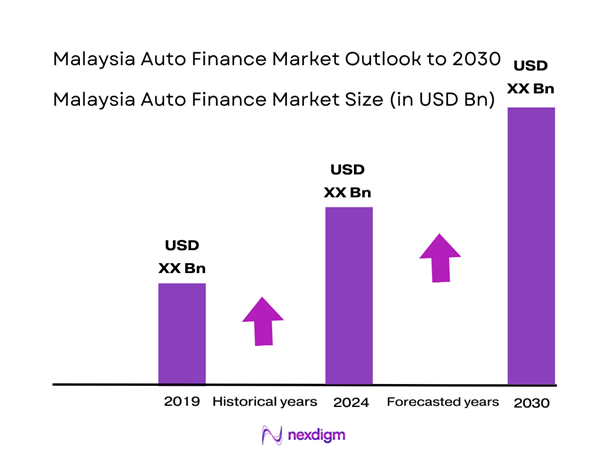

The Malaysia Auto Finance Market is valued at approximately USD 2.6 billion in 2024 with an approximated compound annual growth rate (CAGR) of 4.5% from 2024-2030, driven primarily by increasing vehicle ownership and a robust banking infrastructure offering various financing options. The demand for auto financing has been further fueled by governmental policies promoting affordable vehicle ownership and growth in disposable income among consumers.

Cities such as Kuala Lumpur, Penang, and Johor Bahru dominate the auto finance market due to their significant urban populations and economic activities. Kuala Lumpur, as the capital city, hosts numerous financial institutions and has excellent connectivity, making it a hub for car dealerships and finance companies. Penang and Johor Bahru exhibit high vehicle registration rates driven by manufacturing sectors and rapidly growing middle-class consumers, making these regions crucial to the overall market landscape.

Urbanization in Malaysia continues to rise sharply, with urban areas projected to house 80% of the population by end of 2025. This urban migration is resulting in greater mobility needs, creating a significant demand for personal vehicles to navigate urban congestion. The urban population is expected to increase by approximately 2.5 million people from 2022 to 2025, further escalating the need for accessible auto financing options as more individuals seek ownership of private vehicles.

Market Segmentation

By Financing Type

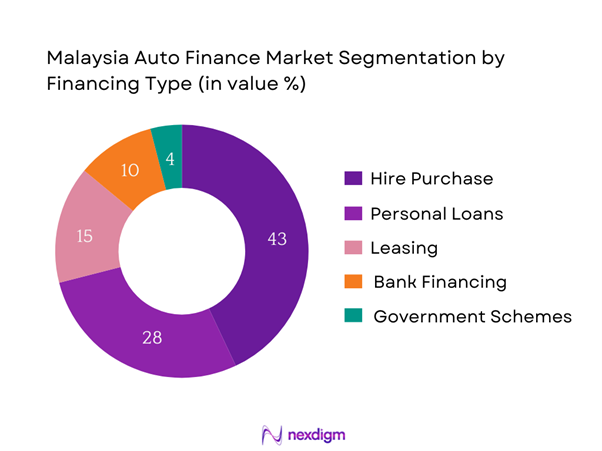

The Malaysia Auto Finance market is segmented by financing type into Hire Purchase, Personal Loans, Leasing, Bank Financing, and Government Schemes. The Hire Purchase segment is currently dominating the market share owing to its widespread acceptance among consumers and its accessibility for those seeking to purchase vehicles without hefty upfront payments. This financing type allows consumers to make monthly instalments, making vehicle ownership financially viable even for those with limited savings. Additionally, the existing partnerships between leading banks and automotive companies further bolster this segment’s dominance by promoting attractive offers and flexible terms.

By Vehicle Type

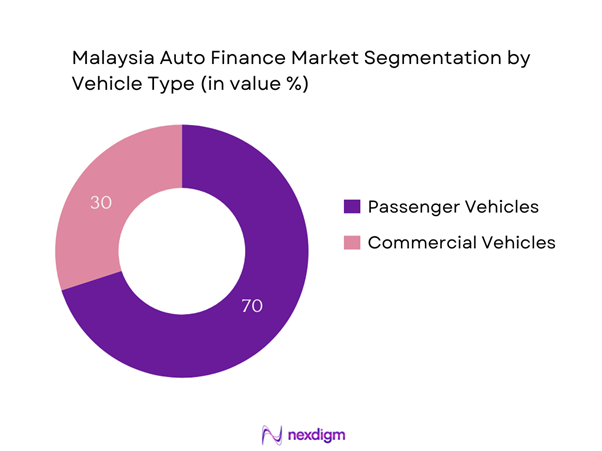

The market is also segmented by vehicle type into Passenger Vehicles and Commercial Vehicles. The Passenger Vehicles segment holds a significant market share due to the increasing trend of personal mobility and urbanization among the Malaysian population. The rising middle class, coupled with a growing preference for personal vehicles over public transport, is driving demand in this segment. Additionally, enticing financing options offered by banks and financial institutions for passenger vehicles contribute to accelerated sales, reinforcing its leadership within the auto finance market.

Competitive Landscape

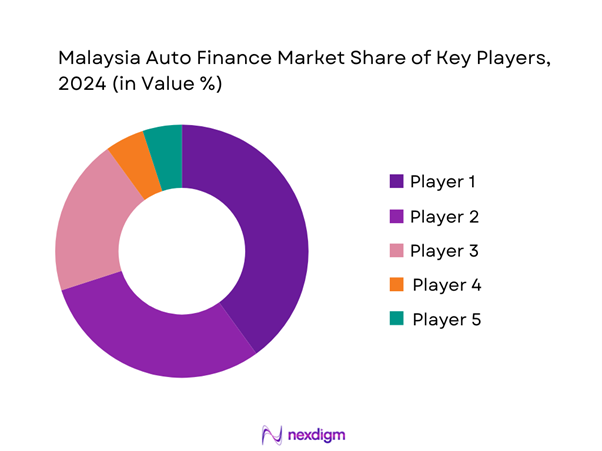

The Malaysia Auto Finance market is dominated by several key players, including prominent banks and financial service providers. The presence of major local and international banks strengthens competition and offers consumers a variety of financing options. The competitive landscape showcases a mix of local and international players who strive for excellence in customer service, competitive pricing, and innovative financing options. This competition not only benefits consumers but also promotes market growth as firms aim to capture a larger share

| Company | Establishment Year | Headquarters | Key Products | Market Focus | Unique Value Proposition |

| Maybank | 1960 | Kuala Lumpur | – | – | – |

| CIMB | 2003 | Kuala Lumpur | – | – | – |

| RHB | 1997 | Kuala Lumpur | – | – | – |

| Public Bank | 1966 | Kuala Lumpur | – | – | – |

| Bank Islam | 1987 | Kuala Lumpur | – | – | – |

Malaysia Auto Finance Market Analysis

Growth Drivers

Rising Vehicle Ownership

Vehicle ownership in Malaysia has been on a significant upward trajectory, with the total number of registered vehicles reaching approximately 32 million by the end of 2023. This growth is driven by rising disposable incomes and increased demand for private transportation, particularly in urban areas. The Malaysian Government has also implemented several initiatives aimed at promoting vehicle ownership, including tax incentives and subsidies, which have resulted in more families opting to buy cars rather than relying solely on public transport. As a result, the growing number of vehicles on the road is propelling the demand for auto finance.

Availability of Attractive Financing Offers

The landscape of auto finance in Malaysia is currently characterized by numerous attractive financing offers provided by financial institutions. As of 2023, lending conditions have become more favorable, with many banks offering competitive interest rates averaging around 3.5% to 4.0%, making vehicle loans more accessible. Additionally, facilitators in the auto financing space are leveraging technology to streamline the loan application process, significantly reducing approval times for consumers. This accessibility increases the likelihood of consumers opting for vehicle financing options, thereby reinforcing the relationship between financing availability and vehicle sales growth.

Market Challenges

Economic Fluctuations

Economic fluctuations pose a considerable challenge to the Malaysia auto finance market. The volatility in global oil prices could affect the overall economy, leading to uncertainty in consumer spending. The IMF has projected the growth of Malaysia’s economy to slow down to approximately 4.5% in 2024 due to ongoing external economic pressures. Such fluctuations in economic performance can lead to shifts in consumer confidence, reducing the propensity to take on new financing commitments. Consequently, tighter spending could adversely affect vehicle purchases and the overall auto finance landscape.

Regulatory Compliance

The regulatory landscape for the auto finance market in Malaysia can be complex, with multiple compliance requirements that financial institutions must meet. Regulatory frameworks are continually evolving to address consumer protection, anti-money laundering, and fair lending practices. For example, new guidelines implemented in 2023 by Bank Negara Malaysia emphasize responsible lending, impacting how banks assess creditworthiness and leading to longer processing times for loan approvals. These regulations, while necessary for market integrity, may impede loan accessibility for some consumers during a period of increasing demand.

Opportunities

Expansion of Digital Financing Solutions

The current market presents substantial opportunities for the expansion of digital financing solutions in the auto finance arena. The Malaysian population demonstrates high digital penetration, with approximately 88% of individuals using the internet as of 2023. Mobile applications and online financing platforms have become increasingly popular, offering consumers the convenience of applying for and managing auto loans directly from their devices. With the ongoing emphasis on technological innovation in banking, auto finance companies are well-positioned to capture a significant share of the market by enhancing their digital service offerings, catering to a tech-savvy audience.

Green Financing Initiatives

The shift toward sustainable practices presents an exciting opportunity for market growth through green financing initiatives, especially in the auto sector. With the Malaysian Government actively promoting electric vehicles (EVs), supported by incentives such as reduced tax rates and rebates, current figures indicate that registrations of electric vehicles increased by 300% in 2023 compared to 2022. Financial institutions can leverage this momentum by developing specialized financing products targeting EV buyers. These green initiatives not only meet government objectives for reducing emissions but also fulfill the growing consumer demand for eco-friendly transportation alternatives, further fueling market development.

Future Outlook

The Malaysia Auto Finance market is projected to experience significant growth in the coming years, driven by continuous government support for the automotive industry, advancements in digital financing technologies, and an increase in consumer demand for personal vehicles. Factors such as rising disposable incomes, changing lifestyles, and a focus on consumer-friendly financing packages are expected to further propel market activity. The shift towards sustainable transportation solutions and eco-friendly vehicles will also shape financing options available to consumers in the years to come.

Major Players

- Maybank

- CIMB

- RHB

- Bank Islam

- Public Bank

- UOB Malaysia

- Kenanga Investment Bank Berhad

- Hong Leong Bank

- Affin Bank

- Alliance Bank

- RHB Bank

- AmBank

- Citibank

- HSBC Malaysia

- OCBC Bank

Key Target Audience

- Investors and Venture Capitalist Firms

- Bank Executives

- Automotive Manufacturers

- Financial Institutions

- Government and Regulatory Bodies (Bank Negara Malaysia)

- Automotive Dealerships

- Insurance Providers

- Payment Processing Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Malaysia Auto Finance market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics and participant interactions.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Malaysia Auto Finance market. This includes assessing market penetration, the ratio of financing solutions to vehicle sales, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates and market projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies involved in auto finance. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple auto financing institutions to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Malaysia Auto Finance market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through Expert Interviews, Primary Research Approach, Limitations and Future Directions)

- Definition and Scope

- Market Evolution and Historical Context

- Key Trends and Developments Timeline

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Vehicle Ownership

Increasing Urbanization

Availability of Attractive Financing Offers - Market Challenges

Economic Fluctuations

Regulatory Compliance - Opportunities

Expansion of Digital Financing Solutions

Green Financing Initiatives - Trends

Shift to Eco-Friendly Vehicles

Growth of Peer-to-Peer Lending - Government Regulation

Financial Compliance Guidelines

Consumer Protection Laws - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Interest Rate, 2019-2024

- By Financing Type (In Value %)

Hire Purchase

– New Car Financing

– Used Car Financing

Personal Loans

– Secured Auto Loans

– Unsecured Auto Loans

Leasing

– Operating Lease

– Financial Lease

Bank Financing

– Fixed Interest Loans

– Floating Interest Loans

Government Schemes

– SME Auto Financing Support

– Low-Income Household Vehicle Financing

– Green Vehicle Incentive Schemes - By Vehicle Type (In Value %)

Passenger Vehicles

– Sedans

– SUVs

– Hatchbacks

– Electric Vehicles (EVs)

Commercial Vehicles

– Light Commercial Vehicles (LCVs)

– Heavy Commercial Vehicles (HCVs)

– Buses & Vans

– Fleet Vehicles - By Customer Demographics (In Value %)

Individual Customers

– Salaried Professionals

– Self-Employed Individuals

– First-Time Buyers

– Repeat Buyers

Corporate Clients

– Small & Medium Enterprises (SMEs)

– Large Corporations

– Government-Linked Companies (GLCs)

– Fleet Operators - By Region (In Value %)

Central Region

Northern Region

Southern Region

East Coast - By Financial Institution (In Value %)

Commercial Banks

– Local Banks (e.g., Maybank, CIMB)

– International Banks (e.g., HSBC, Standard Chartered)

Non-Banking Financial Companies

– Captive Finance Arms (e.g., Toyota Capital, Honda Financial Services)

– Independent Auto Financiers

Credit Unions

– Cooperative Societies

– Community-Based Lenders

- Market Share of Major Players by Value/Volume, 2024

Breakdown by Financing Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Innovation & Technology Adoption, Strengths and Weaknesses, Financial Health, Customer Reach, Product Offering, Operational Capacity, Distribution Channels, Regulatory Compliance and Risk Management)

- SWOT Analysis of Major Players

- Pricing Strategy Analysis for Major Players

- Detailed Profiles of Major Companies

Maybank

CIMB

RHB

Ambank

Bank Islam

Hong Leong Bank

Public Bank

Affin Bank

UOB Malaysia

OCBC Bank

KFH Malaysia

Bank Muamalat

Alliance Bank

Borneo Credit Sdn Bhd

CarSaver

- Demand Forecast by Segment

- Consumer Preferences

- Regulatory Impact on Financing Choices

- Pain Points of Consumers

- Lending Decision Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Interest Rate, 2025-2030