Market Overview

The Malaysia Building Materials Market is valued at USD 18.7 billion, driven by robust construction activities, heightened urbanization, and government initiatives aimed at infrastructural development. Key projects like the Klang Valley Mass Rapid Transit and various housing developments have significantly contributed to this substantial market size. The demand for cement, steel, and wood products remains particularly high, aligning with the ongoing economic growth and recovery post-pandemic.

Cities such as Kuala Lumpur, Johor Bahru, and Penang dominate the market due to their central roles in construction and real estate development. Kuala Lumpur, being the capital, attracts substantial investments and is the hub for major construction projects, while Johor Bahru benefits from its proximity to Singapore, leading to substantial demand for residential and commercial buildings. Penang’s heritage and ongoing development projects further reinforce its position as a critical player in the market.

The Malaysian government promotes initiatives aimed at boosting the building materials market, including the introduction of the National Development Planning Framework in 2023. This strategic framework is designed to facilitate sustainable growth and attract foreign investments in the construction sector, aiming for an inflow of USD 36 billion investments by end of 2025.

Market Segmentation

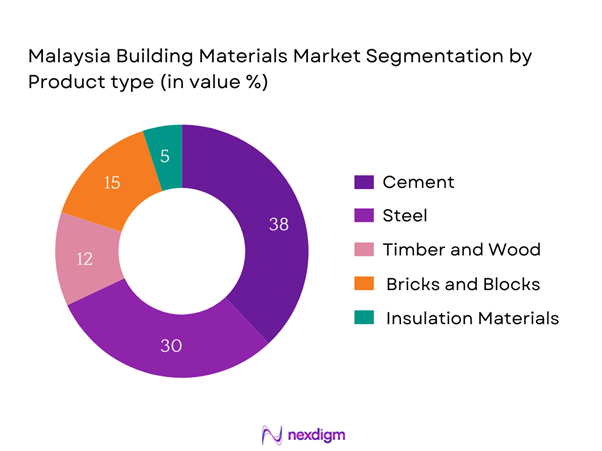

By Product Type

The Malaysia Building Materials Market is segmented by product type into cement, steel, timber and wood products, bricks and blocks, and insulation materials. Within this segmentation, cement has the dominant market share due to its integral role in construction projects. The high demand for cement is attributed to an increase in both residential and commercial construction activities, supported by government infrastructure projects and private investments. Major players, such as YTL Cement and Lafarge, have established a significant presence, ensuring supply consistency and meeting quality standards, further cementing the position of this sub-segment in the market.

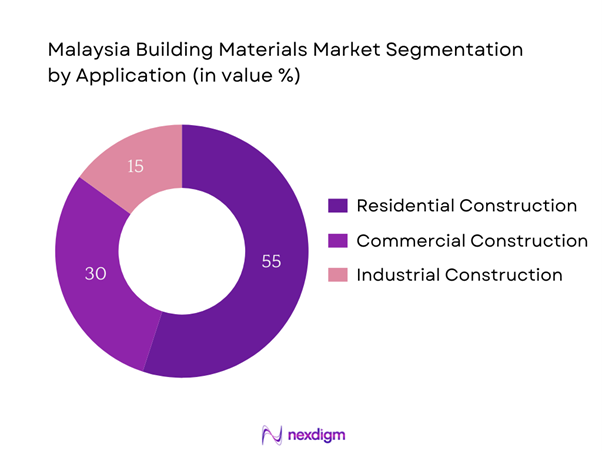

By Application

The market is also segmented by application into residential construction, commercial construction, and industrial construction. The residential construction sub-segment holds a significant market share, driven by thriving urbanization and an increasing population. With government incentives for affordable housing and the rise in property development activities, the residential sector is witnessing an accelerated growth trajectory. Developers and contractors are focusing on innovative building solutions, attracting buyers’ interest in new residential projects, thus solidifying the dominance of this sub-segment.

Competitive Landscape

The Malaysia Building Materials Market is dominated by several key players, each with significant influence over the sector. Companies like YTL Cement, Lafarge Malaysia, and Southern Steel lead the market, highlighting the consolidation of major manufacturers. This strong presence of established firms is critical in the competitive landscape, as it enables them to leverage economies of scale, access to distribution networks, and substantial capital for innovation and expansion.

| Company Name | Establishment Year | Headquarters | Product Range | Market Segment Focus | Annual Revenue | Distribution Channels |

| YTL Cement | 1955 | Kuala Lumpur | – | – | – | – |

| Lafarge Malaysia | 1950 | Petaling Jaya | – | – | – | – |

| Southern Steel | 1973 | Petaling Jaya | – | – | – | – |

| Press Metal Aluminium | 1972 | Selangor | – | – | – | – |

| Cahya Mata Sarawak Berhad | 1974 | Kuching | – | – | – | – |

Malaysia Building Materials Market Analysis

Growth Drivers

Increasing Infrastructure Development

The Malaysian government has invested heavily in infrastructure projects, committing approximately USD 45 billion to various initiatives from 2023 to 2025. This focus is evident in the construction of the East Coast Rail Link and the multi-billion-dollar Mass Rapid Transit (MRT) projects, which aim to enhance connectivity and urbanization across the country. Furthermore, Malaysia’s allocation for infrastructure spending is projected to reach about 14.8% of its total budget in 2023, underscoring the government’s determination to stimulate economic growth through infrastructural advancements. These investments enhance the demand for various building materials essential for construction.

Urbanization and Population Growth

Urbanization in Malaysia is accelerating, with the urban population projected to increase from approximately 76% in 2022 to around 78% by end of 2025, according to World Bank data. This urban growth correlates with a rising population, expected to exceed 34 million by end of 2025, resulting in increased demand for housing and commercial establishments. As cities expand, the need for sustainable and high-quality building materials becomes crucial to accommodate residential developments and urban infrastructure. The growing concentration of people in urban areas further drives the construction boom, intensifying the demand for essential building materials.

Market Challenges

Fluctuations in Raw Material Prices

The Malaysia Building Materials Market faces challenges arising from fluctuations in raw material prices, particularly for steel and cement. The prices for these materials have seen increases of up to 15% due to supply chain disruptions and geopolitical tensions affecting imports in the recent years. Furthermore, reports indicate that global prices for cement and steel are expected to remain volatile, contributing to uncertainty in project budgeting and profitability for construction firms. This instability poses risks for stakeholders across the supply chain in the building materials sector.

Competition and Market Saturation

The competition in the Malaysia Building Materials Market is intensifying, leading to market saturation in certain segments, primarily in urban centers. As of 2023, there are over 3,000 registered building material suppliers in Malaysia, resulting in significant competitive pressure and price wars. This oversaturation makes it challenging for new entrants to gain market footholds, as established players dominate the landscape with brand loyalty and extensive distribution networks. Such competition intensifies the struggle for market share, affecting profit margins across the industry.

Opportunities

Green Building Materials

The trend towards sustainability is opening significant opportunities in the green building materials segment. Currently, the global demand for sustainably sourced building materials is on the rise, with the Malaysian government aiming for 1,000 green building certifications by end of 2025 under its Green Building Index initiative. This shift towards environmentally friendly construction practices, supported by policy incentives, is generating favorable conditions for manufacturers that produce eco-friendly materials, positioning them to capture a growing segment of the market. Access to these materials can enhance building efficiency and align with the global sustainability agenda.

Technological Advancements

Technological innovation presents vast opportunities for enhancing productivity and efficiency in the Malaysia Building Materials Market. With ongoing investments in construction technology, the adoption of Building Information Modeling (BIM), and smart building practices are expected to transform construction methods. Reports indicate that firms utilizing advanced technologies experience project time reductions of up to 30%, thereby increasing profitability and demand for technologically advanced materials. These developments are positioning Malaysian manufacturers favorably in an evolving market landscape where operational excellence becomes a competitive advantage.

Future Outlook

Over the next five years, the Malaysia Building Materials Market is expected to witness significant growth driven by urbanization, government-backed infrastructure initiatives, and increasing consumer demand for sustainable and efficient building solutions. The construction sector is poised for robust expansion as Malaysia continues to invest in smart cities and affordable housing projects, aligning with national development plans. Additionally, technological advancements in building materials are anticipated to aid in reducing costs and enhancing construction efficiency.

Major Players

- YTL Cement

- Lafarge Malaysia

- Southern Steel

- Press Metal Aluminium

- Cahya Mata Sarawak Berhad

- Eversendai Corporation

- UEM Sunrise Berhad

- Malaysian Gypsum Industries

- Sunway Berhad

- Kossan Rubber Industries

- Tasek Corporation Berhad

- I.L.A. Building Materials

- Hartalega Holdings Berhad

- Gabungan AQRS Berhad

Key Target Audience

- Construction Companies

- Real Estate Developers

- Contractors and Builders

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Works, Construction Industry Development Board)

- Material Suppliers and Distributors

- Architectural Firms

- Facility Management Services

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Malaysia Building Materials Market. This step is underpinned by extensive desk research, utilizing a combination of secondary reports, government publications, and proprietary databases to gather comprehensive industry-related information. The primary objective is to identify and define the critical variables that influence market dynamics and competitive landscape.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Malaysia Building Materials Market will be compiled and analyzed. This includes assessing market penetration, the ratio of marketplaces to service providers, and resultant revenue generation. An evaluation of service quality metrics will also be conducted to ensure the reliability and accuracy of the revenue estimates for key building materials and market segments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through structured interviews with industry experts representing a diverse range of companies. These consultations will yield valuable operational and financial insights directly from industry practitioners, which are pivotal in refining and corroborating market data, ensuring that the interpretations are aligned with real-world scenarios.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple building materials manufacturers and stakeholders to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors shaping the market. This interaction will serve to validate and complement the quantitative and qualitative data obtained from the previous steps, thereby producing a comprehensive, accurate, and validated analysis of the Malaysia Building Materials Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Key Milestones and Timeline of Major Players

- Market Dynamics and Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Infrastructure Development

Urbanization and Population Growth

Government Initiatives and Investments - Market Challenges

Fluctuations in Raw Material Prices

Competition and Market Saturation - Opportunities

Green Building Materials

Technological Advancements - Trends

Sustainable Construction Practices

Modular and Prefabricated Building Solutions - Government Regulation

Building Codes and Standards

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Segment: Market Prices, 2019-2024

- By Product Type (In Value %)

Cement

– Ordinary Portland Cement (OPC)

– Portland Composite Cement

– White Cement

– Rapid Hardening Cement

Steel

– Reinforcement Bars (Rebars)

– Structural Steel Sections

– Steel Sheets and Coils

– Wire Rods

Timber and Wood Products

– Plywood

– Laminated Veneer Lumber (LVL)

– MDF & Particle Boards

– Sawn Timber

Bricks and Blocks

– Clay Bricks

– Fly Ash Bricks

– Concrete Blocks

– Lightweight AAC Blocks

Insulation Materials

– Fiberglass

– Rock Wool

– Polyurethane Foam

– Reflective Foil Insulation - By Application (In Value %)

Residential Construction

– Low-cost Housing

– High-rise Apartments

– Bungalows and Villas

Commercial Construction

– Shopping Malls

– Office Buildings

– Hotels & Resorts

Industrial Construction

– Factories & Warehouses

– Processing Plants

– Energy Infrastructure - By Distribution Channel (In Value %)

Direct Sales

– B2B Sales from Manufacturers

– Government and Mega Project Procurement

Retail Outlets

– Hardware Stores

– Home Improvement Stores

Wholesalers

– Building Material Depots

– Regional Distribution Hubs - By Region (In Value %)

Central Region

Eastern Region

Northern Region

Southern Region - By End-User Segment (In Value %)

Contractors

– General Contractors

– Subcontractors (Masonry, Electrical, Plumbing)

Developers

– Real Estate Developers

– Industrial Park Developers

DIY Consumers

– Home Renovators

– Self-Build Project Owners

– Retail Homebuyers

- Market Share of Major Players by Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenue Streams, Market Presence, Technological Innovations, and others)

- SWOT Analysis of Key Players

- Price Analysis of Key Building Materials

- Detailed Profiles of Major Companies

Lafarge Malaysia

YTL Cement Berhad

Press Metal Aluminium Holdings

Southern Steel

Cahya Mata Sarawak Berhad

Eversendai Corporation

Malaysian Gypsum Industries

UEM Sunrise Berhad

Gabungan AQRS Berhad

Sunway Berhad

Tasek Corporation Berhad

Hartalega Holdings Berhad

- Market Demand and Trends

- Consumer Behavior Insights

- Needs and Pain Point Analysis

- Decision-Making Processes

- By Value, 2025-2030

- By Volume, 2025-2030

- By Segment: Market Prices, 2025-2030