Market Overview

The Malaysia Education Market is valued at USD 8.2 billion, according to recent estimates from the Malaysian Ministry of Education. This market is driven by an increasing population, government initiatives promoting educational improvements, and a growing preference for quality education among parents. Furthermore, the rise of digital learning platforms has accelerated educational accessibility and innovation, catering to both urban and rural populations.

Major cities contributing to the dominance of the Malaysia Education Market include Kuala Lumpur, Penang, and Johor Bahru. Kuala Lumpur serves as an educational hub with its concentration of higher education institutions and international schools. Penang’s historic legacy attracts academic institutions and students keen on its unique blend of local and international cultures. Johor Bahru is emerging as a regional educational center due to its proximity to Singapore, facilitating cross-border educational initiatives and partnerships.

The Malaysian government has been proactive in enhancing the education sector, especially through initiatives such as the Malaysia Education Blueprint 2015-2025, which aims to improve educational outcomes. The government allocated MYR 64.1 billion (approximately USD 15.5 billion) to education in 2023, reflecting its commitment to bolstering educational infrastructure and resources. Furthermore, investments in digital education projects have reached RM 3 billion, intended to transition institutions towards incorporating technology into their curricula and ensuring quality educational experiences.

Market Segmentation

By Education Level

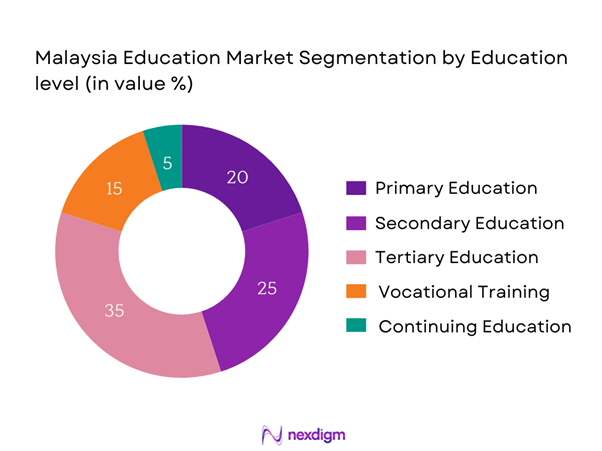

The Malaysia Education Market is segmented by education level into primary education, secondary education, tertiary education, vocational training, and continuing education. Currently, tertiary education dominates the market share, supported by the increasing number of universities and an expanding global recognition of Malaysian degrees. With institutions such as the University of Malaya and Monash University Malaysia setting a high standard, more students are seeking higher education to enhance career prospects in a competitive job market.

By Mode of Education

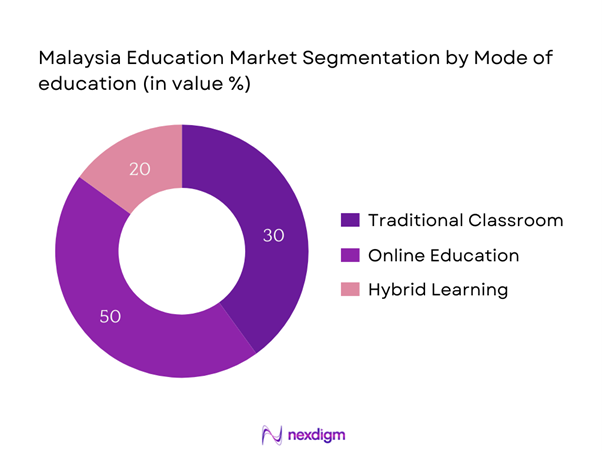

The market is also segmented by mode of education into traditional classroom, online education, and hybrid learning. Online education, in particular, is seeing robust growth as it offers flexibility and accessibility. Platforms that deliver quality educational resources online have increased, especially among younger generations who favor technology-driven learning. This shift is particularly significant post-pandemic as students and educators adapt to new learning methodologies, solidifying online education’s grip on the market.

Competitive Landscape

The Malaysia Education Market is characterized by significant participation from both local and international players, including reputable institutions and educational service providers. The market is dominated by entities such as the University of Malaya and Monash University Malaysia, which drive competition and innovation within the sector. The presence of global brands alongside local institutions showcases the dynamic landscape where quality and diversity in education are pivotal.

| Company | Year Established | Headquarters | Market Share (%) | No. of Programs Offered | Online Courses | International Partnerships | Total Enrollment | Excellence Ratings |

| University of Malaya | 1949 | Kuala Lumpur | – | – | – | – | – | – |

| Monash University Malaysia | 1998 | Bandar Sunway | – | – | – | – | – | – |

| Universiti Sains Malaysia | 1969 | Penang | – | – | – | – | – | – |

| Taylor’s University | 1969 | Subang Jaya | – | – | – | – | – | – |

| Sunway University | 2004 | Bandar Sunway | – | – | – | – | – | – |

Malaysia Education Market Analysis

Growth Drivers

Increasing Demand for Skilled Workforce

The skills gap in Malaysia is leading to a heightened demand for a skilled workforce. As of 2022, the unemployment rate for graduates in Malaysia had reached 4.1%, indicating a significant number of graduates struggling to find jobs that match their qualifications. The projected number of jobs requiring high skills is expected to rise to 6.3 million by end of 2025, according to the Department of Statistics Malaysia. This demand fosters an urgent need for educational institutions to equip students with the necessary skills to meet industry requirements, emphasizing technical and vocational education and training (TVET).

Rising Demand for E-Learning Solutions

With the rapid integration of technology into education, e-learning solutions have seen significant growth. In 2022, Malaysia had around 9.6 million internet users in the 15-24 age group, creating a substantial market for online learning platforms. Additionally, the EdTech sector has attracted MYR 80 million in financing, demonstrating increased interest from investors to innovate and deliver effective digital education tools. The government’s push for digital literacy, alongside students’ growing acceptance of online learning methodologies, further drives this market segment’s expansion.

Market Challenges

Accessibility Issues

Despite advancements, accessibility to quality education remains a challenge, particularly in rural areas. In 2022, approximately 25% of school-age children in rural regions did not have access to secondary education. The uneven distribution of educational facilities leads to significant discrepancies in educational attainment. Moreover, according to the World Bank, around 5.8 million people in Malaysia live below the national poverty line, which directly impacts their ability to afford educational expenses, thereby exacerbating inequality in educational access.

Quality of Education Disparities

There is a noticeable disparity in the quality of education across different regions of Malaysia. The OECD’s Programme for International Student Assessment (PISA) report indicated that Malaysian students scored below the OECD average in reading, mathematics, and science. For instance, the average score for Malaysian students in mathematics was 443 in the 2022 assessment, which was significantly below the OECD average of 487. This indicates an urgent need to address educational quality across the nation, particularly in underfunded and neglected areas.

Opportunities

Emerging Technologies in Learning

The integration of emerging technologies into the education sector represents substantial growth opportunities. Currently, the use of artificial intelligence (AI) in education is being explored with 40% of educational institutions adopting AI tools to personalize learning experiences. Virtual reality (VR) and augmented reality (AR) technologies are also gaining traction as tools for immersive learning experiences, with over MYR 30 million invested in related projects as of 2023. This technological shift promises enhanced engagement among students, paving the way for innovative educational practices.

Global Collaborations

Malaysia’s strategic position in Southeast Asia and its commitment to higher education have opened avenues for global collaborations. Over 80 international programs were established in Malaysian universities in 2023, alongside collaborations with top global universities. This has led to an increase in student mobility, allowing Malaysian students to study abroad while attracting foreign students to local institutions. Such partnerships enhance the reputation of Malaysian education on the global stage, creating opportunities for future growth.

Future Outlook

The Malaysia Education Market is anticipated to experience substantial growth, driven by ongoing technological advancements and an increased emphasis on quality education. Government initiatives aimed at improving education infrastructure and funding for innovative learning methods will further propel market dynamics. Demand for flexible learning platforms, especially in remote areas, will shape educational trends in the years to come.

Major Players

- University of Malaya

- Monash University Malaysia

- Universiti Sains Malaysia

- Taylor’s University

- Sunway University

- International Islamic University Malaysia

- Multimedia University

- Universiti Putra Malaysia

- HELP University

- Limkokwing University

- SEGi University

- Asia Pacific University

- UCSI University

- Kolej Poly-Tech Mara

- MAHSA University

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Education, Malaysian Qualifications Agency)

- Educational Technology Companies

- Non-Governmental Organizations (NGOs) focusing on Education

- Private Investors in Educational Services

- Corporate Training Providers

- International Sponsorship Agencies

- Education Policy Makers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the educational ecosystem within the Malaysia Education Market. This includes identifying stakeholders ranging from students and educators to government bodies and private institutions. Extensive desk research utilizes a mix of secondary data sources such as government publications, educational reports, and educational institutional databases to gather comprehensive information on the sector’s dynamics. The goal is to define the critical parameters influencing market trends and behaviors.

Step 2: Market Analysis and Construction

In this phase, historical data regarding educational enrollment, funding sources, and modality preferences will be gathered and analyzed. This involves evaluating variables such as market penetration rates, types of educational services offered, and their corresponding revenue generation. Additionally, service quality and educational outcomes will be measured to ensure the accuracy and reliability of the financial projections.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses will be validated through qualitative and quantitative research methods, including interviews with industry experts from diverse sectors within the educational field. These interactions are designed to glean insights on operational efficiencies, competitive practices, and student preferences, thus refining the initial approximations and forecasts.

Step 4: Research Synthesis and Final Output

The final step comprises engaging with educational institutions and service providers for feedback on their market positions, strengths, and opportunities. This interaction will serve to corroborate data, enrich analysis, and produce an integrated view of market dynamics. The synthesis includes all collected information to create a well-rounded and accurate representation of the Malaysia Education Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Skilled Workforce

Government Initiatives and Investments

Rising Demand for E-Learning Solutions - Market Challenges

Accessibility Issues

Quality of Education Disparities - Opportunities

Emerging Technologies in Learning

Global Collaborations - Trends

Shift Towards Personalized Learning

Growing Popularity of STEM Education - Government Regulation

Education Policies

Accreditation Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Student Enrollment, 2019-2024

- By Average Tuition Rate, 2019-2024

- By Education Level (In Value %)

Primary Education

– National Schools

– Vernacular Schools

– Private Primary Schools

– International Primary Programs

Secondary Education

– National Secondary Schools

– Private and Independent Secondary Schools

– Religious Schools

– International Secondary Schools

Tertiary Education

– Public Universities

– Private Higher Education Institutions

– International Branch Campuses

Vocational Training

– Community Colleges

– MARA and Technical Education Institutes

– Skill Development Centers

Continuing Education

– Lifelong Learning Programs

– Executive Education and Certifications

– Online MOOCs and Short Courses - By Mode of Education (In Value %)

Traditional Classroom

– Physical Schooling with Full In-person Attendance

– Fixed Curriculum Delivery through Government or Private Setup

Online Education

– K-12 and Tertiary E-Learning Platforms

– Virtual Classrooms and Learning Management Systems

Hybrid Learning

– Blended Public-Private School Programs

– University Programs with Online + On-Campus Modules

– Home-Based Learning Integrated with EdTech - By Funding Source (In Value %)

Government Funding

– Public School Allocations under the Ministry of Education

– Scholarships and Aid

Private Funding

– Tuition Fees and Private Equity Investment

– Non-Governmental Scholarships

International Aid

– Foreign Collaborations and Grants

– NGO and Multilateral Education Support - By Region (In Value %)

Central Region

Northern Region

Southern Region

Eastern Region - By Institution Type (In Value %)

Public Institutions

– Government Schools and Public Universities

– Institutes funded and managed by the Ministry of Education and MOHE

Private Institutions

– Private Colleges and Schools

– Independent Chinese High Schools and Private Islamic Schools

International Branch Campuses

– Foreign Universities Operating in Malaysia

– International K-12 School Chains

- Market Share of Major Players on the Basis of Value/Enrollment, 2024

- Market Share of Major Players by Education Level Segment, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Education Sector, Number of Campuses, Distribution Channels, Market Reach, Teaching Staff, Unique Value Offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis on Tuition Fees for Major Players

- Detailed Profiles of Major Companies

University of Malaya

National University of Malaysia

Monash University Malaysia

Universiti Sains Malaysia

Universiti Teknologi Malaysia

Sunway University

Taylor’s University

International Islamic University Malaysia

Limkokwing University

Multimedia University

Universiti Putra Malaysia

Universiti Malaya

INTI International University

SEGi University

Help University

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Student Enrollment, 2025-2030

- By Average Tuition Rate, 2025-2030