Market Overview

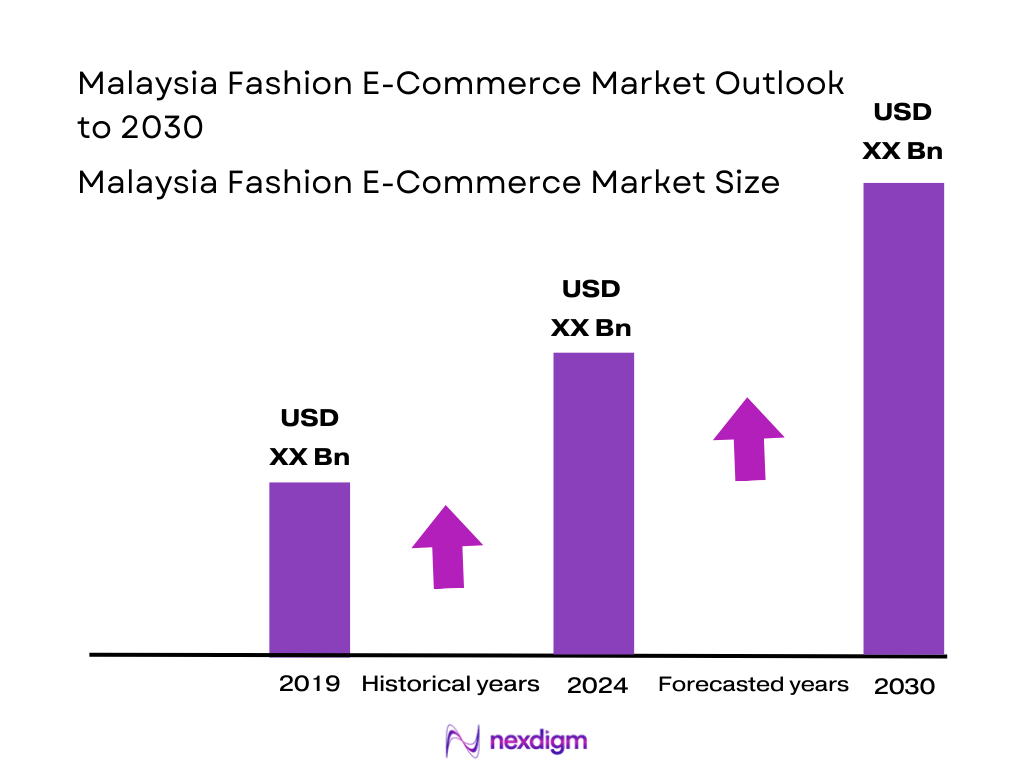

The Malaysia Fashion E‑Commerce Market is valued at approximately USD 4,513 million, based on real transactional data for the current year, with growth rates ranging between 0% to 5% compared to the prior year. This value reflects actual e‑commerce revenue rather than estimates, highlighting the market’s current scale and maturity.

Market dominance within Malaysia’s fashion e‑commerce ecosystem is concentrated in Greater Kuala Lumpur, Penang, and Johor Bahru/Iskandar. These cities thrive due to high urban density, strong smartphone penetration, robust logistics and last‑mile delivery networks, and vibrant digital consumer behavior. Meanwhile, East Malaysia shows rising activity thanks to targeted freight subsidies and improving infrastructure.

Market Segmentation

By Product Category

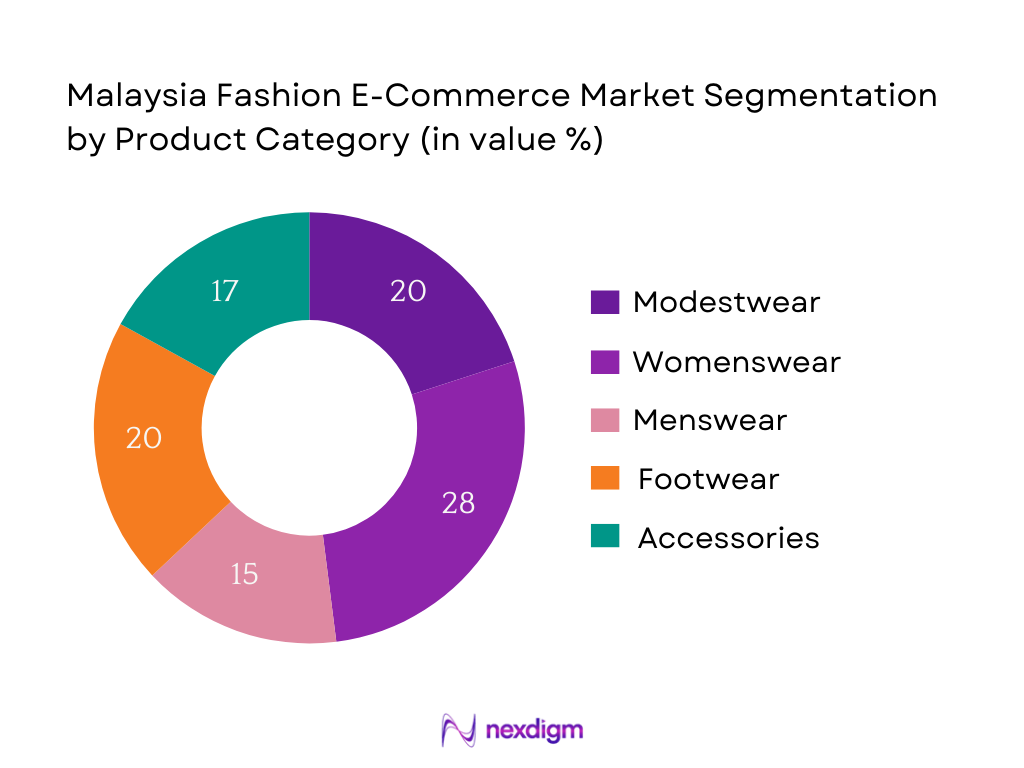

The Malaysia Fashion E‑Commerce Market is segmented into womenswear, menswear, modestwear (Hijab, Baju Kurung, Abaya), kidswear, footwear, accessories, athleisure/sportswear, and innerwear & loungewear. Currently, modestwear commands the largest share—estimated at around 20%+ of the market—driven by strong cultural alignment, rising modest fashion influencers, and tailored collections from local brands, which resonate with both urban and regional consumers seeking both style and modesty.

By Platform Type

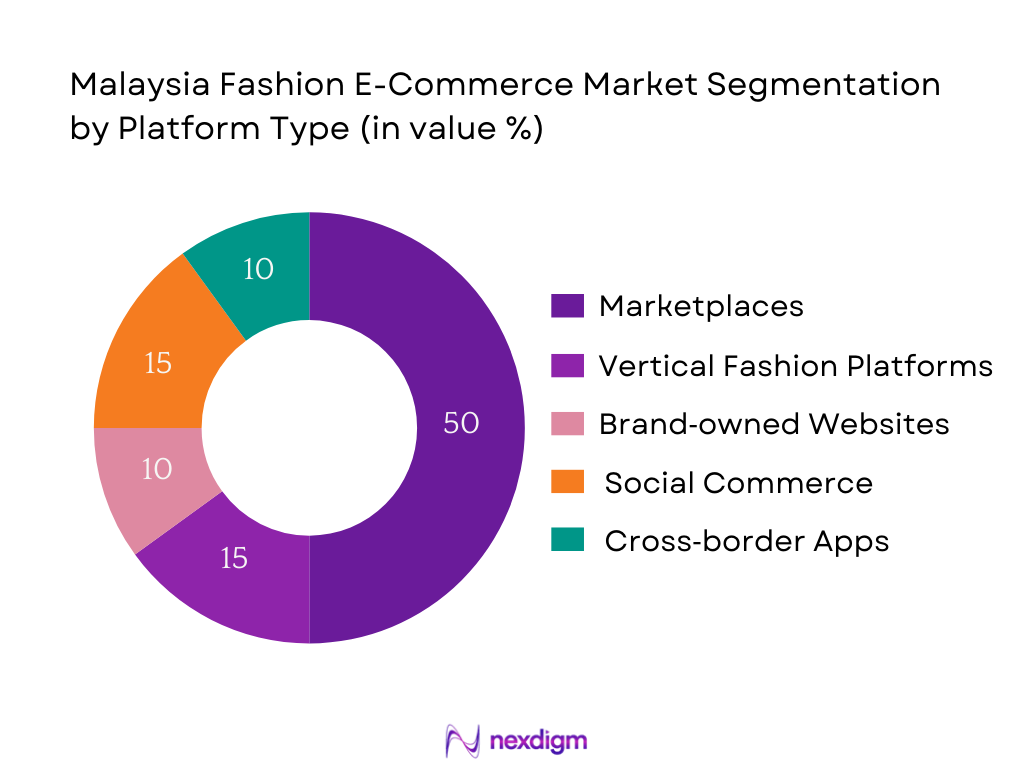

Marketplaces (primarily Shopee and Lazada) remain dominant—estimated at ~50% of the fashion e‑commerce transaction value—due to their wide assortment, frequent campaigns, free shipping thresholds, and brand trust. Vertical fashion platforms like ZALORA hold around 15%, leveraging curated fashion focus. Brand‑owned websites add ~10%, catering to loyal brand communities. Social commerce (TikTok, IG Live) is fast‑growing at ~15% and supported by influencer engagement, while cross‑border apps (SHEIN, TEMU) contribute ~10%, attracting deal‑seeking consumers.

Competitive Landscape

The Malaysia Fashion E‑Commerce Market is shaped by a mix of broad marketplaces, specialist fashion platforms, and global fast‑fashion entrants. The competitive landscape is consolidated, with a few key players capturing significant visibility and sales through integrated logistics, promotional cadence, and omnichannel ecosystems.

| Company | Establishment Year | Headquarters | Focus Category | Fulfilment Model | Live‑Commerce Engagement | Modest Fashion Offering | Payment Options Supported |

| Shopee Malaysia | 2015 | Singapore | – | – | – | – | – |

| Lazada Malaysia | 2012 | Singapore | – | – | – | – | – |

| ZALORA | 2012 | Singapore/Malaysia | – | – | – | – | – |

| TikTok Shop M’sia | 2021 | China-based | – | – | – | – | – |

| SHEIN | 2008 | China | – | – | – | – | – |

Malaysia Fashion E‑Commerce Market Analysis

Growth Drivers

Malaysia’s strong macroeconomic environment underpins robust e‑commerce momentum, including fashion. The real GDP in 2024 is estimated at USD 421 billion (constant 2015 dollars), rising from previous years, reflecting sustained economic activity and consumer spending power. In the final quarter of 2024, annual GDP grew by 5.1 percent, driven by strong domestic demand, investment activity, and sustained household spending. This economic strength correlates with rising disposable income and e‑commerce appetite. Additionally, online engagement touched 97.4 percent of Malaysia’s population in 2024, a 1.1 percent increase from before—showing nearly universal digital connectivity among Malaysians. These combined macroeconomic and digital infrastructure indicators create fertile ground for the fashion e‑commerce segment to flourish, as consumers are financially capable and digitally engaged.

Market Challenges

Despite favorable economic conditions, certain structural constraints may slow down fashion e‑commerce expansion. First, although GDP growth was solid with 5.1 percent in Q4 2024, overall growth expectations in 2024 ranged between 4.6 percent (RHB estimate) to 4.9 percent—highlighting modest moderation and potential vulnerability to external shocks. Economic variability could dampen discretionary spending on fashion goods. Second, Malaysia’s gross domestic savings rate in 2024 stood at about 25.9 percent of GDP, indicating only a quarter of national output is being retained domestically. This relatively moderate savings rate may translate into balanced but cautious household consumption trends. Consequently, while e‑commerce demand persists, fluctuation in disposable income and consumer prudence, especially under subsidy rationalizations and inflation pressures, may pose challenges to sustained fashion e‑commerce growth.

Emerging Opportunities

Current digitization levels and infrastructural foundations signal significant upside potential for Malaysia’s fashion e‑commerce, especially through inclusion and rural expansion. With real GDP estimated at USD 421 billion in 2024, there is ample room for digital sectors to tap growing economic output. Meanwhile, online engagement reached 97.4 percent of the population in 2024, showing nearly universal digital access even beyond urban centres. This suggests that fashion brands and platforms can leverage expanding internet penetration across both established and secondary cities. Furthermore, sustained macroeconomic growth—reflected in 5.1 percent GDP growth in Q4 2024 —adds momentum to consumer readiness. These trends present strategic opportunities for fashion players to innovate via mobile commerce, personalized digital experiences, and rural logistics. Enhancing user interface, leveraging regional influencers, and expanding last‑mile delivery infrastructure in under‑served areas will help capture emerging demand and widen fashion e‑commerce adoption beyond core urban markets.

Future Outlook

Over the coming years, the Malaysia Fashion E‑Commerce Market is expected to grow strongly, supported by broader e‑commerce expansion trends, rising smartphone penetration, and increasing appetite for both modest and trendy fashion. Mobile commerce, BNPL integration, live‑stream engagement, and DTC brand investments will continue to redefine consumer journeys. Improved cross‑border logistics and rising fashion tech (AI‑size recommendations, AR‑try on) will further elevate consumer confidence and conversion. The market’s forecast CAGR of around 14% implies the fashion e‑commerce value could reach approximately USD 9‑10 billion by 2030, even without exact projection figures at hand.

Major Players

- Shopee Malaysia

- Lazada Malaysia

- ZALORA

- TikTok Shop Malaysia

- SHEIN

- TEMU

- UNIQLO Malaysia (brand.com)

- H&M Malaysia (brand.com)

- Padini (brand.com)

- Naelofar (DTC – modestwear)

- Poplook (DTC – modestwear)

- Nike Malaysia (brand.com)

- adidas Malaysia (brand.com)

- JD Sports Malaysia (brand.com)

- Oxwhite (DTC – basics/formal shirts)

Key Target Adience

- Senior leadership teams at fashion e‑commerce platforms (e.g., heads of strategy, operations).

- Executives at major retailers and brand groups expanding into digital.

- Investments and venture capitalist firms evaluating opportunities in Southeast Asia fashion e‑commerce.

- Government and regulatory bodies such as MDEC (Malaysia Digital Economy Corporation), MATRADE (Malaysia External Trade Development Corporation), and Ministry of Investment, Trade and Industry (MITI).

Research Methodology

Step 1: Identification of Key Variables

We map out critical ecosystem stakeholders—including marketplaces, brands, logistics partners, BNPL providers, and urban/rural cohorts. This process is guided by secondary sources and industry whitepapers.

Step 2: Market Analysis and Construction

We aggregate historical revenue figures (e.g., USD 4,513 m for fashion e‑commerce) and broader national e‑commerce projections. We analyze segment penetration rates, platform GMV, and device/payment channel trends to derive realistic growth trajectories.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses—such as modestwear dominance or live‑commerce potential—are tested via interviews with platform category managers, logistics providers, and fintech firms to validate assumptions and refine share estimates.

Step 4: Research Synthesis and Final Output

Data is consolidated into rich analytics, combined with expert feedback, to deliver a validated, actionable report. This ensures consistency between bottom‑up fashion‑segment drivers and top‑down e‑commerce trends.

- Executive Summary

- Research Methodology (Market Definitions, Scope & Assumptions; Classification Frameworks; Market Sizing Approach; Top-Down & Bottom-Up Triangulation; Primary Interviews – Platforms, Brands, Sellers, Logistics, PSPs; Secondary Databases; Data Normalization Techniques; Limitations and Validation Checks)

- Market Definition and Scope

- E-Commerce Market Evolution in Malaysia

- Fashion E-Commerce Journey from Traditional Retail to Omnichannel

- Key Milestones and Platform Launch Timelines

- End-to-End Value Chain (Sellers, Platforms, Payment Aggregators, Logistics, PUDO Points, Returns)

- Stakeholder Mapping (DTC Brands, Marketplaces, Aggregators, Logistics, BNPL Players, Government Bodies)

- Key Growth Drivers

- Market Challenges

- Emerging Opportunities

- Key Consumer Trends

- Regulatory Framework (PDPA, CPETTR, Digital Tax, LVG Taxation)

- Digital Payment & BNPL Infrastructure

- Logistics & Fulfilment Infrastructure (PUDO, Returns Logistics, Same-Day Delivery)

- Social Commerce & Creator Economy (Influencer Affiliates, Live Streaming Adoption)

- Tech Stack & Personalization (Recommendation Engines, AR Try-ons, Chatbots)

- Halal Fashion and Ethical Commerce Trends

- By Gross Merchandise Value (MYR), 2019-2024

- By Number of Orders, 2091-2024

- By Average Order Value (MYR), 2019-2024

- By Units per Order, 2019-2024

- By Domestic vs Cross-Border Contribution, 2019-2024

- By Product Category (In Value %)

Womenswear

Menswear

Modestwear (Hijabs, Abayas, Baju Kurung)

Kidswear

Footwear

Accessories (Bags, Watches, Jewellery)

Athleisure/Sportswear

Innerwear & Loungewear - By Price Tier (MYR) (In Value %)

Economy (< MYR 50)

Value (MYR 51–149)

Mid-Premium (MYR 150–299)

Premium (MYR 300–799)

Luxury (MYR ≥ 800) - By Platform Type (In Value %)

Marketplace (Shopee, Lazada)

Vertical E-Commerce (ZALORA, FashionValet)

Brand-owned Websites (UNIQLO, H&M, Padini, Naelofar)

Social Commerce (TikTok Shop, Instagram Live, WhatsApp Business)

Cross-border Apps (SHEIN, TEMU) - By Fulfilment Model (In Value %)

Seller-Fulfilled

Platform Fulfilment Centers

Third-Party Logistics (J&T, Pos Laju, Ninja Van)

Omnichannel Fulfilment (BOPIS, In-store Pickup) - By Payment Method (In Value %)

Online Banking (FPX)

eWallets (GrabPay, Boost, ShopeePay, TNG eWallet)

Debit/Credit Cards

BNPL (Atome, SPayLater, Grab PayLater)

Cash on Delivery

- Market Share of Major Players by GMV & Orders

- Cross-Comparison Parameters (Gross Merchandise Value (GMV), Average Order Value (AOV), Category Depth, Fulfilment SLA, Return Rate, Payment Modes Offered, Live Commerce Participation, Prepaid vs COD Mix)

- SWOT Analysis of Top Players

- SKU-Level Pricing and Promotion Strategies

- Profiles of 15 Key Competitors

Shopee Malaysia

Lazada Malaysia

ZALORA

TikTok Shop Malaysia

SHEIN

TEMU

Padini

UNIQLO Malaysia

H&M Malaysia

Naelofar

Poplook

JD Sports Malaysia

Nike Malaysia

adidas Malaysia

Oxwhite

- Key Demographics (Age, Gender, Region)

- Purchase Behaviour (Size Preferences, Repeat Rate, AOV Trends)

- Pain Points (Return Process, Delivery Speed, Size Mismatch)

- Wallet Share, BNPL Usage, and Prepaid vs COD Preferences

- Device & Channel Usage (App vs Web, Android vs iOS)

- By GMV (MYR), 2025-2030

- By Orders, 2025-2030

- By AOV, 2025-2030

- By Cross-Border Contribution, 2025-2030