Market Overview

As of 2024, the Malaysia Fintech market is valued at USD 46.6 billion, with a growing CAGR of 13.2% from 2024 to 2030, reflecting a significant uptick fuelled by digitalization and increased adoption of financial technologies. This growth is primarily driven by the rise in smartphone penetration and e-commerce activities, which enhance accessibility to financial services and foster consumer engagement. The number of digital payment users has surged, resulting in an expanding market as more individuals and businesses shift towards digital finance solutions, thereby solidifying the fintech landscape.

Key cities like Kuala Lumpur, Penang, and Johor dominate the Malaysia Fintech market due to their robust infrastructure, high concentrations of technology start-ups, and supportive government policies. Kuala Lumpur serves as the financial hub offering extensive financial services and innovations. Meanwhile, Penang and Johor benefit from their strategic real estate, skilled labour force, and proximity to regional markets, which attract Fintech firms looking to establish a presence in Southeast Asia.

Market Segmentation

By Sector

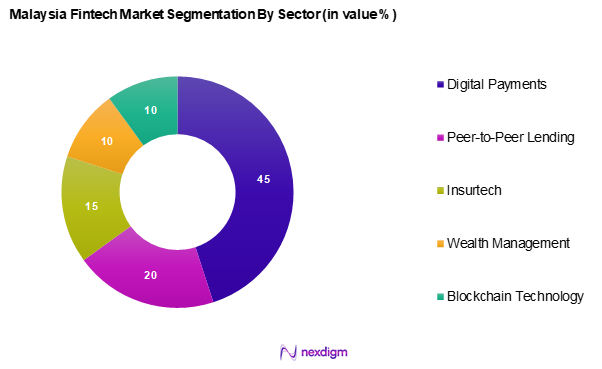

The Malaysia Fintech market is segmented into digital payments, peer-to-peer lending, insurtech, wealth management, and block chain technology. Among these, digital payments hold a significant market share, driven by the growing acceptance of contactless payments and mobile wallets. With a large segment of the population becoming tech-savvy, the convenience and speed of digital transactions have led to widespread adoption. Major players in this sector are innovating continually, enhancing user experience which consolidates their position in the market.

By Customer Type

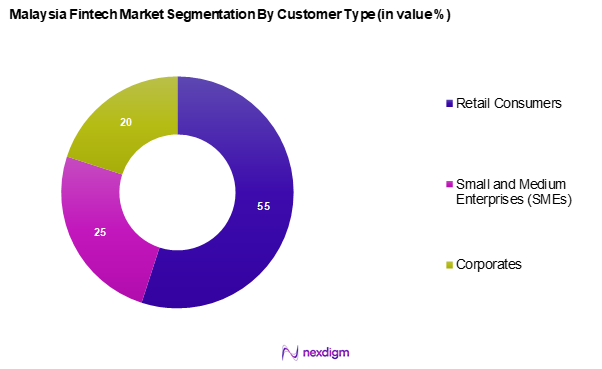

The Malaysia Fintech market is segmented into retail consumers, small and medium enterprises (SMEs), and corporates. Retail consumers dominate the Malaysian Fintech landscape as they increasingly embrace digital banking services and payment solutions. With the rising trend of financial literacy and technological adoption among consumers, this segment experiences rapid growth, driven by promotional offers and user-friendly apps. SMEs also show notable participation as they adopt Fintech solutions to facilitate their operational processes and access to funding.

Competitive Landscape

The Malaysia Fintech market is characterized by the presence of several major players, including local start-ups and established financial institutions. These companies focus on enhancing their technological presence and expanding services to capture a larger market share. Key players include Grab Financial Group, Touch ‘n Go, and Maybank Fintech, which are instrumental in shaping the competitive dynamics across the region.

| Company | Establishment Year | Headquarters | Key Services | Market Focus | Notable Innovations |

| Grab Financial Group | 2012 | Singapore | – | – | – |

| Touch ‘n Go | 1997 | Malaysia | – | – | – |

| Maybank Fintech | 1960 | Malaysia | – | – | – |

| Cimb Fintech | 2006 | Malaysia | – | – | – |

| BigPay | 2017 | Malaysia | – | – | – |

Malaysia Fintech Market Analysis

Growth Drivers

Increasing Smartphone Penetration

A key factor driving the Fintech market in Malaysia is the widespread adoption of smartphones. With millions of users relying on mobile devices, Fintech platforms have gained increased accessibility and engagement. The growing dependence on smartphones has facilitated seamless access to banking services, mobile payments, and investment platforms, contributing to a shift towards digital finance. This trend is significantly enhancing financial inclusion, enabling more individuals to engage with Fintech solutions conveniently.

Rapid Urbanization

The ongoing urbanization across Malaysia is another factor fuelling Fintech adoption. The expanding urban population, particularly in major cities, has led to a rising demand for efficient and accessible financial services. Urban centres contribute significantly to the country’s economic output, creating a concentration of tech-savvy consumers and businesses that are more inclined toward digital financial solutions. As cities continue to grow, Fintech companies are responding with tailored services that meet the evolving financial needs of urban dwellers.

Market Challenges

Regulatory Compliance

Navigating regulatory requirements remains a significant hurdle for Fintech firms in Malaysia. The evolving financial regulations require companies to invest heavily in compliance measures, which can shift focus away from innovation. Regulatory bodies impose stringent guidelines, compelling Fintech firms to balance growth strategies with compliance mandates. The complexity of these regulations continues to shape the market, requiring companies to adapt and implement robust compliance frameworks to sustain operations.

Cybersecurity Threats

The rising prevalence of cyber threats poses a major challenge to the Fintech industry. Digital transactions have become prime targets for cyberattacks, compelling fintech firms to invest in advanced security infrastructure to safeguard user data. Concerns over data breaches and fraudulent activities can impact user trust and slow down Fintech adoption. As security threats evolve, the sector must continuously enhance protective measures to ensure safe and seamless financial transactions.

Opportunities

Expansion of Financial Inclusion

The drive toward broader financial inclusion presents significant opportunities for Fintech companies. A substantial portion of the population remains outside the formal banking system, creating an untapped market for digital financial services. Government initiatives are actively promoting financial literacy and accessibility, particularly in underserved regions where traditional banking services are limited. By offering innovative digital solutions, Fintech firms can bridge the financial gap and cater to previously unbanked communities.

Rise of E-commerce

The continuous expansion of e-commerce is further boosting Fintech growth. The increasing popularity of online shopping has heightened the demand for integrated payment solutions, driving Fintech platforms to innovate and streamline digital transactions. As e-commerce flourishes, Fintech services catering to online retailers and consumers will continue to thrive, offering secure and efficient financial management tools that enhance the digital shopping experience.

Future Outlook

Over the next five years, the Malaysia Fintech market is expected to show robust growth, driven by increasing smartphone penetration, strategic government initiatives, and a heightened focus on financial inclusivity. The financial technology landscape is anticipated to evolve with advancements in security measures and the integration of artificial intelligence, leading to safer and more efficient financial solutions tailored to consumer needs.

Key Players

- Grab Financial Group

- Touch ‘n Go

- Maybank Fintech

- Cimb Fintech

- BigPay

- RHB Bank

- Funding Societies

- RinggitPlus

- PayLater

- Kiple

- Jirnexu

- iMoney

- MoneyMatch

- Fave

- Axiata Digital

Key Target Audience

- Investments and venture capitalist firms

- Government regulatory bodies (Bank Negara Malaysia, Securities Commission Malaysia)

- Payment service providers

- E-commerce platforms

- Insurance companies

- Financial institutions

- Technology solution providers

- Corporate clients seeking Fintech solutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Malaysia Fintech Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as regulatory frameworks, technological advancements, and consumer behaviour.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data pertaining to the Malaysia Fintech Market. This includes assessing market penetration, the ratio of tech start-ups to traditional financial services, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, providing a solid foundation for market assessments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies in the Fintech space. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data, ensuring that all trends and projections are robust and well-founded.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple Fintech companies to acquire detailed insights into product segments, sales performance, consumer preferences, and other relevant factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Malaysia Fintech Market. The final report will present synthesized insights that reflect the dynamics of this rapidly evolving sector.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Smartphone Penetration

Rapid Urbanization - Market Challenges

Regulatory Compliance

Cybersecurity Threats - Opportunities

Expansion of Financial Inclusion

Rise of E-commerce - Trends

Increased Adoption of Digital Wallets

Growing Popularity of Neobanks - Government Regulation

Regulatory Frameworks

Digital Token Guidelines - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Number of Transactions, 2019–2024

- By Average Transaction Value, 2019-2024

- By Sector (In Value %)

Digital Payments

– Mobile Wallets (e.g., Touch ‘n Go, Boost)

– QR Code Payments

– Payment Gateways

– Cross-border Remittances

– BNPL (Buy Now Pay Later) Platforms

Peer-to-Peer Lending

– Consumer Lending Platforms

– SME Lending Platforms

– Microloans and Nano-financing

– Invoice Financing

Insurtech

– Digital-Only Insurance Providers

– Usage-Based Insurance (UBI)

– Insurance Aggregators

– Microinsurance Platforms

Wealth Management

– Robo-Advisors

– Digital Brokerage Services

– Micro-Investment Platforms

– Automated Retirement Planning Tools

Blockchain Technology

– Cryptocurrency Exchanges and Wallets

– Decentralized Finance (DeFi) Applications

– Blockchain for KYC and Identity Verification

– Smart Contract Platforms - By Customer Type (In Value %)

Retail Consumers

– Individual Investors

– Unbanked and Underbanked Users

– Gen Z and Millennial Users

– Freelancers and Gig Workers

Small and Medium Enterprises (SMEs)

– MSME Financing Tools

– Payroll and Invoicing Fintechs

– SME-Centric Payment Solutions

– Accounting Software Integrations

Corporates

– Treasury and Cash Flow Solutions

– B2B Payments and Trade Finance

– Corporate Insurance Tech

– Corporate Expense Management Platforms - By Technology Adoption (In Value %)

Mobile Applications

– Super Apps (e.g., Grab, BigPay)

– Mobile-Only Banks (Neobanks)

– Biometric Authentication for Transactions

Web Platforms

– Online Investment Portals

– Desktop-Based Lending Platforms

– Insurtech Websites with AI Chatbots

AI and Blockchain

– AI-driven Fraud Detection

– Machine Learning for Credit Scoring

– Smart Contracts and Tokenization

– Chatbot-Based Customer Service - By Region (In Value %)

Kuala Lumpur

Penang

Johor

Sarawak - By Business Model (In Value %)

B2C (Business to Consumer)

– Retail Investment Platforms

– Personal Finance Apps

– Digital Banking Services

B2B (Business to Business)

– B2B Payment Gateways

– Invoice Financing Solutions

– Business Analytics and Lending APIs

P2P (Peer to Peer)

– Lending Platforms

– Crowdfunding Platforms

– P2P Insurance and Risk-Sharing Models

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Sector Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenue Models, Customer Acquisition Strategies, Market Positioning, Technology Infrastructure)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Grab Financial Group

Touch ‘n Go

Maybank Fintech

Cimb Fintech

BigPay

RHB Bank

Funding Societies

RinggitPlus

PayLater

Kiple

Jirnexu

iMoney

MoneyMatch

Fave

Axiata Digital

- Market Demand and Utilization Patterns

- Customer Profiles and Preferences

- Regulatory and Compliance Landscape

- Pain Points Analysis

- Decision-Making Factors

- By Value, 2025-2030

- By Number of Transactions, 2025–2030

- By Average Transaction Value, 2025-2030