Market Overview

The Malaysia hypertension therapeutics market is valued at approximately USD ~ billion in 2024, based on available country-level data and extrapolated from regional growth-studies in the hypertension drug space (for Malaysia the market was reported at USD ~0.90 billion in the mid-2020s). This market size is being driven by a rising hypertension prevalence in Malaysia, increasing awareness of cardiovascular risk, and the expansion of primary care as well as outpatient management in public and private settings. The adoption of fixed-dose combination therapies and generics is putting additional volume into the market, while public health programmes are widening the treated patient base.

In Malaysia, the market is dominated by major metropolitan areas such as the Kuala Lumpur/Klang Valley region and key states like Penang and Johor, as well as East Malaysia (Sabah & Sarawak). These dominate because they host the bulk of specialist cardiology clinics, higher concentration of private hospital-networks and pharmacies, better access to healthcare infrastructure, and higher per-capita incomes—thus enabling greater uptake of antihypertensive therapies and advanced treatment options compared to more rural states.

Market Segmentation

By Therapeutic Class

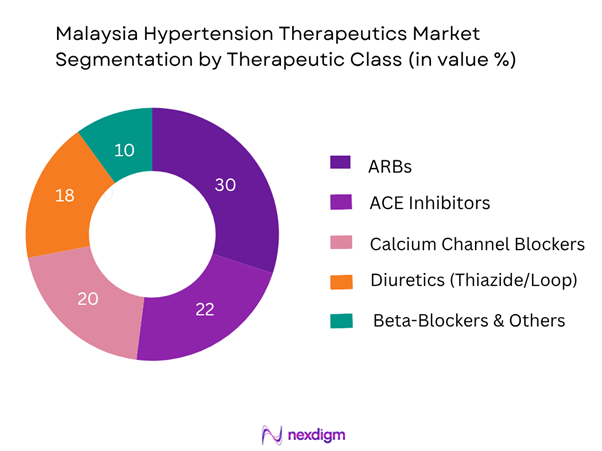

The Malaysia hypertension therapeutics market is segmented by therapeutic class into ARBs, ACE inhibitors, calcium channel blockers, diuretics and beta-blockers & others. The ARBs sub-segment is dominating the market share, which is due to its favourable tolerability profile (especially lower incidence of cough compared to ACE inhibitors), the broad guideline adoption of ARBs in Malaysian hypertension management, and the increasing availability of generics and fixed-dose combinations in ARB-based therapies. In addition, ARB penetration in private outpatient clinics and specialist cardiology settings has been rising, contributing to its higher share.

By Distribution Channel

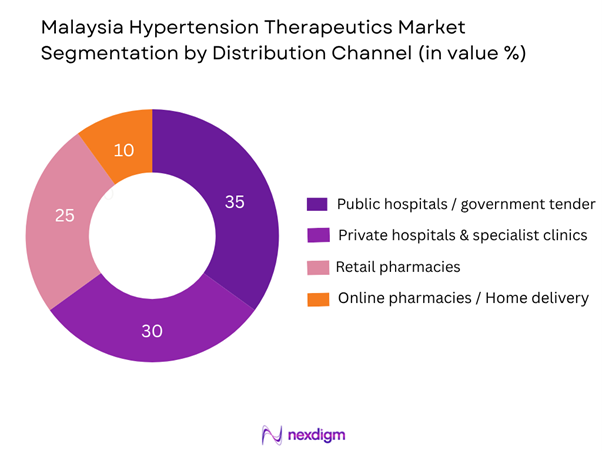

The Malaysia hypertension therapeutics market is segmented by distribution channel into public hospitals/government tender, private hospitals & specialist clinics, retail pharmacies/community pharmacies, and online pharmacies/home delivery. The public hospitals/government tender channel is dominating the share, due to the strong role of the Ministry of Health Malaysia (MOH) in procuring antihypertensive drugs in bulk for the national healthcare system, wide coverage in the public sector, and the fact that many hypertensive patients in Malaysia access medication through subsidised hospital services rather than direct retail purchase. This channel’s broad reach into rural as well as urban areas gives it a foundational role in the market.

Competitive Landscape

The competitive environment in the Malaysia hypertension therapeutics market is characterised by a mix of multinational pharmaceutical companies, regional generics manufacturers and local contract-manufacturers. A few large global players dominate branded prescription antihypertensive therapies, but the growth of generics and fixed-dose combinations is intensifying competition.

| Company | Establishment Year | Headquarters | Malaysia Hypertension Portfolio Depth (no. of SKUs) | Malaysia Sales in Hypertension (USD m) | Generic vs Branded Ratio | Distribution Reach (Public vs Private) | Recent Malaysia-specific Development(s) |

| Pfizer Inc. | 1849 | New York, USA | – | – | – | – | – |

| Novartis AG | 1996 | Basel, Switzerland | – | – | – | – | – |

| AstraZeneca plc | 1999 | Cambridge, UK | – | – | – | – | – |

| Sanofi S.A. | 1973 | Paris, France | – | – | – | – | – |

| GlaxoSmithKline plc | 2000 | London, UK | – | – | – | – | – |

Malaysia Hypertension Therapeutics Market Analysis

Growth Drivers

Ageing population

Malaysia’s population aged 60 years and above has reached approximately 3.9 million people, representing about 11.6 % of the total population of 34.1 million in 2024. As the elderly cohort grows, the incidence of hypertension rises due to vascular ageing, arterial stiffening and cumulative exposure to risk factors. With more older adults, healthcare systems see increased demand for antihypertensive therapeutics and chronic disease management, making the hypertension-therapeutics market more significant in Malaysia’s context.

Rising obesity/hypertension prevalence

According to the National Health and Morbidity Survey 2023, approximately 29.2 % of Malaysian adults have hypertension. In the same survey, adult overweight & obesity prevalence stood at 54.4 % in Malaysia. These elevated levels of obesity drive increased blood-pressure elevation and increase utilisation of hypertension therapeutics. The high base of hypertensive and pre-hypertensive adults escalates lifetime treatment needs, thereby bolstering the Malaysia hypertension-therapeutics market.

Market Challenges

Low BP control rate

Despite high treatment rates, Malaysia still records a modest control rate: in the NHMS 2015 data, hypertension control was about 37.4 % among treated patients. Poor blood-pressure control “resistant” to therapy increases burden of complications but also reflects sub-optimal outcomes and may reduce physician confidence in standard therapies. Lower control rates mean higher unmet need but also highlight therapeutic gaps; however, this also signals cost and outcome pressures for the Malaysia hypertension-therapeutics market.

Cost-containment pressure

Malaysia’s public health procurement and reimbursement systems face pressure to manage healthcare expenditure: the health system places emphasis on generics and cost-efficient therapeutics under the NSP-NCD and related investment frameworks. In the hypertension therapy space, this means branded therapies face substitution, price erosion and tender competition. These cost-containment dynamics limit margin expansion and place pressure on manufacturers to optimise product portfolios in the Malaysia hypertension-therapeutics market.

Market Opportunities

Digital health monitoring

The NHMS 2023 survey reports that 44 % of hypertensive adults in Malaysia have their own blood-pressure measuring device at home. This reflects increasing patient engagement and self-monitoring capability. Digital platforms and home-monitoring tools thus present an opportunity for integrated hypertension-therapeutics strategies—manufacturers can link drug offerings with digital adherence support, remote monitoring and virtual care services, thereby enhancing value proposition in the Malaysia hypertension-therapeutics market.

Specialty therapies for resistant hypertension

With the ageing population and rising comorbidity burden in Malaysia, a subset of hypertensive patients requires advanced or specialty therapies (for example, mineral-receptor antagonists, novel fixed-dose combos). Although exact 2024 numbers are limited, the prevalence of adults with hypertension is ~29.2 % per NHMS 2023. The demand for therapies beyond first-line treatments thus grows, offering a premium segment within the Malaysia hypertension-therapeutics market for innovative therapies tailored to resistant hypertension.

Future Outlook

Over the next five to six years the Malaysia hypertension therapeutics market is expected to show significant growth driven by growing prevalence of hypertension, increased screening and diagnosis rates, and the expansion of outpatient and retail channels for therapy access. The shift towards fixed-dose combination therapies, stronger generic substitution and patient support programmes – especially digital health initiatives supporting therapy adherence – are likely to accelerate market uptake. Moreover, government initiatives under the Ministry of Health to strengthen non-communicable disease (NCD) management will further enhance drug utilisation.

From a therapeutic perspective, ARB-based fixed-dose combinations and newer formulation releases (extended-release, combination tablets) will capture incremental share, while online pharmacy and home delivery channels will gain traction as consumer behaviour evolves. Rising private health expenditure and increased insurance coverage in Malaysia’s urban centres will also support higher value therapies. Overall, the market is forecast to expand from ~USD 0.90 billion in 2024 to ~USD 1.40-1.50 billion by 2030, at a CAGR of approximately 8-10%.

Major Players

- Pfizer Inc.

- Novartis AG

- AstraZeneca plc

- Sanofi S.A.

- GlaxoSmithKline plc

- Bayer AG

- Takeda Pharmaceutical Company Limited

- Boehringer Ingelheim International GmbH

- Cipla Limited

- Sun Pharmaceutical Industries Ltd.

- Mylan N.V. (now part of Viatris)

- UCB S.A.

- Aurobindo Pharma Limited

- Pharmaniaga Berhad (local Malaysian generics / contract manufacturer)

- Hovid Berhad (local Malaysian generics manufacturer)

Key Target Audience

The key target audience for this Malaysia hypertension therapeutics market report includes:

- Pharmaceutical manufacturers (global & regional) – investment and product strategy teams

- Distributors & wholesalers of cardiovascular/antihypertensive therapies in Malaysia

- Retail pharmacy chains and community pharmacies – business development/manufacturing sourcing teams

- Hospital groups (public and private) in Malaysia – procurement & formulary committees

- Health insurance providers and managed-care organisations in Malaysia – cardiovascular portfolio strategy

- Investments & venture capital firms – focusing on Malaysian/ASEAN hypertension therapeutics opportunities

- Government & regulatory bodies (Ministry of Health Malaysia, Malaysia Drug Control Authority) – policy, procurement and access planning

- Private clinics/specialist cardiology networks – service expansion and partnership strategy

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Malaysia hypertension therapeutics market. This step is underpinned by extensive desk research, utilising a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as therapeutic class mix, distribution channels, patient segments, pricing and reimbursement.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data pertaining to the Malaysia hypertension therapeutics market. This includes assessing drug utilisation (volume and value), the ratio of branded to generic therapies, the distribution channel split, and the resultant revenue generation. Furthermore, an evaluation of treatment guidelines, patient prevalence and therapy adoption statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses (for example, growth drivers, shift to fixed-dose combinations, private sector expansion) will be developed and subsequently validated through interviews (phone/web) with industry experts representing pharmaceutical companies, distributors, hospital formularies and specialty clinics in Malaysia. These consultations provide operational and financial insights directly from industry practitioners, which serve to refine and corroborate the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple industry participants in Malaysia to acquire detailed insights into therapy segments, sales performance, pricing dynamics and consumer/patient behaviour. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate and validated analysis of the Malaysia hypertension therapeutics market.

- Executive Summary

- Research Methodology (Definitions & scope (therapeutic classes, hypertension stages, treatment settings), Abbreviations, Market sizing approach (value, unit, average price per therapy), Data sources: primary (KOLs, clinicians, payers, hospitals in Malaysia), secondary (publications, government data), Consolidated research framework (triangulation of demand, supply, consumption), Limitations & assumptions)

- Definition and Scope

- Epidemiology Landscape

- Market Genesis & Evolution

- Disease Burden & Cost of Illness

- Therapeutic Value Chain

- Stakeholder Ecosystem

- Growth Drivers

Ageing population

Rising obesity/hypertension prevalence

Government healthcare initiatives - Market Challenges

Low BP control rate

Cost-containment pressure

Generic substitution - Market Opportunities

Fixed dose combinations

Digital health monitoring

Specialty therapies for resistant hypertension - Emerging Trends

Shift to generics

Telemonitoring for hypertension

Value-based care models - Regulatory & Reimbursement Framework

Pricing policies in Malaysia

NRDL equivalents, tendering - SWOT Analysis

- Porter’s Five Forces

- By Value (pharmaceutical spend on hypertension), 2019-2024

- By Volume (number of prescriptions, defined daily doses), 2019-2024

- By Average Price per Therapy Unit, 2019-2024

- By Therapeutic Class (in value %)

ACE Inhibitors

ARBs (Angiotensin II Receptor Blockers)

Calcium Channel Blockers (CCBs)

Diuretics (Thiazide, Loop)

Beta-Blockers & Others - By Treatment Setting (in value %)

Hospital Inpatient/Outpatient

Private Clinics / Specialist Cardiology

Retail Pharmacy / OTC Adjuncts - By Patient Segment (in value %)

Newly Diagnosed Hypertensive Patients

Treatment-Experienced Patients

Resistant Hypertension / High-Risk (comorbidities like CKD, diabetes) - By Distribution Channel (in value %)

Public Hospitals / Government Tender

Private Hospitals & Clinics

Retail Pharmacies / Community Pharmacies

Online Pharmacies / Home Delivery - By Region / State (in value %)

Kuala Lumpur & Klang Valley

Penang / Northern Region

Johor & Southern Region

East Malaysia (Sabah & Sarawak) - By Pricing Tier (in value %)

Branded Premium Therapies

Generic Therapies

Fixed-Dose Combinations

- Market Share of Major Players (by value/volume)

- Cross-Comparison Parameters (Company overview, Business strategy, Recent development, Strengths, Weaknesses, Malaysia sales (value), Portfolio by therapeutic class, Number of dedicated hypertension SKUs in Malaysia, Pricing strategy in Malaysia, Distribution channel footprint in Malaysia, Manufacturing/contract-manufacturing capacity in Malaysia, R&D investment (Malaysia or ASEAN), Unique value proposition)

- Detailed Profiles of Major Companies

Pfizer Inc.

Novartis AG

AstraZeneca plc

Bayer AG

GlaxoSmithKline plc

Sanofi S.A.

Takeda Pharmaceutical Company Limited

Mylan N.V.

Boehringer Ingelheim International GmbH

Cipla Limited

Sun Pharmaceutical Industries Ltd.

Novartis (Malaysia) Sdn Bhd

Pfizer (Malaysia) Sdn Bhd

AstraZeneca (Malaysia) Sdn Bhd

Generic Drug Manufacturer X (Malaysia)

- Prescribing Behaviour & Treatment Protocols

- Patient Adherence & Persistence Rates

- Payer & Reimbursement Dynamics

- Pain-Points & Unmet Needs

- Patient Journey & Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price per, 2025-2030