Market Overview

The injectable emulsions market in Malaysia is valued at approximately USD ~ million, based on a 2024 global benchmark of USD 3,550 million for lipid injectable emulsions. This market is being driven by increasing adoption of parenteral nutrition in critically ill and oncology-patients, rising minimally invasive surgeries which boost demand for propofol emulsion formulations, and expanding hospital infrastructure investment in Malaysia (especially ICU and tertiary care expansions).

In terms of regional dominance, major Malaysian cities such as Kuala Lumpur and Penang lead due to their concentration of tertiary hospitals, advanced clinical nutrition programmes and strong private-hospital presence, while Malaysia overall benefits from Southeast Asia’s rising healthcare expenditure and inbound medical tourism (from neighbouring Indonesia, Brunei, Singapore) which increases demand for high-end injectable emulsions.

Market Segmentation

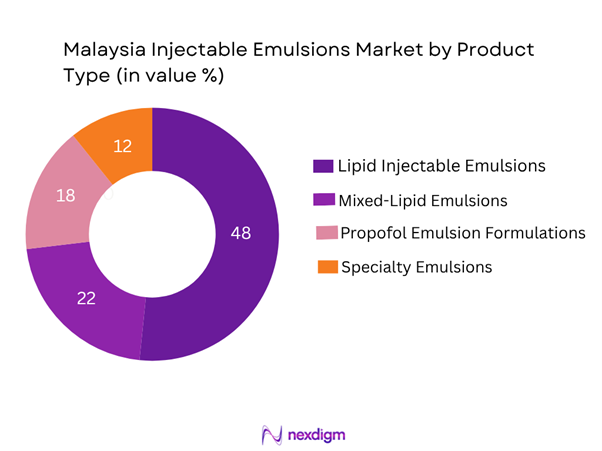

By Product Type

The Malaysia Injectable Emulsions market is segmented into Lipid Injectable Emulsions (soybean oil-based), Mixed-Lipid Emulsions (MCT/long-chain triglyceride blends), Propofol Emulsion Formulations (for anaesthesia/sedation) and Specialty Emulsions (structured lipids, omega-3 enriched fat emulsions). Among these, Lipid Injectable Emulsions continue to dominate the market share due to their longstanding use in parenteral nutrition protocols in Malaysian public and private hospitals, cost-effectiveness versus newer blends, and their wider formulary listing across MOH Malaysia tender contracts.

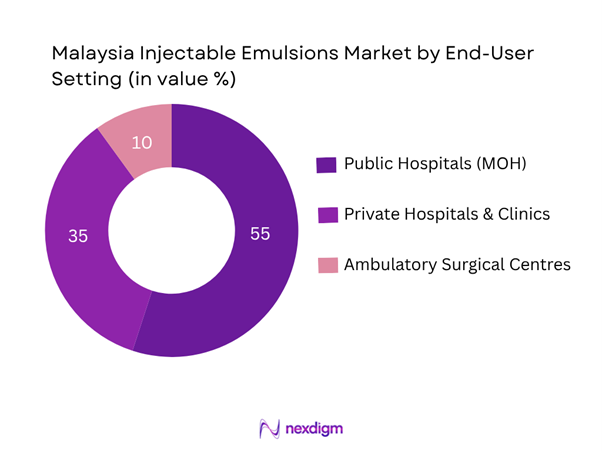

By End-User Setting

The market is further segmented into Public Hospitals (MOH), Private Hospitals & Clinics, and Ambulatory Surgical Centres/Day-Care Units. In Malaysia, Public Hospitals remain the leading end-user setting because they dominate high-volume parenteral nutrition use, government tender procurement, and large ICU/ward bed capacity, thereby commanding the largest share of injectable emulsion volume and value. Private hospitals follow, driven by premium services, medical tourism and higher per-case incident use of sedation/anaesthesia emulsions.

Competitive Landscape

The Malaysia Injectable Emulsions market is characterised by a handful of multinational and regional pharmaceutical/clinical-nutrition companies which supply both generics and speciality formulations. These players compete on sterile fill-finish capacity, local tender compliance (MOH Malaysia), hospital formulary access, differentiated lipid formulations (MCT/LCT, fish-oil, structured lipids) and distribution partnerships.

| Company | Establishment Year | Headquarters | Local Manufacturing/Fill-Finish (Malaysia?) | Number of Emulsion SKUs in Malaysia | Tender/Formulary Presence in MOH | Key Differentiator |

| Fresenius Kabi | 1995 | Germany | – | – | – | – |

| Baxter International | 1931 | USA | – | – | – | – |

| B. Braun Melsungen | 1839 | Germany | – | – | – | – |

| Abbott Laboratories | 1888 | USA | – | – | – | – |

| Otsuka Pharmaceutical | 1921 | Japan | – | – | – | – |

Malaysia Injectable Emulsions Market Analysis

Growth Drivers

Rising Chronic Disease Burden

Malaysia is facing a significant increase in non-communicable diseases (NCDs). More than 2.3 million Malaysian adults live with three chronic conditions among diabetes, hypertension and high cholesterol. In an earlier National Health & Morbidity Survey nearly 16 % of adults had diabetes and 29 % had hypertension. Moreover, NCDs were responsible for about 72.2 % of years-of-life-lost (YLL) in Malaysia in 2018. These large absolute patient pools create increased demand for advanced therapies and nutrition support—including injectable emulsions used in parenteral nutrition and complex therapy settings.

Increasing Parenteral Nutrition Use

Malaysia’s health-expenditure per capita is reported at USD 458 in 2022. While specific national system figures for injectable emulsions are limited, the increasing chronic disease burden combined with longer hospital stays and more complex care indicates rising use of parenteral nutrition solutions—often delivered via injectable emulsions—for patients unable to take enteral nutrition. As Malaysia’s total health expenditure reached RM 78,220 million in 2021. The scale of healthcare financing supports growth in specialised injectable products including emulsions.

Market Challenges

Complex Regulatory Landscape

Malaysia’s regulatory environment for pharmaceuticals and parenteral nutrition products involves multiple approvals from the Malaysian Food and Drug Authority (MFDA) and hospital procurement systems. Though exact data on approval time are not publicly broken out for injectable emulsions, the process involving GMP compliance, clinical safety and import licensing remains more complex for injectable vs oral drugs. This regulatory overhead acts as a barrier for new injectable emulsion products entering the Malaysian market.

High Manufacturing Costs

Manufacturing injectable emulsions is capital-intensive due to sterile production, aseptic fill-finish, ultrafiltration testing, stability challenges and cold-chain logistics. Malaysia’s per-capita health spending (USD 458 in 2022) reflects resource constraints in deploying high-cost therapies. The relative cost burden—particularly for imported emulsions or advanced formulations—places pressure on pricing and margin for manufacturers and distributors in Malaysia.

Opportunities

Emerging Personalized Nutrition Products

With rising chronic disease multimorbidity (2.3 million adults with three NCDs) and expanding home-care and hospital nutrition support, there is significant potential for injectable emulsion products tailored to individual patient nutrition needs (e.g., lipid-based emulsions for renal or ICU patients). Malaysia’s health-spending per capita USD 458 in 2022 provides the financial backdrop for higher-value nutrition therapies. This represents an opportunity for manufacturers of injectable emulsions to develop personalised, higher-margin offerings in Malaysia.

Expansion of Home Care Services

Malaysia’s healthcare system is increasingly shifting toward outpatient, home-care and remote monitoring models to alleviate hospital burden. Infrastructure growth and modernisation (as per white-paper reforms) support this trend. The growth of home-infusion services means injectable emulsions traditionally used in hospitals can be extended to home-based parenteral nutrition or infusion therapy settings—unlocking new channels and patient segments for market growth in Malaysia.

Future Outlook

Over the next six years the Malaysia Injectable Emulsions market is expected to show robust growth driven by expansion of hospital infrastructure, growing prevalence of chronic diseases (malnutrition, cancer, GI disorders) and increasing adoption of advanced emulsions (MCT/LCT blends, omega-3 enriched) in clinical nutrition and sedation workflows. Formulary tender reforms in Malaysia and enhanced private-hospital growth tied to medical tourism will further fuel uptake.

Key Players

- Fresenius Kabi

- Baxter International

- B. Braun Melsungen

- Abbott Laboratories

- Otsuka Pharmaceutical

- Nestlé Health Science

- Mitsubishi Chemical Medience

- Glanbia Nutritionals

- CJ CheilJedang Healthcare

- Hospira (Pfizer)

- Macopharma

- Grifols

- Nutrimedics

- Sino-Biopharm

- Natco Pharmaceuticals

Key Target Audience

- Hospital procurement managers (public hospitals – MOH Malaysia)

- Hospital pharmacy directors (private tertiary hospitals)

- Clinical nutrition specialists and teams

- Anaesthesia/sedation departments in surgical centres

- Medical device & consumables distributors specialising in parenteral nutrition

- Investments and venture-capitalist firms (investing in injectable emulsion technology startups)

- Pharmaceutical companies (expanding their parenteral nutrition/emulsion franchise)

- Government and regulatory bodies (Ministry of Health Malaysia, Medical Device Authority Malaysia)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Malaysia Injectable Emulsions market. This step is underpinned by extensive desk research, utilising a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables—such as formulation type, route of administration, end-user setting, hospital procurement dynamics and regional distribution patterns—that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyse historical data pertaining to the Malaysia Injectable Emulsions market. This includes assessing market value, volume units (vials or litres), hospital penetration rates, adoption ratios by formulation type, and resultant revenue generation. Furthermore, an evaluation of formulation pricing, dosing frequency, and hospital dispensing statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) and semi-structured interviews with industry experts representing a diverse array of companies and institutions (hospital pharmacists, procurement heads, regional distributors). These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers and hospital procurement teams to acquire detailed insights into product segments, sales performance, hospital formulary access, and distribution patterns. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate and validated analysis of the Malaysia Injectable Emulsions market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Data Collection Techniques, Primary Interviews, Secondary Data Sources, Data Validation, Limitations and Future Research Directions)

- Definition and Scope

- Market Genesis and Development

- Key Regulatory Milestones and Approval Timelines

- Business Cycle and Market Maturity

- Supply Chain and Value Chain Analysis (Raw Material Sourcing, API Suppliers,

- Manufacturing Facilities, Distribution Networks, Cold Chain Logistics, Pharmacovigilance)

- Growth Drivers

Rising Chronic Disease Burden

Increasing Parenteral Nutrition Use

Technological Advancements in Formulations

Healthcare Infrastructure Growth - Market Challenges

Complex Regulatory Landscape

High Manufacturing Costs

Cold Chain Management

Import Dependency - Opportunities

Emerging Personalized Nutrition Products

Expansion of Home Care Services

Government Healthcare Initiatives - Trends

Increase in Nano- and Microemulsion Usage

Shift Towards Biocompatible Lipid Carriers

Adoption of AI in Supply Chain Management - Government Regulations

NPRA Approval Process

Quality Assurance Standards

Import/Export Controls - SWOT Analysis

- Stakeholder Ecosystem (Pharma Manufacturers, Healthcare Providers, Distributors, Regulators, Patients)

- Porter’s Five Forces Analysis

- By Value and Volume, 2019-2024

- Pricing Trends and Models, 2019-2024

- Market Share Dynamics, 2019-2024

- By Product Type (In Value %)

Lipid-based Emulsion

Water-in-Oil Emulsions

Oil-in-Water Emulsions

Nanoemulsions

Microemulsions - By Application (In Value %)

Parenteral Nutrition

Anesthetics

Oncology

Cardiovascular Therapy

Dermatology - By End-User (In Value %)

Hospitals

Ambulatory Care

Clinics

Home Healthcare - By Distribution Channel (In Value %)

Hospital Pharmacies

Retail Pharmacies

Online Pharmacies

Direct Sales - By Region (In Value %)

Central

Northern

Southern

Eastern

Western Malaysia

- Market Share of Key Players by Value and Volume

- Cross Comparison Parameters (Company Profile, Product Portfolio, Business Strategy, R&D Investment, Manufacturing Capacity, Distribution Reach, Regulatory Approvals, Pricing Strategies)

- Pricing Analysis by SKU

- Detailed Profiles of Major Companies

Pfizer

Fresenius Kabi

Baxter International

Hikma Pharmaceuticals

Sanofi

Novartis AG

Sun Pharma

Mylan N.V.

Cipla Ltd

GlaxoSmithKline

Leo Pharma

Asta Medica

Jubilant Life Sciences

Recipharm

- Market Demand and Usage Patterns

- Procurement and Budgeting Trends

- Regulatory and Compliance Impact

- User Needs, Preferences, and Pain Points

- Decision-Making Process

- By Value and Volume, 2025-2030

- Pricing Projections, 2025-2030

- Market Share Dynamics, 2025-2030