Market Overview

Malaysia’s K-12 education market (public + private schooling ecosystem) is anchored by national funding and policy execution capacity. The Ministry of Finance highlights that the Ministry of Education received RM55.2 billion in the prior year and RM58.7 billion in the latest year, creating a large, stable demand base for school operations, teacher deployment, curriculum delivery, learning materials, assessments, and school upgrading programs. This funding scale underpins ongoing investments in school access, infrastructure maintenance, and system digitisation initiatives that collectively shape K-12 spending flows.

Within Malaysia’s K-12 landscape, demand concentration is strongest around Greater Kuala Lumpur and the Klang Valley, followed by fast-growing education clusters in Selangor and Johor—driven by household purchasing power, dense private-school networks, and proximity to corporate and expatriate communities. International-school demand is also strengthened by Malaysia’s positioning as a lower-cost English-medium alternative within Southeast Asia, supporting enrolment inflows from regional families and expat cohorts looking for globally benchmarked curricula and university pathways.

Market Segmentation

By School Ownership / Delivery Model

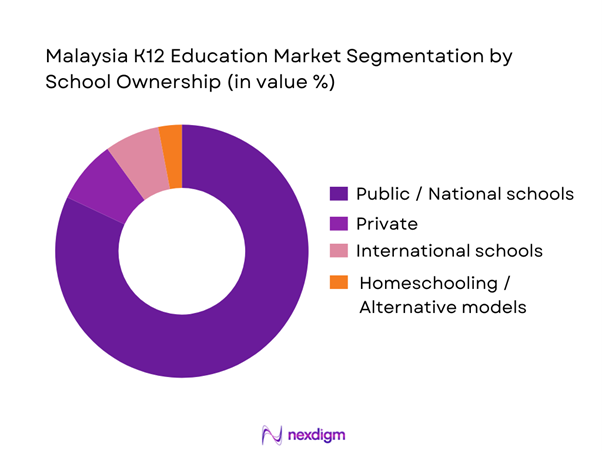

Malaysia’s K-12 education market is segmented by ownership and delivery model into public/national schools, private national-curriculum schools, international schools, and homeschooling/alternative providers. Public/national schools dominate overall participation because they are the default system backbone supported by national funding allocations, standardized curriculum delivery, and broad geographic coverage across urban and rural areas. The public system’s scale also creates the largest downstream demand pool for textbooks, assessments, teacher training, school maintenance, ICT procurement, and student services—making it the primary volume driver for K-12 ecosystem revenue capture by vendors and operators.

By Education Level

Malaysia’s K-12 education market is segmented by education level into primary, lower secondary, and upper secondary. Primary education typically dominates because it has the widest compulsory participation footprint, larger student cohorts, and consistent annual intake, creating the highest recurring demand for core learning content, foundational assessments, uniforms, transport, and school services. Primary also drives the largest volume of EdTech adoption at scale (learning management, classroom devices, digital content supplementation) because the system prioritizes foundational literacy/numeracy and teacher enablement—translating into high repeat procurement cycles across schools and districts, especially where school upgrading budgets and digitisation programs are active.

Competitive Landscape

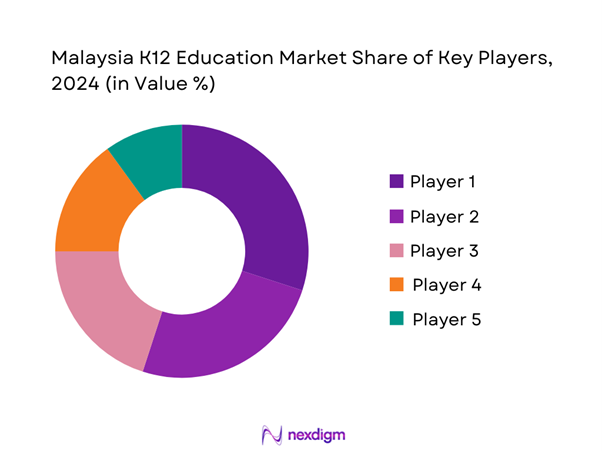

The Malaysia K-12 education market is shaped by a mix of large multi-campus private/international school groups and premium standalone operators, with competition focused on curriculum pathways (British/IGCSE, IB, American, national curriculum), university placement outcomes, teacher quality, campus experience, and differentiated digital learning models. Consolidation dynamics are visible through expansion, partnerships, and M&A interest across Southeast Asia’s private K-12 segment, as Malaysia is increasingly positioned as a regional education hub alternative to higher-cost markets.

| Company | Establishment year | Headquarters | Core curricula offered | Campus footprint in Malaysia | Fee positioning | Digital learning stack maturity | University pathway strength | Boarding capability |

| Tenby Schools | 1960 | Malaysia | ~ | ~ | ~ | ~ | ~ | ~ |

| Taylor’s International School | 2011 | Malaysia | ~ | ~ | ~ | ~ | ~ | ~ |

| Fairview International School | 2008 | Malaysia | ~ | ~ | ~ | ~ | ~ | ~ |

| REAL International School | 2006 | Malaysia | ~ | ~ | ~ | ~ | ~ | ~ |

| Alice Smith School | 1946 | Malaysia | ~ | ~ | ~ | ~ | ~ | ~ |

Malaysia K–12 Education Market Analysis

Growth Drivers

Demographic Trends

Malaysia’s K–12 demand base continues to be anchored in a large and stable school-age population pipeline. The country’s total population stands at 35,977,000, which sustains recurring annual intake across primary and secondary cohorts in both public and private education systems. On the macroeconomic side, Malaysia’s total economic output is recorded at USD 421,970,000,000, indicating strong fiscal capacity to support nationwide education provisioning, school infrastructure maintenance, teacher deployment, and continuity of learning initiatives. Inflation remains contained at 1.8, supporting household budget stability for education-related spending such as transport, digital devices, and supplementary tutoring. Together, population scale, economic output strength, and low inflation reinforce baseline K–12 enrolment stability even as birth-rate growth moderates, ensuring consistent system utilisation and long-term demand continuity across the education value chain.

Urban Middle-Class Expansion

K–12 participation patterns in Malaysia are increasingly shaped by urbanisation and middle-class concentration in metropolitan labour markets. The urban population share has increased from 77.5 to 78.3, reflecting the continued expansion of city-region schooling catchments where private, international, and enrichment-focused education models scale more rapidly than in rural areas. This shift is reinforced by income capacity, with GDP per capita recorded at USD 11,867.3, supporting affordability for supplementary learning services such as exam preparation, language training, and co-curricular programmes that cluster around urban centres. Labour-market conditions further strengthen this trend, as unemployment is measured at 3.8, supporting steadier household cash flows and a higher willingness to invest in education outcomes linked to social mobility, STEM readiness, and bilingual proficiency. As a result, demand becomes structurally concentrated in Greater Kuala Lumpur, Selangor, and Johor, where school choice, private enrolment, and paid learning layers are deeply embedded in household decision-making.

Market Challenges

Teacher Shortages

Teacher availability has emerged as a structural operational challenge across Malaysia’s K–12 system. A total of 13,749 new teachers were placed into primary and secondary schools during the most recent national deployment cycle, highlighting the scale of annual recruitment required to stabilise classroom staffing. However, attrition remains significant: 19,179 teachers exited the system through early retirement between 2022 and May 2025, including 5,306 in one year, 6,394 in the following year, and 5,082 thereafter, with an additional 2,397 exits recorded up to May. These exits must be offset while also addressing subject-specific gaps in mathematics, science, and English, as well as geographic imbalances between urban and rural schools. The broader labour-market context compounds the challenge, as unemployment at 3.8 increases competition for skilled graduates and mid-career professionals who might otherwise enter teaching. This creates a persistent staffing-throughput risk, affecting workload intensity, instructional quality consistency, and hiring lead times for both public schools and private operators.

Cost of Private Education

Affordability constraints continue to limit the scale of private education participation despite rising parental preference. Malaysia’s GDP per capita of USD 11,867.3 creates a bifurcated demand structure in which a defined segment of households can sustain private schooling, while a much larger share remains reliant on public education supplemented by selective paid add-ons such as tutoring, enrichment, and digital learning tools. Enrolment figures illustrate this structural gap: 216,513 students are enrolled across all types of private schools, compared with 4,800,000 students in national schools. Inflation at 1.8 provides short-term cost stability, but the affordability challenge is driven more by multi-year household budgeting pressures in urban areas, where housing, transport, and childcare costs compete directly with education upgrades. For operators, this translates into sensitivity around seat-fill rates outside Tier-1 cities, higher scholarship dependence, and increased pressure to justify outcomes. For families, it results in hybrid strategies such as stage-based switching between public and private systems or reliance on enrichment rather than full private enrolment.

Opportunities

EdTech Integration

Malaysia’s K–12 EdTech opportunity is supported by exceptionally strong digital readiness at the household level. Internet usage stands at 98.0206 individuals per 100 people, enabling widespread participation in blended learning models, digital homework platforms, learning management systems, and parent–teacher communication tools without access constraints. This readiness is reinforced by macroeconomic stability, with GDP at USD 421,970,000,000 and unemployment at 3.8, sustaining household capacity to invest in devices, connectivity, and digital subscriptions even where schools do not fully subsidise technology. For K–12 operators, this creates immediate growth avenues grounded in current conditions: learning analytics that reduce teacher workload pressure, hybrid content delivery that standardises instruction across campuses, and exam-prep or language platforms that monetise outcome-driven parental demand. Rather than replacing physical schools, EdTech acts as a scalable operating layer that improves accountability, instructional consistency, and cost efficiency, making digital integration a core structural feature of Malaysia’s urban K–12 ecosystem.

STEM & TVET Alignment

STEM orientation within Malaysia’s K–12 system has strengthened materially, with 50.83 students enrolled in STEM streams, up from 41.84 in earlier periods, signalling a decisive shift toward science- and technology-focused pathways at the secondary level. This trend aligns with Malaysia’s macroeconomic position as an upper-middle-income economy, reflected in GDP per capita of USD 11,867.3 and total GDP of USD 421,970,000,000, where future productivity gains depend on technical and scientific skill development. On the post-school side, the TVET ecosystem provides substantial capacity, comprising 669 public TVET institutions across 12 federal ministries, 24 state-owned institutions, and 652 private providers, totaling 1,345 institutions and supported by 4,786 nationally listed TVET courses. For the K–12 market, this creates a clear opportunity to develop pathway-linked programmes that connect STEM schooling with applied technical progression through industry-aligned labs, coding and robotics modules, and technical English. Operators that integrate these pathways can differentiate based on employability relevance and progression clarity rather than fee escalation, leveraging existing system scale and institutional depth already present in Malaysia’s education ecosystem.

Future Outlook

Over the next five years, Malaysia’s K-12 education market is expected to expand steadily, supported by sustained public funding capacity and continued private/international school demand in major urban clusters. Growth is likely to be accelerated by digitisation of teaching and administration, learning analytics adoption, and increased competition on outcomes (university pathways, STEM readiness, bilingual proficiency). Using broader private-education market growth references as a directional benchmark, a mid-single-digit growth trajectory is plausible for the private layer of K-12 services through the forecast window, while the public backbone remains the largest spend anchor.

Major Players

- Tenby Schools

- Taylor’s International School

- Fairview International School

- REAL International School

- Alice Smith School

- Sri KDU International School

- Nexus International School Malaysia

- Epsom College in Malaysia

- International School of Kuala Lumpur (ISKL)

- Garden International School (Malaysia)

- British International School Kuala Lumpur (BISKL)

- Regent International School

- Cempaka Schools

- Beaconhouse Malaysia

- Wesley Methodist School

Key Target Audience

- Investments and venture capitalist firms

- Private equity funds focused on consumer services and education assets

- International school operator groups evaluating Southeast Asia expansion

- Domestic private school chains planning multi-campus rollout

- EdTech platform vendors (LMS, SIS, assessments, content) targeting K-12 procurement

- Education publishers and content providers (digital + print)

- Real estate developers planning integrated townships with K-12 anchors

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We construct the Malaysia K-12 ecosystem map covering public system funding flows, private operator models, international curricula pathways, and enabling services such as EdTech, transport, and facilities. Desk research combines policy documents, budget allocations, and operator disclosures to define the variables shaping demand, pricing power, and adoption.

Step 2: Market Analysis and Construction

We compile historical spending signals, operator expansion patterns, and observable enrolment/fee drivers across major hubs such as Greater Kuala Lumpur and key growth states. The model separates public backbone spend from private monetisation layers to map where value capture occurs across the K-12 supply chain.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on growth drivers (digitisation intensity, curriculum preference shifts, premiumisation, and campus scaling) are validated through structured interviews with school leaders, EdTech providers, education service partners, and parent-community representatives to confirm buying criteria and budget realities.

Step 4: Research Synthesis and Final Output

We triangulate findings using bottom-up operator benchmarking, procurement mapping, and stakeholder inputs, then finalise segmentation, competitive positioning, and forecast logic. Outputs are reviewed for internal consistency across demand drivers, constraints, and operator economics before publication.

- Executive Summary

- Research Methodology (Market Definitions and Scope, Abbreviations & Acronyms, Market Sizing Framework, Demand–Supply Mapping, Education System Mapping, Public vs Private Data Triangulation, Primary Interviews with School Operators & EdTech Providers, Parent & Institutional Stakeholder Inputs, Assumptions & Limitations)

- Definition and Scope

- Evolution of Malaysia’s K–12 Education System

- Structure of National, Vernacular, Religious, Private & International Schools

- Education Governance Framework (MOE, State Education Departments, JPN, PPD)

- Business Cycle of the K–12 Education Ecosystem

- Education Value Chain Analysis (Curriculum → Delivery → Assessment → Certification)

- Growth Drivers (Demographic Trends, Urban Middle-Class Expansion, Private School Penetration, International Expat Population, Education Quality Benchmarking)

- Market Challenges (Teacher Shortages, Cost of Private Education, Digital Divide, Regulatory Approvals, Infrastructure Gaps in Rural Areas)

- Opportunities (EdTech Integration, STEM & TVET Alignment, Inclusive Education, Islamic Education Modernization, Public–Private Partnerships)

- Trends (Digital Classrooms, AI-Based Assessment, Holistic & Competency-Based Learning, Micro-Credentials, Global Curriculum Adoption)

- Government Policies & Regulation (Education Acts, Private Education Licensing, Curriculum Mandates, Teacher Certification, Digital Education Policies)

- SWOT Analysis

- Stakeholder Ecosystem (MOE, Schools, Teachers, Parents, EdTech Providers, Content Publishers, Examination Boards)

- Porter’s Five Forces Analysis

- Competitive Intensity & Market Structure

- By Total Enrolment Base, 2019-2024

- By Number of Institutions, 2019-2024

- By Public vs Private Education Spend, 2019-2024

- By Household Education Expenditure, 2019-2024

- By School Ownership Type (In Value %)

National Schools (Sekolah Kebangsaan)

National-Type Schools (SJKC, SJKT)

Religious Schools (Sekolah Agama, Tahfiz)

Private Schools

International Schools - By Education Level (In Value %)

Pre-Primary

Primary

Lower Secondary

Upper Secondary - By Curriculum Framework (In Value %)

National Curriculum (KSSR/KSSM)

Cambridge IGCSE

International Baccalaureate (PYP, MYP, DP)

American Curriculum

Australian & Other International Curricula - By Medium of Instruction (In Value %)

Bahasa Malaysia

English

Mandarin

Tamil

Bilingual / Trilingual Models - By Delivery Mode (In Value %)

Traditional Classroom-Based

Blended Learning

Fully Digital / Virtual Schooling

Supplementary Tuition & After-School Learning - By Geography (In Value %)

Klang Valley

Southern Region

Northern Region

East Coast

East Malaysia (Sabah & Sarawak)

- Market Share Analysis by School Category

- Cross Comparison Parameters (Curriculum Portfolio Depth, Student Capacity & Enrolment Scale, Fee Structure & Affordability Bands, Teacher Qualification & Localization Ratio, Digital Learning Infrastructure Maturity, Assessment & Outcome Framework, Geographic Footprint & Campus Density, Regulatory & Accreditation Compliance)

- SWOT Analysis of Key Players

Fee Structure Benchmarking (Tuition, Ancillary & Digital Learning Components) - Detailed Profiles of Major Companies / School Groups

Ministry of Education Malaysia (Public School Network)

UCSI Schools Group

Tenby Schools Malaysia (Inspired Education)

Sri KDU International School

Beaconhouse Malaysia

Taylor’s Schools

Nexus International School Malaysia

Epsom College in Malaysia

International School of Kuala Lumpur (ISKL)

Fairview International School

REAL Schools Malaysia

Rafflesia International School

HELP International School

Sunway International School

Sayfol International School

- Student Demographics & Enrolment Behavior

- Parent Decision-Making & Fee Sensitivity

- Institutional Budgeting & Funding Models

- Curriculum Preference & Learning Outcomes Expectations

- Pain Points & Unmet Needs Across Public and Private Segments

- By Total Enrolment Base, 2025-2030

- By Number of Institutions, 2025-2030

- By Public vs Private Education Spend, 2025-2030

- By Household Education Expenditure, 2025-2030