Market Overview

The Malaysia low-cost carrier market is projected to reach a significant size, driven by the growing demand for affordable travel options. As of recent assessments, the market value for 2025 is estimated at USD ~ billion. This growth is primarily fueled by an increasing number of air passengers seeking cost-effective alternatives for both domestic and international travel. Additionally, airline companies are intensifying their fleet expansion and offering competitive pricing strategies, further contributing to market expansion. The low-cost carriers’ strong performance can also be attributed to favorable government policies, improved infrastructure, and rising disposable income, especially among the middle-class population.

The market is largely concentrated in urban centers such as Kuala Lumpur, Penang, and Johor Bahru, where airports are well-connected to international and regional routes. Kuala Lumpur remains a key hub due to its strategic location and robust infrastructure, which supports both inbound and outbound travel. These cities have become significant bases for low-cost carriers, contributing to their dominance by offering quick turnaround times, efficient operations, and access to growing tourist markets. Additionally, proximity to major business and tourism destinations has made Malaysia an attractive location for budget travel.

Market Segmentation

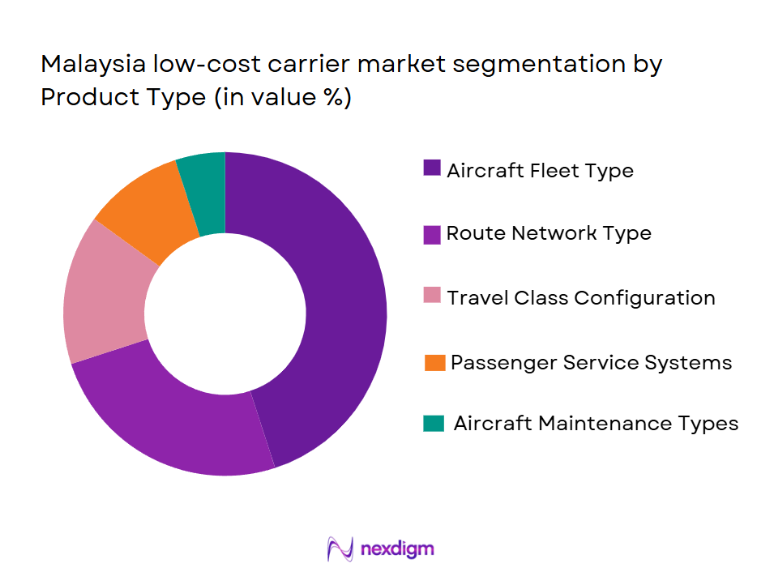

By Product Type

The Malaysia low-cost carrier market is segmented by product type into various categories such as aircraft fleet type, route network type, travel class configuration, passenger service systems, and aircraft maintenance types. Recently, the aircraft fleet type has dominated the market share due to its direct impact on operating costs, performance, and fleet management strategies. The availability of new-generation, fuel-efficient aircraft models and their increasing adoption by low-cost carriers have significantly contributed to the fleet type’s dominance. Airlines are opting for newer aircraft models, which not only reduce operational costs but also enhance customer experience, thereby increasing competitiveness in the market. Additionally, the introduction of fuel-efficient and larger aircraft has enabled low-cost carriers to expand their offerings without increasing fares drastically, leading to a larger market share.

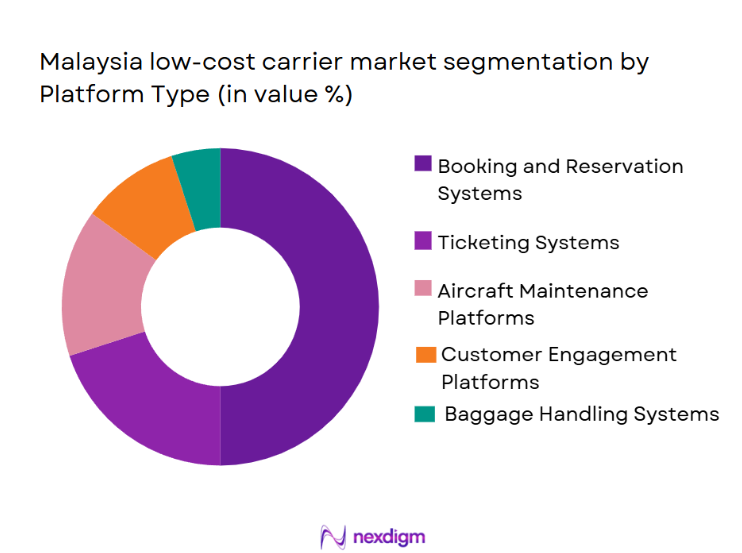

By Platform Type

The low-cost carrier market is segmented by platform type into categories such as booking and reservation systems, ticketing systems, aircraft maintenance platforms, customer engagement platforms, and baggage handling systems. Recently, booking and reservation systems have had a dominant market share. These systems play a critical role in optimizing passenger experience, ensuring easy access to flights, and providing a seamless booking process. With the growing importance of digitalization, low-cost carriers have heavily invested in advanced booking platforms that allow customers to make hassle-free reservations, reducing dependency on travel agencies. Furthermore, these platforms enable airlines to reduce operational costs associated with manual bookings and offer greater flexibility to passengers.

Competitive Landscape

The Malaysia low-cost carrier market is highly competitive, with several players vying for market dominance. Key companies in this space are focusing on expanding their fleets, optimizing routes, and enhancing customer experiences to maintain a competitive edge. The market is witnessing consolidation, where smaller carriers are merging with larger players or exiting the market due to the high operational costs associated with running low-cost airlines. Additionally, new entrants are challenging established players by offering competitive fares and leveraging technological advancements. The influence of major players such as AirAsia, Malindo Air, and Scoot Airlines is evident, with these companies driving innovation and setting industry standards. The competition in the market is expected to remain strong, with players focusing on cost-efficiency, customer retention, and fleet expansion to capture greater market share.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (2024) | Additional Market-Specific Parameter |

| AirAsia | 1993 | Kuala Lumpur | ~ | ~ | ~ | ~ | ~ |

| Malindo Air | 2013 | Kuala Lumpur | ~ | ~ | ~ | ~ | ~ |

| Scoot Airlines | 2012 | Singapore | ~ | ~ | ~ | ~ | ~ |

| Cebu Pacific | 1996 | Manila | ~ | ~ | ~ | ~ | ~ |

| Lion Air | 1999 | Jakarta | ~ | ~ | ~ | ~ | ~ |

Malaysia Low Cost Carrier Market Analysis

Growth Drivers

Increasing Demand for Budget Travel

The demand for affordable air travel in Malaysia has significantly increased due to rising disposable incomes, more budget-conscious travelers, and the growing middle class. This demand is bolstered by the expansion of low-cost carrier offerings, which make air travel more accessible to a larger segment of the population. With the emergence of budget-friendly carriers and low ticket prices, more people can afford to travel, leading to an increase in overall market demand. Additionally, the rise in domestic and international tourism, particularly among young travelers and working professionals, is expected to continue driving demand for low-cost airline services in Malaysia. Furthermore, low-cost carriers are attracting a growing number of customers by offering flexible options, such as customized services, without compromising on safety or service quality.

Government Support and Infrastructure Development

The Malaysian government’s support for the aviation sector, including the expansion of airports and the introduction of policies to encourage air travel, has played a significant role in driving market growth. Infrastructure development in major cities, particularly in Kuala Lumpur, hasfacilitatedthe smooth operations of low-cost carriers. Additionally, the government’s initiatives to boost tourism and foster economic growth have increased the demand for domestic and international flights. By enhancing airport capacity and offering favorable policies, the government has made it easier for low-cost carriers to operate efficiently and expand their reach within the region.

Market Challenges

Intense Competition

One of the primary challenges faced by the Malaysia low-cost carrier market is the intense competition from both established players and new entrants. Established carriers such as AirAsia and Malindo Air face constant pressure to maintain market share, while new low-cost airlines continue to emerge with competitive pricing strategies. This competitive environment makes it difficult for individual carriers to differentiate themselves, leading to price wars and reduced profit margins. Furthermore, competition from full-service carriers that are also targeting budget-conscious travelers has intensified, further squeezing the market for low-cost carriers. The market’s highly competitive nature presents challenges for sustainable growth, requiring carriers to adopt innovative strategies to maintain profitability.

Rising Fuel Costs and Operational Expenses

The volatility in fuel prices poses a significant challenge to low-cost carriers, which rely heavily on fuel for their operations. Fuel costs account for a substantialportionof airlines’ operating expenses, and fluctuations in global oil prices can lead to higher operational costs for low-cost carriers. Additionally, increasing regulatory requirements regarding environmental standards and carbon emissions add to the cost burden. Airlines may be forced to raise ticket prices to compensate for these higher costs, which could deter price-sensitive passengers from flying. Managing fuel price fluctuations while maintaining affordability is a critical challenge for low-cost carriers in Malaysia.

Opportunities

Expansion of Regional Connectivity

The growing demand for regional travel presents a significant opportunity for low-cost carriers to expand their operations in the Asia-Pacific region. By increasing their routes and adding more flights to emerging destinations, low-cost carriers can tap into new markets and attract more customers. The rise in tourism and business travel in ASEAN countries and neighboring regions has created opportunities for low-cost carriers to offer affordable alternatives for regional flights. As air travel continues to become more accessible, airlines can benefit from the increasing number of regional travelers who seek cost-effective options for their journeys. The expansion of connectivity to lesser-served markets can drive growth in the low-cost carrier sector.

Investment in Sustainable Aviation Technologies

There is a growing opportunity for low-cost carriers to invest in sustainable aviation technologies to address environmental concerns and reduce operational costs. Technologies such as fuel-efficient engines, alternative fuels, and eco-friendlyaircraftare gaining traction as carriers look to reduce their carbon footprint and comply with stringent environmental regulations. Low-cost carriers that invest in these technologies can not only benefit from cost savings in the long term but also appeal to environmentally conscious passengers. As sustainability becomes increasingly important, airlines that adopt green initiatives can enhance their reputation and attract a loyal customer base.

Future Outlook

The future of Malaysia’s low-cost carrier market looks promising, with several key factors contributing to sustained growth. Technological advancements are expected to play a significant role in enhancing operational efficiencies, including automated systems for booking, customer service, and fleet management. In addition, rising demand for budget travel, coupled with government initiatives to support the aviation sector, will provide a conducive environment for expansion. Over the next few years, the market will likely see the introduction of more fuel-efficient aircraft and sustainable practices, aligning with global trends toward sustainability. As demand for travel continues to rise, especially among budget-conscious travelers, the low-cost carrier market in Malaysia is poised for significant growth.

Major Players

- AirAsia

- Malindo Air

- Scoot Airlines

- Cebu Pacific

- Lion Air

- Jetstar Airways

- VietJet Air

- Flynas

- Peach Aviation

- GoAir

- Indigo Airlines

- Air India Express

- Tigerair

- Nok Air

- SpiceJet

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airline operators

- Airport management authorities

- Aviation technology providers

- Travel agencies

- Tourism boards

- Aircraft manufacturers

Research Methodology

Step 1: Identification of Key Variables

In this step, critical market variables are identified, including demand drivers, technological trends, regulatory influences, and competitive dynamics. Key factors influencing market growth and challenges are thoroughly assessed.

Step 2: Market Analysis and Construction

A comprehensive market analysis is conducted, including segmentation, historical trends, and competitive landscape. The analysis is then synthesized to build a model of the market’s current structure and its future trajectory.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and drivers are tested with input from industry experts, stakeholders, and key players in the market. This ensures the accuracy and relevance of the assumptions used in the market model.

Step 4: Research Synthesis and Final Output

The findings from the market analysis and expert consultations are synthesized into a detailed report, offering actionable insights and strategic recommendations for stakeholders. The final output provides a comprehensive overview of the market’s dynamics.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Budget Travel

Expansion of Regional Connectivity

Government Initiatives to Promote Air Travel - Market Challenges

Intense Competition from Full-Service Carriers

Fuel Price Fluctuations

Regulatory and Safety Compliance Costs - Market Opportunities

Growth in Emerging Markets

Partnerships and Alliances in ASEAN

Investment in Sustainable Aviation Technologies - Trends

Digitalization and Automation in Operations

Increased Focus on Customer Experience

Growth in International Travel Post-Pandemic - Government Regulations

Aviation Safety Standards

Environmental and Emission Regulations

Passenger Rights and Protection Laws

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Aircraft Fleet Type

Route Network Type

Travel Class Configuration

Passenger Service Systems

Aircraft Maintenance Types - By Platform Type (In Value%)

Booking & Reservation Systems

Ticketing Systems

Aircraft Maintenance Platforms

Customer Engagement Platforms

Baggage Handling Systems - By Fitment Type (In Value%)

New Aircraft Fitment

Retrofit Aircraft Fitment

Maintenance and Overhaul

In-Flight Entertainment Systems

Aircraft Modifications - By EndUser Segment (In Value%)

Domestic Passengers

International Passengers

Corporate Clients

Tourism Agencies

Government and Military - By Procurement Channel (In Value%)

Direct Purchases

Third-Party Vendors

Government Contracts

Airline Consortiums

Leasing Channels

- Market Share Analysis

- CrossComparison Parameters (Market Share, Revenue Growth, Fleet Size, Route Expansion, Technology Adoption)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

AirAsia

Malindo Air

Scoot Airlines

Firefly Airlines

Jetstar Asia

Cebu Pacific

Lion Air

IndiGo Airlines

SpiceJet

Nok Air

Flynas

Siam Air

Peach Aviation

GoAir

Wizz Air

- Domestic Passengers’ Preferences

- Tourism Market Trends

- Corporate Travel Shifts

- Government Procurement Trends

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035