Market Overview

The Malaysia medical devices market is valued at approximately USD 3.2 billion, based on a five-year historical analysis through 2023, reflecting robust growth in domestic production and imports. This expansion is driven by rising government healthcare outlays—such as the Ministry of Health’s budget rising from MYR 36.3 billion to MYR 41.2 billion, with MYR 5.5 billion earmarked for procurement of consumables and equipment.

The medical devices market in Malaysia benefits significantly from imports, with key supply sources including the United States and Germany, known for their advanced, high‑technology offerings, plus Greater China, which is expanding from consumables into complex devices, leveraging agreements between Malaysia’s MDA and China’s NMPA to expedite regulatory flow.

Market Segmentation

By Product Category

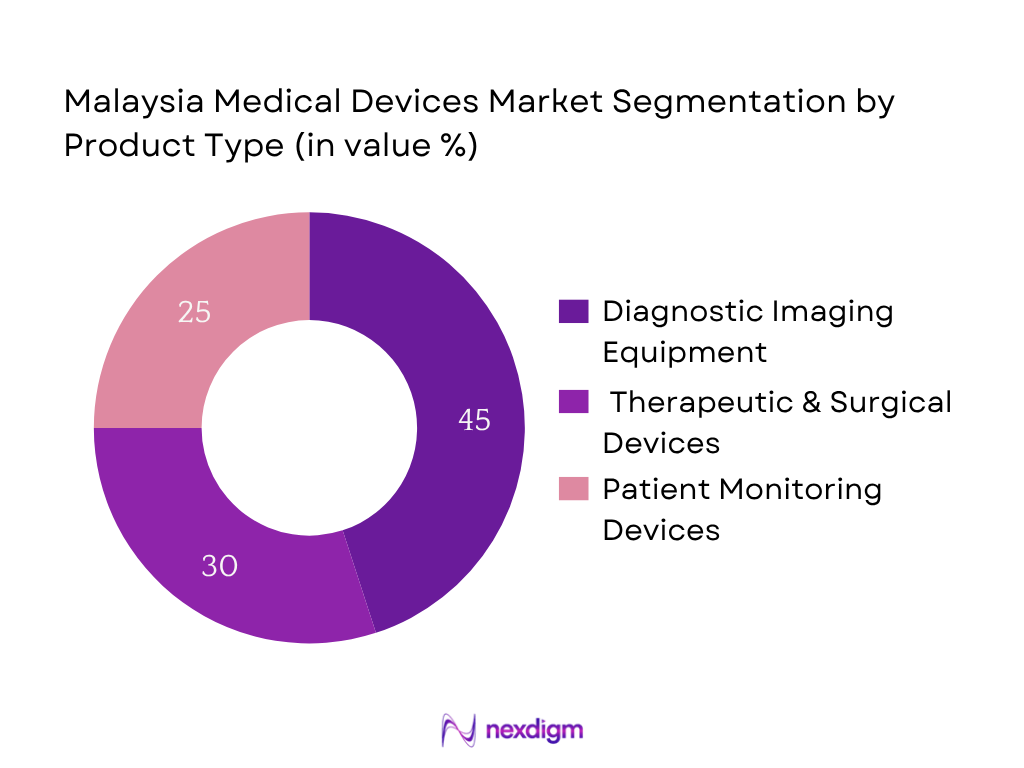

The market is segmented by product category into diagnostic imaging equipment, therapeutic & surgical devices, and patient monitoring devices. Diagnostic imaging equipment holds the dominant share—owing to surging demand from both public and private hospitals upgrading radiology departments, alongside medical tourism facilities investing in MRI, CT, and advanced imaging tech. These high‑ticket, high‑utility devices drive both capital expenditure and recurring service demand, reinforcing this segment’s leadership.

By End‑User

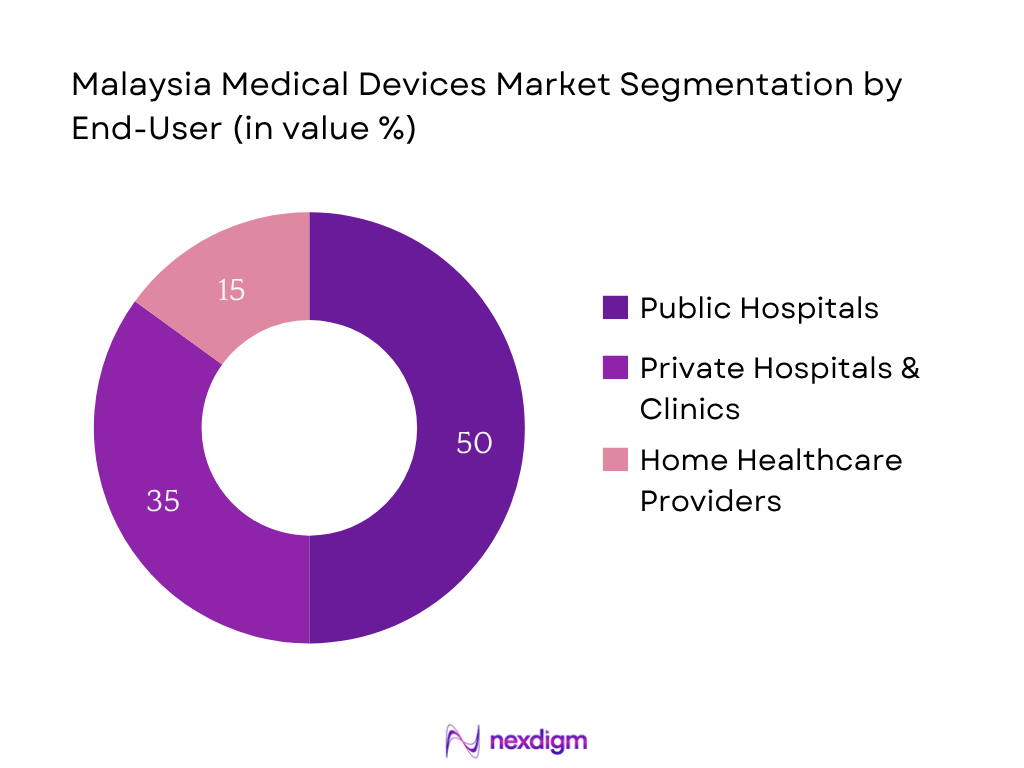

The market is segmented into public hospitals, private hospitals & clinics, and home healthcare providers. Public hospitals maintain the dominant market share, largely due to government‑led procurement programs and budget allocations under the Ministry of Health. Their network-wide investments in equipment for district hospitals and clinics, combined with centralized tenders, ensure economies of scale and widespread adoption across public facilities.

Competitive Landscape

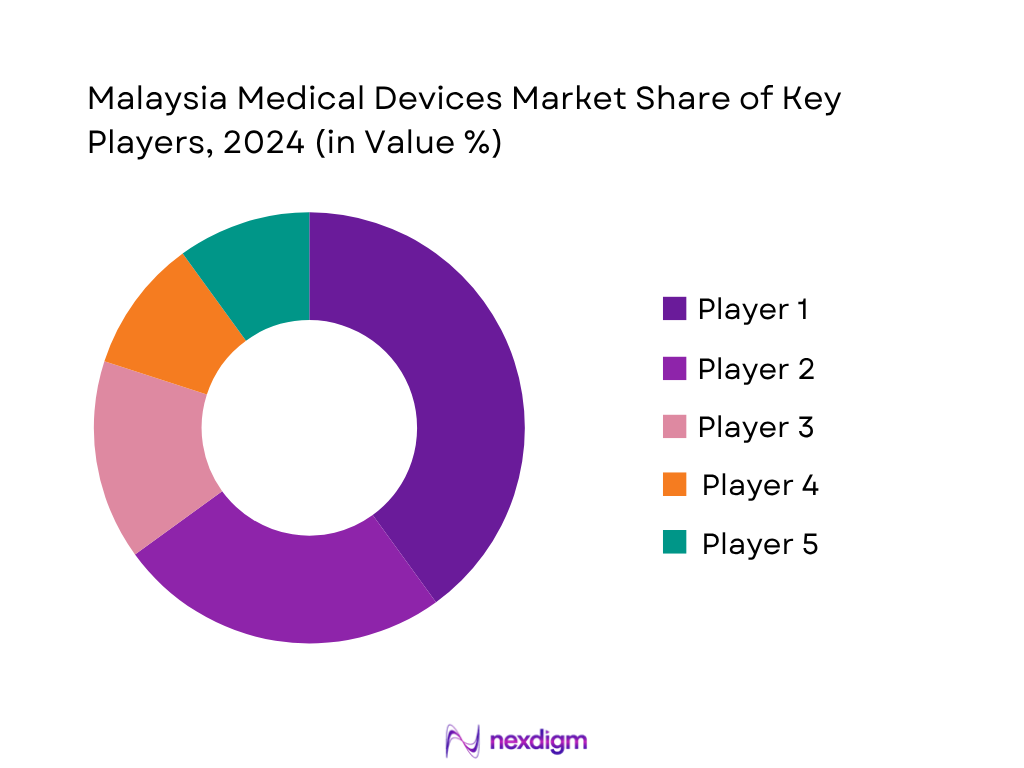

Malaysia’s medical devices market features both global leaders and regional manufacturers, with a competitive landscape dominated by firms possessing strong regulatory capabilities, manufacturing presence, and comprehensive product portfolios.

| Company | Establishment Year | Headquarters | Local Manufacturing | Regulatory Approvals | After‑Sales Network | Import Dependency |

| Siemens Healthineers | 1847 | Germany | – | – | – | – |

| Philips Healthcare | 1891 | Netherlands | – | – | – | – |

| GE Healthcare | 1892 | USA | – | – | – | – |

| Medtronic Malaysia | 1949 | USA/Ireland | – | – | – | – |

| B. Braun Medical Industries | 1839 | Germany | – | – | – | – |

Malaysia Medical Devices Market Analysis

Growth Drivers

Healthcare Digitization & Public Health Expenditure

Malaysia’s current health expenditure stands at 6.36% of GDP, reflecting substantial resource allocation toward modernizing healthcare systems. Government per capita health spending is approximately USD 50.22, indicating increased capacity for hospitals to invest in digitally enabled medical devices. Life expectancy has risen to over 75 years, signaling longer-term healthcare engagement and demand for medical technology. The working-age population comprises 70.0% as of 2023, ensuring the economic base to fund digitization efforts. Together, these macro metrics underscore sustained investments in digital infrastructure, enabling adoption of advanced medical devices for diagnostics and patient management.

Aging Population & Gerontechnology Need

As of 2024, 2.6 million Malaysians aged 65 and above comprise 7.7% of the population—crossing the UN threshold classifying Malaysia as an aging nation. The share of citizens aged 60 and above has similarly grown to 11.6%, or 3.9 million people, underscoring rising demand for geriatric medical care and adaptive devices. With life expectancy exceeding 75 years, the demographic shift necessitates more advanced monitoring and assistive technologies, positioning aging as a key driver of medical device uptake across public and private health systems.

Market Challenges

Import Dependency & Health Financing Structure

Malaysia’s domestic general government health expenditure accounts for around 2.66% of GDP in recent periods, while current health expenditure comprises 6.36% of GDP. Despite significant nominal spending, over 40% of health expenditure is privately funded per capita categories, indicating patients often rely on imports for specialized care. The imbalance between public capacity and private spending suggests heavy reliance on imported medical technologies, creating vulnerabilities related to supply chain disruption and foreign exchange volatility.

Regulatory Delays & Budget Constraints

Per World Bank and IMF forecasts, government spending growth is expected to slow compared to pandemic-induced surges. This signals tighter fiscal years ahead, potentially delaying regulatory approvals and budget allocations for new medical device introductions. In a constrained macro-fiscal environment, capital budgeting for high-cost devices may face re-prioritization, creating adoption bottlenecks despite demand and need.

Rural Access & Demographic Coverage Gaps

While urban centers are well-supported, nationwide infrastructure disparities persist. The workforce composition indicates urban-centric tertiary education levels (35.5%), but rural healthcare facilities may lag in digital connectivity and procurement of advanced devices. This inequitable distribution undermines universal adoption of innovative medical technology, limiting the market’s reach beyond metropolitan zones.

Opportunities

Contract Manufacturing & Healthcare Industrial Policy

Malaysia enjoys solid foundational healthcare spending—6.36% of GDP in current health expenditure. With government prioritization of import substitution and industrial growth, opportunities exist for setting up localized device assembly lines. The strong working-age base (70.0%) ensures availability of labor for contract manufacturing agreements, offering scalable potential without immediate regulatory complications.

Future Outlook

Over the next several years, the Malaysia medical devices market is expected to expand significantly, buoyed by continued healthcare infrastructure modernization, robust government budget increases, rising medical tourism, and the localization goals embedded in NIMP 2030. Adoption of digital health and smart device technologies will further shape demand, while supply chain resilience and import diversification remain strategic focal areas.

Major Market Players

- Siemens Healthineers

- Philips Healthcare

- GE Healthcare

- Medtronic Malaysia

- Braun Medical Industries

- Abbott Laboratories

- Stryker

- Canon Medical Systems

- Terumo Corporation

- Mindray Medical

- Fisher & Paykel Healthcare

- Nihon Kohden

- Zimmer Biomet

- Top Glove Corporation

- Toshiba Medical Systems

Key Target Audience

- Hospital Procurement Directors

- Healthcare Equipment Distributors

- Biomedical Engineering Heads in Public Hospitals

- Biomedical Engineering Heads in Private Hospitals

- Ministry of Health (MOH Malaysia)

- Medical Device Authority (MDA Malaysia)

- Investments and Venture Capitalist Firms

- Public‑Private Partnership (PPP) Development Agencies

Research Methodology

Step 1: Secondary Data Aggregation

Extensive desk research was undertaken, sourcing from government budgets, industry publications, and proprietary databases to establish baseline market size and growth context in Malaysia.

Step 2: Segmentation Mapping

The market was broken down into product categories and end‑user groups using classification from regulatory filings and business registers, allowing focused sub‑segment analysis.

Step 3: Expert Validation

Hypotheses and estimates were validated via interviews with industry stakeholders—regulatory bodies, facility procurement leads, and distributors—to confirm trends and refine data accuracy.

Step 4: Synthesis & Forecast

A bottom‑up approach integrating historical volume data, unit pricing, and policy drivers was synthesized to forecast growth through 2030, ensuring robustness across product and end‑user dimensions.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players in Malaysia

- Business Cycle of Medical Devices in Malaysia

- Supply Chain and Value Chain Analysis

- Growth Drivers

Healthcare Digitization

Aging Population

NCDs

Medical Tourism

Universal Health Coverage - Market Challenges

Import Dependency

Regulatory Delays

Rural Access

Skilled Workforce Gaps

Public Procurement Caps - Opportunities

Contract Manufacturing

Digital Health Devices

ASEAN Export

PPP Projects

Homecare Shift - Trends

AI Integration

ESG in Manufacturing

Local Assembly Initiatives

Preventive Healthcare Equipment - Government Regulations

Medical Device Act

Licensing via MDA

Halal Certification

Device Importation Guidelines - SWOT Analysis

- Stakeholder Ecosystem (MOH, MDA, Private Providers, Device Suppliers, Global Manufacturers)

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Diagnostic Imaging Equipment

Therapeutic and Surgical Devices

Patient Monitoring Devices

Consumables and Disposables

Assistive and Rehabilitation Devices - By End-User (In Value %)

Public Hospitals

Private Hospitals and Clinics

Ambulatory Surgical Centers

Diagnostic Centers

Home Healthcare - By Distribution Channel (In Value %)

Direct Procurement (MOH and State Tenders)

Medical Device Distributors

E-commerce Channels

Hospital Procurement Portals - By Technology Type (In Value %)

IoT-enabled Medical Devices

AI-assisted Imaging & Diagnostics

Remote Patient Monitoring

3D Printed Devices

Surgical Robotics - By Region (In Value %)

Central Malaysia (Kuala Lumpur, Selangor)

Northern Malaysia (Penang, Kedah, Perlis)

Southern Malaysia (Johor, Malacca, Negeri Sembilan)

Eastern Malaysia (Sabah, Sarawak)

- Market Share of Major Players on the Basis of Value/Volume

Market Share by Product Segment (Diagnostics, Surgical, Monitoring) - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Product Category, Number of Distributors, Distribution Channels, Regulatory Approvals, Product Localization, Post-Sale Service Reach)

- SWOT Analysis of Major Players

- Pricing Analysis Basis Key Product SKUs for Major Players

- Detailed Profiles of Major Companies

B. Braun Medical Industries

GE Healthcare

Siemens Healthineers

Philips Healthcare

Medtronic Malaysia

Abbott Laboratories

Stryker Corporation

Canon Medical Systems

Terumo Corporation

Mindray Medical

Fisher & Paykel Healthcare

Nihon Kohden

Zimmer Biomet

Top Glove Corporation

Toshiba Medical Systems

- Market Demand and Utilization (Public vs Private Hospitals)

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030