Market Overview

The Malaysia moisturizing dermatology creams market is valued at USD ~ million in 2024, up from around USD ~ million in earlier years for the broader skin-care category. This value is driven by increasing consumer awareness of skin-barrier damage in humid tropical conditions, rising visits to dermatologists, and stronger retail and e-commerce penetration of dermatology-recommended moisturisers (barrier-repair, sensitive-skin).

Urban centres such as Kuala Lumpur, Penang and Johor Bahru dominate the market, thanks to high disposable incomes, dense dermatology clinic networks, and significant presence of international derma-cosmetic brands. These cities benefit from robust retail infrastructure (pharmacies, modern trade, premium mall stores) and strong online connectivity, enabling brands to capture the urban-affluent and skin-sensitive consumer segments.

Market Segmentation

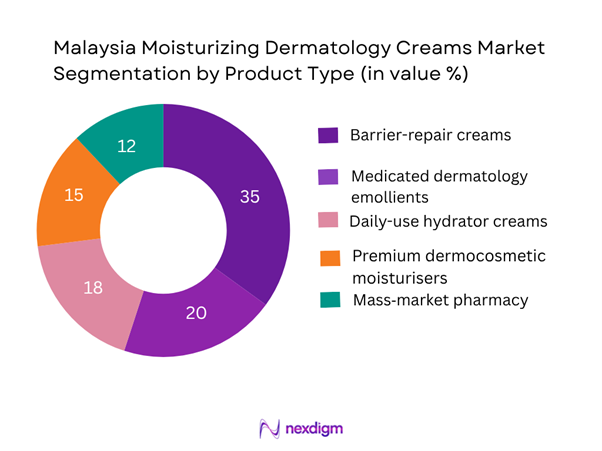

By Product Type

Currently the barrier-repair creams sub-segment dominates market share. This is due to the combination of Malaysia’s hot-humid climate which puts stress on skin barrier function, rising incidence of dry/eczema-prone skin treated in dermatology clinics, and consumer preference for “non-sticky, lightweight but intensive” cream textures suited to tropical weather. Dermatologist-recommended barrier-repair products have built trust and gradually migrated into pharmacy and retail distribution, thus capturing both clinical and retail channels.

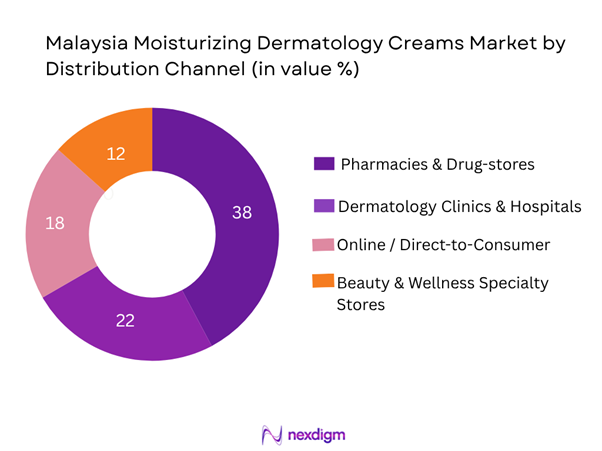

By Distribution Channel

Here, the pharmacies & drug-stores channel currently holds the largest share. This is because dermatology moisturising creams often obtain regulatory or derm-recommendation credibility, making pharmacies the trusted touch-point for consumers seeking dermatologist-approved barrier-repair or medicated products. Pharmacies combine accessibility with consultation trust, carry both clinical and retail brands, and are increasingly integrated with online click-and-collect models. Retail expansion of pharmacy chains across Malaysia has further boosted this channel.

Competitive Landscape

The Malaysia moisturizing dermatology creams market is characterised by a mix of global derma-cosmetic players with strong R&D and local/regional brands that emphasise halal-certification and skin-barrier expertise. While international brands hold brand equity and clinic-channel access, local players and pharmacy chains are gaining ground via tailored formulations for tropical climates and cost-effective pack sizes.

| Company | Establishment Year | Headquarters | Clinic Tie-ups (Yes/No) | Halal-certified Range | Online D2C Platform | Local Manufacturing (Malaysia) | Dermatologist-Recommended Flag |

| Galderma | 1981 | Switzerland | – | – | – | – | – |

| L’Oréal Dermatological | 1909 | France | – | – | – | – | – |

| Beiersdorf | 1882 | Germany | – | – | – | – | – |

| Kenvue | 1886 | USA | – | – | – | – | – |

| Unilever | 1929 | UK/Netherlands | – | – | – | – | – |

Malaysia Moisturizing Dermatology Creams Market Analysis

Growth Drivers

High humidity and skin barrier-stress in Malaysian climate

Malaysia experiences a tropical rainforest climate, with mean annual temperatures around 25.4 °C and rainfall averaging 3,085.5 mm per year. In Kuala Lumpur the average outdoor relative humidity remains between 72% and 78% throughout the year. These sustained humid and warm conditions increase transepidermal water loss and challenge skin barrier function, creating higher incidence of dry, sensitive or compromised skin among consumers. Consequently, the dermatology-moisturising-cream category sees elevated demand in Malaysia, particularly for formulations emphasising barrier repair, lightweight textures and non-sticky occlusion suited for humid climates.

Rising dermatology awareness and increasing visits to dermatologists

Household mean monthly consumption expenditure in Malaysia rose from RM 5,150 in 2022 to RM 5,566 in 2024 according to the Department of Statistics Malaysia (DOSM) survey. This increase in disposable spending supports growing investment in skincare, including dermatology-recommended creams. Moreover, overall skin-care and personal care retail in Malaysia continues strong growth, with the beauty & personal care market reaching USD 3.2 billion in 2024 and online sales accounting for 18% of total revenue. Greater awareness of dermatological conditions (eczema, sensitive skin, dermatographism) and accessibility of dermatology clinics in urban centres are driving consumers toward clinically endorsed moisturisers rather than generic mass creams. This shift supports growth in the dermatology moisturising creams sub-segment.

Market Challenges

Price sensitivity in mass segment

While affluent consumers are shifting to premium dermatology moisturisers, a large portion of Malaysian consumers remain highly price-sensitive. The average monthly household expenditure of RM 5,566 in 2024 (DOSM) indicates limited discretionary budget for many families. Furthermore, in the broader beauty & personal care market, mass-market brands dominate volume, and value promotions and discounts are common. As a result, market players offering clinical moisturising creams must balance formulation cost (e.g., ceramides, lipid actives) with retail pricing to avoid alienating mass-segment consumers. Price inflation in raw materials presents a further risk in maintaining margin without driving away budget-conscious buyers.

Regulatory hurdles (classification cosmetics vs pharmaceutical)

In Malaysia, skincare products that claim therapeutic benefits may face stricter regulation, registration or oversight compared with standard cosmetics. The distinction between “cosmetic” and “dermatology” or “over-the-counter therapeutic moisturiser” means brands must invest in clinical data, compliance documentation and regulatory time. This regulatory burden increases entry cost and slows product launch. Furthermore, evolving frameworks for halal-certified derma products, as noted in Malaysia’s halal cosmetics growth literature, add another layer of complexity. These regulatory requirements challenge brands and hinder rapid rollout of innovative dermatology moisturisers into the Malaysian market.

Opportunities

Private-label dermatology moisturisers for clinics

The rising number of dermatology clinics and skin health-focused practices in Malaysia represents a growing opportunity for private-label or clinic-exclusive moisturising creams. With consumer spend ability increasing (average monthly household spend RM 5,566 in 2024) and skin-sensitivity awareness rising, clinics are looking to differentiate via branded in-office products. Private-label formulations allow dermatology chains to capture margin, build loyalty and deliver targeted barrier-repair or post-procedure moisturisers. This model reduces direct competition from mass-market brands and opens a pathway for mid-premium pricing and clinic-direct channel growth.

Cross-channel omnichannel launches (clinic + online)

Malaysia’s e-commerce ecosystem is well advanced: total retail e-commerce volume was estimated at USD 16 billion in 2024, within a total e-commerce market of USD 23.5 billion. Beauty & personal care now sees increasing online penetration (18% of market revenue by 2024). For dermatology-moisturising players, launching via both clinic channels and online direct-to-consumer allows brands to capitalise on trusted dermatology endorsement and then scale via subscription, auto-replenishment and online loyalty programmes. This omnichannel strategy offers a promising opportunity to increase reach, reduce cost per acquisition and deepen engagement—especially among younger, digital-savvy consumers in Malaysia.

Future Outlook

Over the next six years the Malaysia moisturizing dermatology creams market is expected to show robust growth driven by rising skin-health awareness, increasing dermatologist visits, higher penetration of e-commerce and subscription models, and stronger demand for barrier-repair and sensitive-skin formulations tailored to tropical conditions. Players that deliver clinician-approved claims, halal-certified actives and seamless omnichannel experiences are most likely to capture the growth.

Forecasts indicate a compound annual growth rate (CAGR) of approximately 8.0 % for the period 2024-2030, lifting the market value from USD 786.75 million in 2024 to around USD 1 billion by 2030.

Major Players

- Galderma

- L’Oréal Dermatological Beauty

- Beiersdorf

- Kenvue

- Unilever

- Pierre Fabre

- NAOS (Bioderma)

- Ego Pharmaceuticals

- Rohto-Mentholatum

- Hyphens Pharma (Ceradan)

- Laboratoires Dermatologiques d’Uriage

- LG Household & Health Care (Physiogel)

- Wipro Unza (Safi Dermasafe)

- Watsons Own Brand (Dermaction Plus)

- Cosmoderm (Malaysia)

Key Target Audience

- Senior executives & strategy heads at skincare / derma-cosmetic companies

- Product development and R&D heads (moisturising/derma-active lines)

- Retail pharmacy chains and dermatology clinic networks

- Investors and venture capital firms (looking into derma-cosmetic brands)

- Halal-certification agencies (Malaysia, e.g., JAKIM)

- National regulatory bodies (e.g., Malaysia Ministry of Health – MoH)

- E-commerce platform operators specialising in skincare/dermocosmetics

- Private equity firms & M&A advisors in Beauty & Personal Care (BPC) space

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of major stakeholders in the Malaysia moisturising dermatology creams market, including dermatologists, clinic chains, model pharmacies, derma-cosmetic brands and e-commerce platforms. Desk research leveraged secondary databases and published reports to identify relevant variables such as clinic penetration, formulation trends and distribution channel splits.

Step 2: Market Analysis & Construction

Historical data on market value and volume were compiled for the broader skin-care category in Malaysia, with adjustments made to isolate “moisturising dermatology creams”. Estimates of number of dermatology clinics, dermatology channel revenues and pharmacy roll-out were analysed to build bottom-up value estimates. Price per SKU and penetration rates in clinics vs retail were used to validate figures.

Step 3: Hypothesis Validation & Expert Consultation

Hypotheses regarding product segment dominance (e.g., barrier-repair creams) and channel shifts (e-commerce, clinic-to-retail) were validated through interviews with dermatologists, skincare brand managers, and pharmacists across Kuala Lumpur and Penang. These CATI / in-person consultations provided operational insight on brand positioning, pricing strategies and consumer behaviour.

Step 4: Research Synthesis & Final Output

After integrating primary insights and secondary data, the final output was structured to deliver a comprehensive and validated analysis of the Malaysia moisturising dermatology creams market. Cross-checks with global derma-cosmetic trends and local conditions (e.g., tropical climate, halal demand) were performed to ensure robustness of forecast and segmentation.

- Executive Summary

- Research Methodology (Market definitions and scope, Abbreviations and conventions, Market sizing approach, Data sources: primary interviews, secondary research, Assumptions and conversion factors, Limitations and future outlook assumptions)

- Definition and scope of moisturizing dermatology creams

- Market genesis & Malaysia dermatology skincare context

- Key drivers of demand in Malaysia

- Chain of value

- Regulatory & certification landscape

- Growth Drivers

High humidity and skin barrier-stress in Malaysian climate

Rising dermatology awareness and increasing visits to dermatologists

Surge in halal-beauty/lifestyle formulations and local brand growth

E-commerce penetration and online skincare purchase trend - Market Challenges

Price sensitivity in mass segment

Regulatory hurdles (classification cosmetics vs pharmaceutical)

Ingredient cost escalation / supply-chain disruptions - Opportunities

Private-label dermatology moisturisers for clinics

Cross-channel omnichannel launches (clinic + online)

Premiumisation and advanced barrier-repair formulations (ceramides, lipid repair) - Key Trends

Halal-certified and natural-origin actives taking share

Personalisation and skin-diagnostic tech in moisturising creams

Online subscription models for dermatology-recommended moisturisers - Regulatory Environment & Standards

Cosmetic product registration in Malaysia

Halal certification requirements and impact on product formulation - SWOT Analysis

- Porter’s Five Forces Assessment

- Stakeholder Ecosystem & Value-Chain Map

- By Value (MYR / USD), 2019-2024

- By Volume (units, kilograms), 2019-2024

- By Average Price per SKU, 2019-2024

- By Product Type (In Value %)

Barrier-repair moisturisers

Medicated dermatology emollients (for eczema, psoriasis, xerosis)

Daily-use hydrators (dermatologist-recommended)

Premium/dermal-cosmetic moisturising creams

Mass-market moisturizing creams via pharmacy/beauty retail - By Formulation/Active Ingredient (In Value %)

Ceramides / lipid-repair actives

Hyaluronic acid & humectants

Botanical derivatives (natural-origin emollients)

Medicated actives (urea, salicylic acid, corticosteroid adjunct)

Halal-certified formulations - By Distribution Channel (In Value %)

Dermatology clinics & hospitals

Pharmacies & drug stores

Beauty & wellness specialty stores

Online/direct-to-consumer (brand websites, marketplaces)

Department stores / hypermarkets - By End-User / Consumer Segment (In Value %)

Female consumers

Male consumers

Age-group: Millennials (25–40)

Age-group: Middle-aged (41–60)

Dermatology patients (eczema/psoriasis sufferers) - By Price Tier (In Value %)

Premium segment (dermal-clinic specialty)

Mid-tier (pharmacy-recommended)

Mass segment (beauty/retail)

- Market share of major players by value/volume (latest year)

- Cross‐comparison parameters (Company overview, business strategies, recent developments, strengths, weaknesses, revenue by moisturizing dermatology creams, number of dermatology clinic tie-ups, distribution footprint (retail + online), production capacity, R&D pipeline, unique value offerings)

- SWOT analysis of major players

- Pricing analysis by SKU for major players – premium, mid-tier, mass

- Detailed Profiles of Major Companies

Galderma (Cetaphil)

L’Oréal Dermatological Beauty (CeraVe, La Roche-Posay, Vichy)

Beiersdorf (Eucerin, NIVEA Derma Lines)

Kenvue (Aveeno, Neutrogena)

Unilever (Vaseline, Simple, Pond’s Derma)

Pierre Fabre (Eau Thermale Avène, A-Derma)

NAOS (Bioderma)

Ego Pharmaceuticals (QV)

Rohto-Mentholatum (Hada Labo)

Hyphens Pharma (Ceradan)

Laboratoires Dermatologiques d’Uriage (Uriage)

LG Household & Health Care (Physiogel – Asia)

Wipro Unza (Safi Dermasafe)

Watsons Own Brand (Dermaction Plus by Watsons)

Cosmoderm (Malaysia)

- Demand drivers and utilisation by consumer group

- Purchasing power, budget allocation and buying behaviour (clinic vs retail)

- Dermatologist insight: skin-condition needs, barrier-repair gaps, unmet needs

- Pain-points, unmet needs and product gaps

- Decision-making process (dermatologist recommendation vs self-purchase)

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price per SKU, 2025-2030