Market Overview

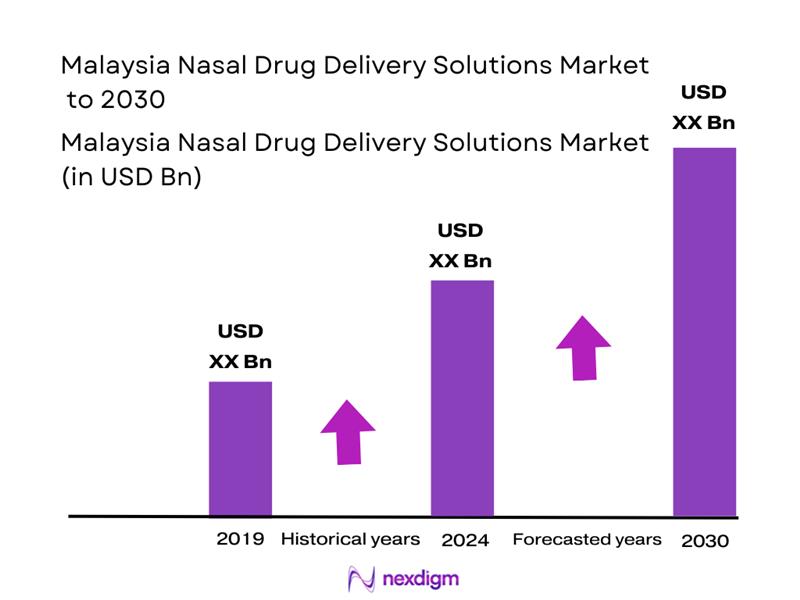

The Malaysia intranasal drug and vaccine delivery market is valued at USD ~ million based on 2023 estimates, with 2024 baseline close to the same ballpark, reflecting steady demand and adoption. This size is primarily driven by rising prevalence of nasal & respiratory conditions such as allergic rhinitis and sinusitis, growing patient preference for non-invasive drug delivery, and increasing uptake of intranasal therapies including sprays, decongestants, and vaccines. In addition, expanding use of nasal delivery in both acute (cold, congestion) and chronic (allergies, sinusitis, maintenance) conditions supports market value as patients increasingly seek easier, self-administered treatments.

Market Segmentation

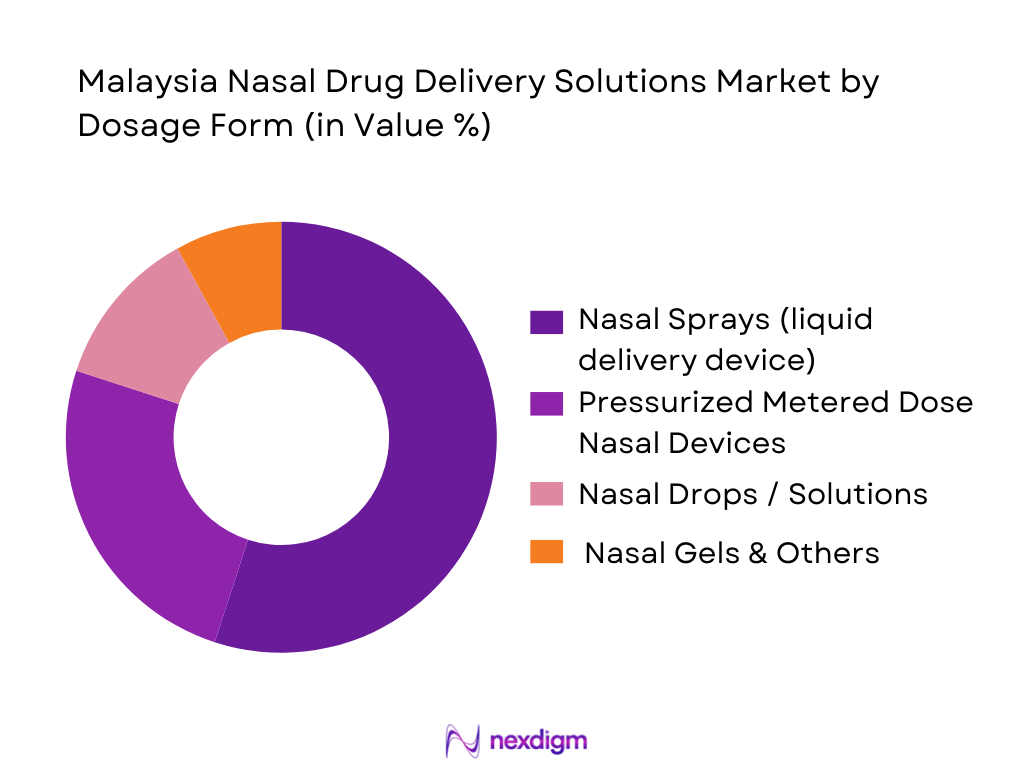

By Dosage Form

The market is segmented into Nasal Sprays (liquid delivery devices), Pressurized Metered Dose Nasal Devices, Nasal Drops/Solutions, and Nasal Gels & Others. Among these, Nasal Sprays (liquid delivery devices) hold the dominant share. This dominance is because nasal sprays offer ease of use, non-invasive self-administration, rapid onset of action and wide applicability across both acute and chronic nasal/respiratory conditions. For Malaysian patients and caregivers seeking convenient, over-the-counter or prescription options, sprays serve as the preferred format: they are portable, require minimal training, and provide reliable dose delivery. The established availability of sprays in pharmacies and their broad acceptance for allergic rhinitis, sinusitis or congestion makes them the largest contributor in the dosage-form segment.

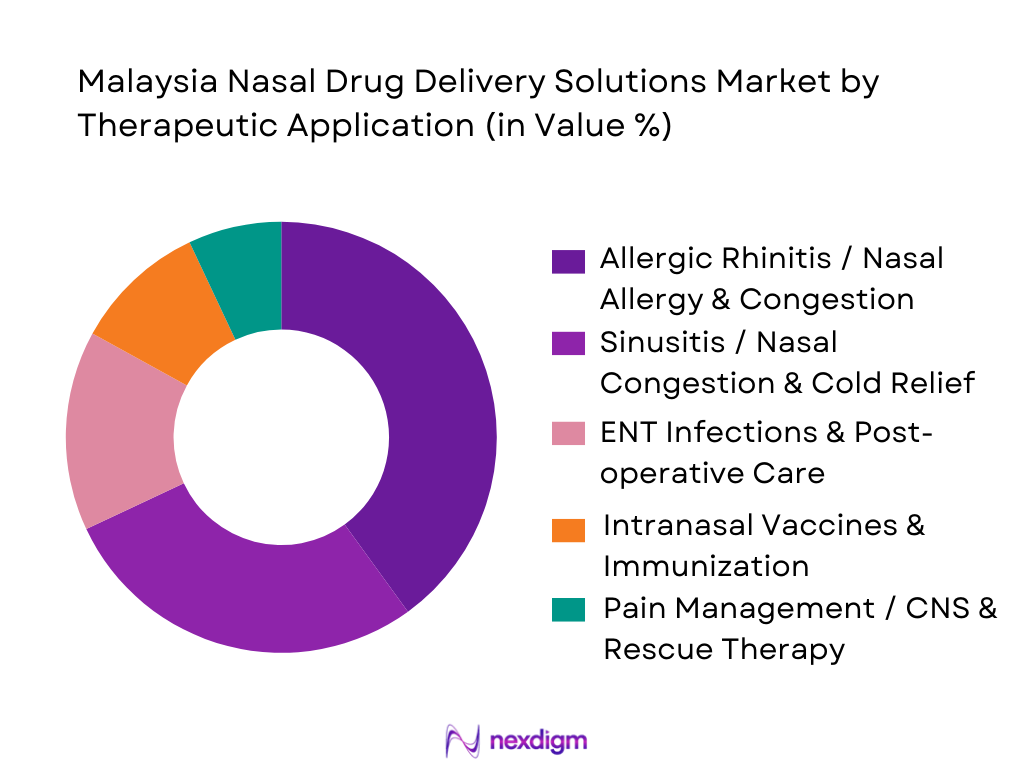

By Therapeutic Application

The market is segmented into Allergic Rhinitis / Nasal Allergy & Congestion; Sinusitis / Nasal Congestion & Cold Relief; ENT Infections & Post-operative Care; Intranasal Vaccines & Immunization; and Pain Management / CNS & Rescue Therapy. The Allergic Rhinitis / Nasal Allergy & Congestion sub-segment dominates currently. This is largely because allergic rhinitis is highly prevalent in urban and peri-urban Malaysian populations — triggered by environmental allergens, air pollution, changing lifestyles — prompting frequent demand for nasal sprays and decongestants. Chronic or recurrent nature of nasal allergies leads to repeated purchase cycles, enhancing volume demand. Also, many of these products are available OTC, facilitating self-medication and driving high market penetration. As a result, allergic rhinitis treatments represent the largest usage and revenue share under therapeutic application.

Competitive Landscape

The Malaysia nasal drug delivery solutions market features a mix of global pharmaceutical giants and regional manufacturers, offering both formulations and device-based nasal delivery products. The market exhibits moderate consolidation around major global players and specialized device suppliers, reflecting the influence of innovation, regulatory approvals, and distribution reach.

| Company | Establishment Year | Headquarters | Nasal Portfolio Breadth* | Device Technology Capability* | NPRA-Registered Nasal SKUs* | Distribution / Channel Coverage* | Notes* |

| Pfizer Malaysia Sdn Bhd | 1950 (global) | New York, USA (global) / Kuala Lumpur, Malaysia (local) | ~ | ~ | ~ | ~ | ~ |

| GlaxoSmithKline (GSK) Pharmaceuticals Malaysia | 1908 (global) | London, UK / Kuala Lumpur, Malaysia | ~ | ~ | ~ | ~ | ~ |

| Johnson & Johnson Sdn Bhd | 1886 (global) | New Brunswick, USA / Malaysia | ~ | ~ | ~ | ~ | ~ |

| Duopharma Biotech Berhad | 1958 (Malaysia) | Kuala Lumpur, Malaysia | ~ | ~ | ~ | ~ | ~ |

| Aspen Healthcare / Aspen Pharmacare Asia | 1850s (global) | Pretoria, South Africa / Malaysia regional office | ~ | ~ | ~ | ~ | ~ |

Malaysia Nasal Drug Delivery Solutions Market Analysis

Growth Drivers

Rising Allergic Rhinitis & Rhinosinusitis Burden

Allergic rhinitis is highlighted by the Malaysian Society of Allergy and Immunology as affecting around one-fifth of the general population, indicating roughly 7–8 million Malaysians living with clinically relevant symptoms that often require intranasal therapies for long-term control. MDPI A national literature review found AR prevalence in local datasets ranging between 1.83 and 9.23% across settings up to 2022, with urban cohorts showing higher symptom reporting and recurrent nasal congestion. PubMed Asthma—closely linked to upper airway disease—affects an estimated 8.9–13.0% of Malaysian children and 6.3% of adults, reinforcing a large pool of patients needing chronic nasal steroids, decongestants and saline irrigation as part of integrated airway care. Ministry of Health Malaysia With total population reaching about 34.7 million and GDP per capita around USD 11,867, scalability of reimbursed and self-pay nasal drug delivery solutions becomes increasingly viable as disease recognition and access to ENT and respiratory specialists expand across the public and private sectors.

Urbanisation, Air Quality & Lifestyle Changes

Malaysia’s urban population has crossed roughly 27.8 million residents, reflecting sustained internal migration into dense conurbations such as the Klang Valley, Penang and Johor Bahru.Macrotrends+1 Recent air-quality assessments show national mean PM2.5 levels around 10–18 μg/m³, more than three times the World Health Organization guideline of 5 μg/m³, driven by traffic emissions, industrial activity and transboundary haze. These exposures are recognised triggers for allergic rhinitis, chronic rhinosinusitis and asthma exacerbations, leading to recurring episodes of nasal obstruction, rhinorrhoea and sinus pressure that favour local intranasal anti-inflammatory and decongestant therapies. Simultaneously, overall GDP of about USD 422 billion and 5.2% real growth signal rising disposable incomes and healthcare spending capacity in metropolitan clusters, supporting uptake of premium nasal sprays, preservative-free formulations and long-acting delivery systems among middle- and upper-income urban households who are disproportionately exposed to air pollution and indoor allergens.

Market Challenges

Generic Competition & Brand Fragmentation

Malaysia’s status as a regional pharmaceutical and medical device exporter—shipping about USD 260.7 million in medicinal and pharmaceutical products in 2023 and maintaining decades of growth in this category—encourages vigorous generic entry across respiratory and ENT classes. CEIC Data With total exports reaching roughly RM 1.508 trillion in 2024 and strong orientation toward high-volume manufacturing sectors such as electrical and electronic products (valued at RM 593 billion in 2022), local and multinational producers have ample incentive to introduce low-cost nasal sprays and solutions that erode premium brand share. Tradeimex Hospital and retail formularies in a two-tier health system—covering 146 government and 202 private hospitals—are highly price-sensitive for chronic rhinitis and sinusitis therapies, intensifying competition between multinational originators, regional brands and Malaysian contract manufacturers offering generics and private-label intranasal products.

Regulatory & Quality Compliance Requirements

Malaysia’s medical device and combination-product ecosystem is governed by the Medical Device Act and Medical Device Regulations, requiring registration and licensing of establishments, including those producing or importing nasal delivery devices, pumps and smart inhalers. MIDA As the largest medical device market in ASEAN with an estimated size in the low billions of US dollars and with over 90% of production destined for export, regulators emphasise alignment with international standards such as ISO 13485 and Good Distribution Practice for Medical Devices, particularly for sterile nasal sprays and preservative-free formulations. MIDA At the same time, rising exports of medicinal and pharmaceutical products—over USD 260,000 per thousand in 2023—the highest level in nearly three decades—bring closer scrutiny from importing authorities, increasing dossier complexity and pharmacovigilance obligations for nasal corticosteroids, decongestants, vaccines and biologic therapies.

Market Opportunities

Differentiated Formulations & Combination Products

Malaysia’s GDP per capita of roughly USD 11,867 and total population near 34.7 million create a sizeable middle-income consumer base that can support premium, differentiated nasal formulations for chronic rhinitis, sinusitis and migraine rescue. World Bank Open Data World Bank Open Data Rising GDP growth of 5.2% and an increasingly services-oriented economy encourage private insurance uptake and employer-sponsored benefits that can reimburse higher-value intranasal corticosteroid-antihistamine combinations, preservative-free saline systems and muco-adhesive gels designed for sustained local delivery.Reuters+1 Growing exports of medicinal and pharmaceutical products—reaching USD 260.7 million in 2023—indicate maturing local formulation and packaging capabilities; manufacturers can leverage this base to produce tailored SKUs (e.g., once-daily sprays for working adults, bedtime formulations for nocturnal congestion) that address adherence gaps documented in regional asthma and AR management studies.

Paediatric-Focused & Age-Friendly Nasal Products

Malaysia’s population aged 0–14 years accounts for about 25% of the national total, translating to more than 7 million children and adolescents who represent a core demand segment for paediatric-friendly nasal products for AR, adenoid-related congestion and recurrent sinus infections. National and regional data indicate that asthma affects 8.9–13.0% of children, while allergic rhinitis frequently begins before age 20, creating a substantial cohort needing long-term, low-volume sprays with child-appropriate nozzles, taste-masked formulations and dosing flexibility. With 98% internet usage and high smartphone access among families, digital educational tools can support caregivers on proper paediatric nasal-spray technique, dosing schedules and monitoring for side-effects, reducing reliance on systemic antihistamines and These demographics favour development of age-segmented product lines—from infant saline drops and isotonic sprays to school-age allergy control kits—linked to preventive ENT and paediatric respiratory programmes in both public and private sectors.

Future Outlook

Over the next six years, the Malaysia nasal drug delivery solutions market is expected to register steady growth, driven by continued rise in respiratory and allergy-related disorders, increasing patient awareness for non-invasive treatment options, and growing adoption of intranasal vaccines and biologic therapies. Advances in formulation and device technologies — including preservative-free sprays, dry-powder delivery, and metered-dose inhalers — will further enhance market penetration. Expansion of private healthcare infrastructure and rising consumer preference for self-administration also contribute positively to future demand.

Major Players in the Market

- Pfizer Malaysia Sdn Bhd

- GlaxoSmithKline (GSK) Pharmaceuticals Malaysia

- Johnson & Johnson Sdn Bhd

- Duopharma Biotech Berhad

- Aspen Healthcare / Aspen Pharmacare Asia

- Bayer Co. (Malaysia) Sdn Bhd

- Novartis Corporation (Malaysia) Sdn Bhd

- Pharmaniaga Berhad

- Glenmark Pharmaceuticals (Malaysia) Sdn Bhd

- Hovid Berhad

- AptarGroup, Inc. (device supplier)

- Starpharma Holdings Ltd (nasal spray / antiviral)

- Merck & Co., Inc. (global, supplying via local distributors)

- Teva Pharmaceuticals (generics, via local distribution)

- OptiNose / 3M / other specialized nasal-device companies

Key Target Audience

- Pharmaceutical companies seeking to enter or expand nasal drug delivery portfolio

- Medical device manufacturers supplying nasal spray pumps and inhalers

- Investors and venture capital firms evaluating opportunities in ASEAN healthcare (especially intranasal therapeutics)

- Hospitals and chain-hospital groups planning tender procurement and formulary expansion

- Retail pharmacy chains and e-pharmacy platforms considering OTC nasal products rollout

- Government and regulatory bodies (e.g., Ministry of Health Malaysia, NPRA) involved in drug approvals and public immunization policy

- Public-health programme planners focusing on respiratory disease and immunization campaigns

- Distributors, wholesalers, and logistics providers assessing demand, cold-chain requirements, and supply-chain investments

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all stakeholders in the Malaysia nasal drug delivery ecosystem — pharmaceutical producers, device suppliers, hospitals, pharmacies, regulators. Secondary data from industry reports, NPRA databases, public health statistics and import-export data were reviewed to define variables such as dosage form mix, distribution channels, therapy type, and regulatory classifications.

Step 2: Market Analysis and Construction

Historical data on sales, import volumes, pharmaceutical registrations and device imports were compiled. Usage patterns (e.g., sprays vs drops) and prescription vs OTC splits were analyzed to estimate revenue and unit volumes for each segment.

Step 3: Hypothesis Validation and Expert Consultation

Key market assumptions — for example patient adherence rates, OTC penetration, uptake of nasal vaccines — were validated via interviews with industry insiders, local distributors, pharmacists and ENT specialists in Malaysia to cross-check demand patterns and real-world usage.

Step 4: Research Synthesis and Final Output

Aggregate data from bottom-up device and drug sales estimates were reconciled with top-down regional and global market trends (Asia-Pacific data) to ensure consistency and robustness. The final report collates validated numbers, segmentation breakdowns, competitive landscape, and future projections.

- Executive Summary

- Research Methodology (Market boundary definition, NPRA product classification, inclusion–exclusion criteria, hospital formulary audits, retail audit datasets, prescription data triangulation, primary interviews with ENT specialists & allergists, secondary desk research, bottom-up and top-downsizing, forecasting models, scenario analysis, data validation framework)

- Definition & Scope of Nasal Drug Delivery Solutions

- Evolution of Intranasal Therapies in Malaysia

- Epidemiology & Disease Burden Relevant to Nasal Therapies

- Patient Journey & Care Pathways (Primary Care, ENT, Respiratory, Emergency)

- Supply Chain & Value Chain Structure for Nasal Products

- Growth Drivers

Rising Allergic Rhinitis & Rhinosinusitis Burden

Urbanisation, Air Quality & Lifestyle Changes

Preference for Non-Invasive & Self-Administered Therapies

Expansion of Specialist ENT & Respiratory Care

Intranasal Vaccines, Biologics & CNS Rescue Therapies - Market Challenges

Generic Competition & Brand Fragmentation

Regulatory & Quality Compliance Requirements

Patient Technique, Overuse & Safety Concerns

Supply Chain, Import Dependence & Cold-Chain Complexity - Market Opportunities

Differentiated Formulations & Combination Products

Paediatric-Focused & Age-Friendly Nasal Products

Smart Devices, Digital Support & Remote Monitoring

Local Manufacturing & ASEAN Export Hub Positioning - Emerging Trends

Switch from prescription to OTC

Saline and natural product uptake

Growth in antiviral and immunomodulatory nasal products

Clinical guideline evolution

Technology & Device Innovation Landscape - Regulatory, HTA & Reimbursement Landscape

- Porter’s Five Forces Analysis

- Stakeholder Ecosystem Mapping

- By Value, 2019-2024

- By Volume, 2019-2024

- Average Price & Out-of-Pocket Spend per Course of Therapy, 2019-2024

- By Dosage Form (in Value %)

Metered-Dose Nasal Sprays

Nasal Drops & Solutions

Nasal Gels & Ointments

Dry Powder & Innovative Nasal Formats

Nebulising & Soft-Mist Nasal Devices - By Therapeutic Area (in Value %)

Allergic Rhinitis & Seasonal Allergies

Sinusitis, Nasal Congestion & Upper Respiratory Conditions

ENT Infections & Post-Surgical Care

CNS, Pain & Emergency Rescue Therapies

Vaccines, Biologics & Hormonal/Metabolic Nasal Therapies - By Device Technology (in Value %)

Multi-Dose Pump Sprays

Pressurised Metered-Dose Nasal Devices

Unit-Dose & Disposable Nasal Devices

Breath-Actuated & Smart Nasal Devices

Device Components & Delivery Accessories - By Molecule Class (in Value %)

Corticosteroids

Saline & moisturisers

Antivirals & anti-infectives

Analgesics & CNS agents

Biologics & vaccines

strength variations, mono vs combination products - By Patient Group & Clinical Setting (in Value %)

Paediatric, adult, geriatric

Primary care, specialist ENT, emergency, home-care use

Dosing adaptations, safety considerations - By End User & Channel (in Value %)

Public hospitals, private hospitals, specialist ENT centres, retail pharmacy chains, independent pharmacies, online pharmacies, public programmes

procurement models, reimbursement, dispensing protocols

- Market Share of Leading Brands & Companies

- Cross-Comparison Parameters of Key Players

- Strategic Initiatives & Recent Developments

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

Pfizer Malaysia Sdn Bhd

GSK Pharmaceuticals (Malaysia) Sdn Bhd

Johnson & Johnson Sdn Bhd

Novartis Corporation (Malaysia) Sdn Bhd

Bayer Co. (Malaysia) Sdn Bhd

Duopharma Biotech Berhad

Pharmaniaga Berhad

Kotra Pharma (M) Sdn Bhd

Glenmark Pharmaceuticals (Malaysia) Sdn Bhd

Hovid Berhad

Aspen Healthcare / Aspen Pharmacare Asia

Cadila / Zydus Lifesciences – Regional Operations

AptarGroup, Inc. (Nasal Device & Pump Systems)

Starpharma Holdings Ltd (VIRALEZE Antiviral Nasal Spray)

Bausch Health Companies Inc.

- Public Hospitals & Specialist Centres

- Private Hospitals & Day-Care Centres

- General Practitioner Clinics & Primary Care Centres

- Retail Pharmacy Chains & Independent Pharmacies

- Online Pharmacies & E-Commerce Platforms

- Public Health & Immunisation Programmes

- Patient & Caregiver Behaviour Insights

- By Value, 2025-2030

- By Volume, 2025-2030

- Average Price & Out-of-Pocket Spend per Course of Therapy, 2025-2030