Market Overview

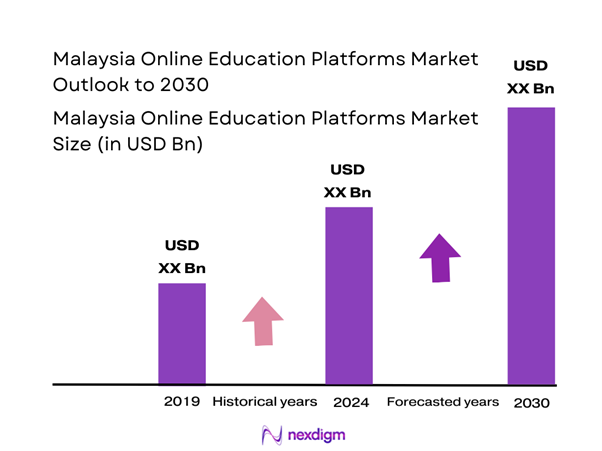

The Malaysia Online Education Platforms Market is valued at USD 3,572.1 million in 2024 with an approximated compound annual growth rate (CAGR) of 28% from 2024-2030 and is experiencing robust growth, driven by increasing adoption of digital learning solutions in various educational sectors. Key factors contributing to this growth include a rising number of internet users, which was 26.5 million in 2024, and a growing appetite for flexible learning options among students and working professionals.

Major cities such as Kuala Lumpur, Penang, and Johor Bahru dominate the Malaysia Online Education Platforms Market due to their urbanization and technological infrastructure. Kuala Lumpur, as the capital city, serves as a hub for educational institutions and technology enterprises, facilitating collaborations between educational content developers and platform providers. Additionally, these cities benefit from a larger population of potential users who are increasingly seeking online learning opportunities for academic and professional advancement, thus intensifying competition among service providers in these regions.

The Malaysian government has launched several initiatives to support the growth of e-learning, including the National Policy on Industry 4.0, which aims to integrate digital technology into education. With an investment of RM 30 million allocated for educational technology projects in recent years, the government is actively promoting online learning across institutions. The Digital Education Transformation Plan focuses on increasing digital competency among educators and students alike.

Market Segmentation

By Learning Type

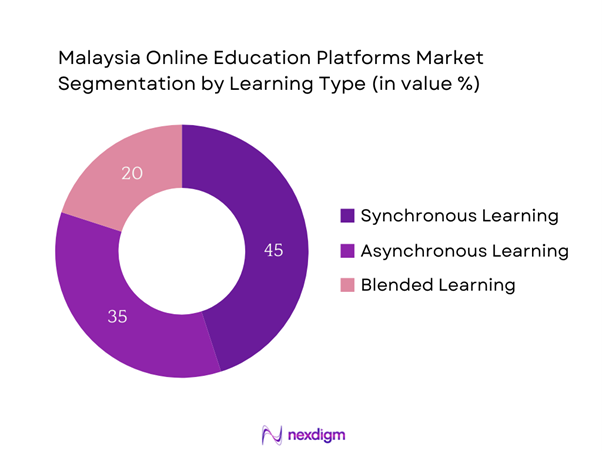

The Malaysia Online Education Platforms Market is segmented by learning type into Synchronous Learning, Asynchronous Learning, and Blended Learning. Among these, Synchronous Learning is currently dominating the market share. This sub-segment focuses on real-time interaction between instructors and students, making it particularly advantageous during the pandemic as educational institutions had to adapt to online environments swiftly. Learners appreciate the immediate feedback and structured learning experience it offers. Supported by technologies like live video conferencing tools, Synchronous Learning gained immense popularity and became a preferred choice among institutions seeking to maintain a traditional classroom atmosphere digitally.

By End User

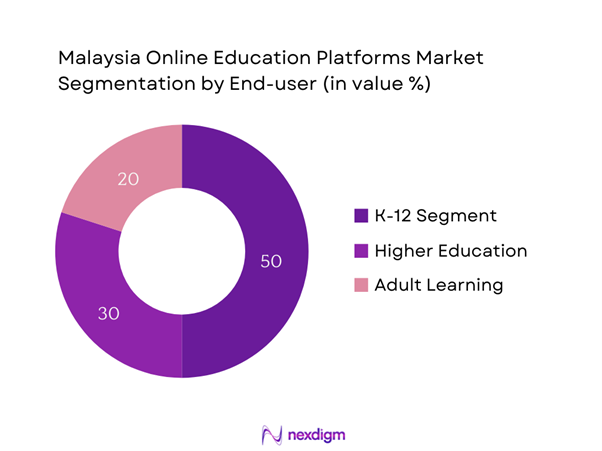

The market is also segmented by end user into K-12 Segment, Higher Education, and Adult Learning. The K-12 Segment is currently holding the largest market share in this category, fueled by heightened digital literacy and increased investment in educational technology. As parents and schools increasingly recognize the benefits of online resources in aiding knowledge retention and enhancing interactive learning experiences, this segment has seen significant growth. Additionally, various government initiatives aimed at integrating technology into the classroom have spurred the adoption of online platforms specifically targeting younger learners.

Competitive Landscape

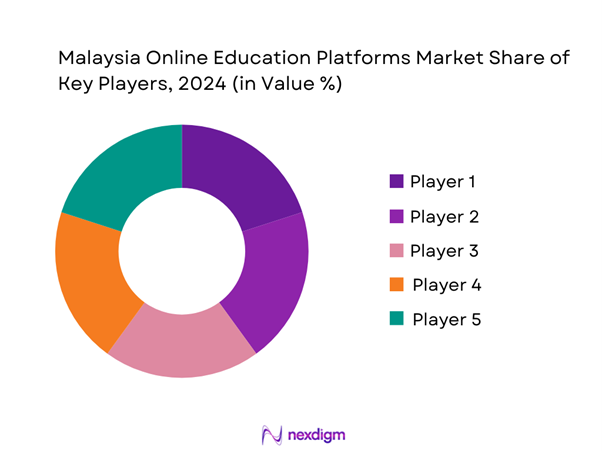

The competitive landscape of the Malaysia Online Education Platforms Market is characterized by a mix of established global brands and innovative local players. Prominent companies include Coursera, Udemy, and local platforms such as NextAcademy and EduNation. The presence of these key players highlights the strategic importance of tailored offerings that cater specifically to Malaysian learners, showcasing localized content, language support, and culturally relevant learning modules.

| Company Name | Year Established | Headquarters | Market Share | Key Offerings | Partnerships | User Engagement Rate |

| Coursera | 2012 | USA | – | – | – | – |

| Udemy | 2010 | USA | – | – | – | – |

| NextAcademy | 2015 | Malaysia | – | – | – | – |

| EduNation | 2014 | Malaysia | – | – | – | – |

| Skillshare | 2011 | USA | – | – | – | – |

Malaysia Online Education Platforms Market Analysis

Growth Drivers

Increased Internet Penetration

As of 2023, Malaysia’s internet penetration rate reached 92.1%, with approximately 28.9 million users, according to the Malaysian Communications and Multimedia Commission. The increasing availability of affordable internet access, especially in urban areas, has encouraged more individuals to engage with Ed-Tech platforms. The proliferation of mobile devices, with over 90% of the population accessing the internet via smartphones, further facilitates seamless access to educational content. This trend is supported by the government’s commitment to enhancing digital infrastructure, making online education more accessible to diverse demographics within Malaysia.

Rising Demand for Flexible Learning Options

According to a report from the Ministry of Education, approximately 60% of Malaysian learners prefer using online platforms for their educational needs due to the flexibility they offer in balancing work and study commitments. The pandemic has significantly accelerated this trend, with many traditional educational institutions pivoting to hybrid learning models. As the workforce evolves, a growing number of professionals are seeking continuous skill development through online courses, enabling them to adapt to changing job requirements. The demand for varied course types, from technical skills to soft skills, is driving platform providers to diversify their offerings.

Market Challenges

High Competition and Market Saturation

The Malaysia Online Education Platforms Market is witnessing intense competition, with over 150 providers currently operating in the sector. This saturation has led to a struggle for market differentiation, compelling platforms to continually innovate their offerings. As nearly 20 new platforms have entered the market in the past year alone, established players find it challenging to retain users amid growing price sensitivity. In addition, consumer expectations for quality and interactive content are rising, which necessitates investment in technology and user experience enhancements. This pressure can impact profitability, especially for smaller providers who may lack the resources to compete effectively.

Quality Assurance and Accreditation Issues

The lack of standardized quality assurance processes poses a significant challenge in the rocky terrain of online education. A study by the Malaysian Qualifications Agency highlights that only 40% of online courses offered adhere to established accreditation standards. This inconsistency in quality raises concerns among learners regarding the credibility of certifications obtained through these platforms. To counter this challenge, educational institutions and online providers need to collaborate more closely, develop comprehensive quality frameworks, and seek to establish more clearly defined accreditation pathways to ensure educational effectiveness and trust.

Opportunities

Incorporation of AI and AR/VR Technologies

The integration of Artificial Intelligence (AI) and Augmented Reality/Virtual Reality (AR/VR) technologies presents significant growth potential in the Malaysia Online Education Platforms Market. Currently, over 15% of educational institutions in Malaysia are experimenting with AI-driven personalized learning systems to enhance user engagement. Additionally, platforms incorporating AR/VR technologies for immersive learning experiences can attract new users seeking modern educational solutions. As the educational technology market evolves, providers that employ these advanced technologies stand to gain a competitive edge by offering innovative and effective learning experiences tailored to individual learner needs.

Global Collaboration for Course Offerings

Malaysia’s positioning as a regional educational hub allows for global collaborations that enrich local course offerings. Presently, approximately 25 international universities have partnerships with Malaysian institutions, facilitating the sharing of curricula and expertise. This collaboration enables local online education platforms to provide globally recognized courses and qualifications, expanding their reach and appeal. Such partnerships can enhance the perceived value of certifications earned through local providers, thereby boosting enrollment numbers and contributing to an even more diverse educational landscape.

Future Outlook

Over the next several years, the Malaysia Online Education Platforms Market is poised for substantial growth, driven by progressive government policies, advancements in educational technologies, and an increasing demand for upskilling among professionals. Anticipated innovations in the realm of personalized learning and AI-driven educational solutions are expected to further propel the market, meeting diverse learner needs. The collaboration between educational institutions and tech companies to refine content delivery will also play a critical role in shaping the future of online education in Malaysia.

Major Players

- Coursera

- Udemy

- NextAcademy

- EduNation

- Skillshare

- FutureLearn

- Khan Academy

- com

- Language International

- Skillsoft

- LinkedIn Learning

- Chegg

- Teachable

- MasterClass

Key Target Audience

- Educational Institutions

- Corporate Training Departments

- Professional Development Organizations

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Education, Malaysian Qualifications Agency)

- E-learning Content Developers

- Non-Governmental Organizations (NGOs) focusing on education

- Technology Providers in Education

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Malaysia Online Education Platforms Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Malaysia Online Education Platforms Market. This includes assessing market penetration, the ratio of online platforms to traditional educational providers, and the resultant revenue generation. Furthermore, an evaluation of service quality metrics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple online education platform providers to acquire detailed insights regarding product offerings, user demographics, educational outcomes, and emerging trends. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Malaysia Online Education Platforms Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Evolution and Trends

- Key Milestones in the Industry

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increased Internet Penetration

Rising Demand for Flexible Learning Options

Government Initiatives Supporting E-Learning - Market Challenges

High Competition and Market Saturation

Quality Assurance and Accreditation Issues - Opportunities

Incorporation of AI and AR/VR Technologies

Global Collaboration for Course Offerings - Emerging Trends

Gamification in Learning

Personalized Learning Paths - Regulatory Framework

E-Learning Standards and Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Revenue Generation, 2019-2024

- By User Base, 2019-2024

- By Course Offerings, 2019-2024

- By Learning Type (In Value %)

Synchronous Learning

– Live Virtual Classrooms

– Real-Time Webinars

– Instructor-Led Group Sessions

Asynchronous Learning

– Pre-recorded Video Courses

– Self-Paced Modules

– Downloadable Learning Materials

Blended Learning

– Hybrid School-Platform Programs

– Online + In-Person Coaching Sessions

– Mixed Corporate Training Solutions - By End User (In Value %)

K–12 Segment

– Primary (Grades 1–6)

– Secondary (Grades 7–12)

– Online Tuition & Enrichment Classes

Higher Education

– Undergraduate Programs

– Postgraduate Programs

– Diploma & Certification Courses

Adult Learning

– Upskilling & Reskilling Programs

– Corporate L&D (Learning & Development)

– Continuing Education for Professionals - By Course Type (In Value %)

Language Learning

– English Language Training

– Mandarin and Other Asian Languages

– IELTS/TOEFL Preparation Courses

STEM Courses

– Coding & Programming (Python, Java, etc.)

– Data Science & AI

– Math & Science Modules

Professional Development

– Business & Management Skills

– Financial Literacy & Investment Training

– Soft Skills & Leadership Development - By Delivery Medium (In Value %)

Mobile Applications

– Android-Based Learning Apps

– iOS-Based Education Apps

– Gamified Learning Interfaces

Desktop Platforms

– Web-Based Learning Management Systems (LMS)

– Browser-Based Video Learning Platforms

– Desktop Simulation & Skill Practice Tools - By Payment Model (In Value %)

Subscription-Based

– Monthly/Annual Plans

– Family or Group Subscriptions

– All-Access Learning Libraries

Pay-Per-Course

– One-Time Paid Certification Courses

– Skill-Specific Course Packages

– Exam-Oriented Single Modules

Freemium Models

– Free Basic Courses with Paid Add-Ons

– Trial Access with Premium Unlocks

– Ad-Supported Learning Platforms

- Market Share of Major Players on the Basis of revenue generation, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Platform Features, User Engagement, Brand Recognition, Customer Support, Technological Integration, Market Reach, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Strategy Analysis of Major Competitors

- Detailed Profiles of Major Companies

Coursera

Udemy

edX

Khan Academy

Tutor.com

Skillshare

FutureLearn

LinkedIn Learning

ClassDojo

Google Classroom

Zoom Video Communications

Chegg

VIPKid

Teachable

MasterClass

- Market Demand and Utilization Trends

- Spending Trends by User Group

- Regulatory and Compliance Needs

- Insights into User Behavior and Preferences

- Decision-Making Process of End Users

- By Revenue Generation, 2025-2030

- By User Base, 2025-2030

- By Course Offerings, 2025-2030