Market Overview

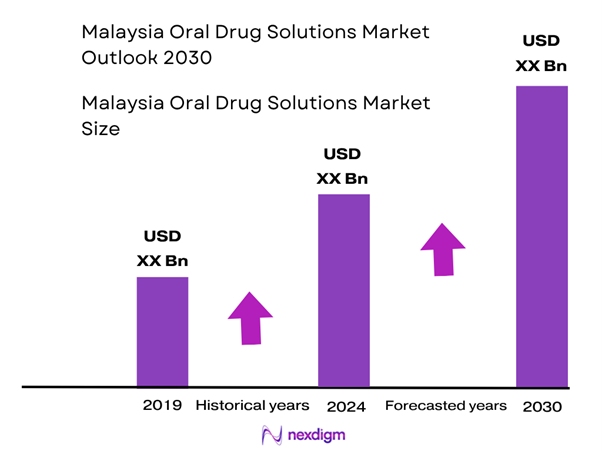

The Malaysia oral drug solutions market is valued at approximately USD ~ billion based on the generic medicines segment data for Malaysia, which was valued in 2022 at USD 10.11 billion and projected rising to USD 12.45 billion by 2029. In parallel, the broader pharmaceutical industry in Malaysia has seen contributions of more than MYR 6 billion to GDP historically, and by 2024 the industry was projected to contribute an additional MYR 10 billion. Growth is being driven by factors including rising chronic-disease burden (diabetes, cardiovascular, oncology), expanding middle classes, increased private healthcare expenditure, and greater access through tele-pharmacy and retail pharmacy channels.

Malaysia’s major urban centres such as Kuala Lumpur, Selangor and Penang dominate as hubs for oral drug distribution, manufacturing and consumption due to superior healthcare infrastructure, higher per-capita incomes and presence of pharmaceutical formulation and contract manufacturing clusters. Additionally, East Malaysian states such as Sabah and Sarawak are growing in importance due to improved logistics and government incentives for pharmaceutical investment.

Market Segmentation

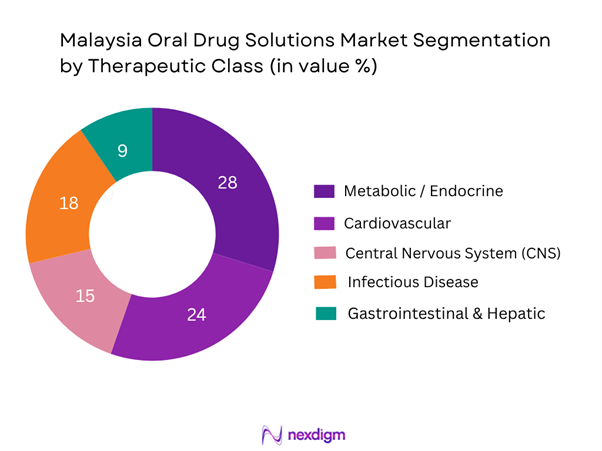

By Therapeutic Class

The Malaysia oral drug solutions market is segmented into metabolic/endocrine, cardiovascular, CNS, infectious disease, gastrointestinal & hepatic and others. In recent years the metabolic/endocrine sub-segment has dominated the share (≈28 %) owing to the high and rising prevalence of diabetes and related complications in Malaysia, leading to sustained demand for oral antidiabetics, insulin adjuncts, and fixed-dose combinations targeted at metabolic syndrome. The relatively high incomes of urban Malaysians, combined with insurance/private-care coverage and government encouragement of chronic-care management, have further boosted this segment’s dominance.

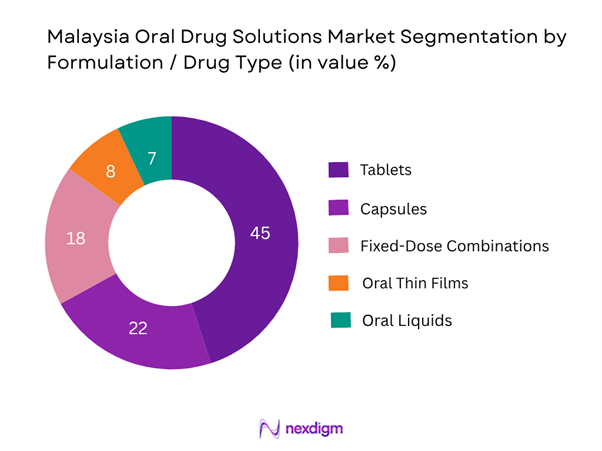

By Formulation / Drug Type

The market is divided into tablets, capsules, fixed-dose combinations (FDCs), oral thin films/dissolvables and oral liquids (for paediatric/geriatric usage). Among these, tablets hold the largest share at ~45 % because they remain the most cost-effective, widely adopted dosage form for oral therapies in Malaysia, supported by well-established manufacturing capabilities and supply-chain familiarity. Many local and multinational pharmaceutical firms favour tablet formats for generic and branded oral drugs, leading to strong penetration across both hospital and retail pharmacy channels.

Competitive Landscape

The competitive landscape of the Malaysia oral drug solutions market features both local/regional players and global multinationals. Consolidation is moderate, and the market remains open to new entrants especially in generics and contract manufacturing. However, major players dominate distribution channels, regulatory know‐how and local manufacturing/warehousing capabilities.

| Company | Establishment Year | Headquarters | Oral Drug Solutions Focus | Local Manufacturing Presence | Distribution Network Coverage | Recent Strategic Move |

| Pharmaniaga Berhad | 1994 | Kuala Lumpur, MY | – | – | – | – |

| Duopharma Biotech Berhad | 2006 | Shah Alam, MY | – | – | – | – |

| Hoe Pharmaceuticals Sdn. Bhd. | 1959 | Ipoh, MY | – | – | – | – |

| CCM Pharmaceuticals Sdn. Bhd. | 1970 | Petaling Jaya, MY | – | – | – | – |

| Sanofi S.A. | 2004 (MY presence) | Paris, FR | – | – | – | – |

Malaysia Oral Drug Solutions Market Analysis

Growth Drivers

Rising chronic disease burden

The prevalence of type-2 diabetes in Malaysia is substantial, with the most recent national survey indicating an adult prevalence of 18.1%. Studies show prevalence in certain ethnic groups reaching 26.4% among Malaysian Indians. Given that chronic conditions such as diabetes and associated oral therapies drive demand for oral drug solutions, this burden creates a broad and sustained base of need for oral medication formats. Moreover, older persons with diabetes frequently require oral combinations and long-term treatment, which supports the growth of oral drug solutions in outpatient settings.

Growing middle-income households

Malaysia has emerged as an upper-middle income country, with increasing disposable incomes and healthcare spending. According to the International Monetary Fund (IMF) data, Malaysia’s GDP per capita in current US dollars rose steadily, enabling greater private and out-of-pocket expenditures in pharmaceuticals. This uptick in consumer ability supports broader uptake of oral drug solutions including branded and fixed-dose combinations rather than injectable or hospital-only forms. The ability of middle-income households to access outpatient oral therapies drives consumption of oral solutions across retail and private care channels.

Market Challenges

Pricing pressure from generics

In Malaysia the majority of the pharmaceutical value market is still driven by imported medicines (63 %) versus local generics (37 %) as of latest available data. With generics dominating because of pricing advantage, branded oral drug solutions face downward price pressure. For oral drug solution manufacturers, this intensifies competition, compresses margins, and may hinder investment in novel oral formulations. The competitive dynamic of generics thus poses a significant challenge for margin growth in this market.

Regulatory delays

The national regulator, National Pharmaceutical Regulatory Agency (NPRA), is the key approval body for oral drug solutions in Malaysia. While NPRA provides structured regulatory oversight, local sources note the regulatory process remains a bottleneck for new dosage forms and fixed-dose combinations in Malaysia. Such delays in registration, approval of novel combinations or halal-certified oral formulations slow time-to-market and impose higher holding/launch costs. This regulatory lag hinders responsiveness in the oral drug solutions market.

Opportunities

Digital pharmacy growth

The digital pharmacy and tele-pharmacy channel is expanding globally and in Malaysia. A recent study on the digital transformation in pharmacy noted the expansion of online platforms and telehealth models. National-level policy documents such as the Malaysia Pharmacy Research Priorities outline explicit intention to strengthen online medicine advertisement regulation and online pharmacy service frameworks. The growth of digital pharmacy platforms offers an opportunity for oral drug solutions (tablets, capsules and FDCs) to reach broader patient populations, reduce distribution cost and improve convenience—particularly in urban and semi-urban markets.

Fixed-dose combinations (FDCs)

Fixed-dose combination oral therapies offer convenience, improved adherence and cost-effective management of chronic diseases. In Malaysia, the high prevalence of diabetes and cardiovascular disease supports uptake of FDCs. The prevalence of diabetes (18.1 %) and rising kidney-disease burden (15.5 % prevalence of CKD among adults in 2018) demonstrate the complex treatment needs of patients that FDCs can address. For manufacturers of oral drug solutions, FDCs represent an opportunity to differentiate, gain formulary preference, and capture higher-value segments through simplified regimens.

Future Outlook

Over the next several years the Malaysia oral drug solutions market is expected to show robust growth driven by the rising burden of chronic diseases, increasing penetration of generics and fixed-dose combinations, and the acceleration of digital pharmacy and e-dispensing channels. Additionally, government incentives for local manufacturing and halal-certified pharmaceuticals will enhance domestic supply-chain resilience and make Malaysia an attractive hub for ASEAN regional exports.

Major Players

- Pharmaniaga Berhad

- Duopharma Biotech Berhad

- Hoe Pharmaceuticals Sdn. Bhd.

- CCM Pharmaceuticals Sdn. Bhd.

- Noipharma Sdn. Bhd.

- Xepa-Soul Pattinson (Malaysia) Sdn. Bhd.

- Sanofi S.A.

- AstraZeneca plc

- Novartis AG

- Pfizer Inc.

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Bristol-Myers Squibb Company

- Novo Nordisk A/S

- GlaxoSmithKline plc

Key Target Audience

- Pharmaceutical manufacturers (local & multinational)

- Contract manufacturing and packaging organisations (CMOs/CMOs)

- Healthcare distributors and pharmacy chains

- Private hospital groups and outpatient clinic chains

- Investments and venture capitalist firms (specialising in life sciences & med-tech)

- Government and regulatory bodies (e.g., National Pharmaceutical Regulatory Agency (NPRA), Malaysian Investment Development Authority (MIDA))

- Importers and exporters of pharmaceutical raw materials and APIs

- Tele-pharmacy and digital health platform providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Malaysia oral drug solutions market — from API suppliers to contract manufacturers, distributors, pharmacies and end-users. Secondary research from industry reports, company filings and regulatory disclosures was used to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase we compiled and analysed historical data pertaining to the Malaysia pharmaceutical market (value, volume, growth by therapy, formulation, channel). We assessed penetration of oral therapies, ratio of generics vs branded, and resultant revenue generation. Channel-analysis (hospital vs retail vs online) was also conducted to ensure reliability of the size estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses (e.g., growth impact of digital pharmacy, halal-certified production) were developed and validated through interviews with industry experts representing local pharmaceutical manufacturing firms, contract formulators, and distribution network players in Malaysia. These consultations provided operational and financial insights directly from industry practitioners, instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with selected pharmaceutical companies operating in Malaysia to acquire detailed insights into their product segments, production capacities, distribution models and pipeline strategies. This interaction served to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate and validated analysis of the Malaysia oral drug solutions market.

- Executive Summary

- Research Methodology (Market definitions and scope, Assumptions and base year / forecast period settings, Data sources (secondary sources, primary interviews with manufacturers, distributors, pharmacies), Research approach: market sizing by value and volume, CAGR calculations, historic vs forecast, Validation and triangulation methodology, Limitations of the study and future outlook constraints)

- Definition and Scope of Oral Drug Solutions in Malaysia

- Market Genesis & Evolution

- Timeline of Major Regulatory / Market Events

- Business Cycle and Market Life-Cycle

- Supply Chain and Value Chain Analysis

- Pricing & Reimbursement Framework

- Regulatory Landscape

- Impact of Public-Healthcare Infrastructure and Private Sector

- Growth Drivers

Rising chronic disease burden

Aging population

Growing middle-income households

Shift to outpatient oral therapies - Market Challenges

Pricing pressure from generics

Regulatory delays

Logistics to remote states

Affordability issues - Opportunities

Digital pharmacy growth

Fixed-dose combinations

Halal-certified formulations

Untapped East Malaysia segment - Trends

Rising telemedicine + e-pharmacy

Personalised/precision oral therapies

Patient adherence programmes - Regulatory & Policy Landscape

Generic substitution policy

Medicine price guide

Value Chain & Stakeholder Ecosystem - Porter’s Five Forces Analysis

- SWOT Analysis

- By Value (MYR / USD), 2019- 2024

- By Volume (units, defined daily doses etc), 2019- 2024

- By Average Price (MYR/USD per unit dose, 2019- 2024

- By Therapeutic Class (In Value %)

Metabolic / Endocrine

Cardiovascular

Central Nervous System (CNS)

Gastrointestinal (GI) & Hepatic

Infectious Disease

Others (including immunology, ophthalmology oral compounds) - By Drug Type / Formulation (In Value %)

Tablets

Capsules

Fixed-Dose Combinations (FDCs)

Oral Thin Films / Dissolvable Oral Solutions

Oral Liquid Formulations (for pediatrics/geriatrics) - By Product Positioning (In Value %)

Branded Innovative Oral Drugs

Branded Generics

Unbranded Generics - By Distribution Channel (In Value %)

Hospital Pharmacies (public sector)

Hospital Pharmacies (private sector)

Retail Pharmacies (chain & independent)

Online Pharmacies / e-commerce

Others (mail-order, mobile dispensing) - By End-User / Patient Setting (In Value %)

Hospital Outpatient (specialist clinics)

Primary Care Clinics / GP Prescriptions

Self-medication / OTC (where applicable for oral solutions)

Home-care / Long-term Care Facilities

Tele-health / Remote Dispensing - By Geography / Region (In Value %)

Peninsular Malaysia – Urban (Kuala Lumpur, Selangor, Penang)

Peninsular Malaysia – Rural / Semi-urban

East Malaysia – Sabah

East Malaysia – Sarawak

Others (Off-shore islands, remote territories)

- Market Share of Major Players (by value/volume) for latest available year

- Cross-Comparison Parameters (Company overview, Business strategies, Recent developments, Product portfolio, Revenues & growth in Malaysia, Manufacturing/ Formulation capacity in Malaysia or ASEAN region, Distribution network / touch-points, Pricing strategy and margin structure, R&D and pipeline specific to oral drug solutions, Unique value proposition, Strengths & weaknesses, Partnerships/alliances & M&A activity)

- Detailed Profiles of Major Companies

Pharmaniaga Berhad

Duopharma Biotech Berhad

Hoe Pharmaceuticals Sdn. Bhd.

CCM Pharmaceuticals Sdn. Bhd.

Noipharma Sdn. Bhd.

Xepa‑Soul Pattinson (Malaysia) Sdn. Bhd.

Sanofi S.A.

AstraZeneca plc

Novartis AG

Pfizer Inc.

Takeda Pharmaceutical Company Limited

Eli Lilly and Company

Bristol‑Myers Squibb Company

Novo Nordisk A/S

GlaxoSmithKline plc

- Demand & Utilisation Patterns

- Patient Demographics & Segmentation

- Affordability & Out-of-Pocket Spending

- Patient Adherence & Compliance

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030