Market Overview

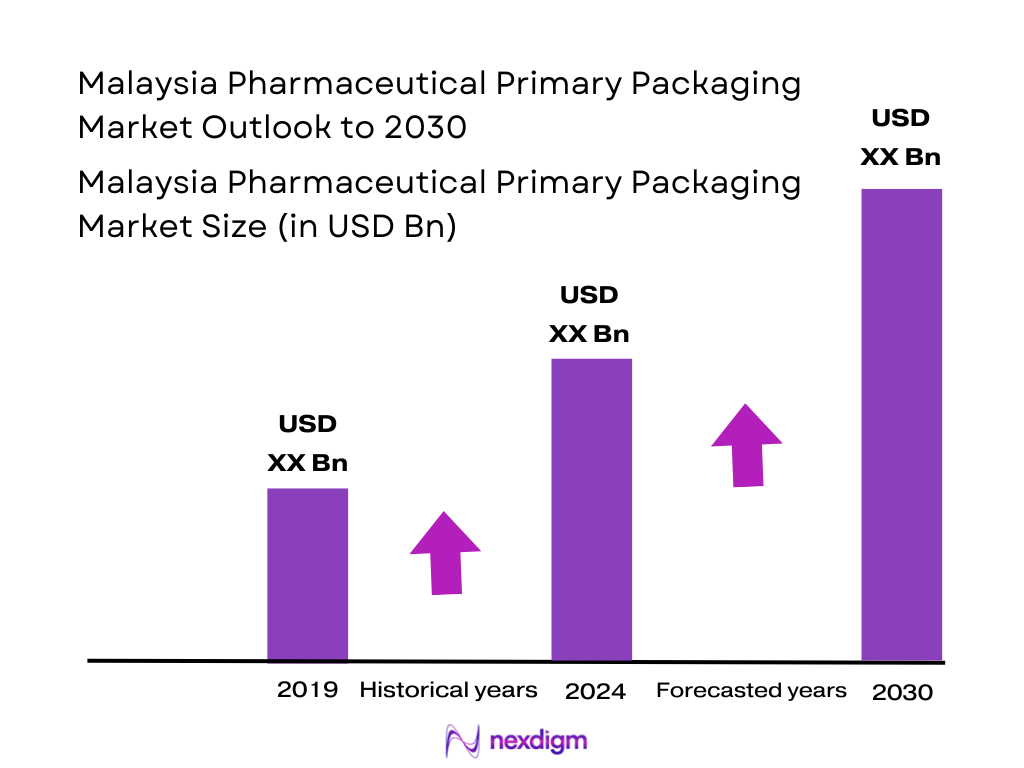

The Malaysia Pharmaceutical Primary Packaging Market is underpinned by a strong pharmaceutical base: the pharmaceuticals-in-dosage market is valued at about USD ~ billion, supported by rising chronic disease burden, higher healthcare spend, and growing exports of medicinal products exceeding USD ~ million. Within this context, Insights10 values Malaysia’s pharmaceutical packaging sector at USD ~ million at the start of the decade, on track toward USD ~ million, driven by rising generic penetration, expanding biologics, and stricter packaging quality and anti-counterfeit requirements.

Primary pharmaceutical packaging demand is concentrated in industrial corridors such as the Klang Valley (Selangor–Kuala Lumpur), Penang’s medical technology and pharma hub, and Johor’s manufacturing clusters, where most of the country’s >445 pharmaceutical companies are based and the sector contributes over MYR 6 billion to GDP. These locations co-locate formulation plants, logistics nodes and contract packers, making them natural anchors for vials, blister packs, bottles and injectable containers. Regionally, Malaysia participates in a Southeast Asia healthcare packaging market worth about USD 5.78 billion, benefiting from spillover of regional investments and supply-chain localization.

Market Segmentation

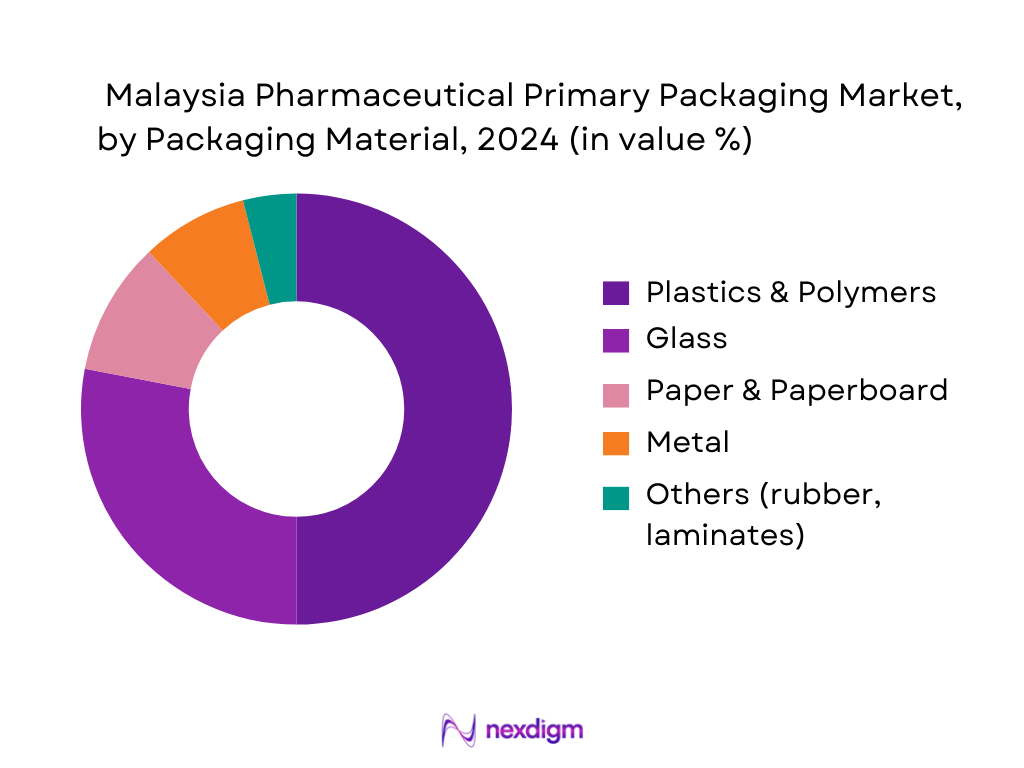

By Packaging Material

The Malaysia Pharmaceutical Primary Packaging Market is segmented into plastics & polymers, glass, paper & paperboard, metals, and others. Plastics & polymers hold a dominant share due to their versatility in bottles, blister lidding and sachets, lighter weight for export logistics, and compatibility with high-speed fill-finish lines. Global trends show plastics leading pharmaceutical packaging by value, with Asia Pacific markets following similar patterns as blister packs and plastic bottles gain share in oral solid and liquid formats. In Malaysia, this is reinforced by strong local converting capability and cost-sensitive government tenders favoring high-volume polymer formats over premium glass for many generics, while glass remains critical for parenterals, vaccines and sensitive biologics.

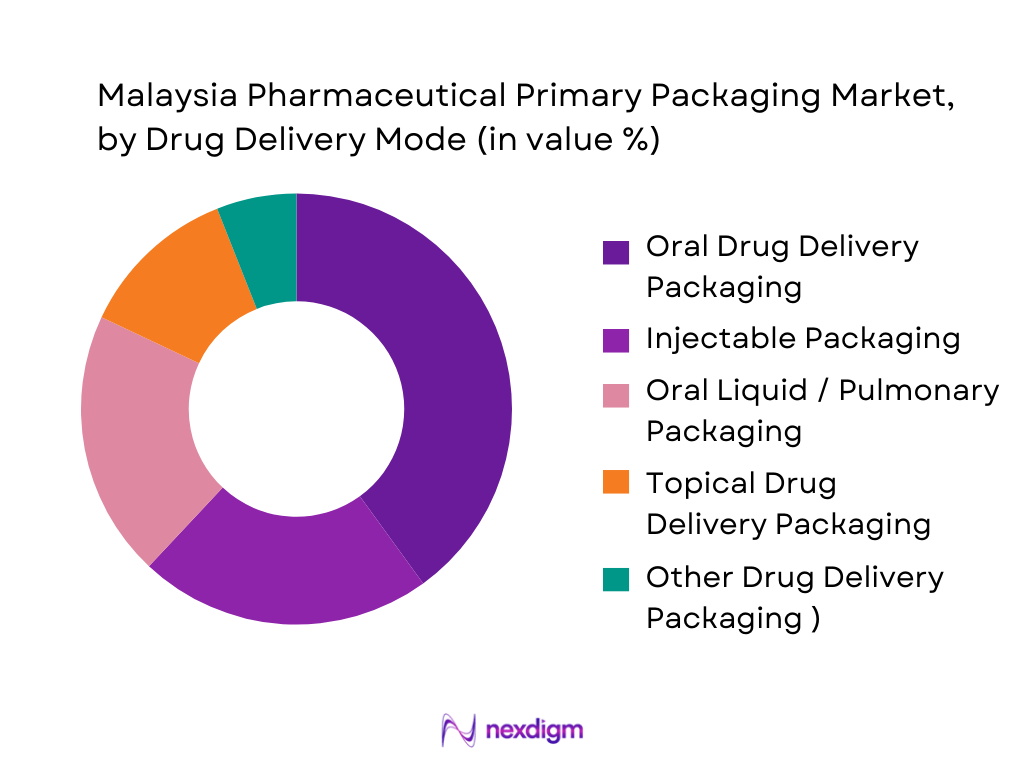

By Drug Delivery Mode

The Malaysia Pharmaceutical Primary Packaging Market is segmented into oral drug delivery packaging, injectable packaging, pulmonary drug delivery packaging, topical drug delivery packaging, and other modes (including nasal, ocular and IV). Oral drug delivery packaging currently dominates, reflecting the large base of solid dose generics and OTC medicines sold via community pharmacies and hospital channels, consistent with per-capita dosage market metrics cited for Malaysia..\ However, injectable packaging holds a rapidly growing share, in line with regional trends where injectable formats lead pharmaceutical packaging revenue as biologics and vaccines expand across Asia Pacific. In Malaysia, public procurement for vaccines, biologics and IV therapies is pushing higher value vials, ampoules and prefilled systems, but the sheer volume of oral solids keeps oral packaging as the single largest segment today.

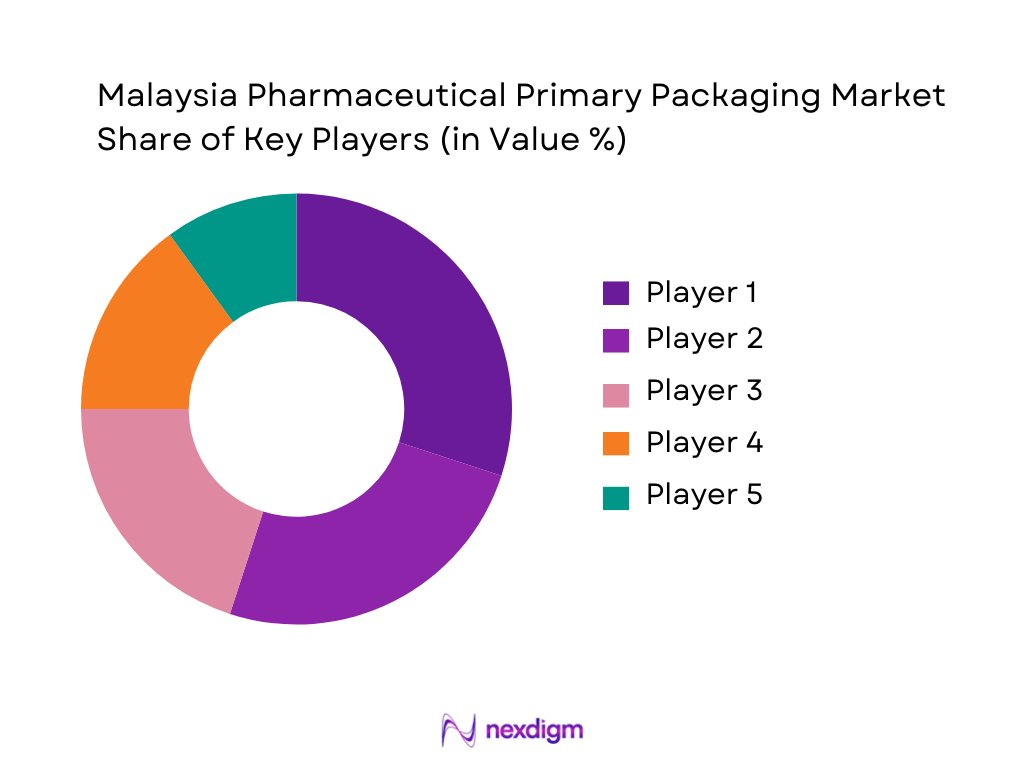

Competitive Landscape

The Malaysia Pharmaceutical Primary Packaging Market combines global pharmaceutical packaging multinationals with regional glass and polymer specialists and local distributors. Insights10 highlights Amcor plc, West Pharmaceutical Services, Schott, Gerresheimer, Berry Global, AptarGroup, Owens-Illinois, BD, Constantia Flexibles and WestRock among key global players supplying into Malaysia. Local firms such as Joyi Link Sdn Bhd act as “one-stop” suppliers for primary packaging components, including vials, bottles and blister films, serving domestic manufacturers and contract packers. Overall, the market is moderately consolidated at the high-spec injectable end (glass vials, elastomer stoppers), with more fragmentation in plastics and secondary labels.

| Company | Establishment Year | Headquarters | Primary Packaging Focus in Malaysia | Key Materials / Formats | Malaysia / SEA Footprint | Key Customer Segments in Region | Notable Malaysia / SEA Milestones |

| Amcor plc | 1859 | Zurich, Switzerland | ~ | ~ | ~ | ~ | ~ |

| Gerresheimer AG | 1864 | Düsseldorf, Germany | ~ | ~ | ~ | ~ | ~ |

| SGD Pharma | 1917 (historic French plant) | Paris region, France | ~ | ~ | ~ | ~ | ~ |

| West Pharmaceutical Services | 1923 | Exton, Pennsylvania, USA | ~ | ~ | ~ | ~ | ~ |

| Joyi Link Sdn Bhd | 1999 | Kuala Lumpur / Sungai Buloh, Malaysia | ~ | ~ | ~ | ~ | ~ |

Malaysia Pharmaceutical Primary Packaging Market Analysis

Growth Drivers

Expansion of Local Fill-Finish & Sterile Injectable Capacity

Malaysia’s pharmaceutical manufacturing base underpins demand for sterile vials, ampoules and prefilled systems. The NIMP 2030 sectoral plan notes more than 260 licensed pharmaceutical manufacturers in the country, employing across formulation, biologicals and related activities. Pharmaceutical exports reached around RM1.7 billion in medicaments and related products, with insulin and other injectable preparations among key export items, signalling significant sterile production capabilities. Separately, approved investments in pharmaceutical manufacturing were about RM266.8 million in one recent year, including RM180.9 million in foreign direct investment, reinforcing capacity upgrades for aseptic fill-finish lines that pull through higher-spec primary packaging.

Growth in Biologics, Vaccines & High-Value Injectables

Malaysia’s reliance on imported high-value biopharmaceuticals is a key driver for advanced primary packaging such as Type I vials, PFS and cartridges. The NIMP 2030 pharmaceutical sectoral plan reports RM10 billion in pharmaceutical product import. Within this, imports of vaccines for human use exceed RM1.0 billion, immunological products around RM0.5 billion, and placebos/clinical trial kits around RM1.1 billion, all categories that typically require stringent glass or polymer primary packaging. These flows reflect expanding biologics and vaccine utilisation domestically, encouraging local contract manufacturers and multinational plants in Malaysia to invest in sterile, high-barrier primary packaging formats.

Market Challenges

High Capex & Cleanroom Requirements for Sterile Primary Packaging

Scaling sterile primary packaging capability in Malaysia must compete with other capital-intensive sectors for investment. World Bank data place Malaysia’s GDP at about US$421.97 billion, with GDP per capita around US$11,867, reflecting upper-middle-income status but also pressure to prioritise high-productivity investments. Manufacturing remains a major economic pillar, contributing more than a third of output, and NIMP 2030 emphasises advanced manufacturing upgrades across multiple sectors. Within this context, establishing or expanding ISO-class cleanrooms, depyrogenation tunnels, siliconisation and high-speed inspection for vials or prefilled syringes requires multi-million-ringgit capital outlays on top of utilities and validation costs, which can deter smaller local converters despite the country’s strong pharmaceutical demand base.

Dependence on Imported Type I Glass, PFS & High-Barrier Materials

Malaysia’s pharmaceutical trade profile shows heavy reliance on imported high-value inputs and finished products that often embed specialised primary packaging. The NIMP 2030 sectoral plan reports pharmaceutical imports worth RM10.6 billion, with Germany, China, United States and France as leading sources. Key imported product categories include vaccines, immunological products and placebos/clinical trial kits, which are typically supplied in high-quality borosilicate vials, PFS and barrier systems sourced from global hubs. This structure highlights Malaysia’s exposure to foreign supply for critical primary packaging formats and the risk that any disruption or re-shoring decisions abroad could constrain local fill-finish and biologics programmes.

Opportunities

Biologics, Cell & Gene Therapy-Oriented Primary Packaging

Malaysia’s industrial and health policy is explicitly steering the pharmaceutical sector towards higher-value biologics and advanced therapies, creating structural demand for sophisticated primary packaging. The NIMP 2030 sectoral plan highlights pharmaceuticals as one of 21 priority sectors, with missions to “expand to high value-added activities” and “identify high value-added opportunities in the pharmaceutical and medical devices sectors.” Malaysia’s rich biodiversity, with an estimated 15,000–20,000 vascular plant species and more than 1,300 documented medicinal plant species, supports a growing pipeline of biologically derived candidates and clinical research centres. As more monoclonal antibodies, vaccines and potentially cell or gene therapies move into local fill-finish or clinical packaging, requirements for low-extractable glass, polymer PFS, specialised stoppers and sterile transfer systems will intensify, opening opportunities for global and regional packaging innovators to localise in Malaysia.

High-Barrier, Temperature-Controlled & Cold Chain-Ready Systems

The combination of rising biologics usage, vaccine reliance and international patient flows makes Malaysia a natural hub for cold-chain-dependent pharmaceuticals and their packaging. NIMP 2030 notes that imports of vaccines for human use (around RM1.0 billion), immunological products (about RM0.5 billion) and placebos/clinical trial kits (approximately RM1.1 billion) are significant components of the pharmaceutical import basket. Concurrently, Malaysia’s healthcare travel industry generated an estimated RM2.25 billion in revenue in a recent year, with hundreds of thousands of health tourists annually and hundreds of thousands more in the first half of the following year alone, according to MHTC-linked reporting. These flows necessitate reliable cold-chain infrastructure and high-barrier primary packaging—such as coated vials, specialised PFS and temperature-monitoring components—that can maintain biologic integrity across transport, storage and administration, creating long-term growth prospects for advanced packaging solutions.

Future Outlook

Over the next several years, the Malaysia Pharmaceutical Primary Packaging Market is expected to expand robustly, in line with pharmaceutical market growth forecasts that take the country from roughly MYR 15–16 billion to over MYR 21 billion in medicine sales within the decade. Rising chronic disease prevalence, ageing demographics, and a growing medical tourism sector are expected to fuel volume growth in both oral and injectable drugs. Parallelly, the Southeast Asia healthcare packaging market’s forecast CAGR of about 6.4% combined with Malaysia’s higher-than-regional pharma packaging CAGR near 11.4% should position the country as an increasingly important node in regional primary packaging supply chains.

Major Players

- Amcor plc

- Gerresheimer AG

- SGD Pharma

- Schott AG / Schott Pharma

- West Pharmaceutical Services, Inc.

- Berry Global Inc.

- AptarGroup, Inc.

- Owens-Illinois, Inc. (O-I)

- Becton, Dickinson and Company (BD)

- Constantia Flexibles Group GmbH

- WestRock Company

- Stevanato Group (vials, syringes, cartridges)

- PGP Glass (formerly Piramal Glass)

- Joyi Link Sdn Bhd (local packaging distributor)

- Regional flexible converters and film suppliers serving pharma (e.g., Constantia and similar regional partners in SEA

Key Target Audience

- Branded and Generic Pharmaceutical Manufacturers

- Contract Development and Manufacturing Organizations (CDMOs) and Contract Packaging Organizations (CPOs)

- Biologics, Biosimilars and Vaccine Manufacturers

- Hospital and Health-System Pharmacies

- Government and Regulatory Bodies

- Procurement and Supply-Chain Departments in Large Private Hospital Groups and healthcare networks

- Investments and Venture Capitalist Firms

- Pharmaceutical Packaging Material and Equipment Suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial stage involves mapping the full ecosystem of the Malaysia Pharmaceutical Primary Packaging Market, including pharma manufacturers, CDMOs, packaging converters, distributors and regulators. Extensive desk research using proprietary and syndicated databases (Insights10, global packaging reports, Malaysia pharma statistics) is applied to identify key variables such as dosage volumes, packaging intensity per therapy area, material mix and import–export flows. These variables form the backbone for market sizing and segmentation

Step 2: Market Analysis and Construction

Historical and current data points—such as Malaysia’s pharmaceuticals-in-dosage value, regional healthcare packaging size, and global pharma packaging benchmarks—are compiled to construct a coherent demand model, The analysis estimates packaging spend per USD of pharma sales by therapy and channel, disaggregating into primary formats (vials, blisters, bottles, prefilled syringes). Both top-down (from pharma market value) and bottom-up (from capacity and throughput of major packers) approaches are employed to triangulate total market value and segment shares.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses on growth rates, dominant materials, and drug-delivery segments are validated through structured interviews and computer-assisted telephone interviews with stakeholders across Malaysia and broader Southeast Asia. These include local pharma companies, packaging converters, multinational suppliers, and hospital pharmacies. Discussions focus on procurement patterns, regulatory changes, localization plans and technology adoption (e.g., prefilled systems, sustainable laminates), allowing refinement of the model and qualitative cross-checks of segment dynamics.

Step 4: Research Synthesis and Final Output

The final stage integrates quantitative modeling with qualitative insights into a structured market narrative. Segment-wise forecasts for 2024–2030 are generated by applying the validated CAGR (aligned with Insights10’s 11.38% trajectory) to each segment based on historical performance and pipeline visibility. Detailed cross-tabulation by material, drug-delivery mode and purchase organization is undertaken, and competitive intelligence on key primary packaging players is synthesized into company profiles and cross-comparison matrices. The output is peer-reviewed to ensure internal consistency and alignment with observable macro indicators such as pharma market growth, healthcare expenditure and investment trends.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Primary vs Secondary Packaging Boundary, Abbreviations, Market Sizing Approach – Value/Volume/Average Price per Primary Pack, Data Triangulation, Primary Interviews with Packaging Procurement & Operations Heads, Secondary Research – Regulatory Dossiers & Trade Data, Validation with NPRA & PIC/S GMP Experts, Study Limitations)

- Definition & Scope of Primary Pharmaceutical Packaging

- Market Genesis – Evolution of Malaysia’s Pharma & Biopharma Fill-Finish Ecosystem

- Timeline of Major Primary Packaging Players Entering Malaysia

- Industry Life Cycle & Investment Attractiveness

- Supply Chain & Value Chain Mapping – Sand-to-Vial, Resin-to-Bottle, Film-to-Blister

- Growth Drivers

Expansion of Local Fill-Finish & Sterile Injectable Capacity

Growth in Biologics, Vaccines & High-Value Injectables

Rising Healthcare Expenditure & Medical Tourism-Driven Demand

Government Procurement, Tender Policies & Local Sourcing Incentives

Increasing Regulatory Stringency on Product Protection & Sterility - Market Challenges

High Capex & Cleanroom Requirements for Sterile Primary Packaging

Dependence on Imported Type I Glass, PFS & High-Barrier Materials

Stringent Qualification, Validation & Documentation Expectations

Price Sensitivity in Public Tenders & Generic Drug Segments

Supply Chain Disruptions & Logistics Lead Time Risks - Opportunities

Biologics, Cell & Gene Therapy-Oriented Primary Packaging

High-Barrier, Temperature-Controlled & Cold Chain-Ready Systems

Localisation of Glass & Polymer Capacity for ASEAN Supply Hubs

Co-Development with CMOs/CDMOs & Global Pharma for RTU Platforms

Sustainability-Driven Packaging Redesign & Lightweighting - Trends

Shift to Sustainable, Recyclable & PVC-Free Materials

Ready-to-Use Vials, Syringes & Cartridges with Nest-and-Tub Systems

Smart, Serialized & Tamper-Evident Primary Packaging

High-Speed, Integrated Fill-Finish & Packaging Lines - Government Regulation & Quality Framework

NPRA & MOH Requirements for Primary Packaging Materials

PIC/S GMP Expectations for Container Closure & Sterility Assurance

ISO 15378, ISO 13485, ISO 14644 & ISO 11607 Compliance Landscape

Environmental, Waste Management & Recycling Regulations for Packaging - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume (Units, Packs, Containers), 2019-2024

- By Key Formats & Materials, 2019-2024

- By Packaging Format (In Value %)

Glass Vials & Ampoules

Ready-to-Use (RTU) Vials & Nested Tub Systems

Prefillable Syringes & Cartridges

Oral Solid Bottles & Jars

Blister & Strip Packs for Solid Dosage - By Material Type (In Value %)

Type I Borosilicate Glass

Other Pharmaceutical Glass (Type II, III)

Cyclic Olefin Polymer & Cyclic Olefin Copolymer Systems

HDPE / PET / PP Primary Containers

Aluminium Foil Lidding & Cold-Form Foil Systems - By Route of Administration (In Value %)

Oral Solids (Tablets, Capsules)

Oral Liquids & Suspensions

Parenteral – Small-Volume Injectables

Parenteral – Large-Volume & Infusion Solutions

Ophthalmic & Otic Preparations - By Drug / Molecule Type (In Value %)

Originator & Innovator Pharmaceuticals

Generic Pharmaceuticals

Biologics & Biosimilars

Vaccines, Blood Products & Plasma-Derived Therapies

High-Potency & Cytotoxic Oncology Products - By End-User / Customer Type (In Value %)

Local Generic Pharma Manufacturers

Multinational Innovator & Regional Export Plants

Biopharma & Vaccine Manufacturers

Contract Manufacturing & Contract Packaging Organizations

Hospital Pharmacies, Government Tender & Public Sector Packaging Units - By Region (In Value %)

Central / Klang Valley Pharma & Packaging Cluster

Northern Manufacturing Corridor

Southern Manufacturing Corridor

East Coast Corridor

East Malaysia – Sabah & Sarawak

- Market Share of Major Players – By Value & Volume

- Market Share by Packaging Format – Vials, Ampoules, PFS, Bottles, Blisters, Pouches & Bags

Market Share by Material - Cross Comparison Parameters (Product Portfolio Depth Local Footprint, Sterile & Containment, Compliance Technology, Supple Chain, Sustainability, Technical Support)

- SWOT Analysis of Major Players

- Pricing Analysis

- Detailed Profiles of Major Companies

Gerresheimer

Schott Pharma

Nipro

SGD Pharma

Corning

Stevanato Group

West Pharmaceutical Services

Amcor

Oliver Healthcare Packaging

ZACROS Malaysia

Pack Smart

TAKO Healthcare

Joyi Link (Primary Pharma Films & Sachets)

Shandong PG

Bormioli Rocco

- Demand & Utilization Patterns by End-User Segment

- Packaging Specification Requirements by Molecule Type & Route of Administration

- Procurement Models – Direct, Tender-Based, Long-Term Supply & Framework Agreements

- Qualification, Validation & Documentation Expectations from Packaging Partners

- Key Pain Points – Change Control, Lead Times, Regulatory Audits, Quality Deviations

- By Value, 2025-2030

- By Volume (Units, Packs, Containers), 2025-2030

- By Format & Material, 2025-2030