Market Overview

The Malaysia warehousing market is valued at approximately USD 29 billion in 2025 with an approximated compound annual growth rate (CAGR) of 5.20% from 2025-2030, driven by the increasing adoption of e-commerce and advancements in logistics technology. This growth is attributed to the changing consumer behaviors, pushing businesses to adapt their supply chain strategies to streamline operations.

Key cities such as Kuala Lumpur, Penang, and Johor Bahru dominate the Malaysia warehousing market due to their strategic locations, which facilitate trade and commerce. Kuala Lumpur, being the capital, serves as an economic hub, attracting numerous multinational companies and logistics providers. Penang, a vital manufacturing center, supports the high demand for warehousing, while Johor Bahru’s proximity to Singapore makes it a critical logistics point for cross-border trade and distribution, further solidifying its importance within the market.

The surge in e-commerce activities in Malaysia has significantly influenced the warehousing market, with a notable expansion in online retail. In 2022, e-commerce sales reached approximately USD 23 billion, reflecting a growth trajectory that is expected to continue as consumers increasingly prefer online shopping. The Digital Economy Report by the Malaysian Communications and Multimedia Commission (MCMC) indicates that the number of online shoppers is projected to rise to 25 million by 2025.

Market Segmentation

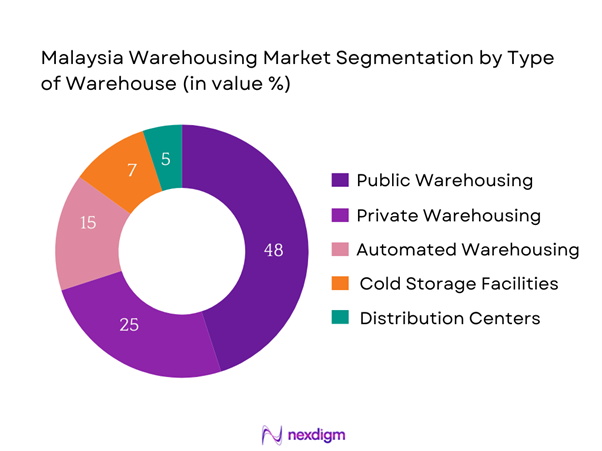

By Type of Warehousing

The Malaysia warehousing market is segmented by type of warehousing into public warehousing, private warehousing, automated warehousing, cold storage facilities, and distribution centers. Among these, public warehousing commands a significant market share due to its flexibility and lower costs for small to medium enterprises. Public warehouses allow businesses to rent space on an as-needed basis, providing a cost-effective solution for inventory management without the high overhead costs associated with owning storage facilities. These types of warehouses are particularly popular among e-commerce businesses that experience fluctuating demand and require adaptable storage solutions.

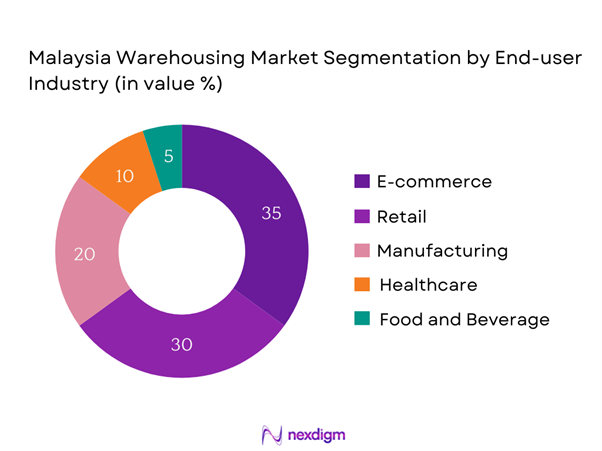

By End-User Industry

Additionally, the market is segmented by end-user industry into e-commerce, retail, manufacturing, healthcare, and food and beverage. The e-commerce sector dominates the market due to the significant increase in online shopping, creating a corresponding demand for warehousing solutions that facilitate efficient logistics and distribution. E-commerce businesses require rapid fulfillment of orders, making it essential for them to invest in extensive warehousing networks that allow for the prompt processing and dispatching of goods. This trend has propelled providers of warehousing services to develop tailored solutions catering to the unique requirements of e-commerce companies.

Competitive Landscape

The Malaysia warehousing market is characterized by a mix of local and international players, creating a dynamic competitive environment. Major companies including YCH Group, Kerry Logistics, and GDEX Berhad dominate the market by leveraging their extensive networks and technological innovations. These players are focused on optimizing supply chain strategies and enhancing service offerings to meet the evolving demands of their clients.

| Major Player | Establishment Year | Headquarters | Market Focus | Technology Utilization | Operational Capacity | Partners |

| YCH Group | 1955 | Singapore | – | – | – | – |

| Kerry Logistics | 1981 | Hong Kong | – | – | – | – |

| GDEX Berhad | 1997 | Malaysia | – | – | – | – |

| SCS Logistics | 2001 | Malaysia | – | – | – | – |

| Puncak Niaga | 1992 | Malaysia | – | – | – | – |

Malaysia Warehousing Market Analysis

Growth Drivers

Urbanization and Infrastructure Development

Urbanization in Malaysia is rapidly transforming the logistics landscape. As reported by the World Bank, Malaysia’s urban population is expected to increase from 77% in 2022 to over 80% by end of 2025. This urban shift drives demand for warehousing spaces in metropolitan areas, where proximity to consumers is essential for efficient distribution. Infrastructure development, supported by government initiatives such as the 12th Malaysia Plan, which allocates substantial budgetary resources for transportation and logistics improvements, further facilitates the establishment of modern warehouse facilities to cater to urban logistics needs while improving connectivity across regions.

Rise in Trade and Export

Malaysia’s strategic location in Southeast Asia bolsters its trade and export activities, significantly influencing the warehousing market. As of 2022, Malaysia’s total trade reached USD 2.11 trillion, with exports accounting for USD 1.23 trillion. This growth has necessitated an expansion in warehousing capacities to accommodate increased inventory levels required for supporting export-oriented businesses. The Department of Statistics Malaysia forecasts that trade might see continued growth, driven by the strengthening of trade relationships, particularly within the ASEAN region, further reinforcing the importance of efficient warehousing in logistics management.

Market Challenges

Supply Chain Disruptions

The warehousing market faces significant challenges due to disruptions in supply chains, exacerbated by global issues such as the COVID-19 pandemic and geopolitical tensions. According to the World Bank, Malaysia experienced delays in logistics performance, which affected supply chain efficiency. As a result, businesses involved in warehousing have had to implement more robust risk management strategies to mitigate these challenges affecting service delivery and operational efficiency.

Rising Operational Costs

Increasing operational costs, primarily driven by inflation, energy prices, and labor shortages, pose a challenge for the warehousing sector in Malaysia. The Ministry of Finance reported a rise in consumer price inflation, which reached 3.3% in 2022. This inflationary pressure has resulted in higher costs for logistics services, including warehousing. Rising energy prices, up 20% due to global market fluctuations, have further exacerbated these operational costs. Companies are compelled to find innovative ways to streamline operations and reduce expenses while ensuring quality service delivery in a competitive environment.

Opportunities

Technological Advancements in Logistics

Technological advancements are significantly shaping the future of the warehousing market in Malaysia. In 2022, investments in logistics technology increased, with automation and digital solutions gaining traction among 40% of logistics firms. Technologies such as warehouse management systems (WMS) and robotics are enabling warehouses to enhance operational efficiency, reduce errors, and improve order fulfilment rates. The growing trend outlined in the Digital Malaysia initiative reflects how embracing technology is pivotal for future growth, enhancing the competitive edge of companies operating in the warehousing space.

Growth in Cold Storage Demand

The burgeoning demand for cold storage solutions in Malaysia is primarily driven by the food and pharmaceutical sectors, which require stringent temperature control for perishable items. In 2022, the cold chain logistics market was valued at approximately USD 1 billion, with a projected annual growth rate driven by increasing consumer demand for fresh produce and pharmaceuticals. The Food and Agriculture Organization (FAO) emphasizes that ensuring the integrity of food supply chains remains critical, presenting significant opportunities for companies specializing in cold storage facilities and logistics solutions in Malaysia.

Future Outlook

The Malaysia warehousing market is poised for significant growth in the coming years, driven by continuous technological advancements, increasing urbanization, and the consistent rise of e-commerce. It is expected that investments in automation and smart supply chain solutions will streamline operations and reduce costs, facilitating an improved logistics infrastructure. Additionally, the market will benefit from escalating consumer demands for faster and more efficient services, prompting the evolution of warehousing solutions to adapt accordingly.

Major Players

- YCH Group

- Kerry Logistics

- GDEX Berhad

- SCS Logistics

- Puncak Niaga

- J&T Express

- DHL Supply Chain

- Braun Melsungen AG

- CEVA Logistics

- Agility Logistics

- Sinotrans Limited

- DB Schenker

- APL Logistics

- Linfox

- JAS Worldwide

Key Target Audience

- E-commerce retailers

- Logistics and supply chain companies

- Manufacturing firms

- Food and beverage distributors

- Retail chains

- Government and regulatory bodies (Malaysian Ministry of Transport, Malaysian Customs Department)

- Investments and venture capitalist firms

- Real estate and property management companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the Malaysia warehousing market. This step utilizes a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define critical variables that influence market dynamics, including market drivers, challenges, and competitive elements.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Malaysia warehousing market. This includes assessing market penetration, the ratio of warehouses to various service providers, and resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, resulting in a well-rounded market analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple warehousing providers and logistics companies to acquire detailed insights into their operational methodologies, service offerings, and market challenges. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Malaysia warehousing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Regulatory Environment Overview

- Growth Drivers

Increase in E-commerce Activities

Urbanization and Infrastructure Development

Rise in Trade and Export - Market Challenges

Supply Chain Disruptions

Rising Operational Costs - Opportunities

Technological Advancements in Logistics

Growth in Cold Storage Demand - Trends

Automation and Robotics in Warehousing

Sustainability Initiatives - Government Regulation

Safety Standards Compliance

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Rental Rates, 2019-2024

- By Type of Warehousing (In Value %)

Public Warehousing

– Shared Storage Facilities

– Short-Term Leasing Options

– Multi-client Warehousing

Private Warehousing

– In-house Logistics Facilities

– Long-term Dedicated Warehouses

– Owner-operated Storage Units

Automated Warehousing

– Automated Storage and Retrieval Systems (AS/RS)

– Robotics-based Fulfillment Centers

– Smart Inventory Management Warehouses

Cold Storage Facilities

– Chilled Storage (2°C to 8°C)

– Frozen Storage (-18°C and below)

– Temperature-Controlled Pharma Storage

Distribution Centers

– Cross-Docking Facilities

– Regional Fulfillment Hubs

– High Throughput Centers - By End-User Industry (In Value %)

E-commerce

– E-fulfillment Centers

– Last-Mile Staging Warehouses

– Return Handling Warehouses

Retail

– Store Inventory Storage

– Omni-Channel Distribution Facilities

– Seasonal Stock Warehousing

Manufacturing

– Raw Material Warehouses

– Work-in-Progress (WIP) Storage

– Finished Goods Warehousing

Healthcare

– Pharmaceutical Storage

– Medical Device Warehousing

– Temperature-Sensitive Logistics

Food and Beverage

– Perishable Goods Storage

– Dry Goods Warehousing

– HACCP-Certified Facilities - By Region (In Value %)

Northern Region

Central Region

Southern Region

Eastern Region

Federal Territories - By Warehouse Size (In Value %)

Small (Up to 10,000 sq. ft.)

Medium (10,000 – 50,000 sq. ft.)

Large (Over 50,000 sq. ft.) - By Service Model (In Value %)

Managed Services

– End-to-End Inventory Control

– Integrated Logistics Management

– Warehouse Operations Outsourcing

Self-Service

– Client-Controlled Operations

– Manual Stock Handling

– Short-Term Flexible Storage

Contract Logistics

– Long-Term 3PL Agreements

– KPI-driven Service Models

– Custom Warehousing Solutions

- Market Share Analysis of Major Players by Value/Volume, 2024

Market Share by Type of Warehousing, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenue, Warehouse Locations, Operational Capacity, Technology Utilization, Client Portfolio, Value-Added Services, Sustainability & Green Practices, Scalability and Flexibility)

- SWOT Analysis of Major Players

- Pricing Analysis for Major Warehousing Services

- Detailed Profiles of Major Companies

YCH Group

Kerry Logistics

GDEX Berhad

SCS Logistics

Giba Group

Puncak Niaga

J&T Express

DHL Supply Chain

Senda Logistics

Linfox

APL Logistics

CEVA Logistics

Swisslog

DB Schenker

Agility Logistics

- Market Demand and Utilization Patterns

- Purchasing Power and Budget Allocations

- Regulatory Compliance Impact

- Needs, Desires, and Pain Point Analysis

- Decision-Making Dynamics

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Rental Rates, 2025-2030