Market Overview

The Maldives Luxury Resort Market is valued at USD 0.60 billion in 2024, based on a thorough industry assessment. This valuation reflects a substantial rise from USD 0.60 billion in 2023, underscoring robust growth fostered by record tourist arrivals crossing 1.9 million and increasing luxury resort demand fueling both occupancy and guest spend.

The central atolls—notably Malé, the capital, and neighboring resort clusters—dominate the market due to their superior infrastructure, high airport connectivity, and strategic positioning as first-entry points and convenience hubs for travelers. Additionally, Addu Atoll is emerging swiftly, supported by government-backed tourism diversification and infrastructure development funding.

Market Segmentation

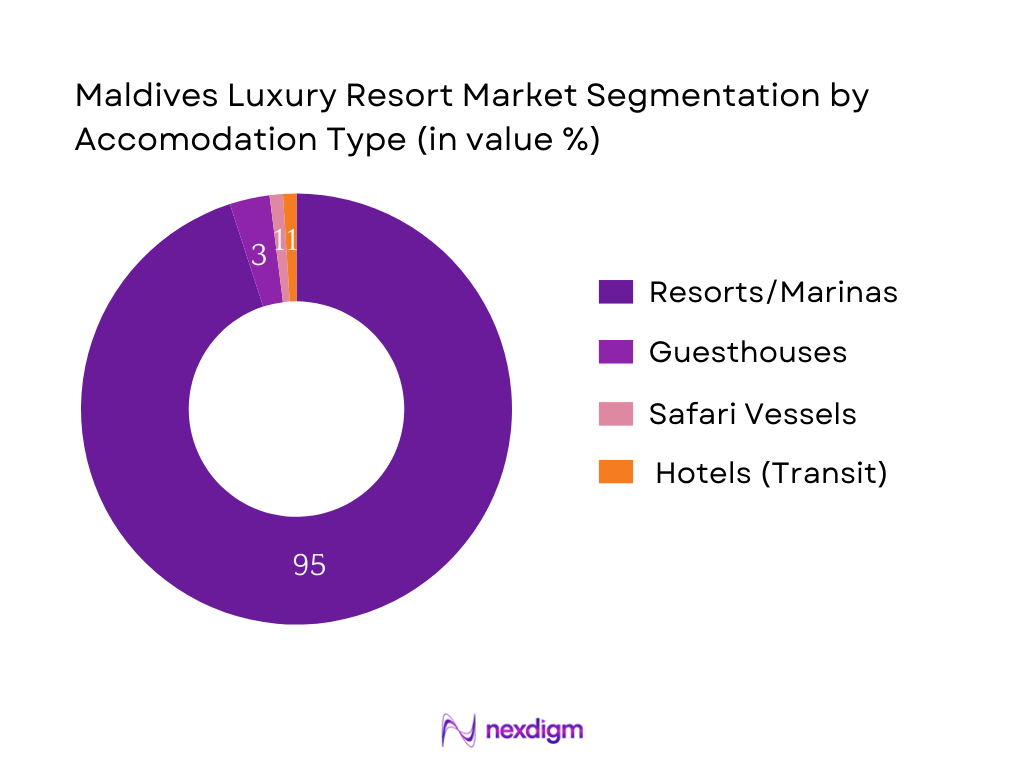

By Accommodation Type

The Maldives Luxury Resort market is segmented by accommodation type into resorts/marinas, guesthouses, safari vessels, and transit hotels. Resorts/marinas hold an overwhelming 95 % of the market share, driven by the iconic “one‑island‑one‑resort” model offering exclusive overwater villas, private beaches, elite spa experiences, and curated high‑touch services. This segment’s dominance stems from its unparalleled appeal to high‑spending international travelers seeking tailored, experiential luxury in secluded island settings. Its market leadership is reinforced by superior RevPAR performance, global brand presence, and consistently high occupancy due to limited comparably immersive alternatives in the Maldives hospitality landscape.

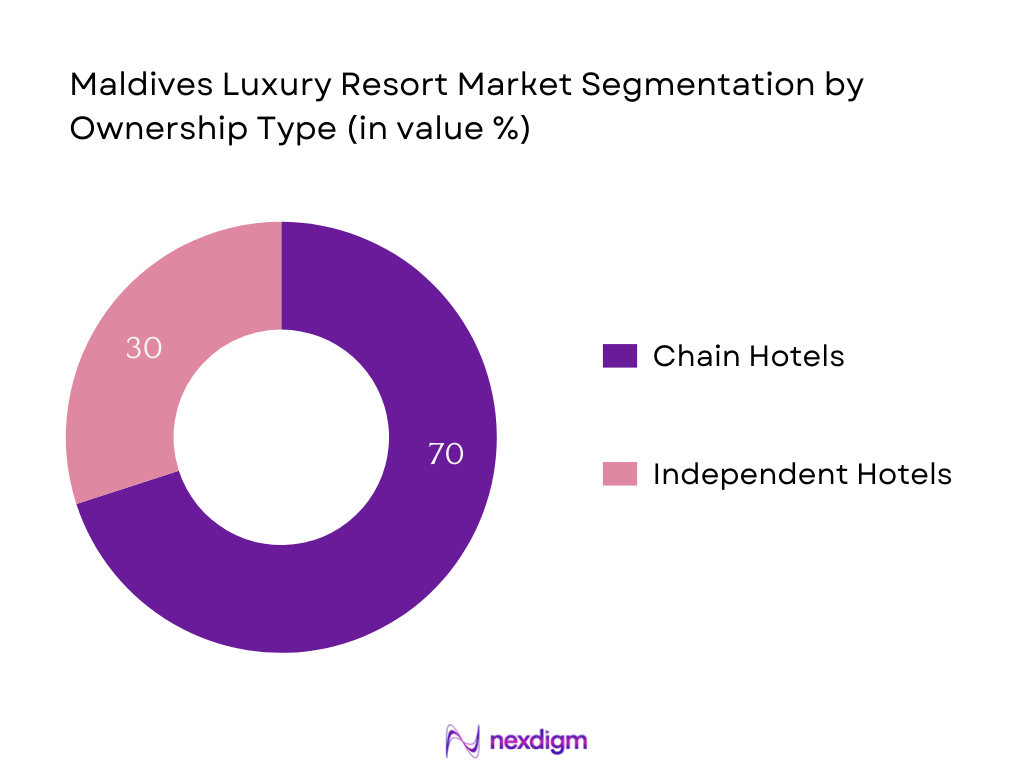

By Ownership Type

The Maldives Luxury Resort market is classified into chain hotels and independent hotels. Chain hotels dominate this segment, driven by the strong brand recognition, loyalty programs, and standardized premium guest experiences that attract affluent global tourists. Guests seeking luxury and familiarity favor chain operators like Four Seasons, Marriott, Hilton, and Banyan Tree that deliver consistency, cutting‑edge experiential design, and integrated wellness or sustainability offerings. These operators also benefit from global distribution networks and digital marketing, boosting advance bookings and occupancy even during softer demand periods. In contrast, independent properties, although valued for local authenticity, lack comparable scale and resource backing, which further reinforces chains’ market leadership.

Competitive Landscape

The Maldives luxury resort market is strongly consolidated, with a handful of global and regional players shaping the competitive environment. These conglomerates benefit from expansive brand equity, expansive service capabilities, and seamless integration of luxury, wellness, and sustainability experiences.

| Player | Establishment Year | Headquarters | No. of Keys (Resort Inventory) | ADR Tier (Average Daily Rate) | Unique Experience Offering | Energy/Sustainability Focus | Location Proximity to Malé Airport |

| Four Seasons Maldives | – | Global (HQ in U.S.) | – | – | – | – | – |

| Soneva | – | Global (HQ in Thailand) | – | – | – | – | – |

| St. Regis Vommuli | – | Global (HQ in U.S.) | – | – | – | – | – |

| Conrad Maldives | – | Global (HQ in U.S.) | – | – | – | – | – |

| Anantara / Banyan Tree Group | – | Global (HQ in Thailand) | – | – | – | – | – |

Maldives Luxury Resort Market Analysis

Growth Driver

The Maldives benefits from a high GDP nominal per capita of USD 13,215.5 in 2024, as reported by the World Bank. This elevated per capita income supports a growing pool of affluent domestic consumers able to access luxury resort experiences. Additionally, real GDP growth of 5.5 percent in 2024, driven by tourism and related services, indicates a strengthening broader economy that underpins the rise of HNWI demand. Further bolstering this dynamic, tourist arrivals climbed to 2.05 million in 2024, an increase from approximately 1.88 million in 2023, signaling sustained international influx of high-value visitors who often comprise HNWI travel segments. These macroeconomic indicators—high per capita income, growth in GDP, and rising arrivals—underscore the expanding population of wealthy individuals within and visiting the Maldives, providing a robust demand base for luxury resort offerings and underpinning this key growth driver.

Market Challenge

The Maldives’ ecosystem is extremely vulnerable. Over 80 percent of its land mass consists of coral islands rising less than one meter above sea level; the highest natural point is only around 2.4 meters. Real GDP growth of 5.5 percent in 2024 restored poverty to pre‑pandemic levels, highlighting socioeconomic dependencies on the fragile environment that supports tourism and livelihoods. Given rising sea levels projected by the World Bank to increase between 10 and 100 centimeters, these islands face severe inundation risk. With 31 protected areas currently administered by the Environmental Protection Agency, efforts are underway—but the environmental baseline remains precarious. These figures reflect a delicate balance where economic gains are inextricably tied to ecosystems that are under existential threat, posing a significant challenge to the long-term sustainability of luxury resort development.

Emerging Opportunity

Infrastructure and tourism investments are unlocking new opportunities for private island ownership and resort development. A major expansion of Maldives’ Hanimaadhoo Airport, valued at USD 800 million, is nearing completion—enabling processing of 1.3 million passengers annually and paving access to northern atolls. Furthermore, the inauguration of the upgraded Velana International Airport, backed by USD 302 million from the Abu Dhabi Fund for Development, enhances connectivity for global travelers. The Maldives’ GDP nominal per capita of USD 13,215.5 in 2024 and 2.05 million tourist arrivals underscore strong economic fundamentals and demand pull for remote, exclusive resort ownership. These expanded aviation capacities and high visitor inflows support the feasibility and attractiveness of private island buyouts targeting ultra-luxury developments by capital-rich investors, signaling promising future market potential rooted in current infrastructural and economic strengths.

Future Outlook

Over the forecast period (2024–2030), the Maldives luxury resort market is expected to exhibit sustained growth underpinned by continuous tourism recovery, luxury experience demand, and infrastructural enhancements like airport expansion and sustainable resort development.

Major Players

- Soneva

- Six Senses Laamu

- Cheval Blanc Randheli

- Four Seasons Maldives

- Gili Lankanfushi

- Velaa Private Island

- Joali Maldives

- Baros Maldives

- The St. Regis Vommuli Resort

- Conrad Maldives Rangali Island

- Waldorf Astoria Maldives

- Patina Maldives

- Anantara Kihavah

- Banyan Tree Vabbinfaru

- COMO Maalifushi

Key Target Audience

- High-net‑worth investor groups

- Private equity and sovereign funds focused on hospitality investments

- Hospitality real estate developers and resort operators

- Investments and venture capitalist firms (e.g., hospitality‑focused VCs)

- Government and regulatory bodies

- Luxury travel conglomerates and destination management companies (DMCs)

- Infrastructure financiers for resort development

- Sustainability and ESG investment arms targeting luxury destinations

Research Methodology

Step 1: Identification of Key Variables

The study begins with mapping key stakeholders in the Maldives luxury resort ecosystem—resort operators, government tourism agencies, DMCs, investors—and gathering baseline data via premier secondary sources, industry databases, and official tourism statistics.

Step 2: Market Analysis and Construction

Historical data for revenue, ADR, occupancy, and guest arrivals are collated to build a market model; peer‐benchmarking and segment penetration are analyzed to validate value estimates and market sizing.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on growth drivers and segmentation are validated through semi‑structured interviews with industry executives from global chains and local operators; financial data and strategic insights are corroborated to refine segmentation and forecasting.

Step 4: Research Synthesis and Final Output

Findings from quantitative models and qualitative interviews are triangulated; field visits, where feasible, inform context on infrastructure and experiential attributes. The final output delivers a validated, richly detailed market picture.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Primary and Secondary Data Sources, On-Ground Interviews with Resort Operators and DMCs, Limitations and Forecasting Assumptions)

- Definition and Scope

- Tourism Arrival Dependency and Seasonality Index

- Evolution of Luxury Tourism in the Maldives

- Premium Property Development Cycle (Resort Lifecycle)

- Value Chain Mapping: DMCs – Travel Platforms – Operators – End Guests

- High-Net-Worth Guest Experience Cycle

- Occupancy Rate Benchmarks and ADR Yield Trends

- 7-Star and Ultra-Luxury Category Evolution

- Growth Drivers (Rising HNWIs, Direct Air Connectivity from Asia & Europe, Govt. Island Leasing Policies, Destination Branding, Repeat Visitors Rate)

- Market Challenges (Fragile Ecosystem, Climate Exposure, Dependence on Europe & China, High Operating Cost of Imported Goods)

- Emerging Opportunities (Private Island Buyouts, Underwater Luxury Concepts, Wellness Tourism Integration, Ultra-Luxury Indian Wedding Packages)

- Trends (Digital Detox Packages, ESG-Based Luxury Experiences, AI-based Guest Personalization, Floating Villas)

- Government Regulation (Island Leasing Policy, Environmental Impact Licensing, Construction Bylaws, Foreign Investment Limits)

- SWOT Analysis

- Stakeholder Ecosystem (Investors, Resort Brands, DMCs, Aviation, MoT, NGOs)

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume (No. of Operational Keys), 2019-2024

- By Average Daily Rate (ADR), 2019-2024

- By RevPAR, 2019-2024

- By Guest Nationality (In Value %)

China

India

Russia

Germany

United Kingdom

Others - By Booking Channel (In Value %)

Online Travel Agencies (OTA)

Direct Hotel Websites

Destination Management Companies (DMCs)

Offline Tour Operators

Loyalty Platforms / Affiliate Programs - By Resort Category (In Value %)

Ultra-Luxury (USD 2000+/night)

High-End Luxury (USD 1200–2000/night)

Entry-Level Luxury (USD 700–1200/night)

Boutique Luxury

Eco-Conscious / Sustainable Resorts - By Ownership Model (In Value %)

International Brand Operated

Owner-Operated

Joint Ventures

Private Equity Owned

Government Leased Islands - By Island Geography / Atoll Cluster (In Value %)

North Malé Atoll

South Malé Atoll

Baa Atoll

Ari Atoll

Other Remote Atolls

- Market Share Analysis by Value / Volume

Market Share by Ownership Model - Cross Comparison Parameters: (Brand Portfolio Positioning, Resort Inventory (No. of Keys), ADR & RevPAR Benchmarking, Experiential Offerings (Underwater Villas, Private Chefs, Spa, etc.), Island Proximity to Malé Airport, Energy Sourcing (Renewables vs Diesel), Target Guest Segments, Sustainability Practices (LEED/Green Globe))

- SWOT Analysis of Leading Players

- Price Benchmarking by Room Type (Water Villas, Beach Villas, Residences)

- Detailed Company Profiles

Soneva

Six Senses Laamu

Cheval Blanc Randheli

Four Seasons Maldives

Gili Lankanfushi

Velaa Private Island

Joali Maldives

Baros Maldives

The St. Regis Vommuli Resort

Conrad Maldives Rangali Island

Waldorf Astoria Maldives

Patina Maldives

Anantara Kihavah

Banyan Tree Vabbinfaru

COMO Maalifushi

- Demand Preferences by Demographic

- Booking Decision Behavior

- Key Amenities and Experience Expectations

- Average Spend per Guest Stay

- Pain Points: Logistics, Transfers, Climate Risk

- By Value, 2025-2030

- By Volume (Operational Keys Forecast), 2025-2030

- By ADR, 2025-2030

- By Guest Arrivals in Luxury Tier, 2025-2030