Market Overview

The Middle East aviation market is valued at approximately USD ~ billion, with growth driven by increasing air travel demand, government investments, and expanding airport infrastructure. The market has experienced consistent growth, driven by investments from major airlines and the region’s strategic position as a global aviation hub. This market is supported by a rapidly growing population, an increase in disposable incomes, and a shift towards regional aviation and travel demand. Increasing geopolitical stability and the expansion of air routes have further strengthened the market dynamics.

The dominant players in this market include the United Arab Emirates, Saudi Arabia, and Qatar, with cities like Dubai, Riyadh, and Doha taking the lead due to their advanced infrastructure, strategic locations, and government-backed investment. These countries are major aviation hubs with state-of-the-art airports, offering world-class services and connectivity. Their dominance is further solidified by the expansion of airline fleets, a surge in international connectivity, and the continued investment in smart aviation technologies.

Market Segmentation

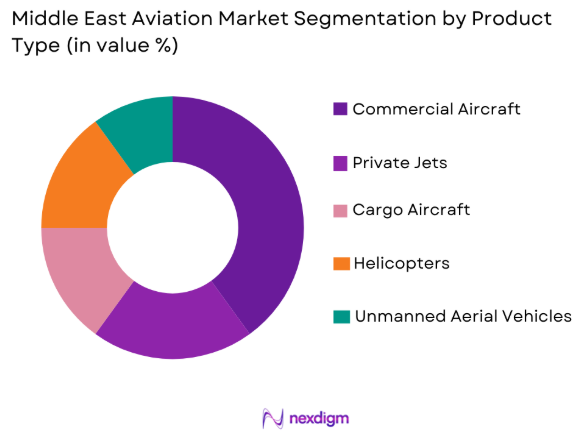

By Product Type

The Middle East aviation market is segmented by product type into commercial aircraft, private jets, cargo aircraft, helicopters, and unmanned aerial vehicles. Recently, commercial aircraft have dominated the market share due to the increasing demand for air travel, with airlines investing heavily in new fleets to accommodate a growing passenger base. Infrastructure availability, especially the rapid expansion of international airports in key cities, further fuels this growth. Moreover, government-backed policies to increase aviation capacity in countries like the UAE and Saudi Arabia have contributed to the dominant presence of commercial aircraft in the market. With global airlines competing to expand their networks, the demand for larger, more fuel-efficient commercial aircraft has risen sharply.

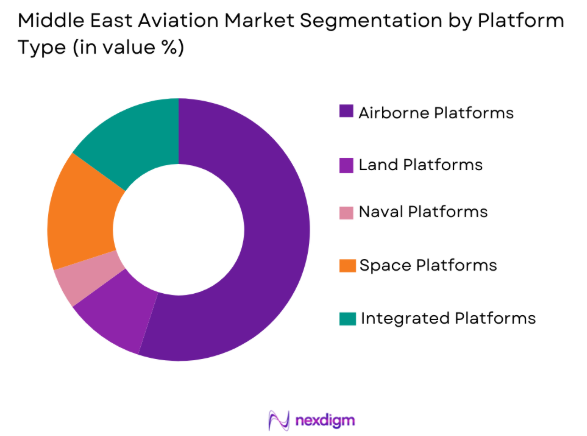

By Platform Type

The Middle East aviation market is segmented by platform type into land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Recently, airborne platforms have dominated the market share due to increasing demand for air travel, military upgrades, and the growing number of airlines operating in the region. Countries such as the UAE, Qatar, and Saudi Arabia continue to invest heavily in commercial and military aircraft, ensuring airborne platforms remain at the forefront. This dominance is further driven by the rise of low-cost carriers, which have boosted air travel within and outside the region. Strategic investments in airports and aviation technologies support the continued dominance of airborne platforms, aligning with regional growth objectives.

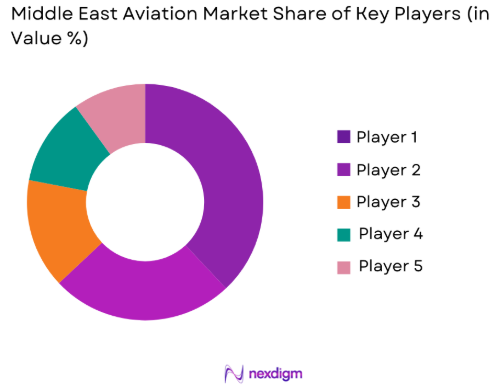

Competitive Landscape

The competitive landscape of the Middle East aviation market is characterized by high competition among key players such as Emirates Airlines, Qatar Airways, and Etihad Airways. These companies continue to dominate the market by expanding their fleet sizes, improving service offerings, and enhancing customer experience. Consolidation is also evident in the market, with strategic mergers and partnerships aimed at strengthening market share and operational efficiency. The influence of major players continues to shape the industry’s future trajectory, with investments in advanced technologies such as AI, UAVs, and automated systems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Fleet Size |

| Emirates Airlines | 1985 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ |

| Qatar Airways | 1993 | Doha, Qatar | ~ | ~ | ~ | ~ | ~ |

| Etihad Airways | 2003 | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ |

| Flydubai | 2008 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ |

| Saudia | 1945 | Jeddah, Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

Middle East Aviation Market Analysis

Growth Drivers

Increased Tourism and Business Travel

The Middle East aviation market is benefiting significantly from rising tourism and business travel. With cities like Dubai, Doha, and Abu Dhabi emerging as international tourism hubs, the demand for air travel has surged. The region’s strategic position between Europe, Asia, and Africa makes it an attractive transit point for international travelers. Business travelers are also contributing to this surge, with multinational companies establishing regional headquarters in cities like Dubai and Riyadh. The increased frequency of flights, the growing demand for international air travel, and the region’s modern airport infrastructure continue to drive the growth of the aviation market. The tourism industry’s growth has spurred demand for larger fleets, more direct routes, and new regional airports, contributing to an optimistic market outlook.

Government Investments and Infrastructure Development

Government investments in aviation infrastructure are a key growth driver for the Middle East aviation market. The governments in the UAE, Saudi Arabia, and Qatar have committed substantial budgets to develop and expand airports and aviation infrastructure, including air traffic control systems, maintenance facilities, and cargo hubs. These investments are designed to enhance the region’s competitive edge, support increasing passenger demand, and boost regional connectivity. Countries in the region are also focusing on integrating the latest technologies into their aviation systems, ensuring that their airports can handle increasing passenger volumes and complex flight operations. With more international airlines choosing the region as a base, the development of these advanced infrastructures is set to propel the market to new heights.

Market Challenges

High Fuel Costs and Operational Expenses

A key challenge faced by the Middle East aviation market is the high cost of fuel, which accounts for a significant portion of an airline’s operating expenses. Fuel price volatility can significantly impact profitability and operations, especially for low-cost carriers. Airlines operating in the region are investing in fuel-efficient aircraft to mitigate these rising costs, but the unpredictability of fuel prices continues to pose a challenge. Additionally, the high cost of aviation technology, airport fees, and maintenance expenses further adds pressure on airline profits. Companies in the region are exploring new business models, such as low-cost carriers, to maintain their competitiveness, but fuel costs remain a major operational challenge for all market players.

Geopolitical Instability and Regulatory Challenges

Another significant challenge for the Middle East aviation market is geopolitical instability in certain regions. Conflicts and tensions between nations in the region can disrupt air travel and freight operations, leading to flight cancellations, changes in flight routes, and increased operational costs. Political instability can also affect passenger confidence, leading to reduced travel demand. Additionally, regulatory challenges, such as meeting international aviation safety standards and compliance with evolving environmental regulations, can limit operational flexibility. As these countries continue to navigate regional political tensions and stricter environmental regulations, the aviation market will need to adapt to these challenges, balancing growth with risk mitigation strategies.

Opportunities

Expansion of Low-Cost Carriers

The rise of low-cost carriers in the Middle East presents a significant growth opportunity for the aviation market. With increasing demand for affordable travel options, especially among young professionals and budget-conscious travelers, low-cost carriers are gaining traction. Airlines such as Flydubai and Air Arabia are capitalizing on this trend, expanding their fleets and routes to meet the growing demand for cost-effective air travel. These carriers offer passengers competitive prices, increased frequency of flights, and greater access to regional and international destinations. As the middle class continues to expand in the Middle East, the demand for budget-friendly air travel will support the growth of the low-cost carrier sector, providing significant growth potential for regional airlines.

Development of Regional Hubs and Infrastructure

The continued development of regional aviation hubs and modern infrastructure presents a significant opportunity for the Middle East aviation market. Countries like the UAE, Qatar, and Saudi Arabia are investing heavily in the expansion and modernization of airports, which will increase capacity and efficiency. Dubai International Airport and Hamad International Airport are already considered world leaders in passenger and cargo handling, and plans to expand these airports further will boost the region’s appeal as a global transit hub. With more regional airports being developed, the market will see increased demand for aircraft, as well as greater opportunities for airlines and cargo carriers. This trend will open up new routes and support business growth within the aviation sector.

Future Outlook

The Middle East aviation market is expected to witness continued growth over the next five years, driven by expanding tourism, increasing air travel demand, and the modernization of aviation infrastructure. Technological developments, including advancements in aircraft efficiency and AI in air traffic control, will also play a crucial role in this growth. Additionally, regulatory support from regional governments will contribute to the expansion of airports and new flight routes, supporting regional connectivity. The demand for both commercial and military aircraft will continue to rise as the region solidifies its position as a global aviation hub.

Major Players

- Emirates Airlines

- Qatar Airways

- Etihad Airways

- Flydubai

- Saudia

- Turkish Airlines

- Air Arabia

- Oman Air

- Kuwait Airways

- Royal Jordanian Airlines

- Gulf Air

- EgyptAir

- Middle East Airlines

- Flynas

- Air Seychelles

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airline companies

- Aircraft manufacturers

- Airport operators and service providers

- Aviation technology firms

- Tour operators and travel agencies

- Freight and cargo service providers

Research Methodology

Step 1: Identification of Key Variables

We identify the key factors that influence the aviation market, including economic trends, government policies, infrastructure development, and technological advancements.

Step 2: Market Analysis and Construction

We conduct a thorough analysis of market trends, industry reports, and primary and secondary research to construct the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

We validate our findings with industry experts and stakeholders to ensure accuracy and relevance.

Step 4: Research Synthesis and Final Output

We synthesize the collected data and expert insights into a cohesive report with actionable insights and forecasts for the aviation market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing Demand for Air Travel

Expansion of Air Cargo Operations

Increased Military Investments

Technological Advancements in Aircraft

Growing Tourism and Economic Growth - Market Challenges

High Operating Costs

Regulatory Compliance Issues

Geopolitical Instability

Infrastructure Limitations

Environmental Impact and Sustainability Issues - Market Opportunities

Growth in Aircraft Leasing and Financing

Partnerships with Tech Firms for Enhanced Avionics

Expanding Regional Airports and Infrastructure - Trends

Increased Use of Eco-friendly Aircraft

Integration of AI and Automation in Aircraft Operations

Growth of Aircraft Leasing Business

Advances in Drone Technology for Commercial Use

Rise in Demand for High-performance Military Aircraft - Government Regulations & Defense Policy

Aviation Safety Standards

Environmental Regulations

Defense Procurement Policies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Commercial Aircraft

Private Jets

Cargo Aircraft

Helicopters

Unmanned Aerial Vehicles - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

OEM Solutions

Aftermarket Solutions

Upgrades and Refurbishments

Retrofit Solutions

Maintenance Solutions - By End User Segment (In Value%)

Military

Commercial Airlines

Private Sector

Freight and Cargo

Government and Defense Agencies - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

OEM Distributors

Third-party Dealers - By Material / Technology (in Value%)

Composite Materials

Lightweight Alloys

Advanced Propulsion Systems

Aerostructures

Avionics Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Emirates Airlines

Qatar Airways

Saudi Arabian Airlines

Airbus

Boeing

Etihad Airways

Lockheed Martin

Raytheon Technologies

General Dynamics

Honeywell International

Thales Group

Dassault Aviation

Northrop Grumman

Gulfstream Aerospace

Leonardo

- Commercial airlines investing in fleet expansions

- Military forces focusing on advanced aviation technologies

- Private sector demand for business jets

- Government agencies focusing on aviation infrastructure

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035