Market Overview

The Middle East Civil Aviation Flight Training and Simulation Market is currently valued at approximately USD ~ billion, with a consistent growth trend driven by the increasing demand for skilled pilots and the expansion of aviation infrastructure in the region. The growth of air traffic and government initiatives supporting aviation development contribute significantly to this market’s dynamics. Increased investments in training facilities and simulation technologies by airlines, government bodies, and private operators are shaping the market’s trajectory. Furthermore, the integration of advanced flight simulators and virtual reality (VR) systems is enhancing training efficiency, thereby fueling market growth.

The Middle East region’s dominance in this sector is mainly attributed to its strategic geographic location as a global aviation hub. Countries like the UAE, Saudi Arabia, and Qatar lead the market due to their expansive aviation infrastructure and significant investments in pilot training programs. These nations’ strong economic positions and large-scale international flight operations further solidify their leadership. Regional growth is also driven by an increasing focus on aviation safety standards and the continued modernization of training facilities.

Market Segmentation

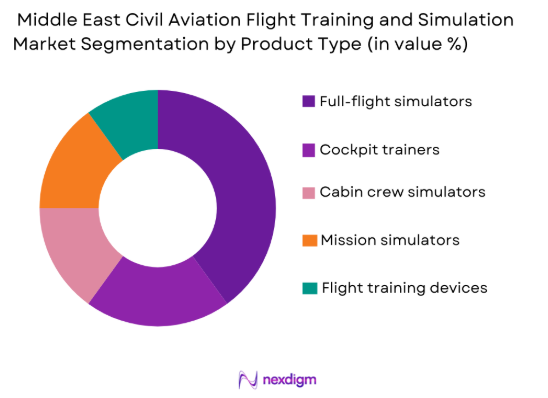

By Product Type

The Middle East Civil Aviation Flight Training and Simulation Market is segmented by product type into full-flight simulators, cockpit trainers, cabin crew simulators, mission simulators, and flight training devices. Recently, full-flight simulators have dominated the market due to their ability to provide comprehensive, immersive training that closely replicates real flight conditions. Factors such as the growing demand for high-fidelity training and the increasing need for pilot qualification across commercial and military sectors are fueling this dominance. Full-flight simulators offer extensive training capabilities, covering a variety of aircraft types and operating conditions, which enhances their adoption by aviation academies and airlines.

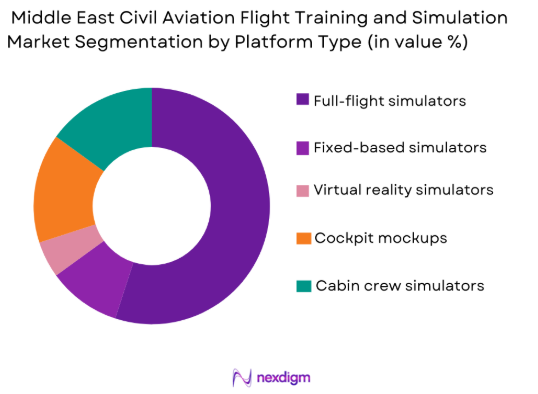

By Platform Type

The Middle East Civil Aviation Flight Training and Simulation Market is segmented by platform type into fixed-based simulators, full-flight simulators, virtual reality simulators, cockpit mockups, and cabin crew simulators. Full-flight simulators dominate the market due to their comprehensive training capabilities that replicate actual flight scenarios, enabling pilots to gain experience in various emergency situations without the risks associated with real flight. The growing emphasis on pilot safety and regulatory requirements, such as those from the International Civil Aviation Organization (ICAO), drives the demand for full-flight simulators. Moreover, their ability to simulate real-time weather, airport layouts, and aircraft systems adds value to flight training programs.

Competitive Landscape

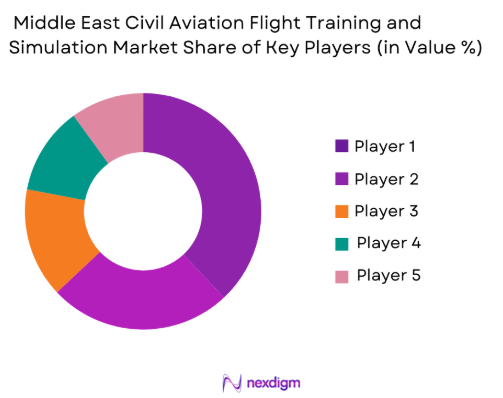

The Middle East Civil Aviation Flight Training and Simulation Market is characterized by intense competition and consolidation. Major players in the market, such as CAE, FlightSafety International, and Thales Group, are significantly shaping the market by expanding their product offerings and technological capabilities. The dominance of these players is due to their established global presence, innovation in training systems, and long-standing relationships with government bodies and commercial airlines. These key players have also been engaging in strategic partnerships and acquisitions to expand their portfolio and strengthen their market position in the Middle East.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Technology Integration |

| CAE | 1947 | Montreal, Canada | ~ | ~ | ~ | ~ | ~ |

| FlightSafety International | 1951 | New York, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2006 | Melbourne, USA | ~ | ~ | ~ | ~ | ~ |

| TRU Simulation + Training | 2005 | Austin, USA | ~ | ~ | ~ | ~ | ~ |

Middle East Civil Aviation Flight Training and Simulation Market Analysis

Growth Drivers

Government Support and Investment

One of the key drivers for the growth of the Middle East Civil Aviation Flight Training and Simulation Market is the strong government support and investment in aviation infrastructure. Governments in countries like the UAE, Saudi Arabia, and Qatar have prioritized aviation as a central part of their economic diversification strategies. Significant investments in aviation training facilities, including flight simulation systems, are aimed at supporting the increasing demand for pilots and crew in the region. Furthermore, these investments are aligned with the region’s broader vision to become a global aviation hub, attracting international airlines, and training centers. National aviation policies, such as regulatory frameworks designed to improve safety and operational standards, have led to a more structured market growth, contributing to the expansion of flight training and simulation systems. As aviation continues to expand, so does the need for cutting-edge simulation technologies, fueling the growth of this market.

Technological Advancements in Simulation Systems

Another important driver of market growth is the continuous technological advancements in flight simulation systems. The integration of virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) in training programs has significantly improved the effectiveness and efficiency of flight training. Advanced simulators now offer more realistic, interactive environments that allow pilots to train in diverse scenarios, including emergency situations, adverse weather, and complex flight operations. These innovations help reduce training costs and improve the quality of training, making it more attractive to airlines and training centers. As technology continues to evolve, these systems are expected to become even more sophisticated, offering greater flexibility and realism. This is expected to drive more investments in advanced simulation technologies and systems, contributing to the overall market expansion.

Market Challenges

High Initial Costs of Simulation Equipment

Despite the growing demand for flight training and simulation systems in the Middle East, one of the main challenges hindering market growth is the high initial costs associated with these systems. Full-flight simulators, in particular, require significant capital investment, which may be a barrier for smaller airlines or private training centers that do not have access to the necessary financial resources. The installation and maintenance costs of these high-tech systems further increase the financial burden, making it challenging for some players to enter the market or expand their operations. While the long-term benefits of these systems in terms of cost savings, efficiency, and safety are clear, the initial financial commitment can be daunting for many stakeholders. This challenge can slow the adoption of advanced simulators, particularly in regions where financial constraints are more pronounced.

Regulatory and Certification Complexities

Another significant challenge facing the Middle East Civil Aviation Flight Training and Simulation Market is the complex regulatory environment surrounding flight training and certification. The aviation industry is heavily regulated, and flight simulation systems must meet stringent requirements set by global aviation bodies such as the International Civil Aviation Organization (ICAO) and the Federal Aviation Administration (FAA). Compliance with these standards requires substantial investment in technology and infrastructure, as well as time-consuming certification processes. For smaller players or new entrants, navigating the regulatory framework and obtaining necessary certifications can be time-consuming and costly. As the market continues to expand, the ability of stakeholders to comply with evolving regulations while keeping costs under control will remain a key challenge.

Opportunities

Expanding Aviation Sector in the Middle East

One of the major opportunities for growth in the Middle East Civil Aviation Flight Training and Simulation Market lies in the expanding aviation sector in the region. As the Middle East continues to see a surge in air traffic, particularly with the rise of low-cost carriers and the growing demand for international flights, the need for qualified pilots and crew has never been higher. This creates an opportunity for training centers and flight simulation providers to meet the growing demand for skilled personnel. Furthermore, the establishment of new airports and the expansion of existing ones, coupled with regional governments’ focus on making the Middle East a global aviation hub, presents a prime opportunity for the market. Increased investments in aviation education and training infrastructure, including simulation systems, will be essential to meet the demands of a rapidly growing aviation sector.

Integration of Virtual and Augmented Reality Technologies

The integration of virtual reality (VR) and augmented reality (AR) technologies into flight training and simulation offers a unique opportunity for growth in the market. These technologies provide more immersive and interactive training experiences that can replicate real-world scenarios in ways traditional flight simulators cannot. As VR and AR technology becomes more advanced and affordable, there is a significant opportunity for flight training centers to integrate these systems into their programs. The use of VR and AR in training not only enhances the realism and effectiveness of training but also reduces operational costs by allowing trainees to practice more scenarios in a controlled environment. This trend is likely to accelerate in the coming years, providing a competitive edge for companies that adopt these technologies and further propelling market growth.

Future Outlook

The Middle East Civil Aviation Flight Training and Simulation Market is expected to experience strong growth over the next five years, driven by technological advancements, continued infrastructure expansion, and increasing government investments in aviation training. As the region continues to strengthen its position as a global aviation hub, demand for advanced simulation systems will rise, spurring innovation in VR, AR, and AI-powered training solutions. Additionally, regulatory support and growing air traffic will ensure a steady supply of new pilots, further propelling the market forward. The future outlook remains positive, with the adoption of new technologies expected to enhance training efficiency and safety across the region.

Major Players

- CAE

- FlightSafety International

- Thales Group

- L3Harris Technologies

- TRU Simulation + Training

- Simtech Aviation

- Indra Sistemas

- Airbus

- Boeing

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- Rockwell Collins

- Safran

- Honeywell

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines and aviation companies

- Aviation training centers

- Flight simulation manufacturers

- Aircraft manufacturers

- Airport authorities

- Private aviation operators

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology involves identifying the key variables that influence the Middle East Civil Aviation Flight Training and Simulation Market. This includes factors such as technological advancements in simulation systems, government regulations, market drivers like demand for qualified pilots, and challenges like high initial investment costs. These variables guide the direction of the market analysis and are critical to the development of the study’s framework.

Step 2: Market Analysis and Construction

In this step, a comprehensive market analysis is conducted, including the examination of historical trends, current market dynamics, and future projections. This analysis incorporates data from reliable sources such as government bodies, industry reports, and market surveys to construct an accurate picture of the market landscape. The market is segmented by product types, platform types, and end-user segments to provide a detailed understanding of the competitive landscape.

Step 3: Hypothesis Validation and Expert Consultation

During this phase, the hypotheses formed based on initial market analysis are validated through consultations with industry experts, stakeholders, and market leaders. This expert feedback is essential for refining the study’s assumptions and ensuring that the market’s growth drivers, challenges, and opportunities are accurately identified. The consultation process also includes feedback from key players in the aviation and training sectors to validate the results of the market analysis.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the findings from the market analysis and expert consultations into a comprehensive research report. This report includes a thorough breakdown of the market dynamics, growth projections, challenges, and opportunities. The final output is designed to provide actionable insights for stakeholders, including businesses, investors, and government agencies, enabling them to make informed decisions based on accurate and reliable data.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Air Traffic in the Middle East

Government Investments in Aviation Training Infrastructure

Technological Advancements in Flight Simulation

Rising Demand for Skilled Pilots and Crew

Expanding Military and Civil Aviation Cooperation - Market Challenges

High Initial Investment Costs for Simulators

Regulatory and Certification Barriers

Lack of Skilled Training Personnel

Technological Integration and Interoperability Issues

Economic Instability in Some Regions - Market Opportunities

Growth in Regional Airline Industry

Increasing Adoption of AI and Virtual Reality in Training

Expansion of Public-Private Partnerships in Aviation Training - Trends

Rise of Cloud-Based Flight Training Solutions

Shift Toward Modular and Scalable Simulators

Integration of AI for Personalized Training Programs

Growing Adoption of Mixed Reality for Pilot Training

Focus on Sustainability in Aviation Training Solutions - Government Regulations & Defense Policy

Aviation Safety and Training Regulations

Pilot Certification and Standards

Government Funding for Aviation Training Programs

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flight Simulators

Cockpit Trainers

Cabin Crew Trainers

Mission Simulators

Full Flight Simulators - By Platform Type (In Value%)

Fixed Base Simulators

Full Flight Simulators

Virtual Reality-Based Simulators

Cockpit Mockups

Cabin Crew Simulators - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Commercial Airlines

Flight Schools

Private Operators

Military and Defense

Aircraft Manufacturers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Software Simulation Platforms

Hardware Simulation Equipment

Virtual Reality Systems

Augmented Reality Technologies

AI-Based Training Tools

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

CAE

FlightSafety International

L3Harris Technologies

Thales Group

Collins Aerospace

Aviation Training Solutions

Airbus

Boeing

Simtech Aviation

FSTC

TRU Simulation + Training

Frasca International

Lockheed Martin

BMT Group

Indra Sistemas

- Commercial Airlines’ Increasing Focus on Training Standards

- Flight Schools’ Expansion to Meet Regional Demand

- Private Operators Investing in Customized Flight Simulators

- Military and Defense Increasing Simulation-Based Training Programs

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035