Market Overview

The Middle East Commercial Aircraft Cabin Interior market is projected to experience substantial growth, with the market size estimated at USD ~ billion. This growth is driven by the increasing demand for enhanced passenger comfort, improved cabin designs, and advancements in in-flight entertainment (IFE) systems. Additionally, rising air passenger traffic and aircraft fleet expansion in the region further contribute to the demand for innovative cabin interiors. These factors, along with increasing airline investments in cabin upgrades, drive the market’s expansion.

Dominant cities and countries in the Middle East for commercial aircraft cabin interiors include the United Arab Emirates, Saudi Arabia, and Qatar. These countries benefit from a robust aviation sector, extensive airport infrastructure, and a growing number of international airlines. Dubai, with its major hubs and state-of-the-art airports, stands as a key player in the region’s aviation industry. Other dominant factors include governmental support, strategic international partnerships, and the presence of major airlines, all driving the market forward.

Market Segmentation

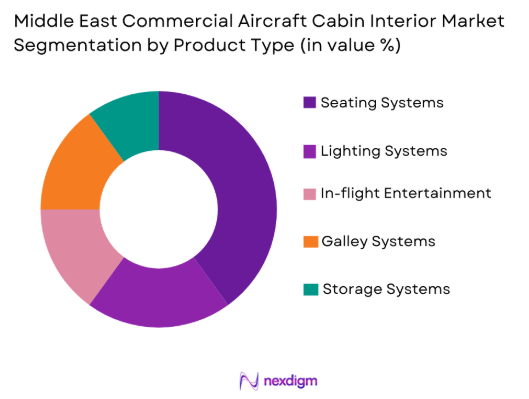

By Product Type

The Middle East Commercial Aircraft Cabin Interior market is segmented by product type into seating systems, lighting systems, in-flight entertainment systems, galley systems, and storage systems. The seating systems segment holds the largest share in the market due to increasing demand for ergonomically designed, comfortable, and space-efficient seating solutions. The passenger experience remains a critical factor, with airlines focusing on providing luxury seating and improved comfort. This sub-segment’s dominant market position is also supported by airline priorities on customer satisfaction and comfort, especially in long-haul flights.

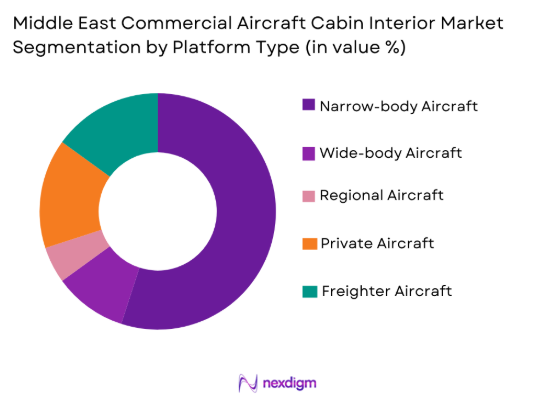

By Platform Type

The Middle East Commercial Aircraft Cabin Interior market is segmented by platform type into narrow-body aircraft, wide-body aircraft, regional aircraft, private aircraft, and freighter aircraft. Narrow-body aircraft have the dominant market share due to the increasing preference for short to medium-haul routes in the Middle East. These aircraft are commonly used by low-cost carriers, which are growing in the region, further supporting demand for affordable yet comfortable interior solutions. Additionally, the infrastructure development of major airports in cities like Dubai and Abu Dhabi further strengthens the demand for narrow-body aircraft.

Competitive Landscape

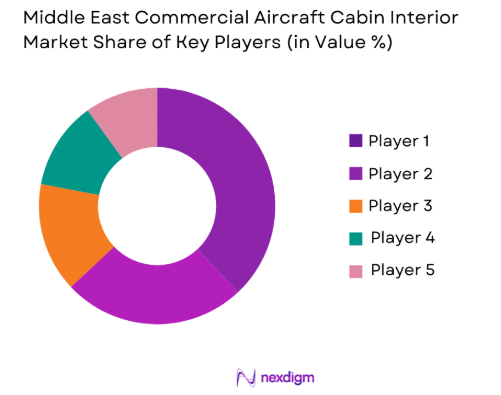

The competitive landscape in the Middle East Commercial Aircraft Cabin Interior market is highly competitive, with leading players consolidating their positions through technological innovations and strategic partnerships. Major players dominate through strong brand presence, high-quality manufacturing capabilities, and a deep understanding of regional demands. The market is also marked by continuous investments in R&D to drive advancements in materials and sustainability, as well as the development of cutting-edge seating and IFE systems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Design Innovation |

| Diehl Aviation | 1909 | Germany | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Zodiac Aerospace | 2008 | France | ~ | ~ | ~ | ~ | ~ |

| Panasonic Avionics | 1979 | USA | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | USA | ~ | ~ | ~ | ~ | ~ |

Middle East Commercial Aircraft Cabin Interior Market Analysis

Growth Drivers

Increasing Air Passenger Traffic

The surge in air passenger traffic in the Middle East is a major driver for the aircraft cabin interior market. As the number of travelers increases, airlines are investing in upgrading their cabins to offer a better experience. This is particularly important for Middle Eastern carriers that cater to a wide range of international and regional routes, making comfort a competitive edge. Airlines are focused on providing high-quality cabin interiors, such as improved seating and entertainment systems, which directly contribute to enhancing customer satisfaction. Governments are also supporting this growth by investing in airport infrastructure, making air travel more accessible. Furthermore, with a strong tourism sector, the Middle East is witnessing an increase in both business and leisure travelers, further fueling demand for better aircraft interiors. The rise of low-cost carriers also promotes more flight options, ultimately benefiting the cabin interior market.

Technological Advancements in Aircraft Interiors

Technological advancements have become a significant growth driver in the Middle East commercial aircraft cabin interior market. Innovations such as improved seating designs, lightweight materials, and smarter in-flight entertainment systems are revolutionizing the sector. Airlines are focusing on incorporating these new technologies into their fleets, not only to enhance passenger comfort but also to reduce fuel consumption and lower operating costs. The integration of in-flight entertainment systems with advanced connectivity, including Wi-Fi and Bluetooth, is growing in demand as passengers expect personalized, seamless experiences during flights. Additionally, the development of modular cabin systems allows airlines to quickly customize their fleets, increasing operational flexibility. Technological improvements in lighting, materials, and space utilization further enhance the overall travel experience, making them essential for airlines seeking to stay competitive in the rapidly evolving aviation market.

Market Challenges

High Costs of Aircraft Interior Components:

One of the significant challenges in the Middle East commercial aircraft cabin interior market is the high cost associated with manufacturing and upgrading aircraft interiors. These costs often include the expense of purchasing high-quality materials, designing custom seats, and integrating advanced systems like in-flight entertainment and lighting. Moreover, airlines may face additional financial pressure from regulatory requirements related to safety standards, which can further increase costs. For low-cost carriers, this is especially challenging as they attempt to balance providing quality interiors with maintaining affordable ticket prices. As the aviation industry continues to face fluctuating fuel prices and economic uncertainty, cost efficiency in cabin interior upgrades becomes increasingly difficult. High costs also limit the rate at which airlines can upgrade their older fleets, thus slowing the overall growth of the market.

Stringent Regulatory Requirements

The Middle East commercial aircraft cabin interior market faces significant challenges due to the region’s strict regulatory requirements concerning safety, quality, and sustainability. Manufacturers and airlines are required to comply with a complex set of regulations concerning fire resistance, material usage, and interior configuration. While regulations are crucial for ensuring passenger safety, they can also lead to delays in the certification and approval of new products. The certification process itself can be costly and time-consuming, which discourages innovation and may hinder the introduction of new technologies and products in the market. Airlines must balance these compliance costs with the need for modernization, leading to slower adoption rates of next-generation cabin interior designs. Regulatory changes may also be unpredictable, making it difficult for companies to forecast costs and timelines accurately, further complicating planning processes.

Opportunities

Rising Demand for Luxury Cabin Interiors

A notable opportunity in the Middle East commercial aircraft cabin interior market is the rising demand for luxury and premium-class cabin interiors. The region’s wealthy population and the high number of international travelers contribute to the growing demand for premium services and amenities on board. Airlines are increasingly investing in high-end features such as lie-flat beds, advanced in-flight entertainment, and more spacious seating configurations in business and first-class cabins. The introduction of private suites and other bespoke services are also becoming popular, further elevating the passenger experience. This demand for luxury cabins is expected to drive market growth, particularly among long-haul airlines servicing international business travelers. As competition increases among premium service providers, airlines in the Middle East are focusing on creating unique and luxurious experiences to attract affluent passengers, offering a lucrative growth opportunity for manufacturers of high-end cabin interior components.

Sustainable and Eco-friendly Aircraft Interiors

Another opportunity in the Middle East commercial aircraft cabin interior market is the growing trend towards sustainability and eco-friendly interior solutions. With increasing awareness about environmental issues and a strong push for reducing the aviation industry’s carbon footprint, airlines are seeking ways to make their cabin interiors more eco-friendly. This includes using sustainable materials, such as biodegradable fabrics and recyclable composites, as well as energy-efficient lighting and reduced waste systems. Airlines are also focusing on creating greener, more efficient cabins to comply with global environmental standards. These sustainable solutions not only align with consumer expectations but also offer airlines the potential to reduce operating costs over the long term. As regulations around sustainability become stricter, the demand for environmentally conscious aircraft interior solutions will continue to grow, providing significant opportunities for suppliers in the market.

Future Outlook

The future of the Middle East commercial aircraft cabin interior market is expected to remain positive, with continued growth driven by technological advancements and an increase in air travel. As airlines in the region focus on improving the passenger experience, demand for both luxury and eco-friendly cabin solutions will rise. The ongoing development of airport infrastructure and the adoption of new technologies such as IoT and AI will further fuel market growth. Regulatory support for sustainability and environmentally friendly materials will also play a key role, pushing airlines to invest in next-generation interiors. With rising disposable incomes and an expanding aviation sector, the region is poised for steady growth in the coming years.

Major Players

- Diehl Aviation

- Safran

- Zodiac Aerospace

- Panasonic Avionics

- Rockwell Collins

- Thales Group

- Collins Aerospace

- Lufthansa Technik

- Airbus

- Boeing

- AAR Corporation

- Bombardier

- Honeywell Aerospace

- Recaro Aircraft Seating

- Aviointeriors

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft manufacturers

- Airlines and fleet operators

- MRO (Maintenance, Repair, and Overhaul) providers

- Aircraft interior design firms

- Aircraft cabin retrofit suppliers

- Aviation technology developers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the critical variables influencing the market, including technological trends, regulatory requirements, and demand-side factors. These variables are essential for shaping the overall research framework.

Step 2: Market Analysis and Construction

This step includes conducting detailed market analysis using both primary and secondary data sources, forming the foundation of market segmentation, sizing, and trend identification.

Step 3: Hypothesis Validation and Expert Consultation

Once key insights are gathered, expert consultation is conducted to validate the assumptions and ensure that the data reflects current industry realities and future projections.

Step 4: Research Synthesis and Final Output

The final research synthesis involves consolidating findings, analyzing trends, and preparing actionable insights that align with industry developments and market demands.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of Air Travel in the Middle East

Increasing Airline Fleet Size and Renovations

Technological Innovations in Cabin Comfort and Efficiency

Rising Demand for Passenger Comfort and Personalization

Government Support for Aviation Industry Expansion - Market Challenges

High Costs of Cabin Interior Components

Stringent Regulatory and Certification Requirements

Supply Chain Disruptions

Technological Integration Difficulties

Fluctuations in Fuel Prices Affecting Airlines’ Investment - Market Opportunities

Growth in Low-Cost Carrier Segment

Adoption of Sustainable Materials in Cabin Interiors

Rising Demand for Premium and Business Class Interiors - Trends

Integration of IoT for Passenger Experience

Advancements in Cabin Noise and Vibration Control

Growth in Use of LED Lighting for Energy Efficiency

Shift Towards Modular Cabin Designs

Increased Focus on Passenger Wellness and Health - Government Regulations & Defense Policy

Aviation Safety Regulations

Sustainability Standards for Aircraft Interiors

Government Incentives for Aircraft Cabin Interior Upgrades

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Seat Systems

Lighting Systems

IFE (In-Flight Entertainment) Systems

Galley Systems

Storage and Stowage Systems - By Platform Type (In Value%)

Narrow-body Aircraft

Wide-body Aircraft

Regional Aircraft

Private Aircraft

Freighter Aircraft - By Fitment Type (In Value%)

Linefit

Retrofit

OEM-fit

Upgrade-fit

Custom-fit - By End User Segment (In Value%)

Airlines

OEMs

MRO Providers

Government and Military Operators

Charter and Leasing Companies - By Procurement Channel (In Value%)

Direct Procurement

Third-party Distributors

Government Procurement

Private Sector Procurement

E-commerce Platforms - By Material / Technology (in Value%)

Composite Materials

Lightweight Alloys

Advanced Textiles

Smart Materials

LED Lighting Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Diehl Aviation

Recaro Aircraft Seating

Safran

Zodiac Aerospace

B/E Aerospace

Thales Group

Panasonic Avionics

Rockwell Collins

Honeywell Aerospace

GKN Aerospace

Mitsubishi Heavy Industries

Alenia Aermacchi

Embraer

STG Aerospace

Boeing

- Airlines Focus on Enhancing Passenger Experience

- OEMs’ Role in Designing and Manufacturing Cabin Interiors

- MRO Providers Driving Retrofit Market Growth

- Leasing Companies Investing in Cabin Interior Upgrades

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035