Market Overview

The Middle East commercial aircraft cabin lighting market is projected to witness significant growth driven by increasing demand for passenger comfort and technological advancements in lighting solutions. The market size in USD ~ billion is expected to grow substantially, fueled by the rise in air traffic and airlines’ continuous efforts to enhance cabin experiences. Key factors contributing to this expansion include the adoption of energy-efficient LED lighting systems and integration of IoT for smarter cabin management. With new aircraft deliveries and refurbishments in the region, airlines are investing heavily in advanced lighting systems that offer customization and better energy management.

The demand for commercial aircraft cabin lighting is concentrated in countries with significant airline fleets and emerging aviation hubs. The UAE, Saudi Arabia, and Qatar are dominating markets in the region, driven by rapid infrastructure growth, government investments, and the increasing importance of aviation in the region’s economy. The demand is also influenced by expanding air passenger numbers, with cities like Dubai, Abu Dhabi, and Riyadh serving as key centers for both passenger and freight traffic. Strategic airline hubs, supported by state-of-the-art airports, continue to attract major international airline operations, boosting demand for sophisticated cabin solutions.

Market Segmentation

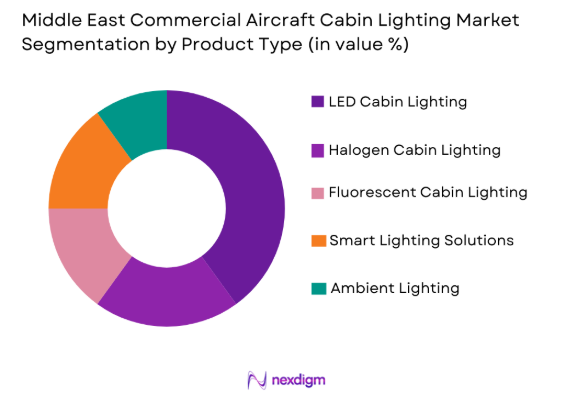

By Product Type

The Middle East commercial aircraft cabin lighting market is segmented by product type into LED Cabin Lighting, Halogen Cabin Lighting, Fluorescent Cabin Lighting, Smart Lighting Solutions, and Ambient Lighting. Recently, LED Cabin Lighting has a dominant market share due to factors such as the demand for energy-efficient, long-lasting, and customizable lighting solutions. The rise in customer preferences for personalized in-flight experiences and advancements in smart technology has further bolstered the LED segment’s growth. Moreover, LED lights provide airlines with operational cost savings over time, making them the preferred choice for airlines in the region.

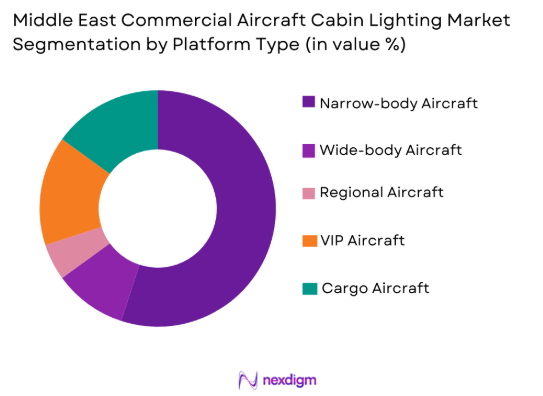

By Platform Type

The Middle East commercial aircraft cabin lighting market is segmented by platform type into Narrow-body Aircraft, Wide-body Aircraft, Regional Aircraft, VIP Aircraft, and Cargo Aircraft. Recently, Narrow-body Aircraft has a dominant market share due to the increasing demand for short-haul flights within the region and the introduction of newer, more efficient aircraft in this category. These aircraft offer airlines more economical solutions for regional routes, with significant investments in upgrading cabin features, including lighting. The widespread adoption of narrow-body aircraft in both low-cost and full-service carriers in the region has contributed to the increased demand for high-quality lighting systems.

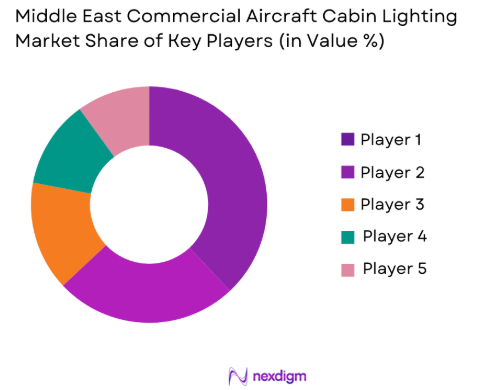

Competitive Landscape

The Middle East commercial aircraft cabin lighting market is highly competitive, with consolidation occurring as major players focus on innovative lighting solutions and strategic partnerships to expand their market presence. The market is influenced by both established global players and regional companies offering tailored solutions for Middle Eastern airlines. Companies are prioritizing technological advancements such as energy-efficient lighting and smart features to meet the growing demand for comfort and efficiency in aircraft cabins. The involvement of large international airlines and aircraft manufacturers is expected to drive further investments in cabin lighting technologies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameters |

| Delhi Aviation | 1902 | Germany | ~ | ~ | ~ | ~ | ~ |

| Zodiac Aerospace | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| UTC Aerospace | 2012 | USA | ~ | ~ | ~ | ~ | ~ |

| Luxstream | 2005 | UAE | ~ | ~ | ~ | ~ | ~ |

| B/E Aerospace | 1987 | USA | ~ | ~ | ~ | ~ | ~ |

Middle East Commercial Aircraft Cabin Lighting Market Analysis

Growth Drivers

Technological Advancements in Aircraft Lighting

Technological advancements in lighting systems are playing a significant role in the growth of the commercial aircraft cabin lighting market. The continuous development of energy-efficient solutions such as LED lighting and OLED technology has allowed airlines to reduce operational costs while improving the passenger experience. The implementation of smart lighting that adapts to passengers’ preferences is also driving growth, with lighting systems now being integrated with in-flight entertainment systems. The ability to adjust the mood lighting to different phases of a flight—boarding, meal service, and arrival—has enhanced passenger comfort, contributing to higher demand for advanced cabin lighting systems. Moreover, airlines are increasingly looking for lighting solutions that comply with environmental regulations, which is spurring innovation in the sector. The demand for eco-friendly and sustainable products also pushes the development of energy-efficient lighting, further propelling the market.

Increasing Air Traffic and Airline Fleet Growth

Another key driver for the market is the substantial increase in air passenger traffic across the Middle East. As the region’s aviation industry grows, airlines are investing more in modernizing their fleets, which includes upgrading aircraft interiors such as cabin lighting. Countries like the UAE and Saudi Arabia are expanding their airport infrastructures, which supports the growth of the regional airline fleet. With newer aircraft being delivered, airlines are seeking to provide enhanced in-flight experiences that include superior lighting systems. Furthermore, the emergence of low-cost carriers in the region has prompted an increase in air travel, directly boosting the demand for advanced cabin lighting systems. The Middle East’s strategic location as a hub between Europe, Asia, and Africa also contributes to the region’s rising air traffic, stimulating demand for modern aircraft with high-quality lighting solutions.

Market Challenges

High Initial Investment in Lighting Systems

One of the key challenges in the Middle East commercial aircraft cabin lighting market is the high initial cost of advanced lighting systems. Aircraft manufacturers and airlines are often reluctant to invest in expensive lighting technologies due to the significant upfront costs involved. While energy-efficient and smart lighting solutions can offer long-term savings through lower maintenance and operational costs, the capital required to implement these systems may discourage smaller operators and regional carriers. Additionally, the cost of upgrading existing aircraft to include modern lighting systems can be a significant barrier, especially for airlines that are operating with older fleets. Despite the benefits, this financial burden remains a hurdle for many players in the industry, slowing down the pace at which new lighting technologies are adopted.

Complex Regulatory and Certification Process

The commercial aircraft cabin lighting market is also challenged by the complex regulatory and certification processes that manufacturers and airlines must adhere to. In the Middle East, regulatory bodies such as the UAE General Civil Aviation Authority and Saudi Arabia’s GACA impose strict safety standards for lighting systems in aircraft cabins. These regulations can delay the approval of new lighting technologies and increase the costs associated with their development and implementation. Furthermore, the certification process for new materials and technologies, particularly in the context of LED and OLED solutions, can be time-consuming and expensive. Manufacturers must ensure that their lighting solutions meet all the required safety and performance standards, adding to the complexity of entering the market.

Opportunities

Integration of IoT in Cabin Lighting

One of the significant opportunities in the Middle East commercial aircraft cabin lighting market is the integration of the Internet of Things (IoT) in lighting systems. By incorporating IoT technologies, airlines can enhance the overall passenger experience by offering more personalized cabin environments. IoT-enabled lighting allows for real-time monitoring, remote adjustments, and integration with other in-flight systems such as entertainment and HVAC. This provides opportunities for airlines to offer dynamic lighting solutions based on passenger preferences or flight conditions. Additionally, the ability to collect data from connected lighting systems offers valuable insights into passenger behavior and operational efficiency. This presents a growth opportunity for lighting manufacturers to develop innovative, interconnected systems that meet the evolving needs of airlines and passengers alike.

Sustainability and Eco-friendly Lighting Solutions

The demand for sustainable and eco-friendly lighting solutions presents another significant opportunity in the market. As airlines face increasing pressure to reduce their carbon footprint and comply with environmental regulations, they are turning to more energy-efficient lighting systems. LED lighting, known for its low energy consumption and long lifespan, is becoming the preferred choice for airlines looking to meet sustainability goals. Moreover, the use of recyclable materials in the production of lighting systems is gaining traction as airlines seek to minimize their environmental impact. The growing trend toward sustainability in the aviation industry creates a market opportunity for lighting manufacturers to innovate in eco-friendly technologies and products, thus helping airlines reduce costs while enhancing their sustainability credentials.

Future Outlook

The Middle East commercial aircraft cabin lighting market is expected to grow significantly in the coming years, driven by rising demand for advanced lighting solutions in the region’s expanding aviation sector. The adoption of energy-efficient technologies, such as LED and OLED lighting, will continue to gain momentum as airlines look to reduce operational costs and enhance passenger comfort. Moreover, technological advancements in smart lighting systems and the integration of IoT technologies are likely to shape the future of the market. Regulatory support for eco-friendly solutions and increased investments in aviation infrastructure will further fuel market growth, creating a strong demand for innovative lighting solutions.

Major Players

- Diehl Aviation

- Zodiac Aerospace

- UTC Aerospace Systems

- Luxstream

- B/E Aerospace

- Honeywell Aerospace

- Panasonic Avionics

- Rockwell Collins

- Safran Cabin

- Astronics

- Astronics Luminescence

- LEDtronics

- Lumitex

- Aerospace Lighting International

- Barco

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft manufacturers

- Airline operators

- MRO service providers

- Aircraft leasing companies

- Aviation infrastructure developers

- Airline passengers and frequent flyers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying and defining key variables affecting the commercial aircraft cabin lighting market, including technology trends, regulatory frameworks, and market demand drivers.

Step 2: Market Analysis and Construction

Here, data from primary and secondary sources are collected and analyzed to construct a comprehensive market framework that includes size, trends, and segment analysis.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations with industry professionals and key stakeholders are conducted to validate assumptions and refine market projections based on real-world insights.

Step 4: Research Synthesis and Final Output

The final output is synthesized into a detailed report that encapsulates all market dynamics, including trends, growth drivers, challenges, opportunities, and competitive landscape analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Fuel-efficient Aircraft

Passenger Comfort and Customization Preferences

Technological Advancements in Cabin Lighting

Rising Number of Air Passengers in Middle East

Government Initiatives Supporting Aviation Sector - Market Challenges

High Initial Investment in Advanced Lighting Solutions

Lack of Standardization in Cabin Lighting Systems

Regulatory Barriers in Aircraft Certification

Technological Integration with Existing Aircraft Systems

Security Risks with Smart Cabin Lighting - Market Opportunities

Integration of IoT in Cabin Lighting Solutions

Emerging Demand for Sustainable and Eco-friendly Materials

Opportunities in Retrofit Cabin Lighting Market - Trends

Rise in Passenger-Centric Lighting

Integration of Smart Lighting Solutions with Aircraft Systems

Development of Energy-Efficient Lighting Technologies

Customization of Cabin Atmosphere for Enhanced Comfort

Use of OLED and Smart Glass in Premium Aircraft - Government Regulations & Defense Policy

Passenger Safety and Certification Standards for Lighting Systems

Energy Efficiency Regulations for Commercial Aircraft

Government Funding for Innovation in Aviation Technologies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

LED Cabin Lighting

Halogen Cabin Lighting

Fluorescent Cabin Lighting

Smart Lighting Solutions

Ambient Lighting - By Platform Type (In Value%)

Narrow-body Aircraft

Wide-body Aircraft

Regional Aircraft

VIP Aircraft

Cargo Aircraft - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Linefit

Post-delivery Installations

Upgrades - By EndUser Segment (In Value%)

Commercial Airlines

Private Jet Operators

Aircraft Leasing Companies

Government & Defense

MRO Service Providers - By Procurement Channel (In Value%)

Direct Procurement

OEM Contracts

Third-Party Suppliers

Retail Distribution

Online Bidding Platforms - By Material / Technology (In Value%)

LED Technology

OLED Technology

Laser-based Technology

Smart Glass Technology

Solar-powered Lighting

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technology Type, Market Value, Region, Lighting System Features, Customer Satisfaction)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Diehl Aviation

Zodiac Aerospace

UTC Aerospace Systems

Luxstream

B/E Aerospace

AAR Corporation

SITA

Astronics

Gulf Aircraft Maintenance Company

Panasonic Avionics

Honeywell International

Rockwell Collins

Safran Cabin

Aviation Lighting International

LEDs Light

- Commercial Airlines’ Focus on Comfort and Efficiency

- Private Jet Operators Seeking Customization in Lighting

- Aircraft Leasing Companies’ Demand for Versatile Lighting Solutions

- Government & Defense Focus on Durability and Safety

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035