Market Overview

The Middle East Commercial Aircraft Cabin Seating market has seen consistent growth, reaching a market size of approximately USD ~ billion, driven by an increase in air travel demand and growing airline fleets. The expansion is largely supported by technological advancements in aircraft seating, along with the increasing demand for premium and comfortable travel experiences in the region. The ongoing modernization of existing fleets and an upsurge in new aircraft orders contribute significantly to this growth, driven by both passenger preference and regulatory standards. Based on a recent historical assessment, market projections indicate continuous growth across various aircraft seat categories, including business, first-class, and economy.

Dominant markets within the region include the UAE, Saudi Arabia, and Qatar, where high levels of infrastructure investment have led to an increase in air travel demand. The aviation sector in these countries is witnessing substantial investments to upgrade fleet capacities and improve passenger experience, which are key factors supporting the growth of the aircraft cabin seating market. Furthermore, these nations’ role as transit hubs and the presence of numerous international carriers help solidify their position as dominant players in the market. Based on a recent historical assessment, the demand in these regions is expected to continue driving growth in the coming years.

Market Segmentation

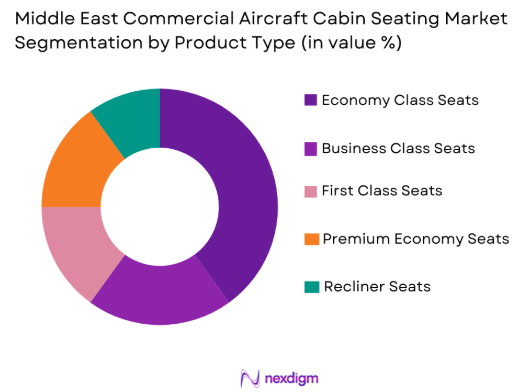

By Product Type

The Middle East Commercial Aircraft Cabin Seating market is segmented by product type into economy class seats, business class seats, first-class seats, premium economy seats, and recliner seats. Recently, economy class seats have a dominant market share due to factors such as demand patterns, brand presence, infrastructure availability, and consumer preference. The mass adoption of economy class seats by airlines is largely driven by rising air traffic, price-sensitive passengers, and the need for airlines to maximize passenger capacity, all contributing to this segment’s dominance in the market.

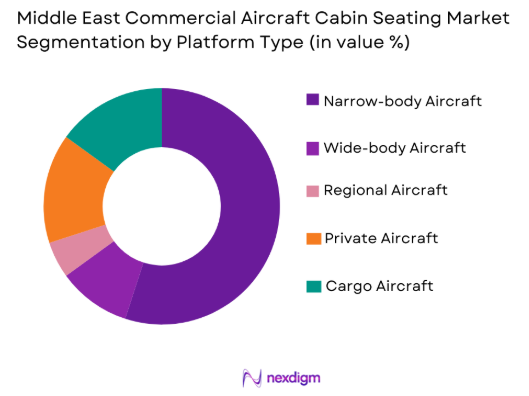

By Platform Type

The Middle East Commercial Aircraft Cabin Seating market is segmented by platform type into narrow-body aircraft, wide-body aircraft, regional jets, cargo aircraft, and private jets. Recently, wide-body aircraft seats have a dominant market share due to factors such as demand patterns, brand presence, infrastructure availability, and consumer preference. Wide-body aircraft are favored by airlines for their ability to carry more passengers over long-haul routes, which makes them ideal for international carriers operating in the Middle East region. The growing number of international and long-haul flights helps to bolster the demand for wide-body aircraft, positioning this segment at the forefront of the market.

Competitive Landscape

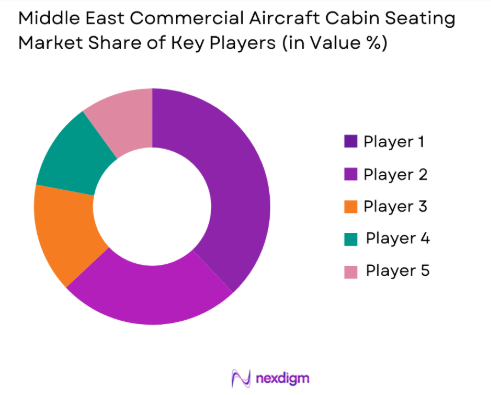

The competitive landscape of the Middle East Commercial Aircraft Cabin Seating market is marked by consolidation and the significant influence of key players who continue to innovate and expand their market share. Companies like Zodiac Aerospace and B/E Aerospace dominate the sector with their advanced seating solutions, ensuring long-term partnerships with major airlines and OEMs. As the market continues to grow, competition intensifies with an increasing focus on passenger comfort, lightweight materials, and space optimization.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-specific Parameter |

| Zodiac Aerospace | 1896 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| B/E Aerospace | 1987 | Wellington, USA | ~ | ~ | ~ | ~ | ~ |

| Recaro Aircraft Seating | 1906 | Schwäbisch Hall, Germany | ~ | ~ | ~ | ~ | ~ |

| Aviointeriors | 1965 | Italy | ~ | ~ | ~ | ~ | ~ |

| Geven | 1989 | Italy | ~ | ~ | ~ | ~ | ~ |

Middle East Commercial Aircraft Cabin Seating Market Analysis

Growth Drivers

Increased Air Travel Demand

The growing demand for air travel across the Middle East has been one of the primary drivers for the commercial aircraft cabin seating market. This surge in demand is largely attributed to the increasing number of passengers traveling for both business and leisure purposes. With regional hubs like Dubai, Doha, and Abu Dhabi becoming key transit points, the demand for both long-haul and short-haul flights is expected to rise significantly. Airlines are prioritizing passenger comfort and optimizing cabin layouts to meet the increasing expectations of travelers. As a result, there is a heightened demand for advanced seating technologies, which are crucial for improving the overall passenger experience. The rise in disposable income and the expanding middle class in many Middle Eastern countries also contribute to the growing travel demand, further boosting the market’s expansion.

Technological Advancements in Cabin Seating

Another key growth driver is the continuous innovation in aircraft seating technologies. Advancements in seat materials, lightweight designs, ergonomic comfort, and in-seat entertainment systems are redefining the cabin experience for passengers. Airlines are increasingly adopting these innovations to differentiate themselves in the competitive marketplace, offering passengers a more comfortable and high-tech flying experience. The shift toward smart seating, with integrated power systems and user-friendly interfaces, has become an essential feature in modern aircraft cabins. These developments not only improve the overall passenger experience but also help airlines reduce operational costs by enhancing fuel efficiency. As these technologies evolve, their widespread adoption across aircraft types, particularly in the premium seating categories, continues to drive market growth.

Market Challenges

High Cost of Advanced Seat Technologies

One of the main challenges in the Middle East Commercial Aircraft Cabin Seating market is the high cost of advanced seat technologies. The cost of materials, manufacturing processes, and research and development for new seating solutions remains significant. While airlines are eager to adopt these technologies to improve passenger experience and meet regulatory requirements, the financial burden of implementing such solutions, particularly for retrofit projects, can be a deterrent. Airlines must balance the need for innovation with cost-effective operations, which often results in delays in the widespread adoption of new seating technologies. Additionally, fluctuating raw material prices and supply chain disruptions add to the financial strain, making it difficult for smaller carriers to invest in cutting-edge seating systems. This presents a major barrier to growth in the market as airlines must carefully manage their investment portfolios.

Regulatory Compliance and Certification Standards

Regulatory compliance and meeting certification standards for seating solutions is another challenge facing the industry. The Middle East market, like other global markets, has stringent safety and comfort regulations for aircraft seating, which can complicate the design and manufacturing processes. Compliance with these regulations requires manufacturers to ensure their seating solutions meet both the regional and international standards, including fire safety, weight restrictions, and durability tests. The constant updates to these regulations can further delay the time-to-market for new seating solutions. Additionally, discrepancies in certification processes across different countries can cause difficulties for seat manufacturers looking to establish a presence across multiple markets. Ensuring consistent compliance while innovating is a delicate balancing act for companies in this space.

Opportunities

Expansion of Low-Cost Carriers

One of the most promising opportunities in the Middle East Commercial Aircraft Cabin Seating market is the expansion of low-cost carriers (LCCs) in the region. LCCs are rapidly increasing their market share in the Middle East due to the growing demand for affordable air travel. These carriers prioritize cost-effective seating arrangements, often opting for high-density configurations with minimal premium offerings. The market potential for cabin seating solutions catering to these carriers is significant, as LCCs are constantly upgrading their fleets and seeking ways to optimize seating capacity while ensuring passenger comfort. Manufacturers who can offer cost-effective, lightweight, and durable seating solutions that align with the operational needs of LCCs are poised to benefit from this growing segment. As LCCs expand into new regional and international markets, the demand for affordable yet comfortable seating solutions will continue to rise.

Partnerships with Airlines for Custom Seating Solutions

Another opportunity lies in establishing partnerships with airlines to create custom seating solutions that cater to specific needs. Airlines are increasingly looking for seating systems that align with their brand identity and enhance the customer experience. Customizable options for seat design, materials, and configurations allow airlines to stand out in a competitive marketplace. These bespoke seating solutions can be tailored for specific routes, such as long-haul flights where passengers expect more comfort, or for niche markets like private jets. Seat manufacturers who can collaborate with airlines to develop innovative, branded, and comfortable seating solutions will be well-positioned to secure long-term contracts. The rise in demand for customized aircraft interiors opens a wealth of opportunities for players in the market, providing them with an edge in terms of both product innovation and customer loyalty.

Future Outlook

The future outlook for the Middle East Commercial Aircraft Cabin Seating market is highly promising, driven by the ongoing recovery in air travel, technological advancements, and an increasing focus on passenger comfort. Over the next five years, the market is expected to grow steadily as airlines modernize their fleets and integrate new seating technologies. The demand for premium and customizable seating is anticipated to rise, particularly in high-traffic markets such as the UAE and Saudi Arabia. Additionally, regulatory support for eco-friendly and lightweight materials will shape the future of seat design. Overall, the Middle East market is set to witness continued innovation, catering to a diverse set of airline preferences and passenger needs.

Major Players

- Zodiac Aerospace

- B/E Aerospace

- Recaro Aircraft Seating

- Aviointeriors

- Geven

- Thales Group

- Stelia Aerospace

- Panasonic Avionics Corporation

- Acro Aircraft Seating

- Triumph Group

- Collins Aerospace

- Safran Seats

- Mirus Aircraft Seating

- Kawaski Heavy Industries

- Aircraft Cabin Modification

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airline operators

- Aircraft manufacturers

- MRO service providers

- Seat manufacturers

- Airport authorities

- Fleet management companies

Research Methodology

Step 1: Identification of Key Variables

In this step, the primary and secondary factors influencing the Middle East Commercial Aircraft Cabin Seating market are identified. These variables include air travel demand, technological advancements in seating, and regulatory requirements, as well as key market dynamics like consumer preferences and airline fleet modernizations.

Step 2: Market Analysis and Construction

Comprehensive data is collected and analyzed from a wide range of sources, including industry reports, market surveys, airline and manufacturer data, and government regulations. This data is used to build a clear picture of current market conditions and forecast trends, considering regional variations and specific requirements within the Middle East.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses formed during market analysis are validated through consultations with industry experts, airline operators, and manufacturers. These discussions help ensure the accuracy of market insights and provide deeper insights into emerging trends and technologies within the commercial aircraft cabin seating market.

Step 4: Research Synthesis and Final Output

The final output synthesizes all gathered data, expert opinions, and analysis into a comprehensive report. The report provides actionable insights, forecasts, and strategic recommendations for stakeholders, ensuring it reflects the most current and relevant market developments.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Air Travel

Expansion of Low-Cost Carriers

Technological Advancements in Aircraft Seating

Rising Focus on Passenger Comfort

Regulatory Push for Seat Standards - Market Challenges

High Cost of Seat Innovation

Space Constraints in Aircraft Cabins

Challenges in Seat Customization

Fluctuating Raw Material Prices

Regulatory Compliance Issues - Market Opportunities

Growth in Regional Air Travel

Technological Advancements in Seat Design

Partnerships with Aircraft Manufacturers - Trends

Shift Towards Sustainable Aircraft Seating

Rise in Demand for Premium Seating Options

Integration of Smart Technology in Seats

Focus on Reducing Aircraft Weight

Emphasis on Passenger Health and Safety - Government Regulations & Defense Policy

Stringent Safety and Comfort Regulations

Environmental Regulations in Aircraft Seating

Aircraft Seating Certification Policies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Economy Class Seats

Business Class Seats

First Class Seats

Premium Economy Seats

Recliner Seats - By Platform Type (In Value%)

Narrow-body Aircraft

Wide-body Aircraft

Regional Jets

Cargo Aircraft

Private Jets - By Fitment Type (In Value%)

New Installations

Retrofits

Upgrades

Customizations

Refurbishments - By End User Segment (In Value%)

Airlines

Aircraft Manufacturers

MRO Service Providers

Seat Manufacturers

Charter Operators - By Procurement Channel (In Value%)

Direct Procurement

OEM Sales

Third-party Distributors

Online Platforms

Tenders & Bids - By Material / Technology (in Value%)

Lightweight Materials

Ergonomic Seats

Modular Seating Systems

Recyclable Materials

Smart Seat Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material / Technology, Price Tier, Market Focus, Innovation Rate, Geographic Reach)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Zodiac Aerospace

Recaro Aircraft Seating

Sperry Aviation

Aviointeriors

B/E Aerospace

Geven

Hera

Acro Aircraft Seating

Stelia Aerospace

Panasonic Avionics Corporation

Bombardier

KID-Systeme GmbH

Thales Group

Mirus Aircraft Seating

Triumph Group

- Airlines Increasing Fleet Modernization

- MRO Providers Adopting Advanced Technologies

- Seat Manufacturers Expanding Custom Solutions

- Charter Operators Focusing on Passenger Experience

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035