Market Overview

The Middle East Commercial Aircraft In-Flight Entertainment System market is expected to reach USD ~ billion by the end of the assessment period. The market is primarily driven by increasing passenger demand for in-flight connectivity, personalized entertainment, and enhanced flying experiences. Additionally, airlines are investing significantly in the modernization of aircraft fleets to meet these demands. Technological innovations, such as high-speed internet and content streaming systems, are key enablers driving the growth of the market, as they create new possibilities for entertainment in-flight.

The Middle East is experiencing rapid growth in the commercial aircraft sector, with cities such as Dubai, Abu Dhabi, and Doha taking the lead in implementing advanced in-flight entertainment systems. These cities have become regional hubs for international travelers, boosting the demand for superior inflight connectivity and entertainment experiences. Airlines in the Middle East are increasingly focusing on enhancing passenger experience through state-of-the-art in-flight systems, driven by both growing tourism and the expanding aviation sector in the region.

Market Segmentation

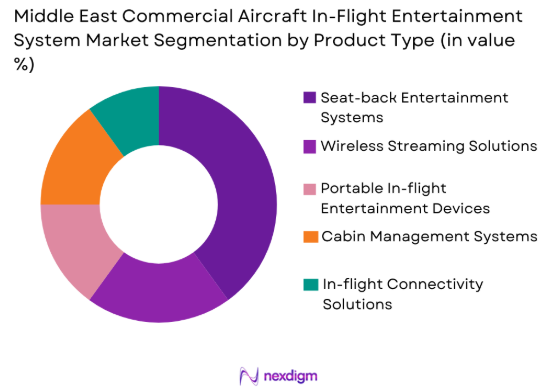

By Product Type

The Middle East Commercial Aircraft In-Flight Entertainment System market is segmented by product type into seat-back entertainment systems, wireless streaming solutions, portable in-flight entertainment devices, cabin management systems, and in-flight connectivity solutions. Recently, seat-back entertainment systems have a dominant market share due to factors such as demand patterns, brand presence, and consumer preference for traditional, interactive entertainment systems. These systems provide a full range of content, including movies, music, and games, and are typically viewed as an essential part of the flying experience. Their widespread adoption is also driven by technological advancements that have made them more affordable and efficient.

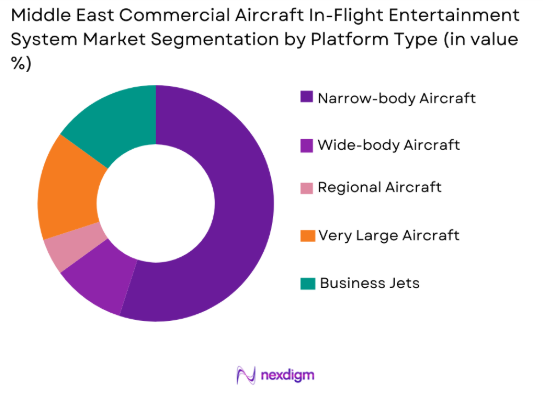

By Platform Type

The Middle East Commercial Aircraft In-Flight Entertainment System market is segmented by platform type into narrow-body aircraft, wide-body aircraft, very large aircraft, regional aircraft, and business jets. Recently, wide-body aircraft have a dominant market share due to factors such as demand patterns, brand presence, infrastructure availability, and consumer preference. These aircraft typically carry more passengers, making them ideal for the installation of advanced entertainment systems. Furthermore, their long-haul flight routes necessitate the use of in-flight entertainment to ensure a comfortable and engaging journey for passengers.

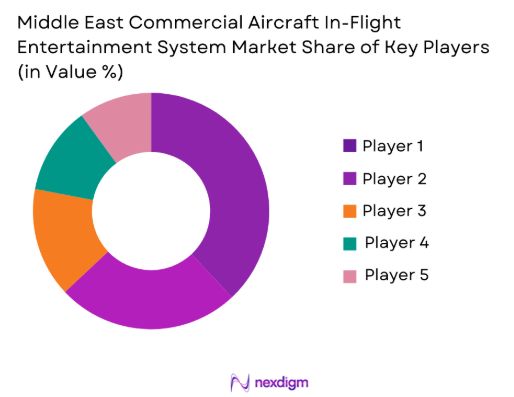

Competitive Landscape

The Middle East Commercial Aircraft In-Flight Entertainment System market is competitive, with key players focusing on technological innovations and partnerships with airlines. Companies like Panasonic Avionics, Thales Group, and Gogo are actively involved in providing state-of-the-art systems that offer seamless connectivity and personalized entertainment experiences. The market is also seeing consolidation as major players seek to expand their market reach by acquiring smaller companies specializing in in-flight systems and connectivity solutions. The increasing demand for high-speed internet and integrated in-flight entertainment systems is a significant factor driving competition among key players in the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-Specific Parameter |

| Panasonic Avionics | 1979 | United States | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| Gogo Inc. | 1991 | United States | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | United States | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | United States | ~ | ~ | ~ | ~ | ~ |

Middle East Commercial Aircraft In-Flight Entertainment System Market Analysis

Growth Drivers

Technological Advancements in In-flight Connectivity

One of the key growth drivers of the Middle East Commercial Aircraft In-Flight Entertainment System market is the continuous development of in-flight connectivity solutions. Airlines are increasingly prioritizing connectivity by implementing high-speed internet, allowing passengers to stay connected throughout their flight. This technological advancement is particularly crucial for long-haul flights, where passengers expect to have access to entertainment and communication. The demand for in-flight Wi-Fi and the integration of advanced entertainment options such as streaming services are propelling this segment of the market. Airlines are also utilizing Wi-Fi to offer e-commerce and other digital services, creating new revenue streams and enhancing the overall passenger experience. As connectivity technology evolves, airlines are able to offer more personalized and interactive entertainment solutions, which is further increasing passenger satisfaction and driving market growth.

Expansion of Airline Fleets

Another significant growth driver is the rapid expansion of airline fleets in the Middle East, particularly in countries such as the UAE, Saudi Arabia, and Qatar. These nations have made substantial investments in expanding their air fleets, aiming to accommodate the growing number of international travelers. As a result, the demand for modern in-flight entertainment systems is rising, as these airlines look to differentiate themselves by offering premium experiences to passengers. Fleet expansion plans involve the acquisition of larger and more advanced aircraft, which are equipped with cutting-edge in-flight entertainment and connectivity systems. This expansion is fueled by the growing aviation sector in the region, which is supported by favorable economic conditions and an increasing number of international and regional flights.

Market Challenges

High Initial Costs

The implementation and installation of advanced in-flight entertainment systems can be prohibitively expensive for many airlines, particularly for smaller operators. These high initial costs are a significant challenge, as airlines must balance the cost of the entertainment systems with other operational expenses such as fuel, crew salaries, and maintenance. The cost of upgrading or retrofitting existing fleets with the latest in-flight entertainment technologies can also be a financial burden. Smaller regional carriers in particular may face difficulties justifying the expense of advanced in-flight systems, which may hinder the widespread adoption of these technologies. The rising demand for connectivity and entertainment options can only be met if airlines are willing to invest in the required infrastructure, which may not be feasible for all players in the market.

Cybersecurity Risks

With the increasing integration of wireless technology and in-flight connectivity systems, cybersecurity risks have become a growing concern in the Middle East Commercial Aircraft In-Flight Entertainment System market. As more systems become interconnected, the potential for cyberattacks on aircraft communication and entertainment networks increases. Airlines must invest in advanced cybersecurity measures to protect both passenger data and critical aviation systems from unauthorized access. Failure to implement robust cybersecurity systems could lead to breaches of sensitive information, such as payment data and personal communications, and disrupt operations. As the market grows, it will be increasingly important for airlines to address cybersecurity challenges to ensure the safety and privacy of their passengers.

Opportunities

Emerging Demand for Sustainable Technologies

An opportunity for the Middle East Commercial Aircraft In-Flight Entertainment System market lies in the growing demand for sustainable and energy-efficient technologies. Airlines and aircraft manufacturers are under increasing pressure to reduce their carbon footprint and adopt environmentally friendly practices. As part of these efforts, there is a rising trend towards energy-efficient in-flight entertainment solutions that minimize energy consumption while still providing high-quality services. Airlines are focusing on implementing systems that are both eco-friendly and cost-effective, such as solar-powered entertainment systems and LED-based displays. As sustainability becomes a priority in the aviation industry, there is significant potential for growth in this segment.

Integration of AI and Personalized Entertainment

The integration of Artificial Intelligence (AI) in in-flight entertainment systems presents an exciting opportunity for market growth. AI can enable the delivery of personalized content, adjusting entertainment options based on passenger preferences, flight data, and previous choices. Airlines can also use AI-powered systems to optimize the management of in-flight entertainment, predicting and addressing maintenance issues proactively. This personalization of the passenger experience enhances customer satisfaction and encourages brand loyalty. As the aviation industry increasingly moves towards data-driven solutions, airlines that invest in AI-enhanced systems will be better positioned to meet consumer demand for customized entertainment during their flights.

Future Outlook

Over the next five years, the Middle East Commercial Aircraft In-Flight Entertainment System market is expected to continue its growth trajectory, driven by advancements in technology, increasing passenger expectations, and airline investments in fleet modernization. The demand for high-speed in-flight connectivity and enhanced entertainment options will be met with innovative solutions such as AI-powered content, sustainable technologies, and improved cybersecurity protocols. Additionally, regulatory support and favorable economic conditions in the Middle East will likely bolster the market’s expansion, enabling airlines to offer more personalized experiences to passengers while maintaining operational efficiency.

Major Players

- Panasonic Avionics

- Thales Group

- Gogo Inc.

- Honeywell International

- Rockwell Collins

- Zodiac Aerospace

- Lufthansa Systems

- Viasat Inc.

- Inmarsat Aviation

- SITAONAIR

- Immarsat

- Global Eagle Entertainment

- Vislink

- AeroMobile

- Embraer

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft manufacturers

- Aerospace component suppliers

- Airline operators

- Airport infrastructure developers

- In-flight service providers

- Technology integrators

Research Methodology

Step 1: Identification of Key Variables

In this step, the key variables affecting the market are identified, such as technological trends, passenger behavior, and economic factors. These variables form the foundation for market analysis.

Step 2: Market Analysis and Construction

A detailed analysis is conducted using both primary and secondary data sources, including interviews with industry experts and market reports, to construct a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through discussions with industry experts, ensuring the data and assumptions are accurate. This step refines the analysis and forecasts.

Step 4: Research Synthesis and Final Output

Data is synthesized into a coherent report, summarizing key insights, trends, and forecasts to provide actionable recommendations for stakeholders in the Middle East Commercial Aircraft In-Flight Entertainment System market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Passenger Demand for Personalized In-Flight Entertainment

Technological Advancements in Connectivity & Streaming Services

Increasing Focus on Enhancing Passenger Experience

Growing Investment in Aircraft Modernization Programs

Rising Adoption of Smart Cabin Solutions - Market Challenges

High Installation and Maintenance Costs

Technological Integration and Interoperability Issues

Cybersecurity Risks in In-Flight Systems

Regulatory Barriers and Certification Challenges

Operational Downtime and System Failures - Market Opportunities

Partnerships with Telecom Companies for Enhanced Connectivity

Growth of In-flight Advertising Opportunities

Adoption of Sustainable and Energy-efficient Technologies - Trends

Integration of AI and Machine Learning for Personalized Content

Rise in Demand for High-speed Internet Connectivity

Increase in Adoption of Streaming-Based Entertainment Systems

Growing Integration of In-flight Shopping and E-commerce Features

Advancements in AR/VR for In-Flight Entertainment - Government Regulations & Defense Policy

Data Privacy Regulations for Passenger Information

Government Investments in Aviation Infrastructure

Regulations on In-Flight Connectivity and Communication Systems

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Seat-back Entertainment Systems

Wireless Streaming Solutions

Portable In-Flight Entertainment Devices

Cabin Management Systems

In-flight Connectivity Solutions - By Platform Type (In Value%)

Narrow-body Aircraft

Wide-body Aircraft

Very Large Aircraft

Regional Aircraft

Business Jets - By Fitment Type (In Value%)

Line-fit Solutions

Retrofit Solutions

Hybrid Solutions

Modular Solutions

Custom Solutions - By End User Segment (In Value%)

Commercial Airlines

Private Airlines

Charter Airlines

Government / Military

Leisure Airlines - By Procurement Channel (In Value%)

Direct Procurement

OEMs & System Integrators

Tenders & Bidding

Private Sales

Third-party Distributors - By Material / Technology (In Value%)

LCD Screens

OLED Screens

Touchscreen Panels

LED Lighting Systems

Wi-Fi Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material/Technology, Region, Product Innovation)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Panasonic Avionics

Gogo Inc.

Thales Group

Honeywell International

Rockwell Collins

Lufthansa Systems

Viasat Inc.

Immarsat

Zodiac Aerospace

Global Eagle Entertainment

Inmarsat Aviation

Vislink

AeroMobile

SITAONAIR

Embraer

- Increasing Demand for Digital In-flight Content from Passengers

- Airlines’ Focus on Improving Passenger Experience and Retention

- Military and Government Aircraft Modernization Projects

- Growth in Low-cost Airlines’ Adoption of IFE Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035