Market Overview

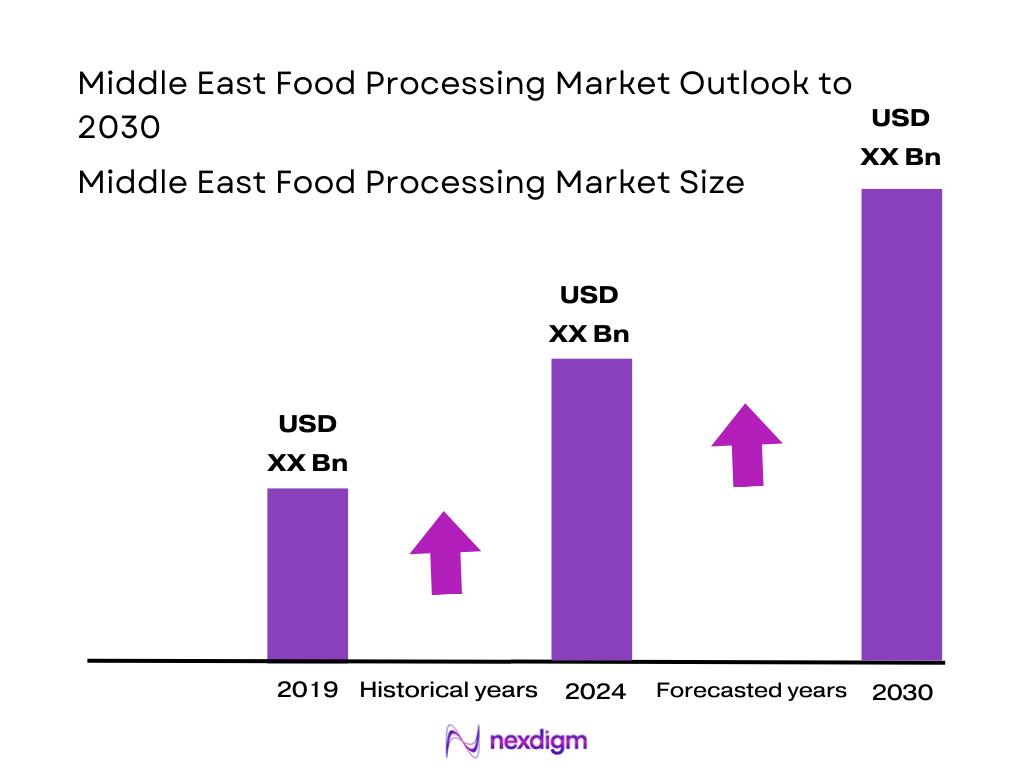

The Middle East & Africa Food Processing and Food Material Handling Equipment Market is valued at USD 9.86 billion, based on industry-standard estimation methodologies analyzing supply‑demand balance, equipment installation data, and financial reporting. Its expansion is driven by increasing demand for processed and packaged foods, rising investments in automation, urbanization, and shifting dietary patterns requiring hygienic, efficient processing systems.

Major hubs—such as South Africa and the United Arab Emirates—hold dominant positions in the market. South Africa leads due to its advanced food and beverage infrastructure, high automation adoption, and strong manufacturing base. The UAE is a fast-rising market, propelled by rapid urban growth, elevated disposable incomes, governmental emphasis on food security, and modernization of food‑processing facilities.

Market Segmentation

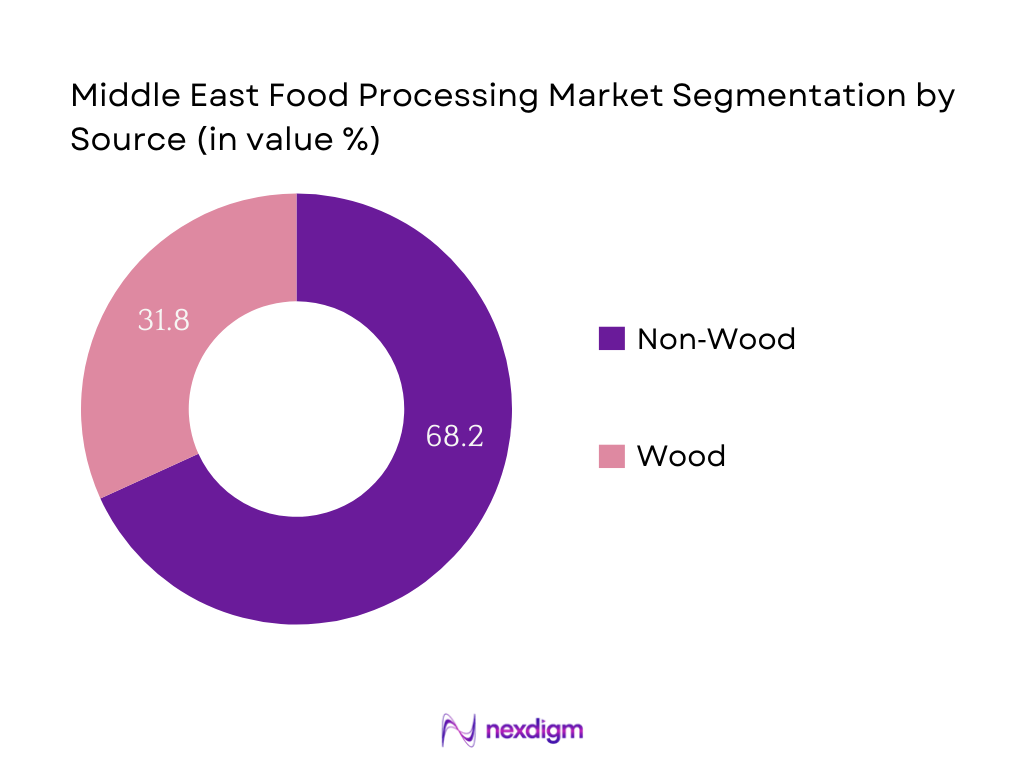

By Source

The Middle East & Africa food processing equipment market is segmented by source into non‑wood and wood. The non‑wood segment dominates with a 68.2 % share in 2024, driven by rising adoption of sustainable materials like biodegradable plastics and composites in packaging equipment—aligned with strong environmental regulations and consumer eco‑preferences. This trend is especially pronounced in high‑infrastructure countries like South Africa.

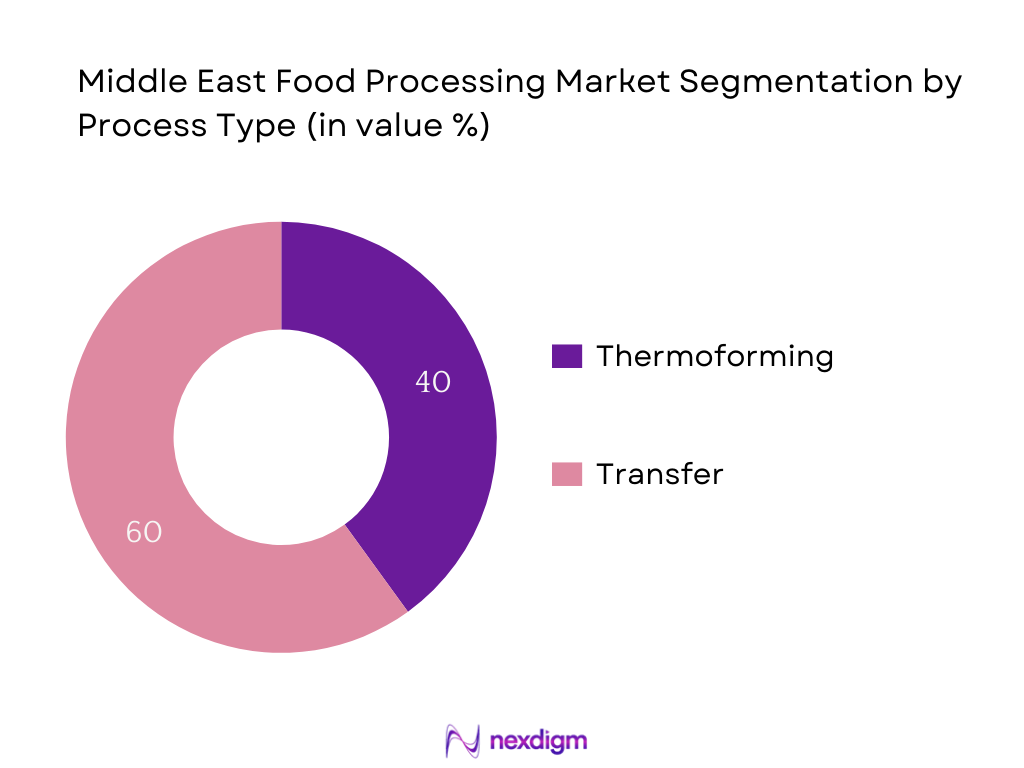

By Process Type

The region’s food processing equipment market is segmented by process, including thermoforming and transfer systems. Thermoforming leads with a 40 % share in 2024, largely because its versatility in producing lightweight, durable containers (e.g., trays, clamshells) makes it widely used across South Africa’s robust processed‑food packaging operations. The transfer process is growing rapidly, especially in the UAE, where advanced precision molding and automation meet demand for customized packaging.

Competitive Landscape

The Middle East & Africa food processing and material handling equipment market is characterized by established global players supplying advanced solutions across multiple countries. The consolidation among these major manufacturers underscores their influence in shaping market standards, technology adoption, and distribution. Leading players include ALFA LAVAL, FENCO Food Machinery, SPX FLOW, Krones AG, TNA Australia, GEA, Marel, JBT, Bühler Group, and More. Below is a snapshot of five key players, with their establishment year, headquarters, and six market‑specific parameters:

| Company | Establishment Year | Headquarters | Installed Processing Capacity | Automation/IoT Integration | Regional Footprint | Sustainability Initiatives | Local Support Presence | Technology Innovation |

| ALFA LAVAL | — | Sweden | — | — | — | — | — | — |

| SPX FLOW | — | USA | — | — | — | — | — | — |

| GEA Group | — | Germany | — | — | — | — | — | — |

| TNA Australia Pty | — | Australia | — | — | — | — | — | — |

| Krones AG | — | Germany | — | — | — | — | — | — |

Middle East Food Processing Market Analysis

Growth Drivers

Investment Trends

Gross domestic product (GDP) for the Middle East and North Africa (MENA) region is estimated at USD 5.03 trillion in 2024 in constant current‑price terms. Real GDP growth for the region rose at 1.9 percent in 2024 with forecast taking it to 2.6 percent in early 2025. This higher economic activity has stimulated capital inflows into food processing infrastructure, as countries reinvest oil revenues into non‑oil sectors. The increase in consumer spending power and public sector investment budgets—though not cited in value—are implied through this GDP growth, directly driving demand for advanced processing equipment and facilities. Such macroeconomic expansion supports procurement of modern machinery, automation systems, and cold chain technologies.

Population Demographics

The MENA region’s demographic dynamics significantly influence food processing demand. Egypt, the region’s most populous country, has a population of approximately 107.8 million, representing around 17 percent of total regional populace. Meanwhile, the overall Middle Eastern population is estimated at 371 million, with a nominal GDP of USD 5.2 trillion in 2024 (per IMF), yielding a GDP per capita around USD 19,860. These large, growing populations, particularly in urban centers, generate intensified demand for processed and packaged foods. Rising household counts and urban demographics compel processors to scale up capacity, modernize operations, and invest in packaging solutions—reflecting direct demographic support for market expansion in processing equipment.

Market Challenges

Raw Material Imports

Many Middle Eastern countries rely heavily on imported raw materials for food processing inputs. The MENA region’s GDP of USD 5.03 trillion in 2024 underscores its scale as a net importer of agri‑commodities, given its limited arable land and water constraints. For example, Egypt and Gulf countries import significant volumes of cereals, oilseeds, and perishables. The dependence on foreign supply chains exposes processors to exchange‑rate volatility and freight disruptions. When global logistics costs rose sharply, processors faced elevated input expenses. Although exact tonnage data is not in the macroeconomic sources, this dynamic is directly tied to the macro‑economic reliance on trade flows and import‑oriented consumption exhibited in regional GDP and trade statistics.

Water Usage Norms

Water scarcity is a chronic issue in the Middle East, constraining certain forms of food processing. The World Bank highlights institutional challenges of water scarcity across the MENA region. Given that 2024 GDP per capita in the region stands at around USD 19,860, water-intensive food processing (e.g., vegetable washing, dairy operations) strains resources and regulatory limits. Processors must adopt water-conserving technologies and treat usage carefully within cost structures. Countries with higher GDP per capita, such as UAE (~USD 49,550 nominal GDP per capita in 2025), face regulatory and environmental pressures on industrial water use. This macroeconomic backdrop compels the industry to invest in water‑efficient systems, raising operational complexity and capital requirements.

Emerging Opportunities

Cold Chain Integration

Growing urbanization and consumer demand for fresh, refrigerated food create openings for cold chain expansion. While direct cold chain stats are unavailable, macroeconomic indicators support this: populations in urban centers like Egypt (~107.8 million) and UAE (~11 million, 2024) demand longer shelf‑life and safety. In 2024, regional GDP stands at USD 5.03 trillion, indicating sufficient economic capacity to invest in cold storage infrastructure. These urban demands paired with food safety awareness (e.g., WHO’s emphasis on safe food handling) reinforce industry opportunities: integrating cold chain systems, temperature‑controlled transport, and refrigerated processing to serve growing urban consumers.

Clean Label Foods

Consumer preference is shifting toward natural, minimally processed products. Macro indicators such as rising GDP per capita in key markets—UAE (~USD 49,550 nominal per capita) , Saudi Arabia (~USD 30,099) —suggest discretionary spending power to demand premium, ‘clean label’ products. Also, population density in areas like Gaza (~5,102 people/km²) highlights urban exposure to regulatory and health messaging. WHO’s emphasis on food safety and evidence‑based standards via World Food Safety Day 2024 reinforces clean label momentum. Given these conditions, processors can capture value by offering preservative‑free or transparent‑ingredient foods—backed by population awareness and consumer expectations tied to improving socioeconomic conditions.

Future Outlook

The Middle East & Africa food processing equipment market is poised for steady growth. Continued demand for packaged and processed foods, coupled with rapid urbanization and rising consumption of hygienic ready‑to‑eat meals, will drive equipment adoption. Governments in the UAE and South Africa are supporting food security and localization of food production through incentives, reinforcing infrastructure investments. Technological integration—including automation, IoT, and eco‑material packaging—will reshape competitive dynamics and unlock new efficiency frontiers across processors and distributors. The market is expected to traverse upward towards USD 15.60 billion by 2032, continuing beyond in line with broader regional economic diversification efforts.

Major Players

- ALFA LAVAL

- FENCO Food Machinery s.r.l.

- SPX FLOW

- TNA Australia Pty Limited

- Krones AG

- JBT (John Bean Technologies)

- GEA Group

- Marel

- Bühler Group

- Schaaf Technologie GmbH

- BAADER

- The Middleby Corporation

- Dover Corporation

- IMA Group

- Tetra Pak

Key Target Audience

- Intended recipients of this report include:

- Food processing equipment manufacturers

- Large food processing enterprises (e.g., packaged foods producers)

- Institutional investors and investment & venture capitalist firms

- Food packaging firms expanding into processing equipment

- Food service chains investing in in‑house processing

- Governments: e.g., UAE Ministry of Economy, Saudi Food & Drug Authority

- Export‑oriented agro‑industrials in MEA

- Private equity firms evaluating acquisitions in automation and food tech

Research Methodology

Step 1: Identification of Key Variables

The process began with mapping stakeholders across the food processing ecosystem—including machinery producers, food manufacturers, distributors, and regulatory bodies. Extensive secondary research sourced data from industry reports (e.g., DBMR), company publications, and market databases to define variables like equipment demand, automation levels, and material segmentation.

Step 2: Market Analysis and Construction

Historical data (e.g., 2024 market value) was aggregated and analyzed to quantify revenue by equipment types, source materials, and geographical spread. Market penetration, the ratio of automated versus conventional equipment installations, and revenue contributions were assessed to validate estimations and trend projections.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were refined through expert interviews (virtual or telephonic) with machinery suppliers, food processors, and policymakers in major markets (South Africa, UAE, Saudi Arabia). These consultations provided firsthand insight into regional adoption barriers, technology drivers, and regulatory impacts.

Step 4: Research Synthesis and Final Output

Findings were corroborated via triangulation—combining bottom‑up data (e.g., equipment shipment volumes) with top‑down valuations (e.g., national food processing sector growth). Final outputs include validated quantitative metrics, future outlook, and competitive analysis, ensuring robustness and relevance for business decision‑makers.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Evolution & Historical Development

- Ecosystem Overview (Raw Material Suppliers, Machinery Suppliers, Processors, Distributors, Retailers)

- Business Cycle Assessment

- Food Processing Value Chain Analysis

- Middle East Trade Flows in Food Processing (Imports/Exports)

- Growth Drivers (Investment Trends, Population Demographics, Food Security Vision 2030, Trade Liberalization, etc.)

- Market Challenges (Raw Material Imports, Water Usage Norms, Price Volatility, Supply Chain Complexity, etc.)

- Emerging Opportunities (Cold Chain Integration, Clean Label Foods, Halal Processing Expansion, Export Substitution, etc.)

- Key Trends (Private Label Penetration, Smart Processing, Automation, Functional Foods, etc.)

- Regulatory Environment (GCC Food Laws, Codex Alimentarius, Labeling Regulations, Additive Norms, Import Tariffs, etc.)

- SWOT Analysis (Processors and Market Dynamics)

- Stakeholder Mapping (Input to Output Chain)

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Processing Yield Efficiency, 2019-2024

- By Product Category (In Value %)

Meat and Poultry

Dairy Products

Fruits and Vegetables

Bakery and Confectionery

Beverages - By Processing Type (In Value %)

Primary Processing

Secondary Processing

Tertiary (Ready-to-Eat/Heat) - By End Use Industry (In Value %)

HoReCa

Retail Chains

Institutional Buyers

Export-Oriented Units

Foodservice Aggregators - By Technology Type (In Value %)

Thermal Processing

Non-Thermal Processing

Fermentation

Drying and Dehydration

Extrusion and Mixing - By Country (In Value %)

Saudi Arabia

United Arab Emirates

Oman

Qatar

Kuwait

Bahrain

- Market Share Analysis by Value/Volume

Segment-Wise Company Positioning – Meat, Dairy, Fruits, Beverages, Bakery - Cross Comparison Parameters (Company Overview, Business Strategy and Expansion Approach, Installed Processing Capacity, Production Plant Locations, Distribution Network (Export/Local), Technology/Automation Adoption, R&D Spend, Local vs Imported Raw Material Dependency, Profit Margins)

- SWOT Analysis of Top Players

- Product-Level Pricing Analysis by Category

- Detailed Profiles of Key Companies

Almarai Co.

Americana Group

National Food Products Company (NFPC)

Agthia Group

Al Islami Foods

Al Kabeer Group

Saudi Dairy and Foodstuff Company (SADAFCO)

Emirates Modern Poultry (Al Rawdah)

Kuwait Food Company (Americana)

IFFCO Group

Nestlé Middle East

Gulf Processing Industries

Al Ain Farms

Mezzan Holding Co.

Al Ghurair Foods

- Usage Trends across Key Industries

- Budget Allocation by Segment

- Regulatory Compliance Readiness

- B2B Purchasing Process and Preferences

- Unmet Needs and Pain Point Analysis

- By Value, 2025-2030

- By Volume, 2025-2030

- By Processing Yield Efficiency, 2025-2030