Market Overview

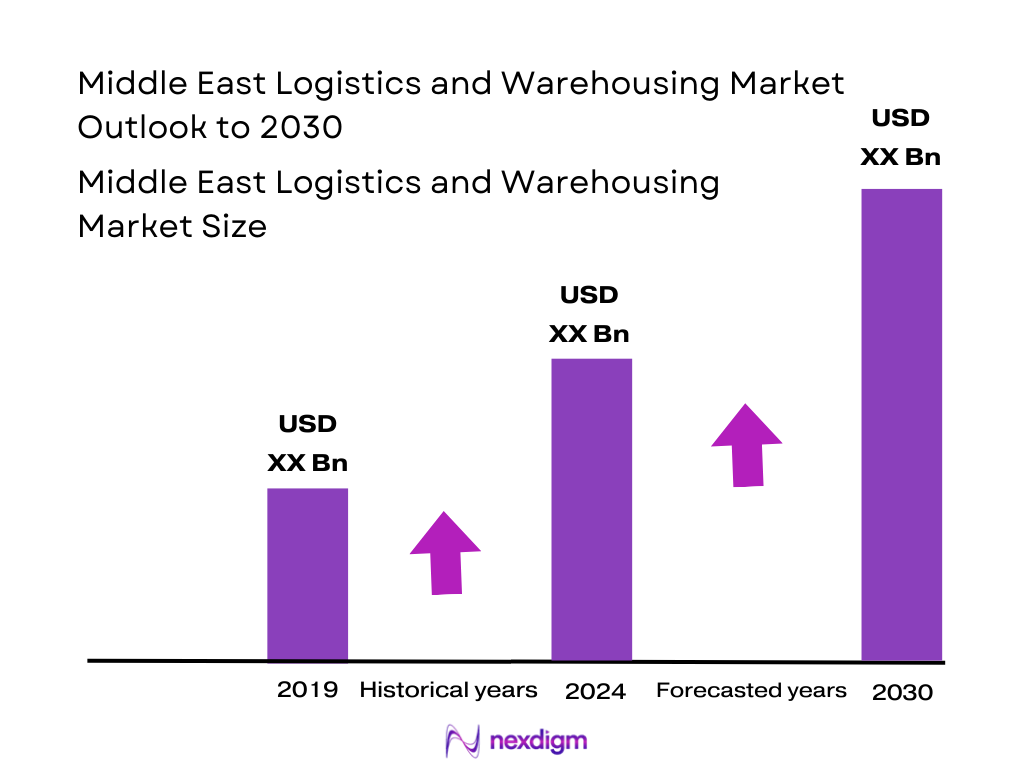

The Middle East logistics and warehousing market is valued at USD 83.1 billion, based on a five‑year historical analysis, with general warehousing representing the largest share, supported by investments in distribution infrastructure throughout 2023 and 2024. This reflects substantial growth in warehousing operations across industrial and commercial hubs, spurred by diversification away from oil and rise in e‑commerce.

Leading cities and countries dominate the market due to strategic port infrastructure, storage capacity, and logistics ecosystems. In particular, hubs such as Dubai, Jeddah, and Riyadh lead thanks to world‑class ports, free zones, and strong multimodal connectivity, making them preferred logistics and warehousing nodes across the region.

According to Nexdigm, the MEA warehousing market generated USD 83.1 billion in 2024. The market is expected to grow at a CAGR of 8% from 2025 to 2030.

Market Segmentation

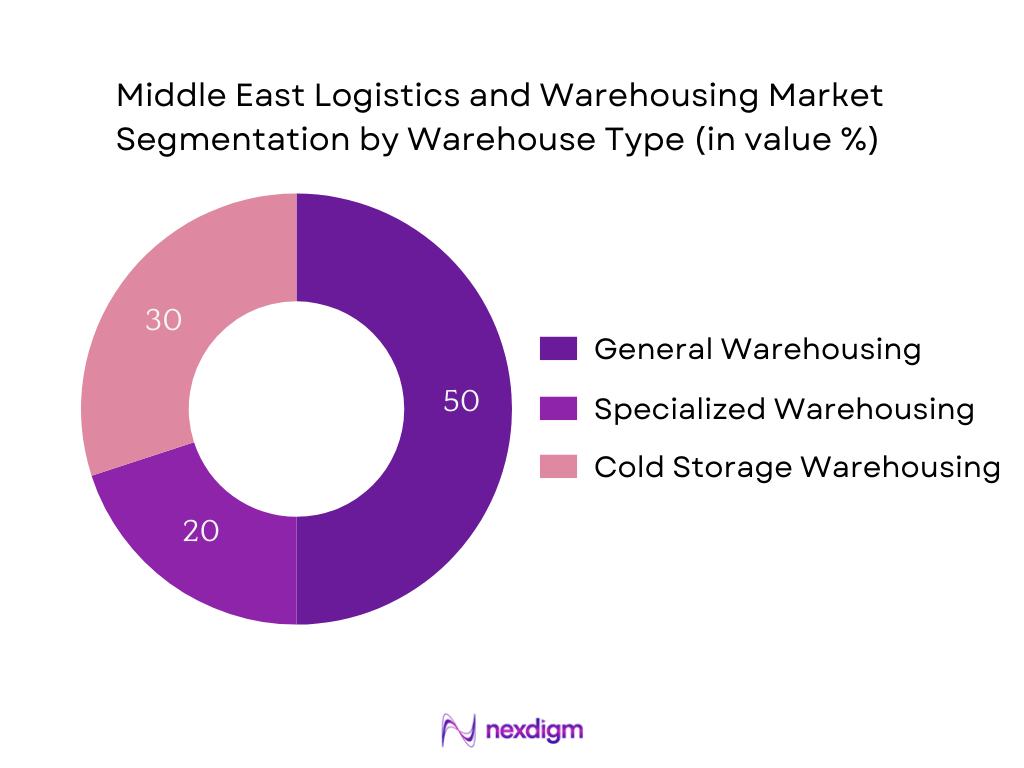

By Warehouse Type

General Warehousing dominates with the highest share due to its versatility in handling a broad mix of goods, cost‑effectiveness, and scalability. It caters to a wide range of industries such as retail, manufacturing, and FMCG. Strong demand from e‑commerce and trade hubs has reinforced general warehousing’s prominence, especially in trade-focused countries with large-scale fulfillment operations. These facilities benefit from proximity to ports and transport corridors, reinforcing their dominance.

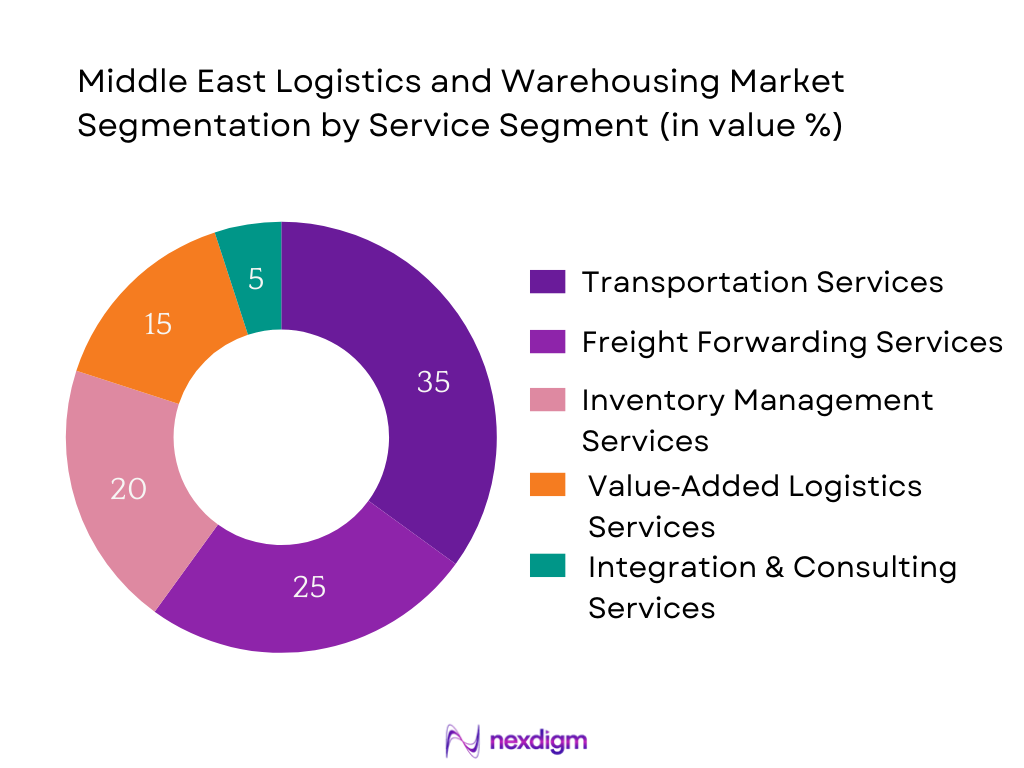

By Service Segment

Warehousing & Distribution Services hold fastest growth and increasing share because of rising demand from e‑commerce, retail, and cold chain needs. These services offer end‑to‑end fulfillment solutions, leveraging warehouse infrastructure for value‑addition and last‑mile readiness. As companies rely on efficiency and speed, warehousing plus distribution centers capture greater share relative to standalone transports.

Competitive Landscape

The Middle East logistics and warehousing market features a mix of strong regional giants and global players, reflecting both consolidation and specialization. Market control is concentrated among companies with integrated supply‑chain networks, warehousing footprints, and technological capabilities.

| Company | Established Year | Headquarters | Warehouse Area (sq ft) | Cold Storage Capacity | FTZ Access | Digital Systems (WMS/TMS) | Fleet Size (vehicles) | Sustainability Initiatives |

| Aramex | — | UAE | — | — | — | — | — | — |

| Agility Logistics | — | Kuwait | — | — | — | — | — | — |

| DHL Global Forwarding | — | Germany / MEA | — | — | — | — | — | — |

| CEVA Logistics Middle East | — | Global / MEA | — | — | — | — | — | — |

| Gulf Warehousing Company (GWC) | — | Qatar | — | — | — | — | — | — |

Middle East Logistics and Warehousing Market Analysis

Growth Drivers

Expanding Trade Volume

Total goods exports from the Middle East and North Africa (MENA) region reached USD 1.125 trillion, while imports stood at USD 0.966 trillion, reflecting a net trade surplus of USD 159 billion. This substantial trade activity reinforces the demand for robust logistics infrastructure, including warehousing, port connectivity, and inland distribution. Trade volume resilience is further underscored by the World Trade Organization (WTO), which reported that global merchandise trade volume—after a brief contraction in 2023—has returned to a 2.6% growth rate in 2024, driven in part by regional supply chain adjustments. As these goods transit through UAE, Saudi Arabia, and Egypt, the need for cross-docking hubs and storage facilities has intensified, making trade volume one of the strongest demand-side factors for warehousing growth.

Expansion of Free Trade Zones (FTZs)

The UAE alone houses over 40 Free Zones, while Saudi Arabia has prioritized four major economic zones launched in 2023 to support logistics and advanced manufacturing. These zones enable zero customs duties and streamlined business setup—ideal for logistics firms. Jebel Ali Free Zone (JAFZA), for example, handles 32% of UAE’s total FDI and supports 7,500+ companies with direct port connectivity. The synergy between FTZs and warehousing has led to clusters of distribution centers in Dubai, Dammam, and Sohar, where land lease prices are subsidized to attract operators. These legally codified zones have fueled infrastructure creation, reinforcing logistics readiness.

Market Challenges

Customs Clearance Bottlenecks

In early 2024, Suez Canal revenue dropped from USD 10.25 billion in 2023 to USD 3.99 billion, while ship volume declined by nearly 50%, from over 26,000 vessels to 13,213, due to regional tensions disrupting maritime logistics. These disruptions strained logistics companies reliant on timely customs clearance and transshipment. Compounded by limited digital infrastructure across customs in parts of Egypt and Levant nations, clearance times often extend beyond 5 days, compared to under 48 hours in developed regions. Inefficient customs procedures increase demurrage costs, warehousing overflow, and reduce reliability in regional distribution networks—creating significant obstacles to growth and profitability in Middle East logistics.

Skilled Labor Shortage

According to the ILO, the Middle East logistics sector continues to face gaps in technical and skilled labor. As of 2024, 40% of the workforce employed in warehousing in the region consists of semi-skilled migrant labor, with only a fraction receiving formal supply chain training. The shortage of certified warehouse operators, automation engineers, and logistics planners has slowed digitalization and increased reliance on inefficient manual processes. Saudi Arabia’s nationalization push (Saudization) further limits the flexibility of hiring foreign skilled staff, tightening the labor pool. Additionally, only 6–7 vocational training centers across the UAE and Oman offer sector-specific logistics diplomas, underscoring the skills gap. This talent shortage inhibits productivity and scale, especially for temperature-controlled and tech-enabled storage operations.

Market Opportunities

Digital Freight Platforms Adoption

The value of global digitally-delivered services reached USD 3.82 trillion in 2023, up from USD 3.5 trillion in 2022, reflecting strong demand for integrated digital logistics and transport coordination. While not exclusive to the Middle East, regional logistics players are increasingly integrating Transport Management Systems (TMS) and Warehouse Management Systems (WMS) into operations. In the UAE, Etihad Rail and DP World both deployed digital freight corridors in late 2023, enabling real-time tracking across rail and sea. These platforms address fragmentation in customs processing and enable real-time ETA updates, thereby reducing turnaround delays. The proven global demand for digital coordination services shows that Middle East logistics players have a clear opportunity to scale digitally and close operational gaps through targeted investments in SaaS-based logistics tools.

GCC Railway Integration

The GCC Railway Project, spanning 2,177 km, is advancing rapidly with several tangible milestones. The UAE completed Stage Two of its Etihad Rail covering over 600 km, while Saudi Arabia commissioned major junctions including the Dammam–Riyadh corridor upgrades. Oman and UAE signed a landmark agreement in April 2024 to implement the Hafeet Rail, establishing the first cross-border rail link between Sohar and Al Ain. This integration will significantly reduce over-reliance on trucking routes, cut delivery timelines, and open inland warehousing hubs in interior Saudi Arabia and Oman. These aren’t future projections but confirmed infrastructure actions with strategic backing—creating direct opportunities for smart warehousing and multimodal supply chain investments along new corridors.

Future Outlook

Over the forecast period, the Middle East logistics and warehousing market is poised for robust expansion, fueled by expanding e‑commerce, infrastructure investments, and adoption of automated technologies. Governments’ push towards economic diversification and smart city initiatives will further elevate demand for advanced warehousing and distribution solutions.

Major Players

- Aramex

- Agility Logistics

- GWC (Gulf Warehousing Company)

- CEVA Logistics Middle East

- DHL Global Forwarding

- Al‑Futtaim Logistics

- Bolloré Transport & Logistics

- Imperial Logistics

- Almajdouie Logistics

- FedEx

- UPS

- Kuehne + Nagel

- GAC (Gulf Agency Company)

- RAK Logistics

- Naqel Express

Key Target Audience

- Logistics & Supply Chain Directors at Retail/E‑commerce companies

- Heads of Warehouse Operations in Manufacturing & FMCG

- Cold Chain Facility Planners at Food & Beverage Firms

- Infrastructure Planners in Port & Free Zone Authorities

- Real Estate Investment Arms focused on Logistics Parks

- Investments and Venture Capitalist Firms (e.g., logistics‑focused funds)

- Government and Regulatory Bodies

- National Trade & Customs Authorities (e.g., GCC Customs Union)

Research Methodology

Step 1: Market Definitions and Scope Setting

We constructed a logistics ecosystem map covering warehousing types, service offerings, stakeholder roles, and regional hubs. This was based on validated secondary sources and our proprietary industry databases.

Step 2: Secondary Data Collection and Triangulation

We compiled historical and 2024 revenue figures from sources. These were cross‑checked using triangulation with trade data, government infrastructure reports, and company disclosures.

Step 3: Primary Validation via Expert Inputs

We conducted interviews with logistics executives—warehouse managers, port operations heads, and transport strategists—to validate trends in demand, capacity utilization, and technology adoption influencing market growth.

Step 4: Forecast Modeling and Sensitivity Scenarios

Using the base year data and expert-validated assumptions, we built bottom‑up models to project warehousing revenue and CAGR to 2030, incorporating variables such as e‑commerce growth, infrastructure roll‑outs, and automation adoption rates.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Primary Research Framework, Trade Flow Analysis, Infrastructure Assessment, Customs and Regulatory Understanding, Industry Expert Validation, Data Triangulation Methodology)

- Definition and Scope

- Logistics and Warehousing Value Chain

- Market Evolution Timeline (Logistics Parks, FTZs, Digitalization Milestones)

- Strategic Importance in Regional Trade and Re-exports

- Impact of Geopolitical Stability on Trade Corridors

- Growth Drivers (Trade Volume, Free Trade Zones, Smart Logistics Investments, E-Commerce Penetration, Industrial Diversification)

- Market Challenges (Customs Clearance Bottlenecks, Skilled Labor Shortage, Regulatory Fragmentation, Last-Mile Cost Optimization)

- Market Opportunities (Digital Freight Platforms, GCC Railway Integration, Green Warehousing, 3PL Expansion)

- Market Trends (Autonomous Trucks, Drone Delivery, Warehouse Automation, Blockchain in Logistics)

- Government Regulations (Customs Reforms, GSO Standards, Logistics National Strategies, Warehousing Compliance Codes)

- SWOT Analysis (Logistics Sector Readiness Index, Hub-and-Spoke Dependency, Port Infrastructure Strengths)

- Stakeholder Ecosystem (Shippers, 3PLs, 4PLs, Port Authorities, FTZ Operators, Customs Consultants)

- Porter’s Five Forces Analysis (Competitive Rivalry, Entry Barriers, Substitution Risk, Buyer and Supplier Dynamics)

- Logistics and Warehousing Competition Ecosystem (Ownership Models, Investment Patterns, Operational Scale, Market Penetration)

- By Value (USD Billion), 2019-2024

- By Volume (Tons Handled), 2019-2024

- By Operational Cost Breakdown (Fuel, Labor, Tech, Lease), 2019-2024

- By Service Type (In Value %)

Contract Logistics

Freight Forwarding

Last-Mile Delivery

Cold Chain Logistics

Express Delivery - By Warehouse Type (In Value %)

Ambient

Cold Storage

Open Yard

Automated Storage

Bonded Warehousing - By Transportation Mode (In Value %)

Road

Air

Sea

Rail

Multimodal - By End-User Industry (In Value %)

Retail & E-commerce

Oil & Gas

Manufacturing

HealthcareFoodBeverage) - By Country (In Value %)

UAE

Saudi Arabia

Qatar

Oman

Kuwait

Bahrain

Jordan

Egypt

- Market Share by Value – Overall Logistics Services

Market Share by Segment – Warehousing, Last-Mile, Freight Forwarding, etc. - Cross Comparison Parameters (Company Overview, Logistics Infrastructure Footprint, FTZ Partnerships, Fleet Strength, Warehouse Area, Tech Integration (WMS/TMS), Sustainability Practices, Regional Network, Workforce Size, Specialized Handling Capabilities)

- SWOT Analysis of Major Players

- Pricing Benchmarking – Per Pallet, Per Kilometer, Per TEU

- Detailed Profiles of Major Players

Aramex

Agility Logistics

DP World Logistics

DHL Supply Chain

Kuehne+Nagel

Hellmann Worldwide Logistics

Naqel Express

Bahri Logistics

GWC (Qatar)

Al-Futtaim Logistics

RSA Global

Binzagr Logistics

FedEx Express Middle East

Yusen Logistics

CEVA Logistics Middle East

- Retail & E-commerce

- Oil & Gas

- Healthcare & Pharma

- Food & Beverage

- Industrial Manufacturing

- By Value, 2025-2030

- By Volume, 2025-2030

- By Operational Cost Structure, 2025-2030