Market Overview

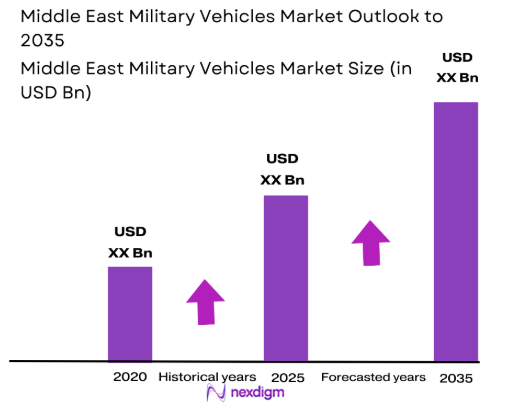

The Middle East military vehicles market is projected to reach a substantial market size, driven by increasing defense budgets, regional geopolitical tensions, and the growing demand for modernized military equipment. Based on a recent historical assessment, the market size is estimated to exceed USD ~ billion in value, with military vehicle demand concentrated in countries with significant defense initiatives. The key drivers include the need for advanced armored vehicles, mine-resistant units, and heavy-duty military trucks for diverse defense operations.

The Middle East region is dominated by nations such as Saudi Arabia, the United Arab Emirates, and Qatar, which are leading military expenditure in response to regional conflicts. These countries are focusing on enhancing their military capabilities through defense procurements and collaborations with global suppliers. Strong infrastructure investments, robust defense alliances, and modernization programs continue to fuel growth. Notably, the demand for advanced military vehicles has accelerated due to the increasing focus on border security, counterterrorism operations, and technological innovation in defense systems.

Market Segmentation

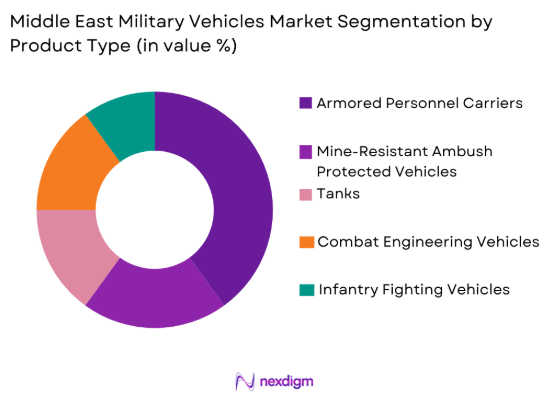

By Product Type

The Middle East military vehicles market is segmented by product type into armored personnel carriers, mine-resistant ambush protected vehicles, tanks, combat engineering vehicles, and infantry fighting vehicles. Recently, armored personnel carriers have a dominant market share due to factors such as increasing demand for mobility and troop protection in conflict zones. These vehicles are highly preferred for their versatility in both urban and battlefield environments, alongside government procurement initiatives aimed at modernizing the military fleet in key countries like Saudi Arabia and the UAE. Their ability to adapt to various terrains and provide a high level of protection against mines and explosive devices has cemented their market leadership in this region.

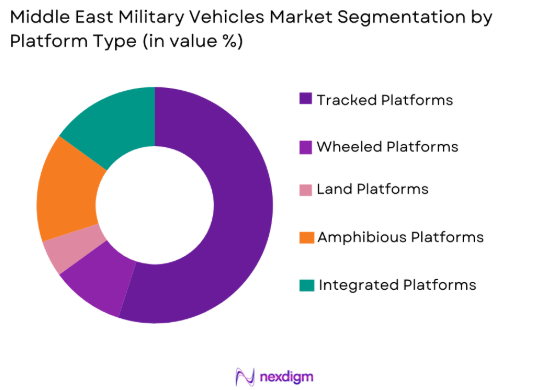

By Platform Type

The Middle East military vehicles market is segmented by platform type into land platforms, wheeled platforms, tracked platforms, amphibious platforms, and integrated platforms. Recently, tracked platforms have a dominant market share due to factors such as their superior mobility and durability in harsh terrains, making them ideal for military operations in regions with challenging landscapes. Additionally, tracked platforms are increasingly favored by military forces for their ability to carry heavy armaments, maneuver through difficult terrain, and withstand harsh combat conditions. This has made tracked military vehicles a key component of defense modernization efforts in nations like Saudi Arabia and the UAE.

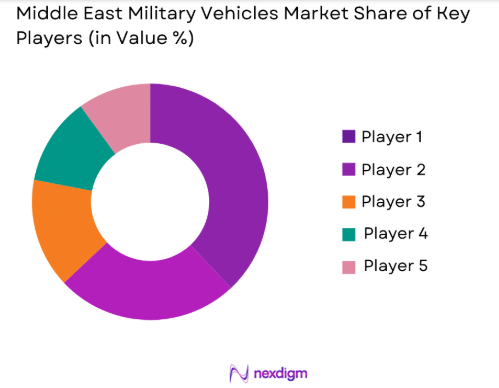

Competitive Landscape

The competitive landscape of the Middle East military vehicles market is characterized by consolidation and the dominance of major international defense manufacturers. These players have established long-term partnerships with government agencies in the region, contributing to significant market influence and technological innovation. Major manufacturers focus on producing advanced military vehicles, offering a range of customized solutions to meet the specific demands of defense forces. As military budgets increase, these firms are also investing in research and development, providing cutting-edge technologies like mine protection systems, advanced armor, and autonomous driving capabilities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| General Dynamics | 1899 | United States | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Oshkosh Defense | 1917 | United States | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ |

Middle East Military Vehicles Market Analysis

Growth Drivers

Increased defense budgets

A key growth driver for the Middle East military vehicles market is the significant increase in defense budgets in countries like Saudi Arabia and the UAE. These nations are investing heavily in modernizing their military fleets, focusing on acquiring advanced vehicles that offer enhanced protection, mobility, and operational effectiveness. Geopolitical tensions, particularly in the Gulf region, are contributing to this surge in defense expenditure, with nations prioritizing military capabilities to safeguard national security and interests. The demand for state-of-the-art military vehicles such as mine-resistant armored vehicles, tanks, and command vehicles is expected to remain strong as military forces look to improve their readiness and capabilities. Additionally, the collaboration between governments and global defense contractors is leading to the development of advanced platforms that align with the region’s strategic goals. This has led to increased competition among military vehicle suppliers, which further accelerates market growth.

Technological advancements in military vehicle design

Another significant growth driver is the rapid technological advancements being integrated into military vehicles. Innovations such as autonomous vehicle systems, artificial intelligence (AI)-powered combat systems, and advanced armor technologies are transforming the defense vehicle market. Middle Eastern countries are keen on adopting the latest technologies to ensure their military vehicles can meet the demands of modern warfare. As these vehicles become more sophisticated, with capabilities such as remote operation, real-time intelligence sharing, and enhanced survivability, the demand for cutting-edge solutions is rising. Moreover, partnerships with international technology firms are enabling local manufacturers to integrate these advanced technologies, offering defense forces enhanced operational capabilities. These technological improvements are expected to drive growth by providing military forces with vehicles that can operate in increasingly complex and challenging environments.

Market Challenges

High capital expenditure

One of the key challenges faced by the Middle East military vehicles market is the high capital expenditure associated with acquiring and maintaining advanced military vehicles. The initial investment required for procuring armored personnel carriers, tanks, and other specialized vehicles is substantial. Moreover, military forces must allocate significant resources for ongoing maintenance, training, and technological upgrades to ensure the longevity of these platforms. This financial burden can strain defense budgets, especially in countries where defense spending is already high. While governments are investing in advanced military technologies, the cost factor often leads to delays or modifications in procurement plans, potentially slowing down the growth of the market. Furthermore, the market faces the challenge of aligning procurement decisions with the evolving geopolitical situation, which can sometimes lead to uncertainty in defense spending priorities.

Complexity in integration with existing systems

Another challenge is the complexity involved in integrating new military vehicles with existing defense infrastructure and systems. As military vehicles become more technologically advanced, ensuring seamless interoperability between new platforms and legacy systems becomes increasingly difficult. This challenge is particularly relevant in the Middle East, where nations are modernizing their military fleets but must also ensure that these new vehicles can operate effectively alongside older equipment. The integration process involves compatibility testing, software and hardware modifications, and extensive training for military personnel. These factors can slow down the adoption of new vehicles and result in higher costs, as well as operational inefficiencies during the transition period. Countries that do not have a well-developed local defense industry often face additional challenges in terms of logistical support and system integration.

Opportunities

Strategic partnerships with defense contractors

The growing need for modernized military fleets presents a major opportunity for strategic partnerships between Middle Eastern countries and global defense contractors. These collaborations allow local governments to access advanced technologies and vehicles while also fostering the growth of the local defense industry. Through joint ventures and licensing agreements, international players can set up production facilities in the region, helping to meet local demand and reduce dependency on foreign imports. These partnerships also offer opportunities for knowledge transfer and technology sharing, strengthening the region’s military capabilities. As defense budgets continue to rise, the market for military vehicles will see increased participation from both domestic and international firms, creating a mutually beneficial environment for the development and deployment of next-generation defense systems.

Demand for autonomous military vehicles

The demand for autonomous military vehicles is another significant opportunity in the Middle East defense sector. As military forces seek to enhance operational efficiency, reduce risks to human soldiers, and improve the effectiveness of missions, autonomous vehicles are becoming a key component of military vehicle fleets. These vehicles offer several advantages, such as the ability to operate in hazardous environments without putting personnel at risk, as well as improved decision-making capabilities through AI integration. Governments in the Middle East are increasingly investing in the development of autonomous platforms, including unmanned ground vehicles (UGVs) and unmanned aerial vehicles (UAVs), which can complement manned military vehicles. This trend is expected to grow in the coming years, as defense forces look to leverage emerging technologies for enhanced operational effectiveness.

Future Outlook

The future outlook for the Middle East military vehicles market appears promising, with anticipated growth driven by technological advancements, strategic defense investments, and rising geopolitical tensions. Over the next five years, military modernization programs, especially in nations like Saudi Arabia, the UAE, and Qatar, will continue to shape the demand for advanced vehicles. Autonomous systems, AI-driven platforms, and next-generation armor technologies will become increasingly prevalent, offering enhanced operational capabilities and protection for military forces. Additionally, regulatory support for defense initiatives and continued partnerships with international manufacturers will further fuel market growth, ensuring the development of robust and versatile defense vehicles.

Major Players

- General Dynamics

- BAE Systems

- Oshkosh Defense

- Rheinmetall AG

- Lockheed Martin

- Elbit Systems

- Textron

- Navistar Defense

- ThyssenKrupp AG

- Hyundai Rotem

- Iveco Defence Vehicles

- SAIC

- Tatra Trucks

- Land Rover

- Combat Vehicle Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors and defense procurement agencies

- National defense ministries

- Defense technology manufacturers

- Defense equipment distributors

- Defense vehicle fleet operators

- International defense alliances

Research Methodology

Step 1: Identification of Key Variables

This involves recognizing all relevant factors influencing the market, including geopolitical risks, military spending trends, defense procurement processes, and technological advancements.

Step 2: Market Analysis and Construction

Comprehensive market analysis is performed through a combination of secondary research and primary data collection, building a detailed view of the market’s scope, growth patterns, and segments.

Step 3: Hypothesis Validation and Expert Consultation

Insights from industry experts, defense consultants, and military analysts are gathered to validate the research hypotheses and ensure data accuracy.

Step 4: Research Synthesis and Final Output

The collected data is synthesized into actionable insights, highlighting key trends, growth drivers, challenges, and opportunities in the military vehicles market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased military spending in the region

Ongoing regional conflicts and security concerns

Technological advancements in military vehicle systems

Rising demand for advanced armor and defense systems

Investment in homeland security and defense infrastructure - Market Challenges

High capital expenditure for military vehicle acquisition

Limited access to cutting-edge technologies

Complex regulatory and compliance challenges

Supply chain disruptions and geopolitical tensions

Logistical constraints in field deployment - Market Opportunities

Expansion of defense modernization programs

Collaborations between defense contractors and local manufacturers

Integration of autonomous systems into military vehicles - Trends

Growing focus on advanced armored protection

Increased demand for amphibious and multi-terrain vehicles

Integration of AI and machine learning in military vehicles

Rise in demand for vehicles with enhanced mobility

Shift toward lightweight and durable materials - Government Regulations & Defense Policy

Export control and compliance policies

Government funding for defense technology

Regulations related to defense procurement and tenders

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Armored Personnel Carriers

Mine-Resistant Ambush Protected Vehicles

Tanks

Combat Engineering Vehicles

Infantry Fighting Vehicles - By Platform Type (In Value%)

Land Platforms

Wheeled Platforms

Tracked Platforms

Amphibious Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions

Custom-built Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Steel

Aluminum

Composites

Hybrid Materials

Advanced Coatings

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material/Technology, Market Value, Installed Units, Price)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

General Dynamics

BAE Systems

Oshkosh Defense

Rheinmetall AG

Navistar Defense

Lockheed Martin

Thales Group

Textron

Krauss-Maffei Wegmann

Northrop Grumman

Saab Group

Tata Motors

Arihant Engineering

ST Engineering

Elbit Systems

- Military forces’ increasing focus on modernizing armored fleets

- Government agencies’ reliance on tactical vehicles for security operations

- Defense contractors integrating more advanced technologies

- Private sector partnerships in defense vehicle manufacturing

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035