Market Overview

The Middle East Non-Lethal Weapons Market is valued at approximately USD ~ billion based on a recent historical assessment. This market is driven by increasing defense budgets, growing concerns over civil unrest, and the rising need for crowd control systems. Governments and law enforcement agencies are investing in non-lethal weaponry to address security challenges without resorting to lethal force. Technological advancements, including directed energy and acoustic weapons, also contribute to the market’s growth by offering more effective crowd management and riot control solutions.

The dominance of countries such as the United Arab Emirates and Saudi Arabia is notable in the Middle East Non-Lethal Weapons Market. These nations invest heavily in advanced defense technologies, including non-lethal solutions, to ensure national security while minimizing casualties. Their political stability, strong military infrastructure, and strategic defense initiatives position them as leaders in this market. Other countries in the region also follow suit by increasing their non-lethal weapon procurement to handle internal and external security threats more efficiently.

Market Segmentation

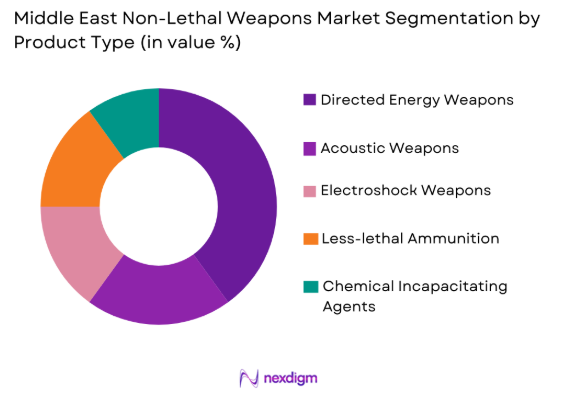

By Product Type

The Middle East Non-Lethal Weapons Market is segmented by product type into directed energy weapons, acoustic weapons, electroshock weapons, less-lethal ammunition, and chemical incapacitating agents. Recently, directed energy weapons have a dominant market share due to their high precision, ability to disable targets without physical harm, and growing interest in their application across defense and law enforcement. The rapid advancement in laser and microwave technologies has contributed significantly to their increased demand in military and crowd control applications.

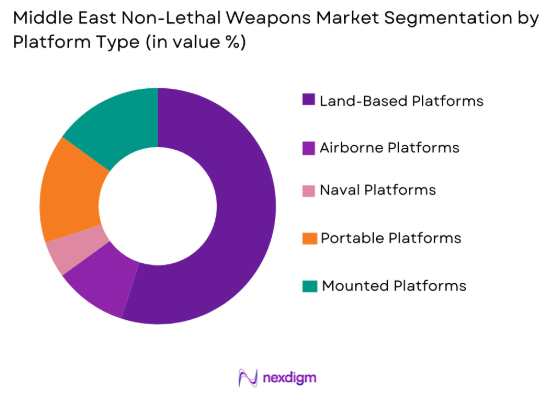

By Platform Type

The market is segmented by platform type into land-based platforms, airborne platforms, naval platforms, portable platforms, and mounted platforms. Among these, land-based platforms hold the dominant market share as they are most widely deployed in security operations for crowd control, border defense, and riot management. Land-based systems are cost-effective, easy to deploy, and adaptable to various terrain, making them highly favored for large-scale military and law enforcement operations across the region.

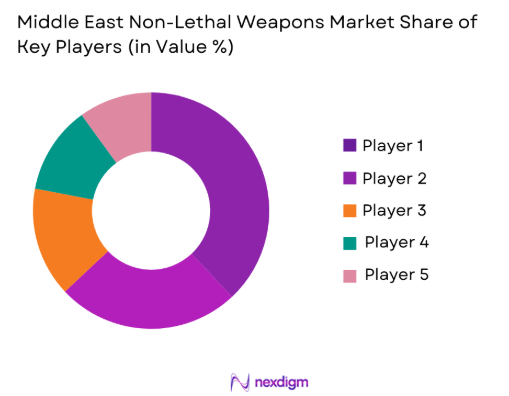

Competitive Landscape

The competitive landscape of the Middle East Non-Lethal Weapons Market is characterized by the presence of a few large players dominating the market, while several smaller firms contribute with niche solutions. Major players often engage in strategic partnerships with governments and law enforcement agencies, ensuring a steady demand for their products. Additionally, companies are focusing on technological advancements and new product development to stay competitive. Mergers and acquisitions have also been common as larger players consolidate resources to offer comprehensive solutions in non-lethal weaponry.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-Specific Parameter |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | Farnborough, UK | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

Middle East Non-Lethal Weapons Market Analysis

Growth Drivers

Increased Demand for Civilian Security Solutions

The demand for non-lethal weapons has surged in the Middle East due to heightened concerns over civil unrest and protests. Governments and law enforcement agencies are turning to non-lethal systems to maintain public order while minimizing harm to civilians. This shift is driven by the need for effective crowd control mechanisms that do not lead to fatalities. The growing instability in certain regions has created a pressing need for technologies that allow governments to address these situations without resorting to lethal force. Additionally, non-lethal weapons are seen as essential for responding to terrorist activities and preventing casualties in high-tension environments. As governments focus on enhancing internal security while adhering to human rights regulations, non-lethal weapons are becoming more integrated into security frameworks, supporting overall market growth. With rising investments in public safety, this driver is likely to continue supporting the market for non-lethal weapons in the coming years.

Technological Advancements in Non-Lethal Weaponry

The rapid development of advanced technologies in the field of non-lethal weapons is a key driver for market growth. Innovations such as directed energy weapons, acoustic devices, and electromagnetic pulse (EMP) weapons are increasingly being adopted by military forces and law enforcement agencies. These technologies offer new capabilities, such as disabling vehicles or electronics from a distance without causing harm to individuals. As these technologies become more affordable and accessible, they are expected to replace traditional crowd control methods, which may result in high collateral damage. The market for non-lethal weaponry is benefiting from these advancements, especially as governments and defense contractors prioritize the development of systems with greater precision, efficiency, and safety. The integration of AI and autonomous systems into non-lethal weapons further supports this growth, providing enhanced decision-making and operational efficiency.

Market Challenges

High Cost of Research and Development

One of the primary challenges in the Middle East Non-Lethal Weapons Market is the high cost associated with the research and development of advanced non-lethal technologies. These systems require substantial investments in innovation and testing to ensure they meet rigorous safety and operational standards. The complexity of these technologies, such as directed energy and acoustic weapons, further increases development costs. For many governments and organizations, the high financial barrier is a deterrent to large-scale adoption. This challenge is compounded by the need for specialized training, integration into existing defense systems, and the ongoing maintenance of these systems. While technological advancements promise to lower costs in the long term, the current financial requirements pose significant barriers for many regional players who may struggle to secure funding for these initiatives.

Ethical and Legal Concerns Regarding Non-Lethal Force

Ethical concerns about the use of non-lethal weapons also present a challenge in the Middle East market. While these systems are designed to minimize fatalities, their use still raises questions about their effectiveness and the potential for misuse. In some cases, there is concern that non-lethal weapons could be used to suppress civil liberties or could be deployed excessively in certain situations. Legal frameworks surrounding the use of non-lethal weapons are often ambiguous, and governments may be reluctant to fully integrate these systems into their defense strategies without clear international guidelines. Additionally, there is a concern that the deployment of such weapons could inadvertently escalate conflicts or be used in ways that do not align with international human rights laws. Addressing these ethical and legal concerns will be crucial for market growth and widespread acceptance of non-lethal weaponry.

Opportunities

Expansion of Non-Lethal Technologies in Crowd Control

The increasing number of protests and public disturbances in the Middle East presents an opportunity for the adoption of non-lethal weapons in crowd control operations. Governments and security agencies are looking for ways to address civil unrest without resorting to violent methods that may harm civilians or lead to fatalities. Non-lethal weapons offer an ideal solution, as they allow law enforcement to disperse crowds or incapacitate individuals without causing long-term damage. This growing demand for crowd control systems is driving innovation and adoption across the region. Non-lethal technologies like sound-based or electromagnetic systems are becoming more mainstream, offering a less destructive alternative to traditional methods such as tear gas or rubber bullets. As such, this opportunity is poised to significantly shape the future of non-lethal weapon use in the region.

Adoption of Non-Lethal Weapons by Private Security Firms

Another opportunity lies in the growing adoption of non-lethal weapons by private security firms operating across the Middle East. These firms are increasingly tasked with securing large infrastructure projects, commercial establishments, and government buildings in volatile environments. As such, they require advanced security solutions that do not rely on lethal force. Non-lethal weapons, including electroshock devices and acoustic weapons, are being integrated into security protocols to ensure the protection of assets while mitigating the risks associated with the use of deadly force. With the rise of private sector investments in security services, this segment is expected to be a major contributor to the growth of the market, as companies seek to adopt technologies that align with both their security objectives and corporate social responsibility.

Future Outlook

Over the next five years, the Middle East Non-Lethal Weapons Market is expected to witness steady growth driven by advancements in technology, an increasing focus on public safety, and the need for non-lethal solutions in conflict zones. Technological developments in directed energy weapons, acoustic systems, and other non-lethal technologies will continue to evolve, improving the effectiveness and affordability of these solutions. Furthermore, increasing demand for crowd control and law enforcement applications, particularly in high-risk environments, will drive market demand. Government policies and international regulations supporting the responsible use of non-lethal weapons will also play a critical role in fostering market growth, ensuring that these technologies are deployed safely and ethically.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- BAE Systems

- Thales Group

- Leonardo

- Saab Group

- L3 Technologies

- Elbit Systems

- Rheinmetall AG

- Honeywell International

- General Dynamics

- Harris Corporation

- Textron Systems

- Crowcon Detection Instruments

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military defense contractors

- Private security firms

- Police and law enforcement agencies

- Non-governmental organizations (NGOs)

- Research and development firms

- Infrastructure development companies

Research Methodology

Step 1: Identification of Key Variables

The identification of critical factors such as market trends, technologies, and regulatory factors relevant to non-lethal weapons is essential to building a comprehensive analysis.

Step 2: Market Analysis and Construction

An in-depth market analysis is conducted using historical data, expert insights, and industry-specific information to estimate the current market size and predict future growth.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultation with industry leaders and technical specialists validates the hypotheses regarding market trends, technologies, and growth drivers.

Step 4: Research Synthesis and Final Output

The final output is synthesized from all data sources, with market insights and projections presented in a structured format for decision-making.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Defense Budget Allocations

Rising Civil Unrest & Public Safety Concerns

Technological Advancements in Non-Lethal Systems

Growing Focus on Minimizing Civilian Casualties

Development of Multi-Platform Integration Solutions - Market Challenges

High Development Costs for Advanced Non-Lethal Weapons

Ethical & Legal Concerns Regarding Use of Non-Lethal Force

Limited Public Awareness & Acceptance of Non-Lethal Solutions

Challenges in Integration with Existing Systems

Varying Regional Regulations & Standards - Market Opportunities

Advancements in Non-Lethal Crowd Control Solutions

Private Sector Demand for Enhanced Security Products

Partnerships for Technology Sharing & Development - Trends

Rise in Demand for Portable Non-Lethal Systems

Integration of Artificial Intelligence with Non-Lethal Technologies

Increased Use of Non-Lethal Weapons in Law Enforcement

Development of Hybrid Systems Combining Lethal & Non-Lethal Technologies

Expansion of Non-Lethal Weapon Training Programs - Government Regulations & Defense Policy

Restrictions on Non-Lethal Weapon Use

International Law Regarding Non-Lethal Technologies

Government Support for Development of Non-Lethal Systems

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Shockwave Weapons

Directed Energy Weapons

Acoustic Weapons

Electromagnetic Pulse (EMP) Weapons

Less-Lethal Ammunition - By Platform Type (In Value%)

Land-Based Platforms

Airborne Platforms

Naval Platforms

Mounted Platforms

Portable Platforms - By Fitment Type (In Value%)

Weaponized Vehicles

Personal Protective Gear

Fixed Installation Systems

Dismounted Soldier Systems

Unmanned Vehicle Integration - By End User Segment (In Value%)

Military Forces

Law Enforcement Agencies

Private Security Firms

Government & Regulatory Bodies

Civilian Applications - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

Private Sector Procurement

Public Auctions

Distributors & Retailers - By Material / Technology (in Value%)

Electromagnetic Technologies

Laser Technology

Acoustic Technologies

Kinetic Impact Materials

Non-lethal Chemical Agents

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material/Technology, Government Regulations, Product Offering, Pricing Strategy, Geographic Reach)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Raytheon Technologies

Northrop Grumman

BAE Systems

General Dynamics

Thales Group

Honeywell International

Leonardo

Saab Group

L3 Technologies

Elbit Systems

Rheinmetall AG

Taser International

Crowd Control Technologies

Safariland Group

- Military Forces’ Increasing Adoption of Non-Lethal Weapons

- Government & Regulatory Bodies Focusing on Non-Lethal Solutions

- Private Security Firms Integrating Non-Lethal Systems into Operations

- Law Enforcement Agencies’ Shift Towards Non-Lethal Methods

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035