Market Overview

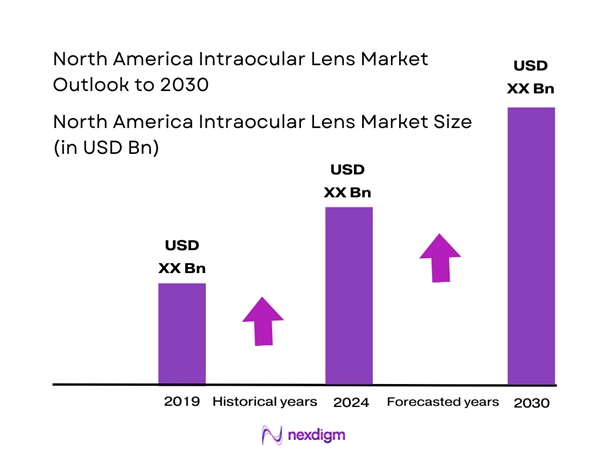

The North America Intraocular Lens market is currently valued at approximately USD 4.6 billion in 2024 with an approximated compound annual growth rate (CAGR) of 6.41% from 2024-2030, driven by the increasing prevalence of cataracts and a growing aging population that demands surgical interventions. Rising healthcare expenditure and advancements in lens technology are essential factors contributing to this robust market expansion. According to credible sources, the market is projected to witness consistent growth, reaching an estimated USD 5.5 billion in value, bolstered by an increasing focus on patient-centric solutions and innovations in lens design.

Key cities dominating the North America Intraocular Lens market include New York, Los Angeles, and Toronto. These cities boast advanced healthcare infrastructure, a high concentration of ophthalmic specialists, and a commitment to adopting innovative medical technologies. Such environments facilitate rapid advancements in intraocular lenses, enabling easier access to surgeries and treatment options for patients suffering from vision impairments.

Technological advancements in intraocular lenses have significantly enhanced surgical outcomes. For instance, innovations such as the development of accommodating and bifocal lenses allow for improved vision at multiple distances. A study published by the American Society of Cataract and Refractive Surgery indicated that these advanced lenses have seen adoption rates soar, with over 2 million multifocal intraocular lenses implanted in a recent year.

Market Segmentation

By Product Type

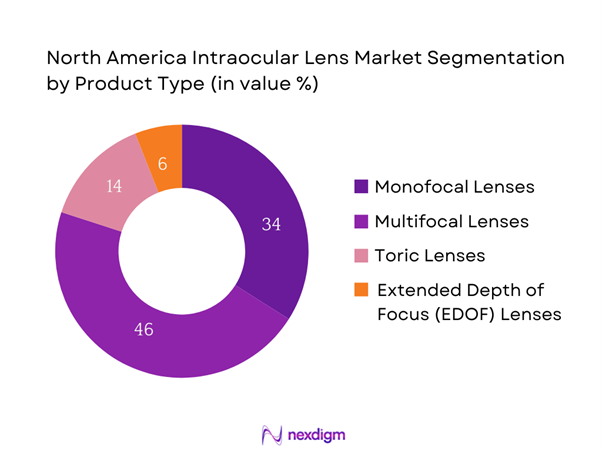

The North America Intraocular Lens market is segmented by product type into monofocal lenses, multifocal lenses, toric lenses, and extended depth of focus (EDOF) lenses. Recently, multifocal lenses have gained a dominant market share within this segmentation due to their ability to correct presbyopia and provide patients with clear vision at various distances. Their increasing acceptance among patients aiming for improved quality of life has solidified their prevalence in eye surgeries. Furthermore, advancements in multifocal lens technology, along with growing awareness about the benefits, have enhanced their popularity among ophthalmic professionals and consumers alike.

By Material Type

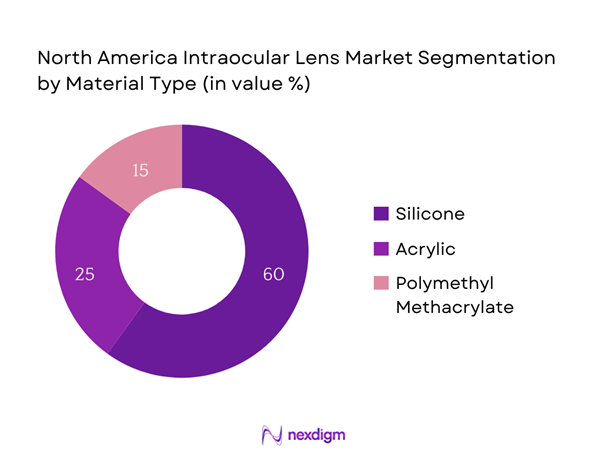

The market is also segmented based on material type, which includes silicone, acrylic, and polymethyl methacrylate (PMMA). Among these, silicone lenses dominate the market primarily due to their high biocompatibility, flexibility, and improved optical properties. Silicone intraocular lenses are more effective in reducing glare and halos, which significantly enhances postoperative satisfaction rates. The lightweight nature of silicone lenses also facilitates easier handling during surgical procedures, making them a preferred choice for many ocular surgeons.

Competitive Landscape

The North America Intraocular Lens market is dominated by a few major players, including prominent companies like Alcon, Johnson & Johnson Vision, and Bausch + Lomb. This consolidation highlights the significant influence of these key companies, which compete rigorously to innovate and expand their product offerings.

| Company | Establishment Year | Headquarters | Product Types Offered | Market Strategy | R&D Investment |

| Alcon | 1945 | Fort Worth, Texas | – | – | – |

| Johnson & Johnson Vision | 1987 | Santa Ana, California | – | – | – |

| Bausch + Lomb | 1853 | Bridgewater, New Jersey | – | – | – |

| Hoya Surgical Optics | 1941 | Tokyo, Japan | – | – | – |

| Staar Surgical | 1982 | Lake Forest, California | – | – | – |

North America Intraocular Lens Market Analysis

Growth Drivers

Rising Prevalence of Cataracts

Cataracts remain one of the leading causes of blindness globally, with an estimated 24 million Americans affected. The prevalence of cataracts increases with age, as over 50% of individuals over age 80 experience significant lens opacity. With the aging population in the United States expected to reach 78 million by 2035, the number of cataract cases is likely to increase exponentially. According to the National Eye Institute, there will be an estimated 38 million cataract surgeries performed annually in the U.S. by 2032. This growing patient population directly drives the demand for

Increasing Geriatric Population

The geriatric population is projected to reach approximately 80 million by 2040, with the fastest growth occurring within the age group of 65 and older. By end of 2025, the U.S. Census Bureau estimates that around 56 million individuals will be aged 65 and older. This demographic shift significantly drives the demand for intraocular lens implants as older individuals are more prone to develop cataracts and require vision correction. Additionally, the aging population tends to prioritize healthcare needs, thereby further increasing the incidence of cataract surgeries and the corresponding need for advanced intraocular lens options.

Market Challenges

High Cost of Surgery

While advancements in intraocular lens technologies have led to improved surgical outcomes, the costs associated with cataract surgery remain a significant barrier. The average out-of-pocket expense for cataract surgery in the United States can range from USD 3,000 to USD 5,000 per eye, depending on the complexity of the procedure and the type of lens used. These costs often deter patients without comprehensive insurance coverage from pursuing necessary treatments. According to the Centers for Medicare & Medicaid Services, over 60% of cataract surgeries are partially or fully covered by Medicare; however, high costs still pose risks for many patients needing lenses.

Regulatory Hurdles

The intraocular lens market faces numerous regulatory hurdles that can delay product launches and increase compliance costs. Approval processes for new products can take years, requiring extensive clinical trials to demonstrate safety and effectiveness. The U.S. Food and Drug Administration (FDA) meticulously reviews the data, and the process can prolong the entry of innovative lenses to the market. Recent data indicates that the average time for medical device approval by the FDA has been upwards of 3 years, which can significantly affect the competitiveness of new entrants in the intraocular lens market.

Opportunities

Growth in Medical Tourism

Medical tourism is emerging as a significant opportunity for the intraocular lens market, particularly as patients seek affordable and high-quality eye care services abroad. In 2023, it was estimated that approximately 1.4 million Americans traveled abroad for various medical treatments, including cataract surgery. The affordability and quality of care in destinations like Mexico and Costa Rica have become compelling draws for patients seeking reduced costs for surgery and lenses. This trend is bolstered by an increase in technological capabilities in foreign markets, allowing them to provide quality services at competitive prices.

Innovation in Lens Design

The push for innovation in intraocular lens design presents a formidable opportunity for market players as patient demands evolve. Recent advancements focus on creating lenses that address specific vision problems, such as astigmatism and presbyopia, leading to smarter lens solutions. Companies are currently investing significantly into R&D, with statistics revealing that the global spend on healthcare R&D has reached over USD 200 billion, fostering a conducive environment for breakthrough technologies in lens design.

Future Outlook

Over the next five years, the North America Intraocular Lens market is expected to show significant growth driven by continuous advancements in lens technologies, increasing consumer demand for personalized surgical options, and expanding geriatric population. Moreover, the rising awareness about vision correction solutions will support sustainable market growth, leading to innovative product introductions and improved surgical techniques.

Major Players

- Alcon

- Johnson & Johnson Vision

- Bausch + Lomb

- Hoya Surgical Optics

- Staar Surgical

- Rayner Intraocular Lenses

- Abbvie (Allergan)

- Ophtec

- Capitol Medical

- Carl Zeiss AG

- Santen Pharmaceutical

- Eagle Vision

- MediGlobe

- Nidek Co., Ltd.

- Creations IOL

Key Target Audience

- Ophthalmic Surgeons

- Hospitals and Surgical Centers

- Eye Care Professionals

- Medical Equipment Distributors

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (FDA, Health Canada)

- Insurance Providers

- Pharmaceutical Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Intraocular Lens Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including regulatory factors, technological advancements, and demographic trends.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the North America Intraocular Lens Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, thereby establishing a robust foundation for future forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data. Expert feedback will help validate market trends and product innovations, enhancing the research accuracy.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple intraocular lens manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the North America Intraocular Lens Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Prevalence of Cataracts

Advancements in Lens Technologies

Increasing Geriatric Population - Market Challenges

High Cost of Surgery

Regulatory Hurdles - Opportunities

Growth in Medical Tourism

Innovation in Lens Design - Trends

Adoption of Digital Health Solutions

Increasing Demand for Customized Solutions - Government Regulation

FDA Guidelines

Reimbursement Policies - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Monofocal Lenses

– Aspheric Monofocal Lenses

– Spheric Monofocal Lenses

– UV-Blocking Monofocal Lenses

Multifocal Lenses

– Refractive Multifocal Lenses

– Diffractive Multifocal Lenses

– Apodized Multifocal Lenses

Toric Lenses

– Monofocal Toric Lenses

– Multifocal Toric Lenses

– Custom Toric Designs

Extended Depth of Focus (EDOF) Lenses

– Non-Diffractive EDOF

– Diffractive EDOF

-Hybrid EDOF Technology - By Material Type (In Value %)

Silicone

– Hydrophobic Silicone

– Hydrophilic Silicone

Acrylic

– Hydrophobic Acrylic

– Hydrophilic Acrylic

– Blue-Light Filtering Acrylic

Polymethyl Methacrylate (PMMA)

– UV-Filtering PMMA

– Non-UV PMMA

– Foldable vs. Rigid PMMA - By End User (In Value %)

Hospitals

– Public Hospitals

– Private Multi-Specialty Hospitals

– Eye Specialty Units within Hospitals

Ambulatory Surgical Centers (ASCs)

– Independent Ophthalmic ASCs

– Hospital-Affiliated ASCs

– Specialty Day-Surgery Eye Centers

Ophthalmology Clinics

– Standalone Eye Clinics

– Chain Eye Clinics (e.g., LASIK centers)

– Refractive Surgery Centers - By Distribution Channel (In Value %)

Direct Sales

– Manufacturer-to-Hospital Contracts

– Direct Sales to ASCs & Large Chains

Distributors

– Medical Device Distributors

– Specialty Ophthalmic Distributors

Online Sales

– Manufacturer B2B Portals

– Licensed Medical E-Commerce Platforms - By Geography (In Value %)

United States

Canada

Mexico

- Market Share of Major Players on the Basis of Value, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength and Weakness, Organizational Structure, Revenues, Revenues by Product Type, Product Portfolio Breadth, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Production Capacity, Regulatory Approvals & Certifications, R&D Investment and Pipeline Products, Unique Value Offering, Geographic Market Reach, OEM Partnerships & Surgeon Training Programs)

- SWOT Analysis of Major Players

- Pricing Analysis Based on SKUs for Major Players

- Detailed Profiles of Major Companies

Alcon Labs

Johnson & Johnson Vision

Bausch + Lomb

Carl Zeiss AG

Hoya Surgical Optics

Rayner Intraocular Lenses

Abbott Medical Optics

Novartis

Essilor

eyeCRO

Ophtec

STAAR Surgical

Nidek Co., Ltd.

Santen Pharmaceutical

Xcellent Surgical Inc.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030