Market Overview

As of 2024, the Oman auto finance market is valued at USD ~ billion, with a growing CAGR of 5.4% from 2024 to 2030. This value is driven by a combination of factors, including robust economic growth and a rising middle-class population that is increasingly inclined toward vehicle ownership. Financial institutions in Oman are providing competitive interest rates and flexible financial products, which further contribute to the market’s expansion. Reports from industry analyses underline the dynamic increase in consumer spending power and the growing significance of automotive financing options.

Muscat and Salalah dominate the Oman auto finance market, largely due to their dense population and economic activities as central hubs for business and trade. These cities have a high penetration of banking and financial services, facilitating easier access to auto financing. The presence of corporate headquarters of major financial institutions also contributes to the dominance of these areas, making vehicle financing more accessible to both individual and business customers.

Market Segmentation

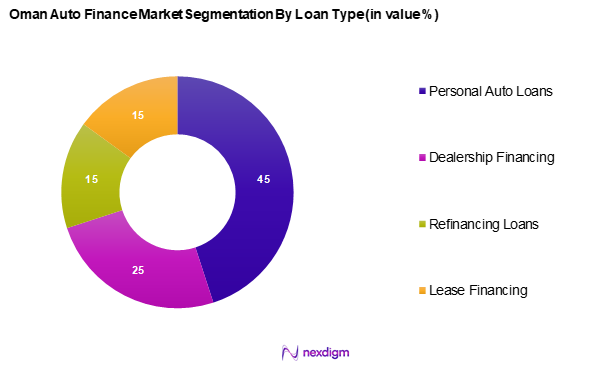

By Loan Type

Oman’s auto finance market is segmented into personal auto loans, dealership financing, refinancing loans, and lease financing. Personal auto loans dominate the market share due to their widespread availability and flexibility in terms of tenure and interest rates. Financial institutions focus on personal loans because individuals constitute a substantial portion of the consumer base, looking to finance their personal vehicles with easier repayment plans.

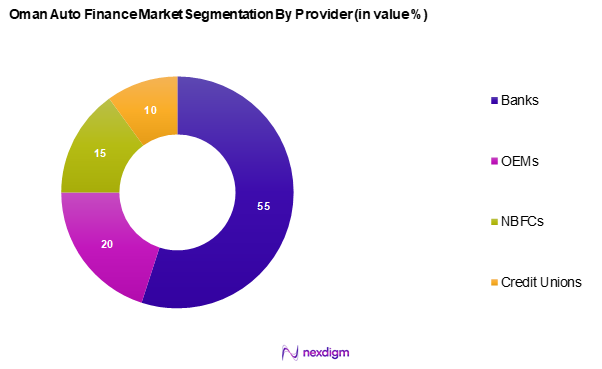

By Provider

Oman’s auto finance market is segmented into banks, OEMs, NBFCs, and credit unions. Banks hold a dominant market share mainly due to their established reputation, extensive branch networks, and trustworthiness. They offer customized financial products and competitive interest rates, attracting a large number of consumers. Banks also have robust customer service infrastructure which enhances consumer confidence in securing loans for vehicle purchases.

Competitive Landscape

The Oman auto finance market is structured with a mix of local and regional players. Key players include banks like Bank Muscat and National Bank of Oman, which leverage their extensive networks and financial products to capture market share. The consolidation in the market underscores the importance and influence of these dominant institutions that have a deep understanding of local consumer behavior and financial needs.

| Company | Establishment Year | Headquarters | Interest Rates | Loan

Portfolio |

Number of Branches | Digital Platforms |

| Bank Muscat | 1982 | Muscat, Oman | – | – | – | – |

| National Bank of Oman | 1973 | Muscat, Oman | – | – | – | – |

| Oman Arab Bank | 1984 | Muscat, Oman | – | – | – | – |

| HSBC Bank Oman | 1948 | Muscat, Oman | – | – | – | – |

| Bank Dhofar | 1990 | Salalah, Oman | – | – | – | – |

Oman Auto Finance Market Analysis

Growth Drivers

Increasing Car Ownership

Oman is witnessing a steady rise in personal vehicle ownership, a key factor propelling the auto finance market. This growth is largely influenced by rising living standards and a stable economic environment, which together enhance consumers’ capacity to invest in personal transportation. A strong job market further supports consumer confidence, leading to increased demand for vehicle financing solutions. As more individuals view personal vehicles as a necessity rather than a luxury, the role of auto loans in facilitating ownership continues to expand.

Rise in Middle-Class Population

The expanding middle-class demographic plays a crucial role in shaping the auto finance landscape in Oman. As more people experience economic mobility, they are showing a higher willingness to adopt lifestyle upgrades such as personal vehicles. This shift is supported by growing disposable incomes, encouraging financial institutions to develop more personalized and accessible financing options. The increasing aspiration for personal convenience and mobility is prompting lenders to cater to this upwardly mobile segment with competitive loan products.

Market Challenges

Regulatory Compliance Issues

The regulatory framework governing the financial sector in Oman presents ongoing challenges for auto finance providers. Strict compliance requirements demand that institutions allocate considerable time and resources toward meeting guidelines related to transparency and consumer protection. While these regulations are vital for maintaining market integrity and protecting borrowers, they can restrict lenders’ ability to quickly adapt to changing market needs or to launch innovative financing products with ease.

Economic Fluctuations

Economic fluctuations present notable challenges, affecting the stability of the auto finance market in Oman. The IMF’s recent economic outlook indicated fluctuations in oil prices and GDP growth stalling around 2.7%, leading to unpredictable shifts in consumer confidence. Economic uncertainty tends to make consumers and businesses cautious about committing to long-term financial obligations such as auto loans.

Opportunities

Adoption of Digital Financing Solutions

The increasing integration of digital technologies into financial services presents a significant growth opportunity for the auto finance sector in Oman. As consumers grow more comfortable with online platforms, lenders are in a strong position to offer end-to-end digital loan services that enhance convenience and accessibility. Digital finance not only improves the customer experience but also allows institutions to streamline their operations and reach a wider audience, especially tech-savvy younger consumers.

Expansion in Rural Financing Programs

The rural market in Oman remains relatively untapped in terms of vehicle financing, presenting a compelling opportunity for growth. Government-led initiatives to improve financial inclusion have spotlighted the need for targeted lending programs in less urbanized areas. By offering customized finance products designed for rural populations, financial institutions can address mobility needs while also contributing to broader national goals around balanced regional development.

Future Outlook

Over the next five years, the Oman auto finance market is anticipated to experience substantial growth, bolstered by technological advancements, growing awareness of auto financing options, and expansion of rural financing programs. Government policies supporting financial inclusion and digital transformation will also play pivotal roles in shaping the future landscape of auto finance in Oman.

Major Players

- Ahli Bank

- Al Omaniya Financial Services

- Bank Nizwa

- Muscat Finance

- National Finance

- Oman Arab Bank

- Oman Orix Leasing

- Taageer Finance

- United Finance

- Sohar Islamic

- National Bank of Oman (NBO)

- Bank Dhofar

- Bank Muscat

- HSBC Bank Oman

- Oman Development Bank

Key Target Audience

- Automotive Manufacturers

- Financial Institutions

- Investment and Venture Capitalist Firms

- Banking and Financial Regulators (e.g., Central Bank of Oman)

- Automotive Dealerships

- Insurance Providers

- Government and Regulatory Bodies (e.g., Ministry of Commerce and Industry, Oman)

- Technology Solution Providers

Research Methodology

Step 1: Identification of Key Variables

The research initiates with mapping the auto finance market’s ecosystem in Oman, identifying key stakeholders like banks, financial service providers, and regulatory bodies. Comprehensive secondary research helps in defining influential variables affecting the market dynamics.

Step 2: Market Analysis and Construction

Historical data is analyzed to understand market penetration, customer demographics, and the financial institutions’ service provision spread. This phase also includes revenue assessment and customer satisfaction measurements to ensure data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses are validated through interviews with industry experts from prominent financial entities. These consultations provide practical insights into broader market trends and operational challenges faced by stakeholders.

Step 4: Research Synthesis and Final Output

Collaboration with major automotive and finance companies is done to validate data obtained from secondary research. This step ensures a comprehensive, accurate analysis reflecting the real-time market scenario in Oman.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Industry Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Car Ownership

Rise in Middle-Class Population - Market Challenges

Regulatory Compliance Issues

Economic Fluctuations - Opportunities

Adoption of Digital Financing Solutions

Expansion in Rural Financing Programs - Trends

Growth in Peer-to-Peer Lending

Increased Consumer Awareness - Government Regulation

Financial Conduct Authority Guidelines

Consumer Credit Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Interest Rates, 2019-2024

- By Loan Type, (In Value %)

Personal Auto Loans

Dealership Financing

Refinancing Loans

Lease Financing - By Borrower Profile, (In Value %)

Individual Borrowers

Businesses/Corporate Entities

Governmental Entities - By Vehicle Type, (In Value %)

New Vehicles

Used Vehicles - By Payment Schedule, (In Value %)

Monthly Payments

Bi-Weekly Payments

Annual Payments - By Provider, (In Value %)

Banks

OEMs

NBFCs

Credit Unions - By Interest Rate Type, (In Value %)

Fixed Rate

Variable Rate - By Region, (In Value %)

Muscat

Salalah

Sohar

Nizwa

Others

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type Loan Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, Number of Dealers, Unique Value Offerings, Customer Innovations)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Competitors

Ahli Bank

Al Omaniya Financial Services

Bank Nizwa

Muscat Finance

National Finance

Oman Arab Bank

Oman Orix Leasing

Taageer Finance

United Finance

Sohar Islamic

National Bank of Oman (NBO)

Bank Dhofar

Others

- Market Demand and Utilization

- Borrower Spending Behaviour

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Interest Rates, 2025-2030