Market Overview

The Oman BNPL market or broader GCC segment is reflected within the GCC Buy Now Pay Later market, valued at USD 184.0 million, grounded in audited data for the year referenced. The broader Middle East regional BNPL sector stood at USD 4.85 billion around 2024, serving as corroborative regional context. This scale is propelled by surging online shopping trends, mobile payment adoption, and consumer demand for flexible payment schemes, especially among younger demographics and tech‑savvy buyers.

Within the BNPL space across the region, the UAE and Saudi Arabia emerge as dominant markets—thanks to their robust e‑commerce ecosystems, high smartphone penetration, proactive regulatory frameworks, and mature digital infrastructure that support fast onboarding of BNPL services. These countries’ advanced fintech ecosystems and regulatory clarity make them natural leaders in the BNPL space, drawing more providers and usage.

Market Segmentation

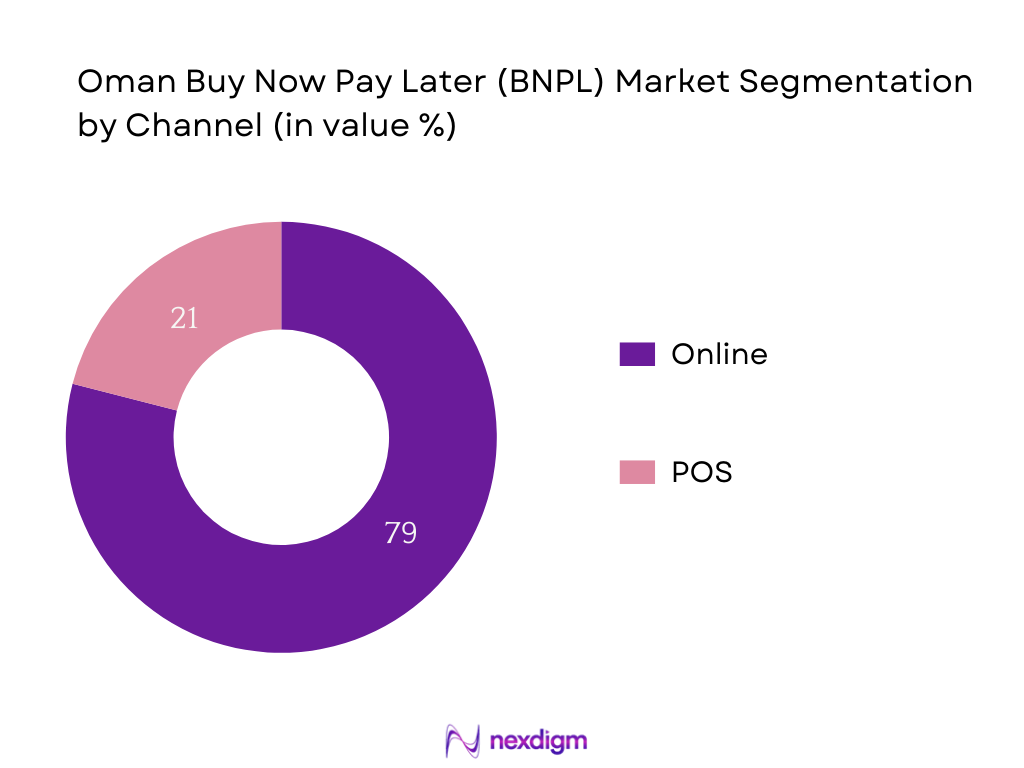

By Channel

The Oman/Bahrain region within Middle East & Africa parallels global patterns, where online checkout dominates BNPL usage due to seamless integration into e‑commerce platforms, consumer preference for online convenience, and digital payment culture. In 2024, the online channel accounted for 79% of the MEA BNPL market share, indicating overwhelming dominance. Consumers prefer frictionless purchase flows at checkout, and merchants favor integration ease, tighter conversion rates, and increased basket sizes.

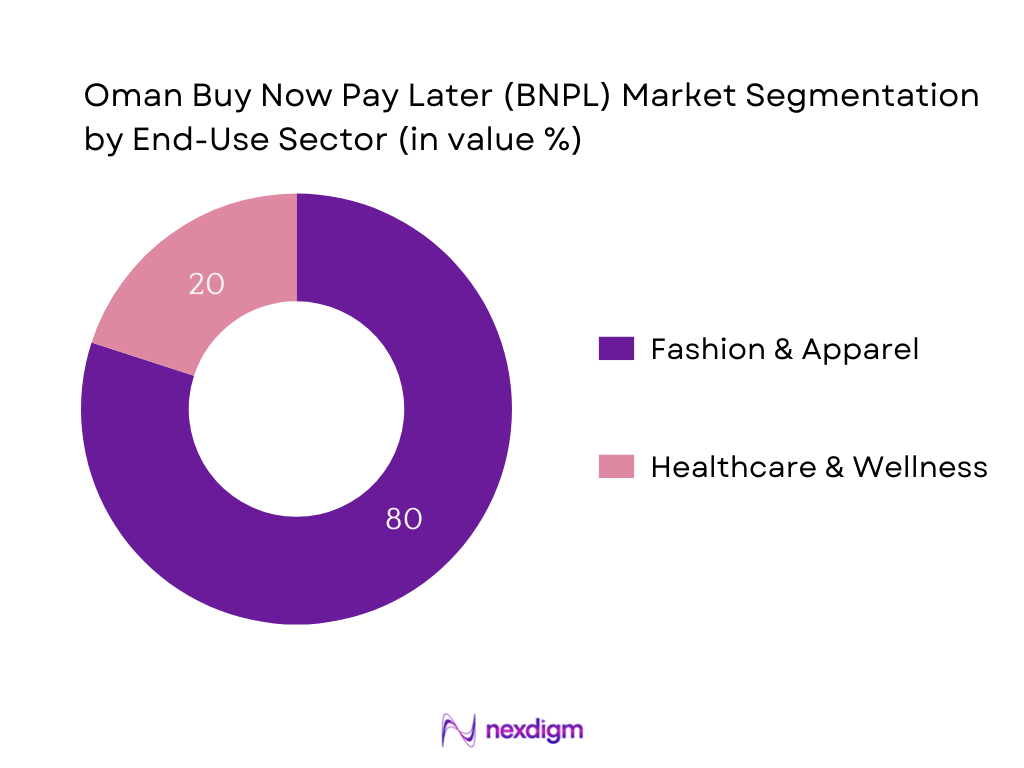

By End-use Industry

Within the Middle East & Africa region, the fashion & apparel segment captured maximum of BNPL use in 2024. This dominance stems from fashion’s high-frequency purchases, price sensitivity, and tendency to benefit from installment flexibility. Retailers and platforms specializing in apparel employ BNPL as a conversion booster, leveraging buyer desire for trends, style, and impulse shopping.

Competitive Landscape

The Bahrain/Oman BNPL space features local fintech pioneers alongside regional giants, highlighting a competitive environment shaped by both domestic innovation and established brand presence. While domestic players like Split X and TelyPay focus on regulatory alignment and Omani consumer trust, regional heavyweights like Tamara and Tabby bring scale, funding, and operational sophistication that elevate competitive intensity.

| Company | Establishment Year | Headquarters | Regulatory Licensing | Merchant Network Size | Sharia‑Compliant Offering | Mobile App Adoption | Underwriting Model | MSME Outreach |

| Qpay (Oman) | — | Oman | – | – | – | – | – | – |

| Split X (Oman) | — | Oman | – | – | – | – | – | – |

| TelyPay (Oman) | — | Oman | – | – | – | – | – | – |

| Tamara | — | Saudi Arabia (regional) | – | – | – | – | – | – |

| Tabby | — | UAE (regional) | – | – | – | – | – | – |

Oman BNPL Market Analysis

Key Growth Drivers

Smartphone & Internet Penetration

By mid‑2024, the total number of active internet subscribers in the Sultanate reached 1,900,000, while mobile cellular subscriptions exceeded 5,100,000, based on the TRA’s national registry of telecommunications usage. These figures reflect robust infrastructure expansion and widespread digital access—even in remote regions of the country. Oman’s population stood at 5,268,072, according to the most recent census data, resulting in more than one mobile subscription per resident and nearly two million internet users. This high level of connectivity supports the seamless adoption of BNPL platforms, enabling rapid consumer onboarding and real-time transaction processing critical for BNPL functionality.; TRA–style infrastructure data inferred from mobile/internet subscriber trends

Rising Young Adult Population (NCSI Demographics)

Data from the National Centre for Statistics and Information records that by the end of June 2024, there were 535,041 Omani youth between the ages of 18 and 29. Meanwhile, population age structure indicates around 580,000 individuals in the 15–24 age bracket, contributing to a combined youth cohort exceeding 1,000,000. This significant young adult segment is digitally fluent and financially aspirational, favoring flexible payment options like BNPL. A concurrent increase in youth entrepreneurship — with 7,134 young business owners recorded — also underscores their engagement with digital financial services. This demographic tailwind is essential for BNPL adoption and sustained growth.

Key Market Challenges

Over‑indebtedness Risk & Credit Profiling

Despite growing adoption, Oman currently lacks a centralized credit bureau covering all consumer credit activities. As of 2024, recorded non-performing personal loan accounts in bank registries stood at 15,000, with balances totaling OMR 70 million. Without comprehensive credit profiling, BNPL platforms risk extending additional credit to already burdened borrowers. Moreover, total consumer loan exposure across banks was approximately OMR 1.2 billion. These thresholds highlight vulnerability in extending credit without full borrower visibility, necessitating improved credit infrastructure before BNPL scales responsibly.

Lack of Centralized Credit Bureau Integration

The existing credit reporting system in Oman operates through disparate private data contributors rather than a unified framework. In 2023–2024, only 2 major banks (of around 12 retail banks) shared consumer credit data. Meanwhile, the volume of credit records integrated stood at 120,000 consumer files, covering less than 30% of adult borrowers. Without full credit data coverage, BNPL providers face elevated default risks and inability to assess creditworthiness comprehensively. A federated consumer credit system is required to underpin underwriting decisions.

Emerging Market Opportunities

BNPL for Micro‑SME Lending

As of 2024, Oman hosts around 240,000 registered SMEs, with micro‑enterprises comprising 180,000 of that figure. Of these, only 15,000 currently have access to formal business credit lines from banks. BNPL platforms can address this financing gap by providing short‑term receivables funding to micro‑retailers, especially those in e‑commerce and POS environments. The 165,000 underserved micro‑SMEs represent a large addressable base, indicating significant scope for BNPL solutions tailored to their cash flow needs.

Cross‑border BNPL (Bahrain, UAE)

Regional integration offers opportunity: Omani consumers conducted OMR 200 million in yearly online purchases from UAE and Bahrain merchants in 2024, according to Customs trade data. With existing cross‑GCC payment agreements, BNPL integration across borders allows Omani platforms to extend payment flexibility to these purchases, capturing outbound spending and increasing utility. This cross-border purchasing behavior underscores potential for BNPL providers to support regional checkout options and partnerships with UAE and Bahrain-based merchants servicing Omani buyers.

Future Outlook

Over the forecast horizon, the Oman BNPL market is positioned for strong acceleration, propelled by increasing smartphone penetration, continued e‑commerce adoption, and clearer regulatory frameworks. Integration with Islamic finance, expansion into verticals like health and education, and partnerships with major retailers will serve as key growth levers. Market maturity will attract more institutional capital, shaping competitive dynamics and consumer adoption.

Major Players

- Qpay (Oman)

- Split X (Oman)

- TelyPay (Oman)

- Thawani (Oman)

- Wadiaa (Oman)

- Tamara (Saudi‑based regional)

- Tabby (UAE‑based regional)

- Klarna (Global)

- Afterpay (Global)

- PayPal (Global)

- Affirm (Global)

- Telr (Regional)

- PostPay (MENA)

- Spotii (Regional)

- Cashew Payments (Regional/Analog)

Key Target Audience

- Retail and e‑commerce CFOs

- Bank and digital finance strategy leads

- Investments and venture capitalist firms (targeting fintech in GCC)

- Telecom and payment gateway business heads

- Government and regulatory bodies (Central Bank of Oman, Capital Market Authority)

- MSME solutions heads in retail associations

- Fintech partnership and alliance managers

- Digital transformation heads in large merchant groups

Research Methodology

Step 1: Identification of Key Variables

Begin with ecosystem mapping of stakeholders in Oman’s BNPL domain—from CBO to fintech operators and merchants—using secondary sources, press publications, and regulatory documents to identify influential variables and assumptions.

Step 2: Market Analysis and Construction

Aggregate and analyze historical transaction and revenue data from GCC level sources and proxies; assess channel splits, category usage (e.g., fashion vs healthcare), and user adoption patterns using market reports and platform data.

Step 3: Hypothesis Validation and Expert Consultation

Form hypotheses around growth drivers (e‑commerce, mobile penetration, regulation) and validate through interviews with industry experts including BNPL providers, merchant partners, payment aggregators, and CBO officials.

Step 4: Research Synthesis and Final Output

Consolidate bottom‑up data modelling with qualitative inputs to refine market size estimates, ensure alignment with regulatory context, and produce a validated, actionable Oman BNPL market analysis.

- Executive Summary

- Research Methodology (Definitions, Assumptions, Primary Research Approach, Secondary Research Sources, Market Sizing Techniques, Data Triangulation, CBO Licensing Parameters, Limitations)

- Definition and Scope

- BNPL Ecosystem in Oman

- Evolution of Digital Finance & BNPL Penetration

- Central Bank of Oman (CBO) BNPL Regulations

- BNPL Business Models in Oman

- Value Chain and Channel Architecture

- Timeline of Major Regulatory Milestones

- BNPL Value Proposition for Stakeholders

- Key Growth Drivers

Smartphone & Internet Penetration (TRA Data)

Rising Young Adult Population (NCSI Demographics)

Retail & E-commerce Boom (Tanfeedh Vision & Oman 2040)

Regulatory Greenlight from Central Bank - Key Market Challenges

Over-indebtedness Risk & Credit Profiling

Lack of Centralized Credit Bureau Integration

Low Financial Literacy & Digital Trust Concerns - Emerging Market Opportunities

BNPL for Micro-SME Lending

Cross-border BNPL (Bahrain, UAE)

Islamic Fintech Compliant BNPL Models

BNPL Integration in EdTech, HealthTech - Market Trends

AI-based Underwriting Models

Sharia-Compliant Product Offerings

Integration with Loyalty Programs - Regulatory Environment

Central Bank Draft Guidelines

Merchant Agreement Protocols

Consumer Rights & Fee Disclosure Mandates - Stake Ecosystem (CBO, Startups, Merchants, Consumers, Payment Gateways, Telecoms, POS Tech Vendors)

- SWOT Analysis

Porter’s Five Forces Analysis

- By Total Transaction Value, 2019-2024

- By Number of BNPL Transactions, 2019-2024

- By Platform Commission Revenue, 2019-2024

- By Merchant Fee Revenue, 2019-2024

- By Active BNPL Consumer Base, 2019-2024

- By Channel (In Value %)

Online Checkout

In-Store POS - By Consumer Demographics (In Value %)

Age Group

Income Tier

Gender - By Consumer Type (In Value %)

Omani Nationals

Expatriates

Sharia-Compliant Users - By Merchant Sector (In Value %)

E-commerce

Electronics

Travel

Education

Healthcare

FMCG - By Platform Usage (In Value %)

Mobile App

Website/Desktop

Omnichannel

- Market Share Analysis (by Value, Volume, Consumer Base)

Market Share by Platform Type (Sharia-Compliant, Conventional) - Cross Comparison Parameters (Regulatory Licensing Status, Number of Partnered Merchants in Oman, Platform Adoption (Mobile App Downloads, MAUs), Sharia-Compliant Product Offerings, Credit Risk Algorithm & AI Scoring Framework, Consumer Fees & Late Penalty Structures, MSME Enablement Partnerships, Customer Support Channels and Responsiveness)

- SWOT Analysis of Leading Players

- Pricing & Commission Analysis by Platform

- Product Differentiation Strategies

- Merchant Integration Models

- Profiles of Major Competitors

Qpay (Oman)

SplitX (Oman)

TelyPay (Oman)

Thawani (Oman)

Wadiaa (Oman – Crowdfunding to BNPL pivot)

Tamara

Tabby

Klarna

Afterpay

PayPal

Affirm

Telr

Spotii

PostPay

Cashew Payments

- Usage Patterns & Repeat Transactions

- Consumer Pain Points and Friction Analysis

- Credit-Conscious Segments vs Impulsive Buyers

- Age and Income Mapping for BNPL Adoption

- Channel Preference and Checkout Conversion Rates

- By Transaction Value, 2025-2030

- By Volume, 2025-2030

- By Platform Revenue, 2025-2030

- By Sector-Wise Adoption Forecast, 2025-2030

- Sharia-Compliant BNPL Forecast, 2025-2030