Market Overview

As of 2024, the Oman car rental and leasing market is valued at USD ~ million, with a growing CAGR of 5.1% from 2024 to 2030. This growth is propelled by an increase in tourism and the subsequent demand for rental vehicles, alongside a burgeoning corporate sector requiring flexible transportation options. As of 2024, the estimated market size continues to rise, bolstered by economic diversification efforts, enhancing Oman’s attractiveness for both leisure and business travel.

Muscat and Salalah are dominant cities in the Oman car rental and leasing landscape. Their growth is driven largely by robust tourism activities and significant foreign investment. Muscat, as the capital, serves as both a business hub and a transport gateway, while Salalah’s appeal as a tourist destination further fuels rental demand. The combination of infrastructure development and affluent consumer bases cements the prominence of these cities in the market.

Market Segmentation

By Vehicle Type

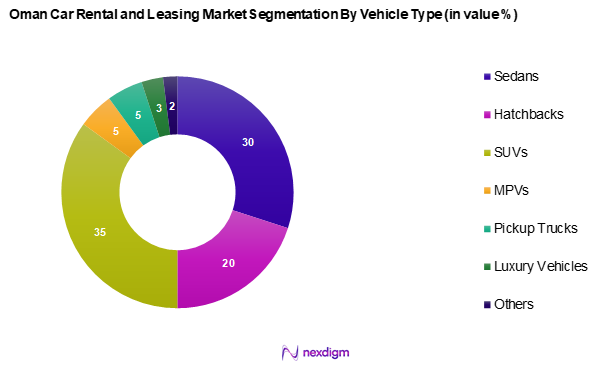

The Oman car rental and leasing market is segmented into sedans, hatchbacks, SUVs, MPVs, pickup trucks, luxury vehicles, and others. SUVs have a dominant market share due to their versatility and popularity among consumers seeking comfort and space. This segment is particularly favored by tourists exploring Oman’s diverse landscapes, as well as by local businesses needing reliable vehicles. Additionally, numerous global and local brands offer a variety of SUV models, further popularizing this vehicle type.

By Rental Duration

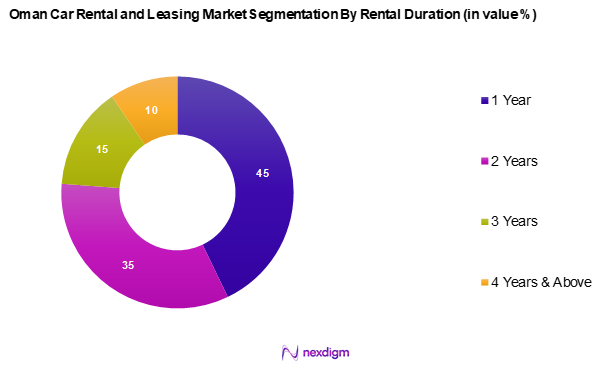

The Oman car rental and leasing market is segmented into 1-year, 2-year, 3-year, and 4 years & above. Long-term rentals, particularly the 1 to 2-year segments, capture the majority of the market share as businesses and government agencies often prefer leasing vehicles for extended periods due to cost-effectiveness and maintenance benefits. Moreover, the increasing trend of corporate clients toward outsourcing their transportation needs further solidifies the dominance of this segment.

Competitive Landscape

The Oman car rental and leasing market is highly competitive, characterized by several key players, including local operators and international brands. The presence of established companies such as Hertz and Avis enhances market dynamics. These companies leverage extensive networks and diverse fleets to maintain a significant competitive advantage in the market.

| Major Player | Establishment Year | Headquarters | Fleet Size | Market Strategy | Strengths | Weaknesses |

| The Hertz System, Inc. | 1918 | Estero, Florida | – | – | – | – |

| Sixt | 1912 | Pullach, Germany | – | – | – | – |

| Avis Rent A Car System, LLC | 1946 | New Jersey, U.S.A. | – | – | – | – |

| Budget Rent A Car System, Inc. | 1958 | New Jersey, U.S.A. | – | – | – | – |

| Enterprise Holdings, Inc. | 1957 | Missouri, U.S.A. | – | – | – | – |

Oman Car Rental and Leasing Market Analysis

Growth Drivers

Tourism Growth

Tourism is a powerful growth driver for the Oman car rental and leasing market, contributing significantly to the overall demand for rental vehicles. In 2023, approximately 4 million tourists visited Oman, with tourism contributing approximately USD 7.2 billion to the country’s GDP. The Oman Tourism Strategy 2040 aims to attract 11 million tourists by 2040, indicating a strong commitment to developing the sector. Such projections suggest increasing demand for transportation solutions like car rentals to accommodate tourists exploring Oman’s cultural and natural attractions, further stimulating the market growth.

Economic Diversification

Oman’s efforts towards economic diversification are vital in growing the car rental and leasing market. The Sultanate’s Vision 2040 aims to reduce reliance on oil revenue, pushing sectors such as tourism, logistics, and manufacturing. The non-oil sector’s contribution to the GDP is projected to grow from 61% in 2022 to 71% by 2025. As the economy diversifies, a larger corporate sector is emerging, leading to increased demand for rental vehicles among businesses seeking cost-effective transportation solutions, thus providing substantial growth opportunities in this market.

Market Challenges

Regulatory Compliance

Regulatory compliance poses a challenge for the Oman car rental and leasing market. As the government strives to enhance road safety and environmental standards, the implementation of stricter vehicle regulations can increase operational costs for rental operators. In 2022, the Royal Oman Police reported a 23% increase in traffic inspections to enforce safety regulations. In addition, compliance with the environment-related regulations, such as emissions standards, will necessitate investments in upgrading fleets and adapting business models, which can be a significant burden for smaller operators.

Competition from Ride-Hailing Services

The popularity of ride-hailing services has introduced a new layer of competition to traditional rental businesses. Consumers are increasingly drawn to the convenience and flexibility offered by app-based transport solutions, which can diminish demand for conventional rentals.

Opportunities

Growth in E-commerce Delivery

The rapid growth of e-commerce presents a significant opportunity for the car rental and leasing market in Oman. In 2023, e-commerce sales in the country surged to approximately OMR 400 million, driven by an increasing number of online shoppers. This trend calls for efficient logistics and transportation solutions, including vehicle rentals for delivery purposes. As businesses look to enhance their last-mile delivery capabilities, car rental companies that provide specialized logistics services will likely thrive, capturing a larger share of the market.

Enhanced Customer Experience using Technology

Embracing technology to enhance customer experiences presents a robust growth opportunity within the Oman car rental market. In 2023, the digital landscape in Oman witnessed a significant growth trajectory, with internet penetration reaching 96.4% among the population. This shift encourages rental companies to invest in online booking systems, mobile applications, and customer relationship management tools, enabling a more streamlined and user-friendly service. As businesses adapt to these technological advancements, they can meet evolving consumer expectations and capture a broader customer base.

Future Outlook

Over the next five years, the Oman car rental and leasing market is expected to experience significant growth. Factors driving this expansion include the ongoing development of tourism infrastructure, increasing international travel to Oman, and a rising preference for flexible vehicle leasing options among both consumers and businesses. These elements collectively position the market for continued success and innovation, benefiting from both technological advancements and shifts in consumer behavior.

Major Players

- The Hertz System, Inc.

- Sixt

- Avis Rent A Car System, LLC

- Budget Rent A Car System, Inc.

- Enterprise Holdings, Inc.

- Dollar

- Discovery

- DRIVUS

- Autorent

- Al Maha Rent a Car

- Sunnycars

- Value Plus

- Hyundai Motor Oman

- Kia Corporation

- Others

Key Target Audience

- Investors and venture capitalist firms

- Government and regulatory bodies (Ministry of Transport, Oman Tourism Authority)

- Corporations requiring fleet solutions

- Travel agencies

- Hotels and resorts

- Oil and gas companies

- Event organizers and planners

- Logistics and transportation firms

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves creating a comprehensive ecosystem map that includes all significant stakeholders within the Oman car rental and leasing market. Extensive desk research is employed, utilizing both secondary and proprietary databases to gather relevant industry-level information. The primary goal is to identify and define the critical variables that influence market dynamics, providing a solid foundation for further analysis.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Oman car rental and leasing market is compiled and analyzed. This includes assessing market penetration rates, the ratio of rental services to consumer demand, and resultant revenue generation. Additionally, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, forming an integral part of the market assessment.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts via Computer-Assisted Telephone Interviews (CATI). These interviews involve professionals from various companies within the industry, providing valuable operational and financial insights. This step is crucial for refining and corroborating the market data gathered during previous analysis phases.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with multiple car rental and leasing companies to gather detailed insights about product segments, sales performance, consumer preferences, and additional relevant factors. This interaction serves to confirm and supplement the statistics derived from the previous analyses, ensuring a comprehensive, accurate, and validated analysis of the Oman Car Rental and Leasing Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Tourism Growth

Economic Diversification - Market Challenges

Regulatory Compliance

Competition from Ride-Hailing Services - Opportunities

Growth in E-commerce Delivery

Enhanced Customer Experience using Technology - Trends

Shift Towards Sustainable Fleet

Growth in Long-Term Leasing - Government Regulation

Licensing and Registration - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Daily Rental Rate, 2019-2024

- By Vehicle Type, (In Value %)

Sedans

Hatchback

SUVs

MPVs

Pickup Trucks

Luxury Vehicles

Others - By Rental Duration, (In Value %)

1 Year

2 Year

3 Year

4 Years & Above - By End-user Type, (In Value %)

Individual Consumers

Corporate Clients

Oil and Gas

Government militaries & ministries

Construction

Logistics and Transportation

Others - By Fuel Type, (In Value %)

Gasoline

Diesel

Electric - By Booking Type, (In Value %)

Offline Booking

Online Booking - By Services Type, (In Value %)

Airport Transfers

Interstate Services

Intrastate Services - By Rental Type, (In Value %)

Business Rental

Chauffeur Drive

Self-Driving

Special Events - By Market Structure, (In Value %)

Organized

Unorganized - By Region, (In Value %)

Muscat

Salalah

Sohar

Nizwa

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Vehicle Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenue, Distribution Channels, Number of Locations, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

The Hertz System, Inc.

Sixt

Avis Rent A Car System, LLC

Autorent

Discovery

DRIVUS

Budget Rent A Car System, Inc.

Dollar

Enterprise Holdings, Inc.

Sunnycars

Orbit

Value Plus

AUDI AG

Al Maha Rent a Car

Hyundai Motor Oman

Kia Corporation

Others

- Market Demand and Utilization Rate

- Purchasing Power and Behavioural Insights

- Regulatory Compliance and Customer Preferences

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Daily Rental Rate, 2025-2030