Market Overview

As of 2024, the Oman cold chain market is valued at USD ~ billion, with a growing CAGR of 11.1% from 2024 to 2030, reflecting robust growth driven by increasing demand for temperature-sensitive goods such as food and pharmaceuticals. The growth is propelled by rising consumer expectations for fresh produce, government initiatives to improve food safety standards, and the expansion of the food and beverage sector. With access to advanced cold chain logistics, operators are better equipped to meet these demands, ensuring product integrity throughout the supply chain.

Dominant cities in the Oman cold chain market include Muscat, Salalah, and Sohar, primarily due to their strategic locations and infrastructural developments. Muscat, the capital city, serves as a major hub for trade and logistics, enhancing access to both domestic and international markets. Salalah, with its port facilities, plays a significant role in facilitating seafood and perishable goods. Sohar is emerging as an industrial center, supporting the growth of cold chain facilities desired for an expanding population.

Market Segmentation

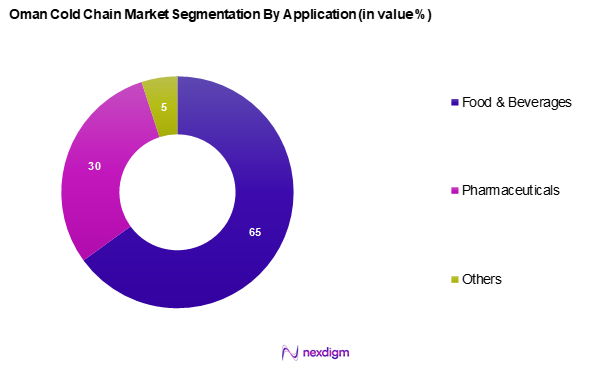

By Application

The Oman cold chain market is segmented into food & beverages, pharmaceuticals, and others. Food & beverages segment dominate this market, driven by increasing consumer preferences for fresh and high-quality products. Within this segment, dairy products lead due to high local consumption and demand for products like milk and cheese, which require strict temperature controls to maintain quality and safety. Food & beverages represent the largest proportion of the cold chain market due to the growing demand for diverse food products in Oman. The increasing trends toward healthy eating and an expanding retail sector underline the necessity for effective cold storage and transportation. Furthermore, local producers of fresh fruit and vegetables require cold chain solutions to prolong shelf life, thereby boosting this segment’s dominance within the broader market.

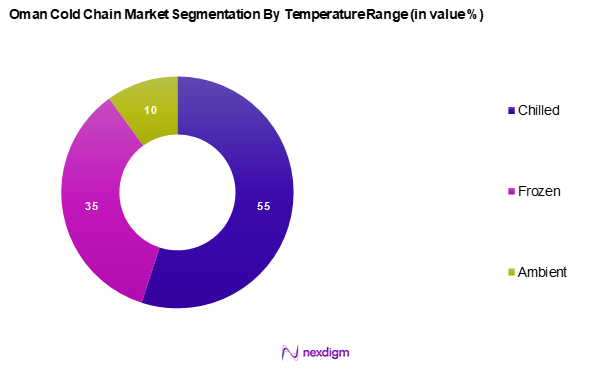

By Temperature Range

The Oman cold chain market is segmented into chilled, frozen, and ambient. The chilled segment is leading the market owing to the diverse range of products that require controlled temperatures, especially within the food sector, including dairy and meats. This segment is crucial, as it maintains product quality while extending the shelf life of perishable items. The dominance of the chilled temperature range in the Oman cold chain market is attributed to factors such as the increasing preference for fresh produce and the rise of the retail sector in urban areas. Retailers are investing in improved refrigeration systems to meet customer demands, particularly for fresh fruits, vegetables, and dairy, reinforcing the segment’s substantial market position.

Competitive Landscape

The Oman cold chain market is characterized by a competitive landscape dominated by major players, including local companies and international firms. The need for integrated logistics services has intensified market competition, allowing firms to leverage technology and innovation to improve service delivery. The Cold Chain market in Oman showcases several key players who have established themselves through innovation, extensive distribution networks, and strategic partnerships. Companies like Agility Logistics and ILS Logistics leverage their technological capabilities to enhance operational efficiencies, thereby reinforcing their competitive stance in meeting the rising demands of the cold chain sector.

| Company Name | Establishment Year | Headquarters | Market Share (%) | Specialization | Key Technology Used | Revenue (USD million) |

| Al Madina Logistics | 2007 | Muscat | – | – | – | – |

| ILS Logistics | 2010 | Salalah | – | – | – | – |

| Agility Logistics | 2008 | Muscat | – | – | – | – |

| Al Khaleej Cold Store | 2005 | Sohar | – | – | – | – |

| Modern Cold Industrialization Co. LLC | 2015 | Sohar | – | – | – | – |

Oman Cold Chain Market Analysis

Growth Drivers

Population Growth

Oman is witnessing a steady rise in its population, which is directly contributing to the growing demand for perishable goods such as fresh produce, dairy, and pharmaceuticals. With more people to feed and care for, the importance of efficient cold chain logistics has become increasingly critical. The population’s changing lifestyle preferences, including a greater focus on health, nutrition, and convenience, have further amplified the need for reliable cold storage and transportation systems. These demographic shifts are prompting both public and private sectors to invest in enhancing cold chain capabilities to ensure food safety and pharmaceutical integrity.

Growing Urbanization

The rapid urban expansion in Oman is transforming the retail and food distribution landscape, particularly in major cities like Muscat and Salalah. As more of the population relocates to urban areas, the demand for timely and quality delivery of perishable goods has surged. This urban-centric consumption trend has encouraged companies to upgrade and expand their cold chain logistics to serve high-density areas effectively. As retail formats evolve and consumer expectations rise, there is a growing emphasis on advanced temperature-controlled logistics to maintain product freshness and safety across the supply chain.

Market Challenges

Infrastructure Limitations

Despite growing demand, Oman’s cold chain market continues to face structural challenges, particularly in terms of outdated facilities and limited transportation networks in remote regions. Many cold storage units still require modernization to align with global best practices, which hampers the sector’s efficiency. Moreover, difficulties in accessing rural and less-developed areas add complexity to last-mile delivery, especially for temperature-sensitive goods. These infrastructure gaps create inconsistencies in product availability and quality, thereby restricting the sector from reaching its full potential.

High Operational Costs

The cost of operating cold chain logistics in Oman remains relatively high, mainly due to rising energy consumption and the increasing demand for skilled labor. Refrigeration systems, which are essential for preserving perishable items, consume a significant amount of power, making operations expensive—especially in the face of energy pricing trends. Additionally, retaining qualified personnel in logistics and cold storage management further contributes to the financial burden. These operational challenges can lead to tighter profit margins and may discourage smaller firms from entering or expanding within the market.

Opportunities

Investment in Technological Innovations

Technological advancements are opening new avenues for enhancing cold chain operations in Oman. The integration of automation, IoT-based temperature monitoring, and smart warehousing solutions is helping companies improve efficiency, reduce spoilage, and ensure compliance with safety standards. A growing number of logistics providers are adopting digital solutions to streamline inventory tracking and improve transparency across the supply chain. This shift toward tech-driven logistics is expected to be a key enabler for future market growth, offering opportunities for innovation and value-added services.

Expansion of Cold Chain Facilities

There is increasing momentum toward the development and expansion of cold chain infrastructure across the country. With strong support from government initiatives and private sector investments, new storage and distribution hubs are being established in strategically important locations. These developments are aimed at supporting both domestic supply chains and export logistics, particularly for food and pharmaceutical products. Enhanced infrastructure is expected to strengthen Oman’s position as a regional logistics hub, offering scalable and efficient cold chain services to meet growing market demands.

Future Outlook

Over the next several years, the Oman cold chain market is poised to experience significant growth driven by increasing consumer demand for fresh produce, pharmaceutical goods, and enhancements in cold chain infrastructure. With the government’s focus on food safety standards and optimization of logistics for perishables, the market is set to thrive. Advancements in technology, including IoT and automation, will further improve efficiency and reliability within the cold chain.

Major Players

- Al Madina Logistics

- ILS Logistics

- Agility Logistics

- Al Khaleej Cold Store

- Modern Cold Industrialization Co. LLC

- Himalaya Cold Room

- BrightLink Oman

- P. Moller – Maersk

- Enhance Oman

- Cold Chain Solutions LLC

- SeaLand Logistics

- Gulf Cold Chain

- Oman Cold Storage Co.

- Oman Logistics Company

- Al Safwa Cold Stores

Key Target Audience

- Retail Chains (Supermarkets and Hypermarkets)

- Food Processing Companies

- Pharmaceutical Companies

- Freight and Logistics Services Providers

- Importers of Perishable Goods

- Restaurants and Catering Services

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health, Ministry of Agriculture and Fisheries)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Oman cold chain market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Oman cold chain market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple cold chain service providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Oman cold chain market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Population Growth

Urbanization - Market Challenges

Infrastructure Limitations

High Operational Costs - Opportunities

Investment in Technological Innovations

Expansion of Cold Chain Facilities - Trends

Increasing Adoption of IoT in Cold Chain

Sustainable Practices in Cold Storage - Government Regulation

Food Safety Standards

Trade Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Application, (In Value %)

Food & Beverages

Dairy Products

Fish, Meat, and Seafood

Pharmaceuticals

Others - By Temperature Range, (In Value %)

Chilled

Frozen

Ambient - By Mode of Transportation, (In Value %)

Road

Rail

Air

Sea - By Market Structure, (In Value %)

Organized

Unorganized - By Service, (In Value %)

Storage

Transportation

Value-added Services - By Technology, (In Value %)

Blast Freezing

Evaporative Cooling

Vapor Compression

Cryogenic Systems

Programmable Logic Controller

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Application Segment, 2024 - Cross-Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Market Share, Technological Capabilities, Customer Base, Revenue, Distribution Networks, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Profiles of Major Companies

Al Madina Logistics

ILS Logistics

Agility Logistics

Al Khaleej Cold Store

Enhance Oman

Modern Cold Industrialization Co. LLC

Himalaya Cold Room

BrightLink Oman

Moller – Maersk

Others

- Consumer Demand and Behaviour

- Industry-Specific Requirements and Budget Allocations

- Needs Assessment of Key Stakeholders

- Decision-Making Processes in Procurement

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030