Market Overview

The Oman Education Market is valued at USD 4.5 billion, based on a comprehensive analysis developed from industry reports and educational institutions’ data. The growth of the education sector in Oman is driven primarily by government initiatives aimed at enhancing educational infrastructure, increasing enrollment rates, and improving the quality of education provided. Significant investments in digital learning and the integration of technology into the education system have further propelled market expansion.

Key cities such as Muscat, Sohar, and Salalah dominate the Oman Education Market due to their high population densities and the presence of major educational institutions. Muscat, as the capital, hosts a concentration of universities and vocational training centers, contributing to its educational leadership. Sohar’s strategic location along the coast supports access to international educational programs, while Salalah benefits from initiatives promoting higher education and vocational training in the southern region of Oman.

The Omani government has significantly increased its investment in education, allocating approximately OMR 3.3 billion (USD 8.57 billion) for the education sector in the 2023 budget. This represents an increase from OMR 2.9 billion in 2022 aimed at enhancing educational infrastructure and expanding existing facilities. Furthermore, the government plans to earmark 20% of its total budget for education in the future, emphasizing its commitment to achieving educational quality and accessibility nationwide. This sustained investment reflects the government’s focus on improving educational outcomes and fostering a skilled workforce.

Market Segmentation

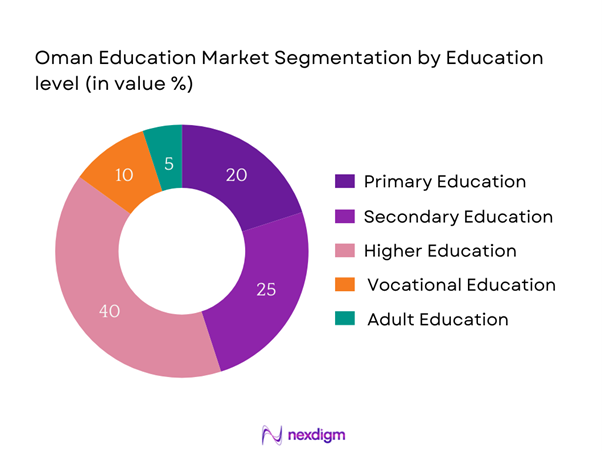

By Education Level

The Oman Education Market is segmented by education level into primary education, secondary education, higher education, vocational training, and adult education. Among these, higher education holds a dominant market share due to increasing demand for quality tertiary education and the establishment of several renowned universities and colleges. Initiatives by the Omani government to improve higher educational outcomes, alongside a growing emphasis on research and professional training, have led to significant enrollment increases in this segment. Additionally, partnerships with international institutions enhance the appeal of higher education, making it a preferred choice for students.

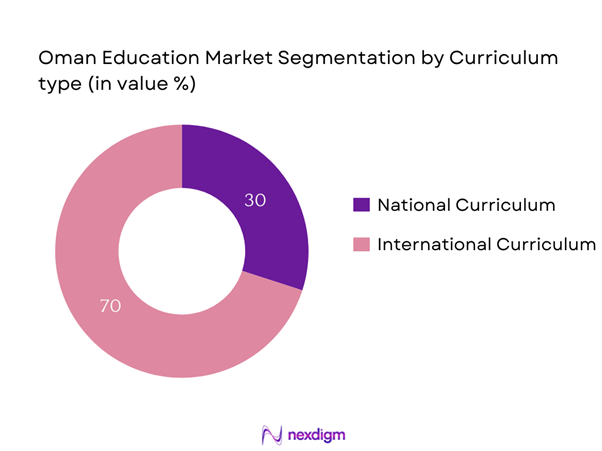

By Curriculum Type

The market is also segmented by curriculum type, which includes national curriculum and international curriculum. The international curriculum segment currently dominates the Oman Education Market due to a rising number of expatriates and local families seeking global education standards for their children. International schools offering Cambridge, IB, and American curriculums have gained popularity, catering to the growing demand for diverse educational options. This segment’s rapid growth is attributed to the emphasis on holistic education models that foster critical thinking and creativity, appealing to parents’ aspirations for their children’s global competitiveness.

Competitive Landscape

The Oman education market is dominated by a few major players, including established institutions such as Sultan Qaboos University and Muscat University, alongside private players. This consolidation illustrates the significant influence of these key organizations in shaping educational trends and standards within the country.

| Company | Establishment Year | Headquarters | Number of Students | Program Offerings | Partnership Institutions | Market Focus |

| Sultan Qaboos University | 1986 | Muscat | – | – | – | – |

| Muscat University | 2016 | Muscat | – | – | – | – |

| Dhofar University | 2004 | Salalah | – | – | – | – |

| British International School Muscat | 2004 | Muscat | – | – | – | – |

| International School of Oman | 2005 | Muscat | – | – | – | – |

Oman Education Market Analysis

Growth Drivers

Increasing Population and Urbanization

Oman’s population is expected to reach approximately 5.45 million by end of 2025, with urbanization rates around 88% as of 2022. This surge in population, particularly in urban areas, creates a higher demand for educational facilities and services. The increasing number of school-age children, estimated at around 900,000 in 2023, highlights the urgent need for quality education systems to cater to this growing demographic. Urbanization also drives families to seek better educational options, influencing the proliferation of private and international schools.

Demand for Skilled Workforce

The demand for a skilled workforce is rising due to the diversification efforts of the Omani economy, particularly as it transitions from oil dependency to sectors such as tourism and manufacturing. By end of 2025, it is anticipated that 60% of Oman’s workforce will require higher education and specialized training. The government has acknowledged this need and aims to increase the number of vocational training programs to over 100 by end of 2025, thus equipping youth with the necessary skills to meet industry demands and enhance employability.

Market Challenges

Regulatory Constraints

Oman’s education system faces regulatory challenges that can impede growth, primarily due to a stringent accreditation process. For example, the Ministry of Education has established rigorous standards that all institutions must meet for accreditation, which affects new and especially private institutions aiming to enter the market. Currently, over 30% of applicants seeking accreditation encounter significant delays and bureaucratic hurdles, leading to frustration among stakeholders and limiting quick responses to growing educational demands.

Quality of Education Concerns

Despite substantial investments in education, concerns regarding the quality of education remain prevalent. In assessments conducted in 2022, only 58% of students met the expected performance levels in mathematics and science, raising alarms about educational standards in public schools. The Omani government has initiated programs aimed at teacher training and curriculum improvement; however, immediate action is required to address the disparities in educational quality across various institutions. This differential access to quality education is increasingly problematic as global competitiveness intensifies.

Opportunities

Expansion of E-learning Platforms

The ongoing digital transformation in education presents significant opportunities for the Oman Education Market, particularly through the expansion of e-learning platforms. Current statistics indicate that internet penetration in Oman stands at approximately 98%, creating a robust foundation for online education. As of 2023, over 30% of students in higher education programs are enrolled in online or hybrid courses. This trend is expected to continue, especially with the government’s push to collaborate with educational technology firms to enhance learning experiences and accessibility for remote learners. Customized digital learning solutions are a clear path forward, promising to broaden educational outreach.

International Student Attraction

Oman is strategically positioning itself as an attractive destination for international students, capitalizing on its diverse culture and quality educational offerings. Currently, around 40,000 international students are enrolled in Omani educational institutions, with the government targeting a boost in these numbers through partnerships with global universities. Recent initiatives to simplify visa regulations and promote the country as a multicultural educational hub highlight a clear intention to attract talent and strengthen international collaborations. Enhanced marketing efforts and program recognition will likely increase enrollments significantly in the coming years.

Future Outlook

Over the next five years, the Oman Education Market is projected to experience substantial growth. Factors driving this expansion include continued investments in educational technology, increasing government support for higher education, and a rising emphasis on enhancing educational quality and accessibility. Furthermore, the integration of e-learning platforms is likely to attract more students, optimizing learning experiences and reaching underserved populations.

Major Players

- Sultan Qaboos University

- Muscat University

- Dhofar University

- British International School Muscat

- International School of Oman

- Oman International School

- Al Jazeera Academy

- Azzan Bin Qais University

- Muscat Institute of Health Sciences

- United Schools International

- College of Banking and Financial Studies

- Oman Medical College

- Majan University College

- Al Sharqiyah University

- Tawdheef Institute

Key Target Audience

- Governments and Regulatory Bodies (Ministry of Education, Oman)

- Investors and Venture Capitalist Firms

- International Educational Institutions

- Private Education Providers

- Corporate Training Organizations

- Non-Governmental Organizations (NGOs) focused on education

- Education Technology Firms

- Educational Policy Makers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Oman Education Market. Extensive desk research is employed, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as enrollment rates, institutional types, and educational outcomes.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Oman Education Market. This includes assessing market penetration, the ratio of educational institutions to students, and resultant revenue generation over recent years. An evaluation of service quality statistics is also conducted, ensuring the reliability and accuracy of the revenue estimates gathered during the research process.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through structured interviews with experts representing various educational institutions and organizations in Oman. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the identified market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple educational institutions to acquire detailed insights into program offerings, enrollment figures, student demographics, and other pertinent factors. This interaction verifies and complements the statistics derived from the preliminary research, ensuring a comprehensive, accurate, and validated analysis of the Oman Education Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Context and Evolution

- Timeline of Major Players

- Education Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Government Investment in Education

Increasing Population and Urbanization

Demand for Skilled Workforce - Market Challenges

Regulatory Constraints

Quality of Education Concerns - Opportunities

Expansion of E-learning Platforms

International Student Attraction - Trends

Emphasis on STEM Education

Rise of EdTech Innovations - Government Regulation

Accreditation Processes

Funding and Budgeting Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Enrollment Numbers, 2019-2024

- By Institutional Type, 2019-2024

- By Education Level (In Value %)

Primary Education

Secondary Education

– Lower Secondary (Grades 7–9)

– Upper Secondary (Grades 10–12)

Higher Education

– Undergraduate Degrees (BA, BSc, BBA)

– Postgraduate Degrees (MBA, MSc, PhD)

– Government universities

Vocational Training

– Technical Industrial Colleges

– TVET (Technical and Vocational Education and Training)

– Skill development in logistics, construction, oil & gas, IT, etc.

Adult Education

– Literacy and continuing education programs

– Corporate training, part-time diplomas, language and computer courses - By Curriculum Type (In Value %)

National Curriculum

International Curriculum

– British (IGCSE, A-Levels)

– American (SAT, AP),

– IB

– Indian (CBSE, ICSE) - By Mode of Delivery (In Value %)

Traditional Classroom

Online Learning

Hybrid Learning - By Sector (In Value %)

Public Sector

Private Sector - By Region (In Value %)

Muscat

Dhofar

Al Dakhiliyah

Al Sharqiyah

Al Batinah

- Market Share of Major Players by Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Campuses, Number of Programs Offered, Enrollment Capacity, Market Presence, Innovations, and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Educational Institutions

- Detailed Profiles of Major Companies

Sultan Qaboos University

Muscat University

Dhofar University

University of Nizwa

Oman International School

British International School Muscat

International School of Oman

Tawdheef Institute

Muscat Institute of Health Sciences

Majan University College

Sohar University

Azzan Bin Qais University

Al Sharqiyah University

Bait Al-Mashura Financial Consultancy

Oman Medical College

- Market Demand and Utilization

- Budget Allocations and Expenditure Analysis

- Regulatory Compliance Impact

- Needs Assessment and Pain Points

- Decision-Making Processes

- By Value, 2025-2030

- By Enrollment Numbers, 2025-2030

- By Institutional Type, 2025-2030