Market Overview

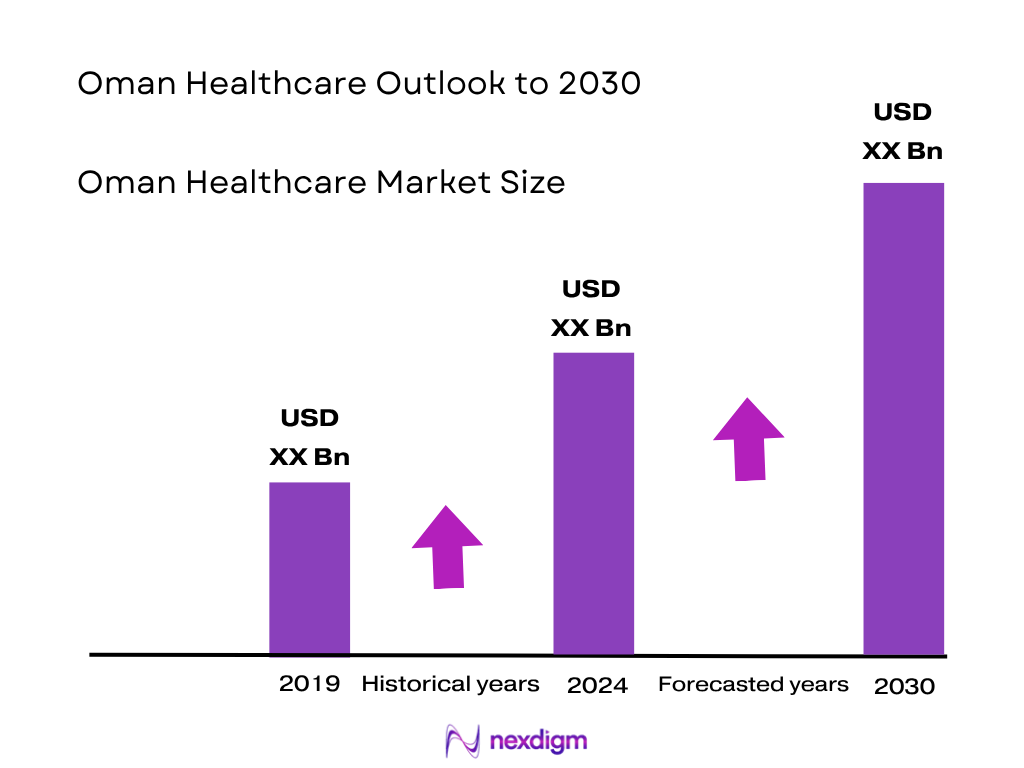

The Oman healthcare market is valued at USD 4.4 billion in 2024, based on a five-year historical analysis. Growth is being propelled by the expansion of mandatory health insurance coverage, the government’s continuous investment in healthcare infrastructure, and rising demand from the expatriate population. Additionally, the increasing prevalence of non-communicable diseases such as diabetes, cardiovascular conditions, and cancer is driving demand for advanced treatments, specialist care, and medical technologies. The private sector’s growing involvement, supported by PPP models, is further accelerating market modernization and capacity expansion.

Muscat remains the primary hub for healthcare services in Oman due to its concentration of tertiary care hospitals, specialist clinics, and diagnostic centers. The region houses the majority of the country’s accredited facilities and attracts both domestic and medical tourism patients because of advanced infrastructure and specialist availability. Dhofar, particularly Salalah, is emerging as a secondary hub due to government-led hospital expansions and its strategic location serving southern Oman and neighboring Yemen. These regions dominate because of better accessibility, high concentration of skilled medical professionals, and established referral networks.

Market Segmentation

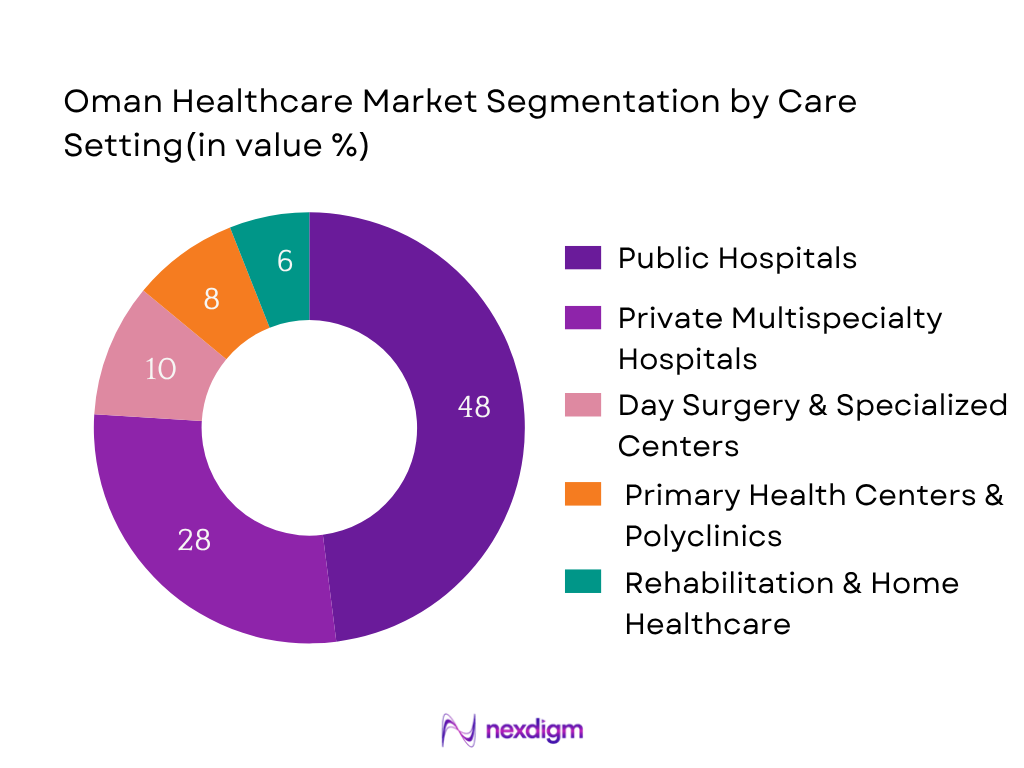

By Care Setting

Oman’s healthcare market is segmented by care setting into public hospitals, private multispecialty hospitals, day surgery & specialized centers, primary health centers & polyclinics, and rehabilitation & home healthcare providers. Recently, public hospitals have a dominant market share in Oman under the segmentation of care setting. This dominance is due to their extensive nationwide network managed by the Ministry of Health, offering low or no-cost services to Omani nationals. Public hospitals are the primary providers for specialized and tertiary services, including cardiac surgery, oncology, and trauma care. Their integration into the national referral system and their role in handling high-acuity cases ensure they remain the first choice for complex treatments. Additionally, these facilities have greater capacity in terms of beds, diagnostic equipment, and ICU units compared to private competitors.

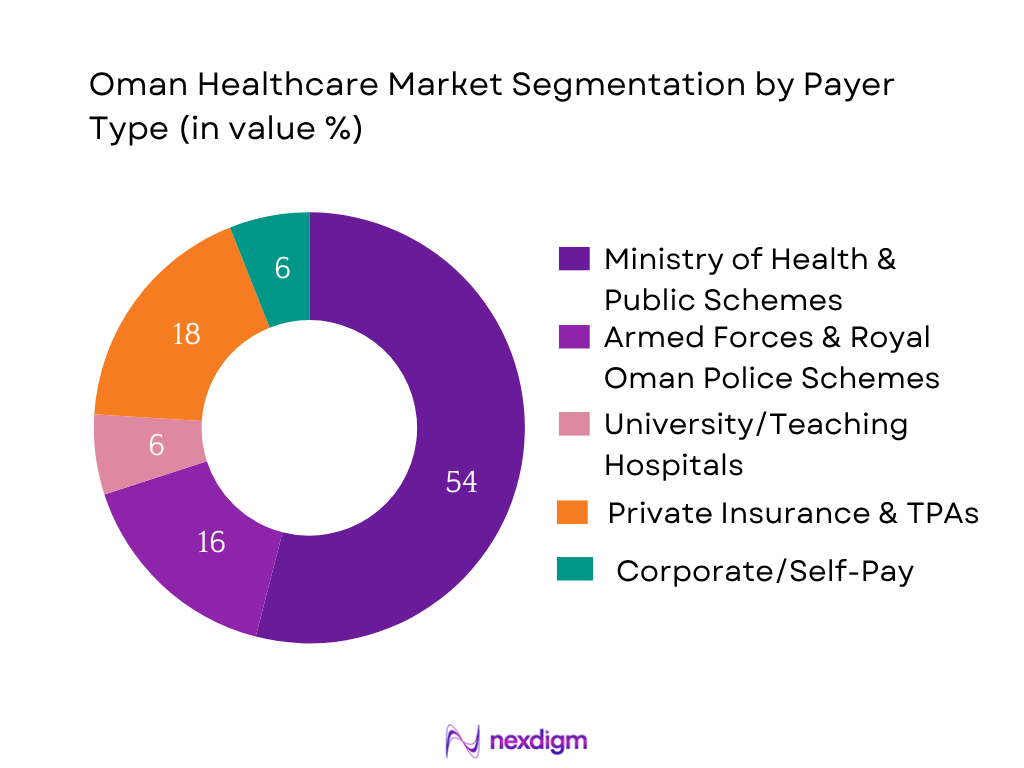

By Payor

Oman’s healthcare market is segmented by payor into Ministry of Health & public schemes, armed forces & police schemes, university/teaching hospitals, private insurance & TPAs, and corporate/self-pay. Recently, Ministry of Health & public schemes have a dominant market share under the segmentation of payor type. This is because the MoH covers the healthcare needs of the majority of Omani nationals, offering comprehensive services without direct costs to patients. These schemes fund large-scale tertiary care facilities, public health initiatives, and specialist centers across the country. The government’s commitment to universal health coverage and infrastructure development ensures a high utilization rate of MoH-funded services, even among insured patients, due to trust in quality and accessibility.

Competitive Landscape

The Oman healthcare market is dominated by a mix of public institutions and established private hospital chains. Major private players such as Badr Al Samaa Group, KIMSHEALTH, and Aster Royal Al Raffah compete alongside flagship public facilities like the Royal Hospital and Sultan Qaboos University Hospital. Insurers such as Liva Insurance and Dhofar Insurance play a significant role in shaping patient flows in the private sector, while distributors like Muscat Pharmacy are critical for supply chain continuity. The competitive environment is characterized by service quality differentiation, insurer relationships, and geographic coverage.

| Company | Year Established | Headquarters | No. of Facilities in Oman | Bed Capacity | Accreditation Status | Primary Specialties | Digital Health Adoption | Key Insurer Partnerships |

| Badr Al Samaa Group | 2002 | Muscat | – | – | – | – | – | – |

| KIMSHEALTH Oman | 2009 | Muscat | – | – | – | – | – | – |

| Aster Royal Al Raffah | 2009 | Muscat | – | – | – | – | – | – |

| Muscat Private Hospital | 2000 | Muscat | – | – | – | – | – | – |

| Royal Hospital | 1987 | Muscat | – | – | – | – | – | – |

Oman Healthcare Market Analysis

Growth Drivers

Mandatory Health Insurance Rollout & Coverage Expansion

Oman’s Financial Services Authority has formalized the Dhamani electronic platform for health insurance transactions, with binding regulations on electronic linkage and the unified policy already issued (official circulars reference 6521 and Decision E/131/2022). Coverage expansion potential is large given Oman’s 5,301,000 population and the sizeable expatriate base of 2,253,724 residents recorded by the national population clock. These figures, combined with the IMF’s assessment that Oman maintained fiscal and external surpluses and low inflation through the recent period, underpin state capacity to enforce employer compliance and stabilize premiums as private plans scale across expatriates and private-sector Omanis. Regulatory digitization (e-claims, e-eligibility) mandated by Dhamani reduces leakage and supports faster settlement cycles once fully live, creating hard incentives for providers to contract on standardized benefit schedules.

Demographic Shifts & NCD Burden

Population ageing and longevity are raising demand for chronic-care pathways. World Bank data show 139,649 residents aged 65+ and a national life expectancy near 80 years, both consistent with a maturing demographic profile that typically consumes more specialty visits, diagnostics, and long-term medications. Oman’s total population above 5.3 million gives scale to these pressures on hospitals and primary care. While disease-specific prevalence varies by source, the macro signal is unambiguous: a larger elderly cohort needs cardiac, oncology, renal, and diabetes management capacity, and longer lifespans expand utilization windows per patient. These shifts require more internists, cardiologists, and endocrinologists and greater volumes of imaging, lab tests, and rehab services across Muscat and emerging secondary hubs.

Market Challenges

Specialist Shortages & Workforce Localization

World Bank health workforce data place Oman at about 2.1 physicians per 1,000 people (most recent value), underscoring pressure on specialist availability against a population base above 5.3 million. The Ministry of Health’s annual reporting counted 92 hospitals with 7,691 beds, indicating capacity that must be staffed and upskilled to meet complex NCD demand. Localization policies mean more Omanis must be trained and retained in high-skill roles as expatriate clinicians rotate, challenging continuity in sub-specialties such as interventional cardiology and medical oncology without parallel growth in postgraduate seats and fellowship pipelines.

Referral Bottlenecks & Capacity Constraints

With 92 hospitals and 7,691 beds in the MoH system snapshots, tertiary centers in Muscat remain key referral sinks for cardiac, oncology, and trauma, stretching ICU, imaging, and OR schedules. The demographic base—139,649 aged 65+ and a national life expectancy near 80—adds sustained demand for multi-specialty follow-ups and day-care chemotherapy cycles, increasing bookings and queues. These hard counts imply bottlenecks when complex cases converge at a few hubs, especially for MRI/CT and cath labs that require both equipment time and specialist teams. Without load-sharing to accredited day-surgery and rehab units, system throughput remains constrained.

Opportunities

Centers of Excellence in Cardiac, Oncology & Mother-Child

Aging (139,649 residents aged 65+) and higher life expectancy (~80 years) imply rising volumes for interventional cardiology, radiation oncology, and high-risk obstetrics/neonatology. MoH system capacity—92 hospitals and 7,691 beds—provides a foundation, but complex treatments cluster in Muscat, creating clear white space for Centers of Excellence with multi-disciplinary teams and advanced diagnostics in secondary hubs like Salalah and Sohar. IMF-noted fiscal buffers and a sound banking sector help mobilize project finance, while e-claims rails under Dhamani improve bankability by reducing receivables risk. These current macro and system counts justify near-term investments without relying on speculative demand numbers.

Ambulatory Shift & Day-Surgery Growth

The legal and digital groundwork for e-eligibility/e-claims via Dhamani creates a clean pathway to expand day-surgery and ambulatory care where reimbursements depend on accurate coding, not length-of-stay. With Oman’s population at 5,301,000, hospitals can decongest ORs/ICUs by routing suitable volumes to licensed day-care centers, preserving inpatient beds (7,691 counted) for higher acuity. Stable macro conditions observed by the IMF improve credit availability for fit-outs (OTs, CSSD, PACU), while robust national connectivity (TRA semiannual indicators) supports digital pre-authorizations and post-op tele-follow-ups. The combination of current population scale, hard bed counts, and e-claims rails supports immediate ambulatory expansion without needing forward-looking demand estimates.

Future Outlook

Over the next six years, the Oman healthcare market is projected to grow at a CAGR of 7.5%, driven by nationwide health insurance implementation, capacity expansions in private hospitals, and the integration of digital health platforms. The government’s PPP strategy will open doors for foreign investments in specialty care, rehabilitation, and advanced diagnostics. Rising demand for chronic disease management, elderly care, and medical tourism will further shape market opportunities. Private players are likely to expand into underserved regions beyond Muscat, enhancing accessibility and diversifying service offerings.

Major Players

- Badr Al Samaa Group of Hospitals & Medical Centres

- KIMSHEALTH Oman Hospital & Medical Centres

- Aster Royal Al Raffah Hospital & Clinics

- Muscat Private Hospital

- Starcare Hospitals & Medical Centres

- Oman International Hospital

- Burjeel Hospital & Medical Centre Oman

- Al Hayat International Hospital

- National Life & General Insurance (Liva Insurance)

- Dhofar Insurance

- Al Madina Insurance

- Oman United Insurance

- Takaful Oman Insurance

- Oman Qatar Insurance (OQIC)

- Muscat Pharmacy & Stores LLC

Key Target Audience

- Hospitals and Healthcare Chains (public and private)

- Medical Device Manufacturers & Distributors

- Pharmaceutical Companies & Wholesalers

- Private Health Insurers & TPAs

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health, Oman Medical Specialty Board)

- Digital Health Solution Providers

- Public-Private Partnership (PPP) Project Developers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map encompassing all major stakeholders within the Oman Healthcare Market. This step was supported by extensive desk research, leveraging secondary and proprietary databases to collect comprehensive industry-level information. The main objective was to define the critical variables influencing market performance.

Step 2: Market Analysis and Construction

Historical market data was compiled to assess penetration rates, patient volumes, and service provider capacity. The analysis evaluated care setting utilization, payor mix, and infrastructure readiness. Revenue estimation was cross-verified using supply chain data from distributors and procurement agencies.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through in-depth interviews with hospital administrators, medical directors, and insurance executives. These consultations provided operational and financial insights that were essential for refining market size and segmentation accuracy.

Step 4: Research Synthesis and Final Output

The final stage involved integrating quantitative and qualitative findings into a cohesive analysis. This included mapping future growth scenarios based on policy changes, investment trends, and technological adoption, ensuring the final output is both comprehensive and market-specific.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Mandatory Health Insurance Rollout & Coverage Expansion

Demographic Shifts & NCD Burden

Private Investments & PPP Pipeline

Digital Health Adoption & E-Claims Enablement

Medical Tourism & Cross-Border Care - Market Challenges

Specialist Shortages & Workforce Localization

Referral Bottlenecks & Capacity Constraints

Import Dependency for Medicines & Devices

Pricing Transparency & Tariff Rationalization

Claims Denials & TAT Variability - Opportunities

Centers of Excellence in Cardiac, Oncology & Mother-Child

Ambulatory Shift & Day-Surgery Growth

Home Healthcare & Remote Patient Monitoring

Revenue Cycle Optimization & TPA Collaboration

Rehab, Long-Term Care & Post-Acute Expansion - Trends

Accreditation (JCI/ISQua) Uptake

Telehealth, E-Prescription & Patient Apps

Outcomes-Based Contracting & Bundled Payments

Biomedical Uptime SLAs & Lifecycle Management - Government Regulation

Facility Licensing & Classification

Drug & Device Registration Pathways

Clinical Coding, E-Claims & Audit Norms

Medical Liability & Patient Safety Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Care Setting (In Value %)

Public Hospitals (Tertiary & Secondary)

Private Multispecialty Hospitals

Day Surgery & Specialized Centers

Primary Health Centers & Polyclinics

Rehabilitation, Long-Term Care & Home Healthcare - By Payor (In Value %)

Ministry of Health & Public Schemes

Armed Forces & Royal Oman Police Schemes

University/Teaching Hospitals

Private Insurance & TPAs

Corporate Self-Funded & Self-Pay - By Service Line (In Value %)

Inpatient Care

Outpatient & Day-Care

Diagnostics & Imaging

Pharmacy & Retail Health

Rehabilitation & Dialysis - By Clinical Area (In Value %)

Cardiology & Cardiac Surgery

Oncology & Hematology

Orthopedics & Trauma

Obstetrics, Gynecology & Neonatology

Endocrinology & Diabetes - By Region (In Value %)

Muscat

Dhofar

Al Batinah (North & South)

Al Dakhiliyah

Al Sharqiyah (North & South)

Al Dhahirah

Al Wusta

Musandam

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Care Setting Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Service Line, Number of Touchpoints, Network Breadth & Insurer Panels, Tariff Bands & Bundles, Biomedical Uptime SLAs, Digital Maturity & E-Claims Readiness, Quality/Accreditation KPIs)

- SWOT Analysis of Major Players

- Pricing Analysis Basis Tariffs/Packages for Major Providers in Oman Healthcare Market

- Detailed Profiles of Major Companies

Badr Al Samaa Group of Hospitals & Medical Centres

KIMSHEALTH Oman Hospital & Medical Centres

Aster Royal Al Raffah Hospital & Clinics

Muscat Private Hospital

Starcare Hospitals & Medical Centres

Oman International Hospital

Burjeel Hospital & Medical Centre Oman

Al Hayat International Hospital

National Life & General Insurance (Liva Insurance)

Dhofar Insurance

Al Madina Insurance

Oman United Insurance

Takaful Oman Insurance

Oman Qatar Insurance (OQIC)

Muscat Pharmacy & Stores LLC

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030