Market Overview

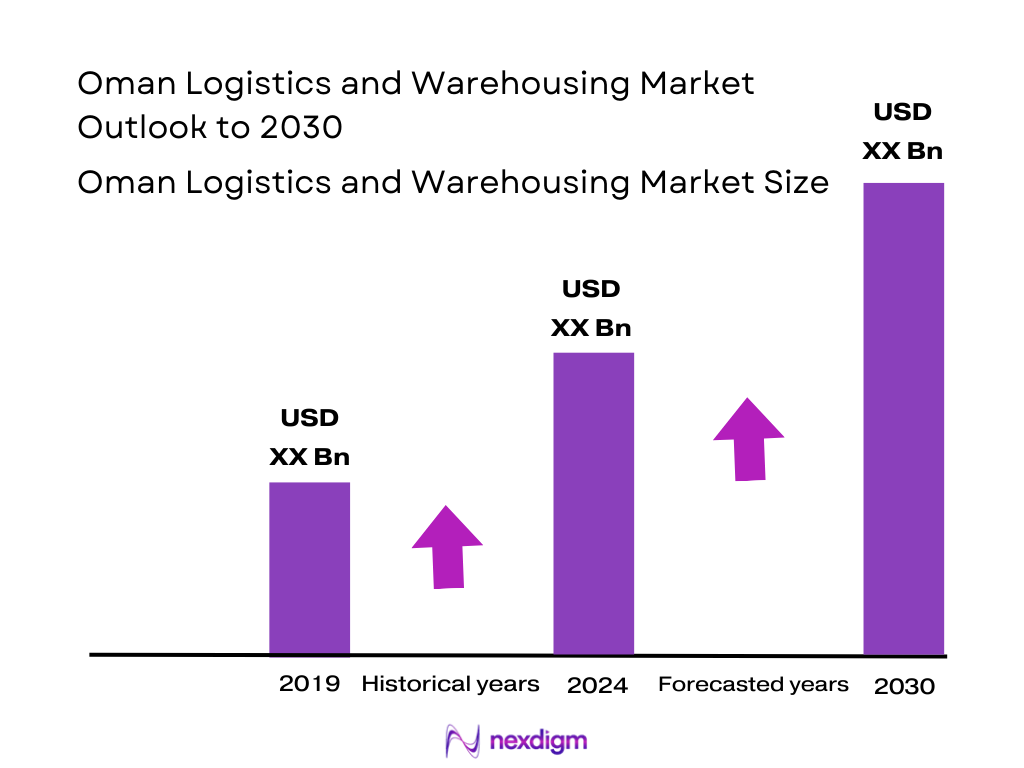

The Oman Logistics & Warehousing market is valued at approximately USD 1.00 billion in 2024, based on a historical analysis of the Oman Third‑Party Logistics segment (valued at USD 1.00 billion in 2024, growing to USD 1.10 billion in 2025). This indicates robust logistics demand underpinned by expanding e‑commerce, trade corridor activity, and port infrastructure expansion across Sohar, Duqm, and Salalah. Growth in manufacturing, retail and F&B has spurred warehousing needs, while rising cold‑chain logistics supports overall warehousing expansion.

Major logistics hubs in Oman include Sohar, Duqm and Salalah. Sohar dominates due to its deep‑sea port linked to manufacturing and free‑zone clusters attracting global investors. Duqm Port benefits from integrated SEZ developments—dry dock, industrial zone, multi‑modal logistics—supporting mega‑projects and large cargo flows. Salalah holds efficiency leadership with world‑class container throughput and hinterland connectivity, servicing transshipment traffic across Gulf‑Asia routes.

Market Segmentation

By Service Type

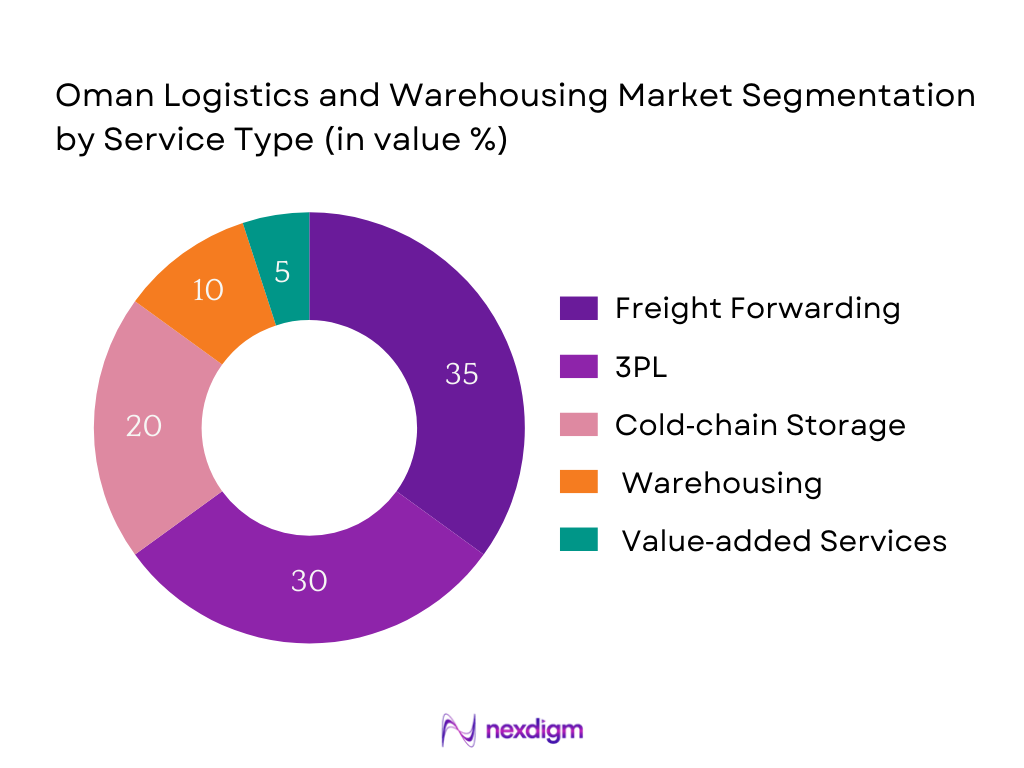

The Oman logistics market’s largest share is held by Freight Forwarding (≈ 35 %) supported by strong port throughput and international trade corridors. 3PL Services (≈ 30 %) remain a close second, driven by high demand for general storage linked to retail, manufacturing, and distribution. Cold‑chain Storage captures around 20 %, propelled by growth in perishable goods and pharmaceutical distribution, especially in Muscat and Sohar. Warehousing (≈ 10 %) is significant around free zones catering to import-export flexibility. Value‑added Services (≈ 5 %) include packaging, cross-docking and light assembly and are gradually growing with e‑commerce and industrial logistics.

By Freight Forwarding

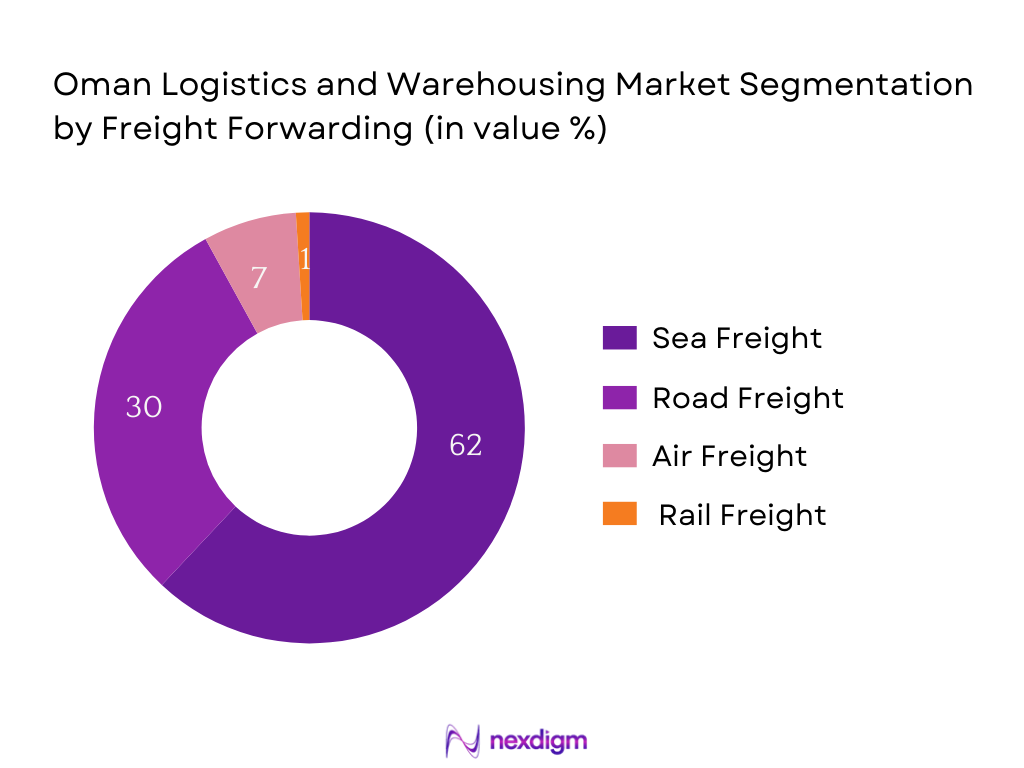

Oman’s freight forwarding is segmented into sea, road, air, and rail/dry-port linked movements. Sea freight holds the dominant share due to deep-sea capabilities at Sohar, Salalah, and Duqm, strong mainline connectivity on East–West routes, and extensive free-zone infrastructure supporting container, bulk, and project cargo. Road freight ranks second, driven by dense Oman–UAE cross-border flows, GCC distribution links, and last-mile pulls from ports to inland hubs such as Muscat and Khazaen. Air freight remains focused on high-value or time-critical cargo via MCT, while rail/dry-port linked moves are nascent, used mainly for planned multi-modal pilots and limited industrial flows.

By Warehousing

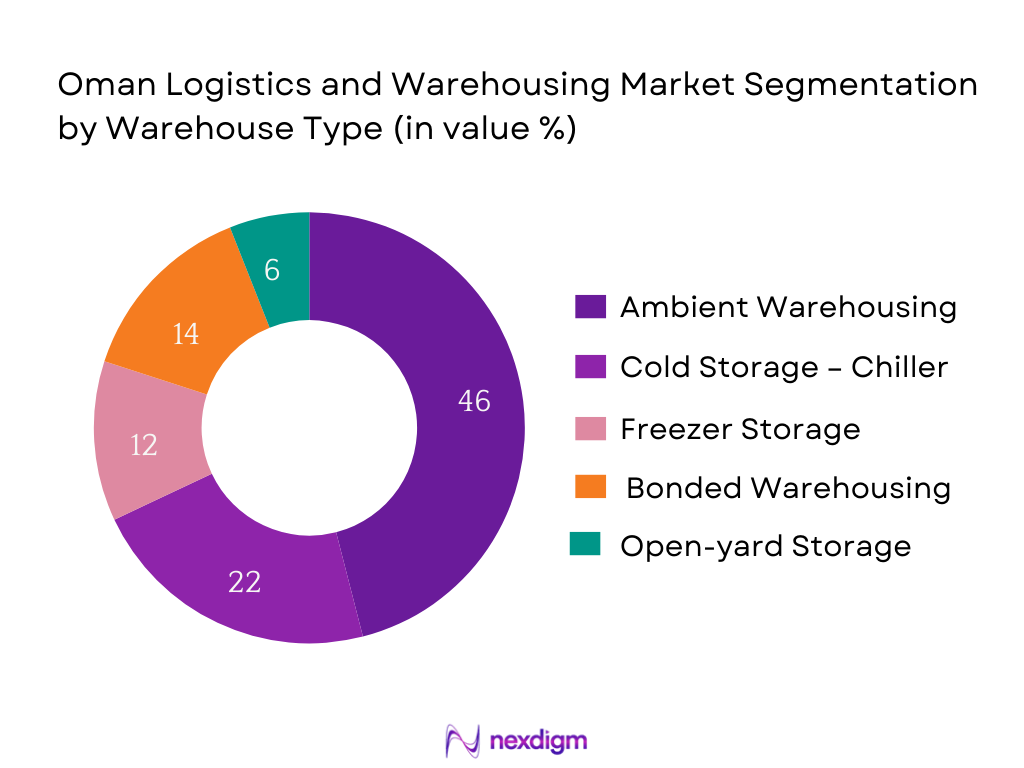

Oman’s warehousing market is segmented into general ambient storage, cold storage (chiller and freezer), bonded warehousing, and open-yard storage. General ambient storage dominates due to its widespread use across FMCG, retail, industrial, and e-commerce goods, especially around Sohar, Muscat, and Salalah logistics zones. Cold storage—particularly chiller—has grown significantly with rising perishable imports and F&B production, while freezer capacity supports frozen foods and pharmaceuticals. Bonded warehousing is strategically concentrated in free-zones, enabling duty deferral and re-export efficiencies for GCC redistribution. Open-yard storage caters to project cargo, heavy machinery, and bulk commodities linked to oil & gas and infrastructure sectors.

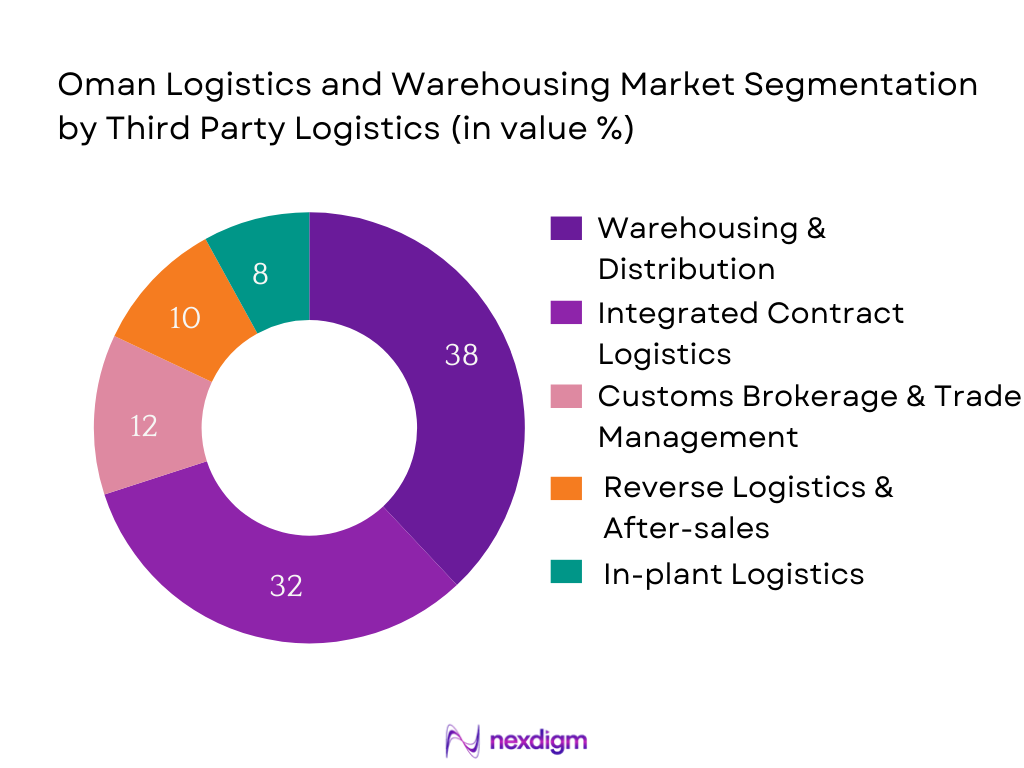

By 3PL

Oman’s 3PL market is segmented into warehousing & distribution, integrated contract logistics, customs brokerage, reverse logistics, and in-plant logistics. Warehousing & distribution leads given occupier needs for shared and dedicated capacity around Sohar, Muscat, Duqm, and Salalah, with rising cold-chain requirements for F&B and pharma. Integrated contract logistics follows closely as shippers seek OTIF-driven SLAs, visibility, and scalable multi-modal execution under one partner. Customs brokerage remains critical due to bonded/free-zone flows and cross-border procedures. Reverse logistics is expanding with e-commerce returns and warranty loops, while in-plant logistics serves industrial sites with line-feeding and yard management.

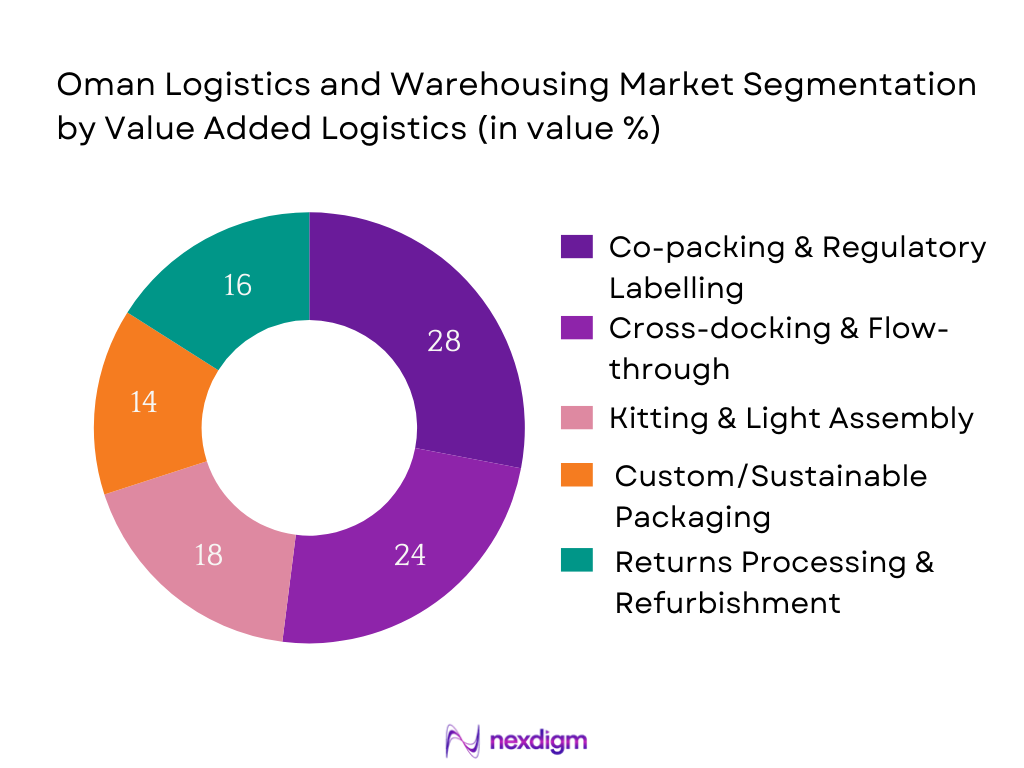

By Value-Added Services (VAS)

Oman’s VAS mix spans co-packing/labeling, cross-docking, kitting/light assembly, custom packaging, returns/refurbishment, and repair. Co-packing & regulatory labeling dominates because import-heavy retail, F&B, and pharma need Arabic/halal/regulatory compliance, date coding, and GCC-specific artwork close to market. Cross-docking ranks next as ports/free-zones push faster flow-through for GCC redistribution. Kitting/light assembly supports industrial spares and consumer bundles. Custom/sustainable packaging grows with retailer mandates. Returns/refurbishment scales with CEP/e-commerce while repair & reconditioning remains niche, focused on B2B equipment and MRO.

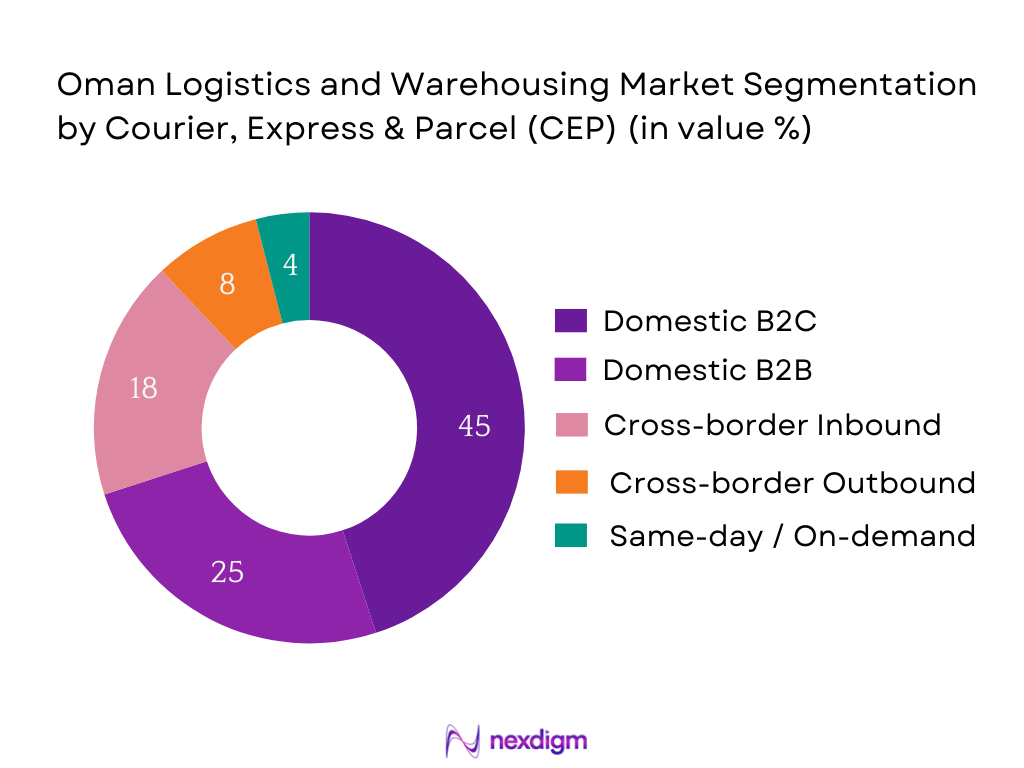

By Courier, Express & Parcel (CEP)

Oman’s CEP market divides into domestic B2C, domestic B2B, cross-border inbound, cross-border outbound, and same-day/on-demand. Domestic B2C leads, powered by marketplace growth, COD/reverse workflows, and delivery density in Muscat and key urban corridors. Domestic B2B follows, tied to retail replenishment and SME shipments. Cross-border inbound is sizable via integrators channeling consumer imports through air and express lanes; outbound is smaller but rising as Omani brands expand GCC sales. Same-day/on-demand remains limited to metro clusters, micro-fulfilment, and pharmacy/food niches but is gaining traction with locker and PUDO rollouts.

Competitive Landscape

The Oman logistics and warehousing sector is dominated by several well‑established players, including Asyad Group and Agility, supported by global networks and integrated port‑warehouse offerings. A handful of providers control logistics corridors, underlining market consolidation.

| Company | Established | Headquarters | Bonded Capacity | Cold‑Storage Capacity | Free‑zone Linkage | WMS Automation | Distribution Fleet | Key Industry Focus |

| Asyad Group | — | Muscat, Oman | – | – | – | – | – | – |

| Agility Logistics | — | Kuwait/Oman | – | – | – | – | – | – |

| Bahwan Logistics LLC | — | Muscat | – | – | – | – | – | – |

| Al Madina Logistics | — | Muscat | – | – | – | – | – | – |

| Worldlink Shipping | — | Sohar | – | – | – | – | – | – |

Oman Logistics & Warehousing Market Analysis

Growth Drivers

Omani ports—including Sohar, Salalah and Duqm—recorded cargo handling of more than 137 million tonnes in 2024, up from 119 million tonnes in 2023, with vessel calls exceeding 12,000 ships during the year; Salalah and Sohar collectively handled ~4.2 million TEUs in 2024, including ~3.3 million TEUs at Salalah and ~942,000 TEUs at Sohar. This surge underscores the logistics sector’s growth through port-linked warehousing uptake, driven by enhanced container throughput and bulk cargo flow. The expansion of port infrastructure under national plans has directly stimulated demand for bonded facilities and third‑party logistics, fuelling warehousing development in port corridors.

Oman’s nominal GDP stood at USD 106.94 billion in 2024, up from approximately USD 101 billion in 2023, with industry and transport services comprising over 45 percent of GDP. The government’s Vision 2040 and SOLS transport‑logistics strategy aim to further diversify the economy, catalysing investments in integrated free zones and logistics parks. This macroeconomic momentum translates into increased infrastructure funding and logistics modernization, enabling the market to support higher service tiers such as cold‑chain and value‑added services tied to industrial diversification.

Market Challenges

While port cargo throughput grew robustly, the logistics sector faces significant constraint from limited available land proximate to ports like Salalah and Sohar. Port authorities report that expansion within 10 km of terminals is constrained by industrial zoning and coastal buffer zones, limiting new warehouse construction. Customs clearance delays remain notable: average dwell time for import cargo in 2023 ranged from 48 to 72 hours at key gateways, creating bottlenecks for bonded warehousing operators linked to free‑zones. Similarly, workforce skill shortages persist: only around 35 percent of logistics roles in the sector are held by Omanis, requiring ongoing training and Omanisation efforts for specialized logistics management and cold‑chain operations

Opportunities

In 2024, Duqm Port’s cargo volume soared by 152 percent compared to 2023 levels, while bulk volume at Sohar rose by 72 percent, and Salalah and Suwaiq each saw 10 percent increases in general, bulk and liquid cargo throughput. This reflects rising demand for logistics real estate tied to free‑zone integrated developments. At present, the cold chain segment in Oman is valued at approximately OMR 180 million in 2023, indicating ripe demand for temperature-controlled facilities alongside fresh produce and pharmaceutical distribution. Furthermore, transport services constitute a growing share of service exports, evidencing the potential for automated warehouse management systems (WMS), green warehousing, and multimodal logistics parks to capture future growth. These market-specific indicators present an opportunity to upgrade infrastructure, integrate automation and enhance sustainability in logistics operations.

Future Outlook

Over the coming years, the Oman logistics & warehousing market is projected to achieve a strong upward trajectory, supported by strategic government initiatives under Vision 2040, port expansions at Sohar, Duqm, and Salalah, and accelerating demand in e‑commerce, industrial growth, cold‑chain continuity, and transshipment logistics. The anticipated CAGR of ≈ 9.3 % through to 2030 underscores this sustained growth momentum.

Major Players

- Asyad Group

- Agility Logistics

- Bahwan Logistics LLC

- Al Madina Logistics (AMLS)

- Al Nowras Logistics Solutions

- Global Corp Logistics

- Worldlink Shipping & Logistics LLC

- Smart Logistics

- Radiant Freight & Logistics LLC

- City Shipping & Services Oman

- Greenfield Logistics Services

- Oman Post / Asyad Express

- Majan Shipping & Logistics

- Seven Ocean Logistics Services LLC

- Liwa Port Logistics

Key Target Audience

- C‑level Supply Chain Directors at major Oil & Gas and FMCG companies

- Logistics and Operations Heads at large Industrial & Manufacturing firms

- E‑commerce fulfillment centre operators

- Cold‑chain distribution network planners in Healthcare sector

- Investment & Venture Capitalist Firms assessing logistics/industrial park investments

- Infrastructure Development Authorities of SEZAD/Khazaen

- Government and Regulatory Bodies (Oman Ministry of Transport, Asyad Ports & Free Zones Authority)

- Port Development and Strategic Planning Departments at Duqm, Sohar, Salalah

Research Methodology

Step 1: Identification of Key Variables

We begin by mapping Oman’s logistics ecosystem: stakeholders across ports, warehousing, freight forwarding, regulatory bodies. Secondary sources identify variables such as throughput, inventory levels, storage pricing, segment mix.

Step 2: Market Analysis and Construction

Historical data (2019–2024) for 3PL, warehousing and freight forwarding segments are collated from published reports; penetration across industry verticals, pricing trends (USD per m², per TEU) and utilization metrics are analyzed.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses on segment dominance and growth drivers are validated via expert discussions (industry logistics managers, port executives, warehousing operators) using structured interviews.

Step 4: Research Synthesis and Final Output

Bottom‑up approach is reinforced through consultations with logistics providers (e.g. Asyad, Bahwan) for capacities, SLA performance, pricing models; results triangulated with top‑down macro forecasts (e‑commerce growth, port throughput expansion, infrastructure investments) for a robust and validated market model.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In‑Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis (Economic and Trade Context, SOLS 2040 Logistics Strategy)

- Timeline of Major Infrastructure Developments (Sohar Port, Duqm Port, Khazaen Logistics City)

- Business Cycle (Logistics Demand Cycle and Port Throughput Trends)

- Supply Chain and Value Chain Analysis (Import‑Export Flow, Bonded vs Non‑bonded Warehousing)

- By Value, 2019-2024

- By Volume (Total Warehouse Space in Sq. m, Port TEU Throughput), 2019-2024

- By Average Price (Cost per m² per Month, Cost per TEU Storage), 2019-2024

- By Service Type (In Value %)

Freight Forwarding

3PL

Cold‑chain Storage

Warehousing

Value‑added Services - By End‑user Industry (In Value %)

Oil & Gas

Food & Beverages

FMCG & Retail

Manufacturing & Industrial

E‑commerce & Healthcare - By Geography (In Value %)

Muscat Area

Sohar / Al‑Batinah Region

Duqm / Al‑Wusta Region

Salalah / Dhofar Region

Northern Land‑border Corridors

- Executive Summary

- Oman Warehousing Ecosystem (Developers: Free zone authorities, private industrial parks; Operators: 3PLs, captive; Utilities & compliance: Civil Defense, food/pharma authorities)

- Value Chain for Warehousing & Distribution (Inbound receiving, put-away, storage—racked/bulk, value-added, picking, dispatch, reverse flows)

- Trends in Warehouse Real Estate & Operations (High-bay racking, multi-tenant logistics parks, cross-dock facilities, micro-fulfilment for e-commerce)

- Commercial Models in Warehousing (Shared vs dedicated, pallet-position billing, term leases vs flex, bonded vs non-bonded)

- Technological Advancements in Oman Warehousing (WMS integration with customs single-window, RF scanning, AS/RS, AMRs for case picking, temperature monitoring)

- Cold-Chain & Pharma Compliance Overview (GDP/GSP processes, validated chambers, excursion logging, quarantine/HACCP)

- HSE & Quality Framework (Fire loads, sprinklers & hydrants, FM-approved systems, racking certifications, MHE standards)

- Key Challenges in Oman Warehousing (Land close to ports, utility provisioning, skilled MHE operators, peak-season capacity)

- Key Benefits/Outcomes for Occupiers (Lower supply-chain cycle times, inventory accuracy, cost per order optimization, service-level adherence)

- Cross Comparison – Major Warehouse Developers & 3PL Operators (GBA, clear height, cold capacity, bonded status, automation level, energy intensity, location advantage)

- Oman Warehousing Market Size (USD Billion)

- Market Segmentation by Warehouse Type (General Ambient, Cold Storage—Chiller/Freezer, Bonded, Open-Yard, Fulfilment/Micro-fulfilment)

Market Segmentation by End-User (Retail & FMCG, F&B, Pharma/Healthcare, Industrial/Spare Parts, E-commerce, Oil & Gas) - Future Market Size (USD Billion)

- Executive Summary

- Oman 3PL Ecosystem (International 3PLs, regional players, integrators allied with ports/air cargo, CEP tie-ups)

- Value Chain – End-to-End Contract Logistics (Planning/S&OP, inbound logistics, warehousing, distribution, returns, after-sales logistics)

- Trends in 3PL Outsourcing (Vertical specialization—pharma, F&B, automotive; SLA-driven operations; green logistics)

- Commercial Models in 3PL (Open-book cost-plus, gain-share, unit-rate per order/line/pallet, transformation projects)

- Technology Stack in 3PL (Control towers, TMS/WMS integration, IoT for reefer and fleet, analytics for slotting & labor)

- KPI Framework & Governance (OTIF, inventory accuracy, order cycle time, damages, safety incidents, carbon intensity)

- Key Challenges Driving 3PL Adoption (Complex customs/bonded processes, variable demand, infrastructure dispersion Muscat–Sohar–Salalah)

- Benefits for Shippers (Capex avoidance, scalability, multi-modal reach, compliance assurance, digital visibility)

- Cross Comparison – Leading 3PLs in Oman (Network breadth, sector expertise, bonded/free-zone presence, cold-chain depth, automation level, fleet mix)

- Oman 3PL Market Size (USD Billion)

- Market Segmentation by Service (Integrated contract logistics, warehousing & distribution, in-plant logistics, reverse logistics, customs brokerage)

- Market Segmentation by End-User (Pharma/Healthcare, F&B, Retail & E-commerce, Energy & Industrial, Automotive & Spares)

- Future Market Size (USD Billion)

- Executive Summary

- Oman Freight Market Ecosystem (Ports & Free Zones: Sohar, Duqm, Salalah; Land Borders: Hafeet, Wajajah; Air Cargo: MCT; Regulators: MTCIT, Customs, Asyad Ports; Operators: Global forwarders, regional NVOCCs, truckers, customs brokers)

- Value Chain Analysis of Freight Market (Origin booking, consolidation/LCL-FCL, port handling, customs, line-haul multi-modal, deconsolidation, last-mile B2B, returns)

- Trends in Oman Transportation Industry (Sea-sea transshipment growth, cross-border GCC road freight, project cargo for energy/mining, temperature-controlled movements, e-com air/express uplift)

- Commercial Models in Oman Transportation (Port-to-door, door-to-port, FCA/FOB/CIF arrangements, rate indexation to fuel/surcharges, MSAs, spot vs contract)

- Technological Advancements in Freight Forwarding (EDIfact/API with carriers, e-AWB, track-and-trace, digital quotations, visibility platforms, IoT reefer telemetry)

- Digital Freight Aggregator Market Overview (Brokerage platforms linking shippers with FTL/LTL carriers; load boards; rate discovery tools)

- Digital Truck Aggregators Business Model (Take-rate, subscription, compliance/KYC, embedded finance, digital POD, e-invoicing)

- Major Challenges Enabling Rise of Digital Platforms (Empty miles on Oman–UAE lanes, fragmented SME fleets, manual documentation, variable dwell times at gates)

- Major Benefits of Digital Freight Aggregators (Cycle-time cuts, higher asset utilization, real-time visibility, automated compliance, faster cash cycles)

- Cross Comparison – Major Digital Freight Platforms (Geographic coverage, carrier density, verified fleet size, tendering tools, payments, claims support)

Oman Freight Market Size (USD Billion) - Market Segmentation by End-User (Retail, Pharma, Oil & Gas, Automotive & Spares, Industrial Projects, Others) and by Mode (Sea, Road, Air, Rail/Dry-port)

- Freight Market Future Market Size (USD Billion)

- Executive Summary

- VAS Ecosystem in Oman (3PLs, specialist co-packers, bonded value-add, packaging suppliers, quality & compliance bodies)

- VAS Value Chain (De-boxing, kitting, labeling, re-packing, postponement/light assembly, QA/QC, returns refurbishment)

- Trends in Logistics VAS (Regulatory-compliant relabeling for pharma, sustainable packaging, SKU proliferation, cross-dock flow-through)

- Commercial Models for VAS (Piece-rate, time & materials, project-based, SLA penalties/bonuses)

- Technology Enablement (WMS task-interleaving, MES for light assembly, vision systems for QA, serialization for pharma)

- Compliance & Certifications (GDP, ISO 9001/22000, halal standards for F&B, temperature mapping, traceability)

- Key Challenges (Demand volatility, artwork/regulatory changeovers, skilled labor for precision work, audit readiness)

- Benefits to Shippers (Inventory postponement, faster speed-to-shelf, localized labeling for GCC, reduction in obsolescence & returns)

- Cross Comparison – Major VAS Providers (Service breadth, regulated-sector coverage, automation, rework capacity, audit performance, turnaround time)

Oman VAS Market Size (USD Billion) - Market Segmentation by VAS Type (Kitting & Assembly, Co-packing/Labeling, Cross-docking, Custom Packaging, Refurbishment/Repair, Returns Processing)

- Market Segmentation by End-User (F&B, Pharma/Healthcare, Retail & E-commerce, Industrial/Auto, Oil & Gas)

- Future Market Size (USD Billion)

- Executive Summary

- CEP Ecosystem in Oman (National operator, international integrators, regional CEPs, cross-border partners, PUDO/locker networks)

- CEP Value Chain (First-mile pickup, sortation hubs, line-haul air/road, last-mile urban & out-of-city, COD/reverse)

- Trends in CEP (E-commerce B2C volume growth, next-day standards, click-and-collect, micro-hubs, lockers)

- Commercial Models in CEP (Zonal slab pricing, dimensional weight, fuel surcharge, COD fee, returns fee, SME merchant plans)

- Technology & Operations (Route optimization, handheld apps, real-time status, dynamic re-attempts, address geocoding, locker APIs)

- Cross-Border & Customs for CEP (De-minimis thresholds, simplified declarations, IOR/EOR models, duty/tax prepayment)

- Service Quality & CX (Delivery promise tiers—same-day/next-day, NDR flows, doorstep QC, returns SLAs, CSAT)

- Key Challenges (Delivery density outside Muscat, address standardization, reverse logistics cost, seasonality surges)

- Benefits for Merchants & Marketplaces (Faster conversion with precise ETAs, reduced cart abandonment, plug-and-play cross-border, lower WISMO)

- Cross Comparison – Major CEP Players in Oman (Network coverage, hubs, locker footprint, on-time performance, reverse logistics, e-commerce integrations)

Oman CEP Market Size (USD Billion) - Market Segmentation by Service (B2C Domestic, B2B Domestic, Cross-border Inbound, Cross-border Outbound, Same-day/On-demand)

- Market Segmentation by End-User (Marketplaces, D2C Brands, Pharma/Health, Electronics, Fashion & Lifestyle, Documents)

- Growth Drivers (Port Expansions, SOLS 2040 Policy, E‑commerce Growth, Cold‑chain Demand)

- Market Challenges (Land Scarcity near Ports, Customs Delays, Workforce Skill Gaps)

- Opportunities (Integrated Free‑zone Logistics Parks, Technology‑driven WMS, Sustainable Warehousing)

- Trends (Automation, Blockchain in Logistics, Multi‑modal Hubs)

- Government Regulation (Customs Licensing, Port Authority Rules, Safety & Quality Standards)

- SWOT Analysis

- Stake Ecosystem (Ports, Free‑zones, Customs, Private Operators)

- Porter’s Five Forces

- Market Demand and Utilization (Occupancy Rates, TEU Storage Days)

- Purchasing Power and Budget Allocations (Rental vs Capex)

- Regulatory and Compliance Requirements (Customs, Trade Licenses, Safety)

- Needs, Desires, and Pain Point Analysis (E‑commerce Fulfilment, Cold Chain Gaps)

- Decision‑Making Process (Location Proximity, SLA Criteria, Tech Adoption)

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Service Segment - Cross Comparison Parameters (Company Overview, Service Portfolio, Bonded & Free‑zone Capacity, Cold Storage Capacity, Port/Free‑zone Linkage, WMS/Automation Tech, Distribution Fleet Size, Global Partner Network, Pricing Model, Client Vertical Mix, Renewal Lease Count, Sustainability Certification Status, Average SLA Uptime)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players in Oman Logistics & Warehousing Market

- Detailed Profiles of Major Companies

Asyad Group

Bahwan Logistics LLC

Al Madina Logistics (AMLS)

Al Nowras Logistics Solutions

Global Corp Logistics

Worldlink Shipping & Logistics LLC

Smart Logistics

Radiant Freight & Logistics LLC

City Shipping & Services Oman

Greenfield Logistics Services

Agility Logistics

Oman Post / Asyad Express

Majan Shipping & Logistics

Seven Ocean Logistics Services LLC

Liwa Port Logistics

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030