Market Overview

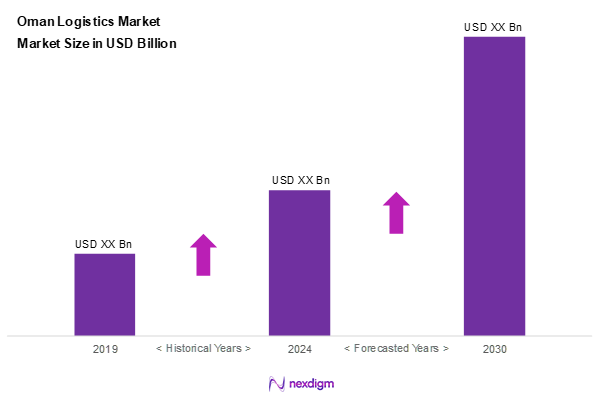

As of 2024, the Oman logistics market is valued at USD ~ billion, with a growing CAGR of 6.3% from 2024 to 2030, driven by increasing trade volumes and substantial investments in infrastructure by the government. The logistics sector in Oman showcases robust growth due to its strategic geographical location, acting as a gateway for trade between Asia, Europe, and Africa. Additionally, the rise in economic diversification efforts by Oman has led to an enhanced logistics framework, making the sector increasingly crucial for the nation’s economic stability.

The dominant cities in the Oman logistics market include Muscat, Salalah, and Sohar. Muscat serves as the capital and a major business hub, facilitating trade and supply chain activities. Salalah is notable for its free trade zone, enhancing its logistics capabilities, while Sohar has developed significant port facilities, making it an essential point for shipping and transport, thereby solidifying their positions within the logistics landscape.

Market Segmentation

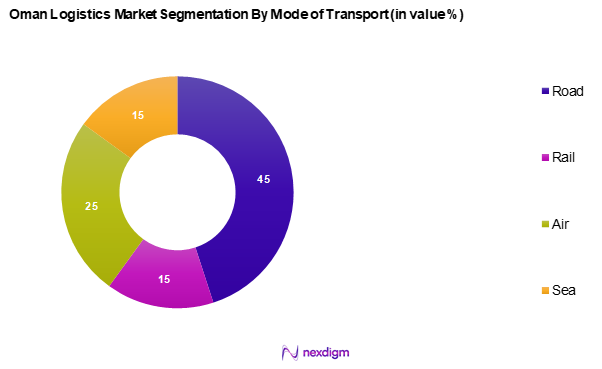

By Mode of Transport

The Oman logistics market is segmented into road, rail, air, and sea. The road transport sub-segment dominates the market, accounting for 45% of the overall share in 2024. This supremacy is attributed to the extensive road networks across Oman, facilitating efficient and flexible transportation of goods. Road transport remains a vital component due to its capability to reach remote areas, thus enhancing supply chain connectivity. Additionally, the expansion of logistics companies offering road freight services has further reinforced this segment’s leading position.

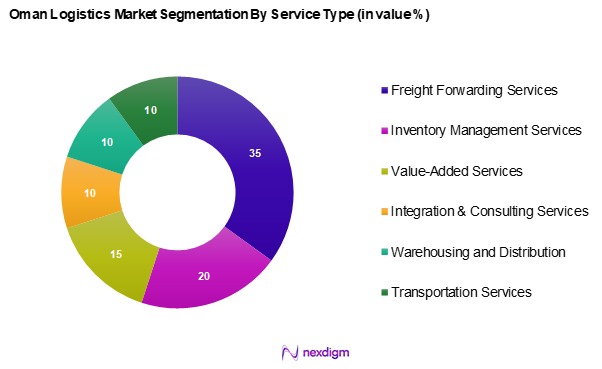

By Service Type

The Oman logistics market is segmented into freight forwarding services, inventory management services, value-added services, integration & consulting services, warehousing and distribution services, and transportation services. Freight forwarding services dominate this segment with a market share of 35% in 2024. The growth of this sub-segment is driven by the increasing complexity of global trade and the need for efficient customs clearance and documentation. With many companies relying on third-party logistics providers, the demand for forwarding services continues to rise, aided by improved logistics technology that enhances service efficiency.

Competitive Landscape

The Oman logistics market is dominated by a few major players, including local enterprises and global logistics giants. Companies like DHL, Aramex, and DB Schenker play a pivotal role in shaping the market dynamics, offering comprehensive logistics solutions tailored to meet the growing demands of various industries. This consolidation highlights the significant influence of these key companies, which leverage extensive networks and advanced technologies to maintain competitiveness.

| Company | Establishment Year | Headquarters | Service Offerings | Business Strategies | Revenue

(USD Mn) |

Market

Share |

| DHL | 1969 | Bonn, Germany | – | – | – | – |

| Aramex | 1982 | Dubai, UAE | – | – | – | – |

| DB Schenker | 1872 | Essen, Germany | – | – | – | – |

| Kuehne + Nagel | 1890 | Switzerland | – | – | – | – |

| Agility | 1977 | Sulaibiya, Kuwait | – | – | – | – |

Oman Logistics Market Analysis

Growth Drivers

Increasing Trade Volumes

Oman’s strategic location at the crossroads of global trade routes has led to an increase in trade volumes. In 2023, Oman’s total merchandise trade reached approximately USD 70.5 billion in exports, primarily driven by rising exports of oil and gas, which accounted for nearly 80% of total exports. The port of Salalah has seen significant growth, handling over 4 million TEUs in container traffic. This increase in trade is fueled by the government’s initiative to enhance trade relations, making Oman a regional hub for logistics and distribution. Trade agreements with Asia and Europe further support this trend, bolstering the logistics sector’s growth.

Government Investments in Infrastructure

Government-led infrastructure development continues to be a strong pillar supporting Oman’s logistics market. Major investments are being directed toward expanding key transportation assets—airports, seaports, and road networks—ensuring better connectivity and operational efficiency. Projects like the development of Duqm Port and Free Zone underscore the country’s commitment to becoming a logistics powerhouse. Additionally, Oman’s national transport strategy aims to facilitate seamless intermodal transport, further strengthening the logistics ecosystem.

Market Challenges

High Operational Costs

Logistics firms operating in Oman face mounting operational costs due to a combination of high fuel expenses, increasing labor costs, and equipment maintenance. Government initiatives to increase local employment have led to upward pressure on wages, making cost control more challenging. These cost burdens are further intensified by global fluctuations in shipping expenses, putting a strain on the profit margins of logistics providers and affecting their ability to scale operations efficiently.

Regulatory Compliance

Oman’s complex and evolving regulatory environment poses a challenge to logistics operations. Providers often encounter bureaucratic delays related to customs and transportation compliance. Multiple layers of approval and documentation increase administrative overhead and affect supply chain timelines.

Opportunities

Digitalization of Logistics

As Oman continues to modernize its logistics sector, the digitalization of logistics operations presents substantial growth opportunities. The adoption of advanced technologies, such as RFID and block chain, in logistics operations is gaining traction. In 2023, technology investments in the logistics sector were estimated at USD 50 million, focusing on improving tracking, inventory management, and supply chain efficiency. The Ministry of Transport and Communications is actively promoting digital solutions to streamline processes, which is expected to attract more investors and enhance operational efficiency in the logistics sector.

Green Logistics Initiatives

The growing focus on sustainability is influencing the logistics landscape in Oman, providing opportunities for green logistics initiatives. In 2023, over USD 200 million was invested in projects promoting sustainable transportation and eco-friendly practices among logistics companies. Initiatives include transitioning to electric vehicles and optimizing supply chains to reduce carbon footprints. Regulatory support for these practices is also increasing, as the government targets a 20% reduction in emissions from the transport sector by 2025. This trend toward sustainability is expected to enhance market competitiveness and attract eco-conscious clients.

Future Outlook

Over the next five years, the Oman logistics market is expected to witness substantial growth, driven by ongoing infrastructural investments, enhancements in digital logistics solutions, and the government’s focus on economic diversification. The anticipated surge in e-commerce activities and a global shift towards sustainable logistics solutions will further propel the sector. Moreover, the strategic developments in key logistics hubs will facilitate the growth of both domestic and international logistics operations.

Major Players

- DHL

- Aramex

- DB Schenker

- Kuehne + Nagel

- Agility

- GAC

- Al Nowras Logistics Solution

- Omani Integrated Logistic Services

- ASYAD

- bhacker.com

- Global Corp Logistics LLC.

- Clarion Shipping Services L.L.C

- Duqm United Logistics LLC.

- Allegiance Logistics

- Al Badr Transportation

Key Target Audience

- Government and Regulatory Bodies (e.g., Ministry of Transport)

- Logistics Service Providers

- E-commerce Companies

- Retail Corporations

- Manufacturing Firms

- Automotive Companies

- Investments and Venture Capitalist Firms

- Supply Chain Management Firms

Research Methodology

Step 1: Identification of Key Variables

The preliminary phase involves defining a comprehensive ecosystem map that encapsulates all relevant stakeholders within the Oman logistics market. This step is fundamentally supported by extensive desk research, combining secondary and proprietary databases to accumulate a wide array of industry-level data. The goal is to identify and delineate the critical variables that govern market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and scrutinize historical data concerning the Oman logistics market. This scrutiny entails assessing market penetration, the ratio of various service providers, and the resulting revenue generation. An analysis of service quality metrics is executed to ensure reliability and accuracy in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and subsequently validated through structured expert interviews with industry professionals representing a spectrum of logistics sectors. These consultations will yield vital operational and financial insights directly from practitioners, instrumental for refining and corroborating the generated market data.

Step 4: Research Synthesis and Final Output

The concluding phase involves engaging with multiple logistics operators to garner detailed insights into service segments, performance metrics, customer preferences, and other essential factors. Such interactions will serve to authenticate and enrich the statistics acquired through both qualitative and quantitative methodologies, leading to a thorough and validated analysis of the Oman logistics market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Trade Volumes

Government Investments in Infrastructure - Market Challenges

High Operational Costs

Regulatory Compliance - Opportunities

Digitalization of Logistics

Green Logistics Initiatives - Trends

Rise in E-commerce Activities

Increasing Demand for Sustainable Practices - Government Regulation

Logistics Licensing Requirements

Import/Export Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Mode of Transport, (In Value %)

Road

Rail

Air

Sea - By Service Type, (In Value %)

Freight Forwarding Services

Inventory Management Services

Value-Added Services

Integration & Consulting Services

Warehousing and Distribution Services

Transportation Services - By End-User Vertical, (In Value %)

Manufacturing

Consumer Goods

Retail

Food and Beverages

IT Hardware

Chemicals

Construction

Automotive

Telecom

Others - By Model, (In Value %)

1PL

2PL

3PL

4PL - By Category, (In Value %)

Conventional Logistics

E-Commerce Logistics - By Customer Type, (In Value %)

B2B

B2C

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Mode of Transport Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenue Analysis, Service Offerings, Technology Adoption)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

DHL

Aramex

DB SCHENKER

Kuehne + Nagel

Agility

GAC

Al Nowras Logistics Solution

Omani Integrated Logistic services

ASYAD

bhacker.com

Global Corp Logistics LLC.

Clarion Shipping Services L.L.C

Duqm United Logistics LLC.

Others

- Market Demand and Utilization Patterns

- Purchasing Power Analysis

- Regulatory and Compliance Requirements

- Needs and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Mode of Transport, 2025-2030