Market Overview

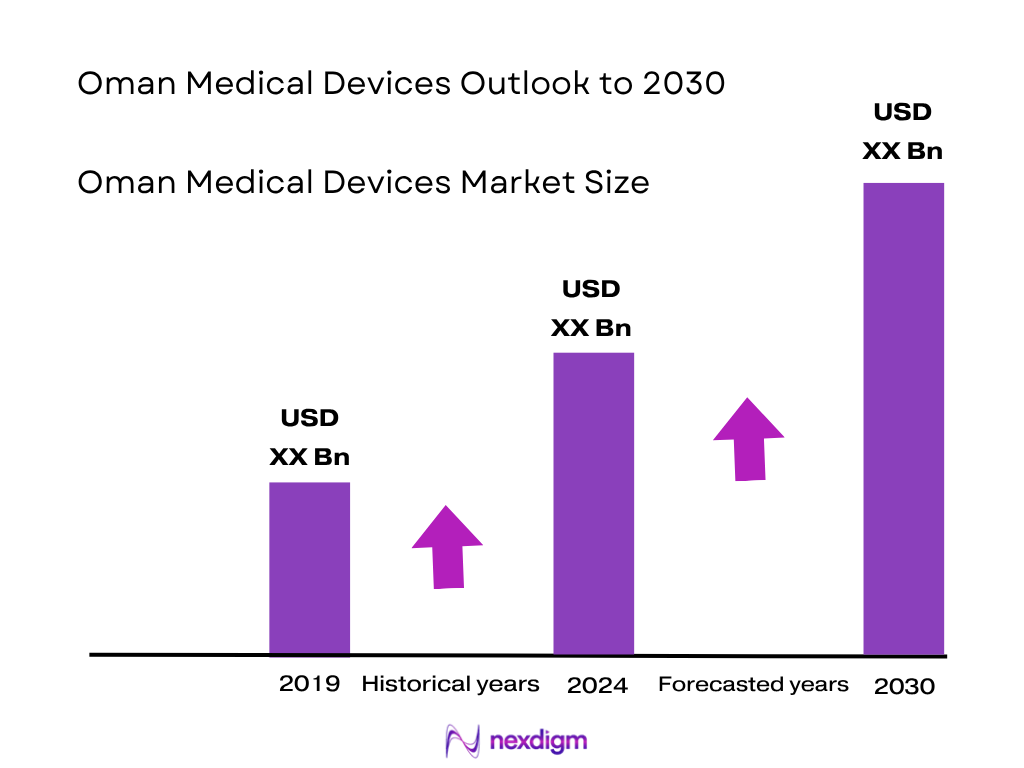

The Oman medical devices market is valued at approximately USD 4.3 billion, based on projections of the broader medical supplies and equipment sector reaching OMR 1.6 billion by 2025 (≈USD 4.3 billion). This size reflects sustained investment in large-scale healthcare infrastructure projects such as Al Suwaiq Hospital and the New Sultan Qaboos Hospital, which are driving demand for advanced imaging, monitoring, and therapeutic devices.

The market is dominated by major urban centers—primarily Muscat, along with Salalah and regional hubs—due to their concentration of tertiary hospitals, private healthcare chains, and regional procurement coordination. These cities host the bulk of capex budgets, distribution networks, and service ecosystems, making them pivotal for medical device deployment and supplier presence.

Market Segmentation

By Product Category

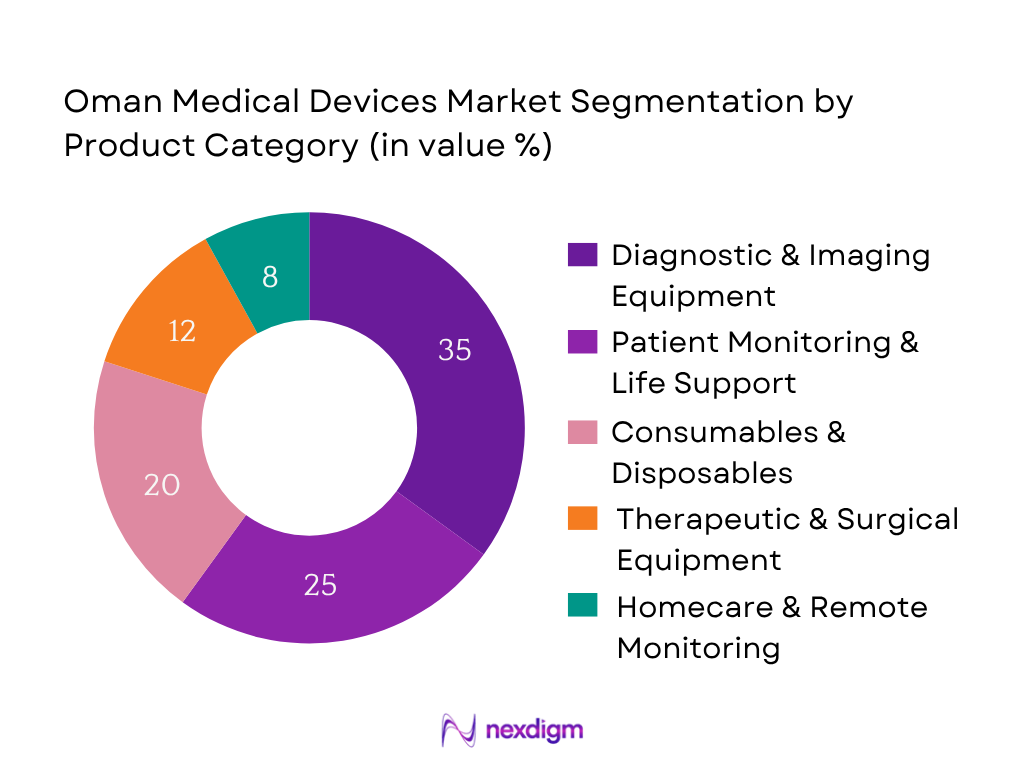

The Oman medical devices market is segmented by product category into diagnostic & imaging equipment, patient monitoring & life support, consumables & disposables, therapeutic & surgical equipment, and homecare & remote monitoring devices. Diagnostic & imaging equipment is currently dominating the market share—its prevalence is driven by high-cost capital investments in new hospital builds and imaging upgrades through government-led infrastructure initiatives. This category benefits from modernization plans that prioritize early disease detection and advanced treatment pathways.

By End-User Sector

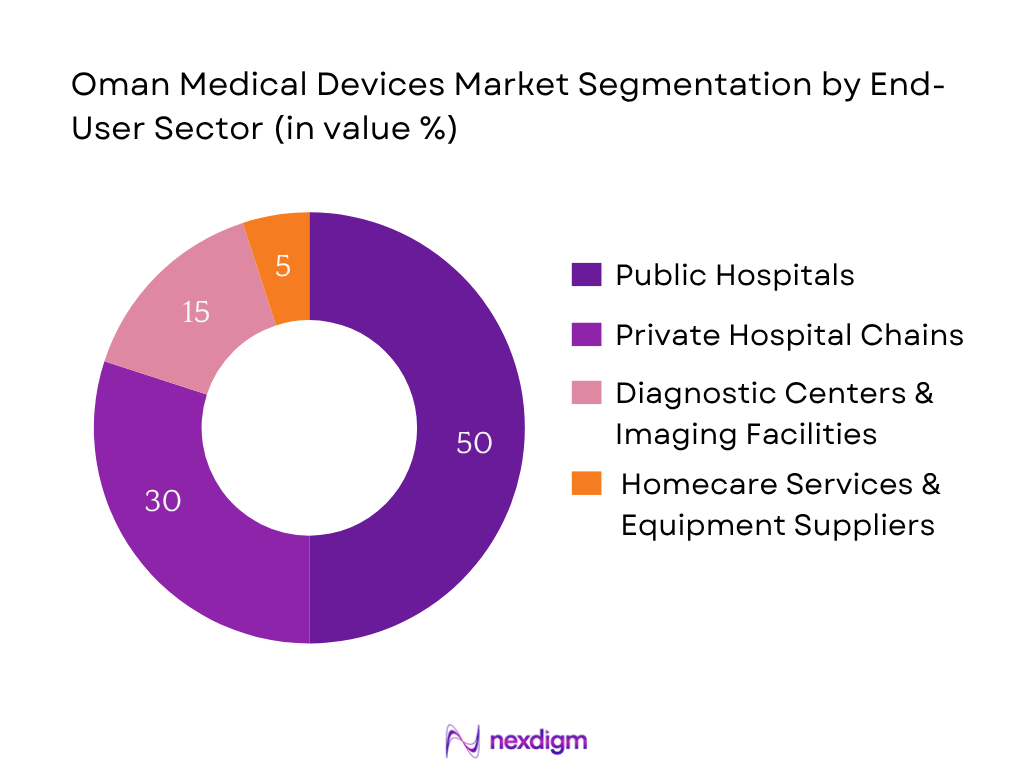

The segmentation by end-user includes public hospitals, private hospital chains & specialty clinics, diagnostic centers, and homecare services & equipment suppliers. Public hospitals currently hold the dominant share due to centralized procurement policies, substantial government funding, and bulk tendering mechanisms for nationwide deployment. This sector benefits from strategic projects under Health Vision 2050 and Oman Vision 2040, which channel capex into public healthcare infrastructure.

Competitive Landscape

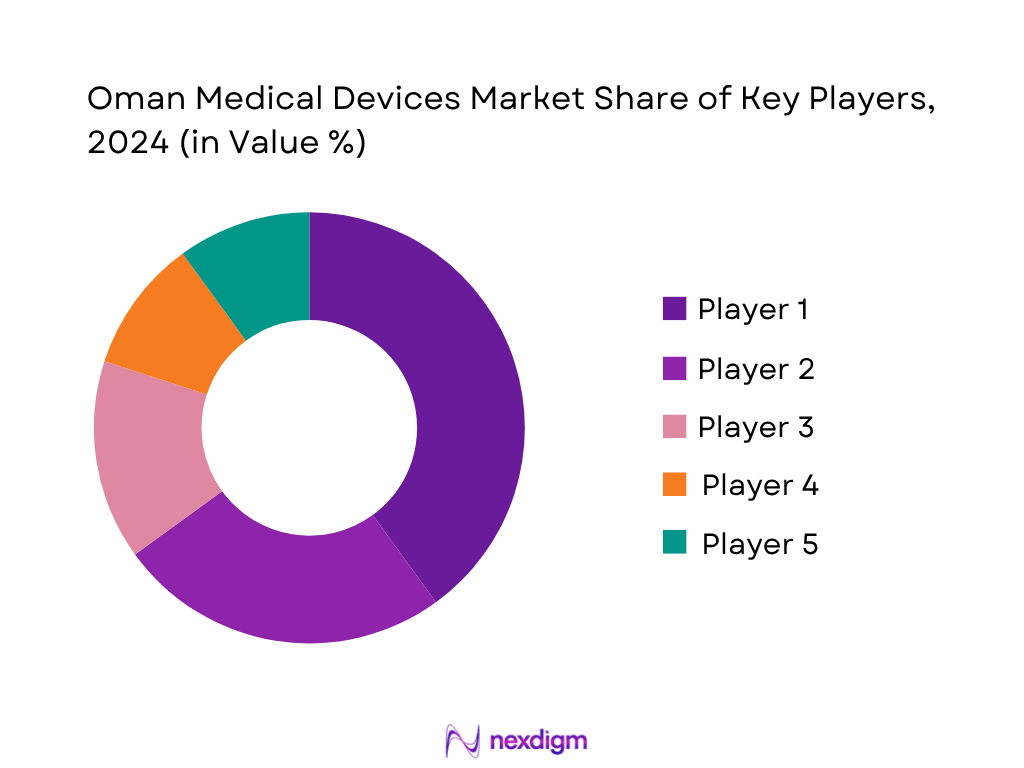

The Oman medical devices market is highly concentrated, with a few major distributors and OEM channel partners dominating the supply of capital equipment and consumables. The Oman medical devices market is led by a mix of established local distributors and international OEM channels servicing both public and private sectors. Their dominance reflects strong ties with government procurement, regional service presence, and comprehensive product portfolios spanning imaging, diagnostics, and consumables.

| Company Name | Establishment Year | Headquarters | DGPA Listing Status | MoH Tender Presence | Local Service Hub | Product Portfolio Depth | Installed Base in Major Hospitals |

| Muscat Pharmacy & Stores LLC | — | Muscat, Oman | – | – | – | – | – |

| Al Zahrawi Medical Supplies LLC | — | Muscat, Oman | – | – | – | – | – |

| Bahwan Healthcare Centre | — | Muscat, Oman | – | – | – | – | – |

| Gulf Medical Supplies LLC | — | Muscat, Oman | – | – | – | – | – |

| Private OEM Channels (Siemens, GE, Philips) | Global brands | Oman Branch Offices | – | – | – | – | – |

Oman Medical Devices Market Analysis

Growth Drivers

Expansion of Public Hospital Capacity

Oman’s public system is scaling throughput and installed base, evidenced by 86,955 surgical operations conducted in public facilities, 15.3 million outpatient visits, and ~1.8 million X-ray examinations in the latest reporting cycle; public providers managed 265 institutions with 50 hospitals and 5,024 beds, within a national total of 92 hospitals and 7,691 beds (14.9 beds per 10,000 people). These volumes directly pull demand for anesthesia, monitoring, sterilization, and imaging devices, and create replacement cycles for critical equipment. Population momentum (~5.05 million) sustains case growth, particularly in Muscat and regional hubs.

Insurance Penetration under Dhamani Driving Procedure Volumes

Compulsory private-sector health coverage (Dhamani) is being operationalized on a national platform, with 555,000 insured lives reported as uptake accelerated, supported by insurance claims paid of OMR 322.806 million in 2023 for medical policies—expanding covered diagnostics, day cases, and admissions across private and public providers. This formalizes payment for imaging and IVD, and stabilizes consumables procurement. The scheme’s regulatory base (Decision 78/2019) and the new Financial Services Authority (Royal Decree 20/2024) underpin the rollout and e-linkage with providers.

Market Challenges

Import Dependency and Logistics Lead Times

Medical devices are predominantly imported; for HS 9018 categories alone, Oman recorded inbound value entries such as USD 36.77 million for instruments (901890) with a broad supplier base. Oman handled 93.2 million tonnes across its top five ports, highlighting sea-air reliance for inbound healthcare cargo. On logistics capability, the country ranked 43 / 139 in the 2023 World Bank Logistics Performance Index. Import dependence plus port-centric flows expose devices to shipment batching and customs variability that impact installation calendars and service parts availability.

Price Compression in MoH eTendering

Centralized e-tendering aggregates large volumes and bidders, intensifying price competition. The public dashboard reports 60,281 tenders published with 268,464 bids submitted—pressuring capital and consumable margins as award criteria emphasize technical compliance at the lowest evaluated cost. Health entities routinely solicit supplies—e.g., MOH tenders for medical parts and consumables—expanding competitive sets per lot. High bid counts per package and standardized specifications for gloves, syringes, imaging disposables, and OR items compress achievable ASPs and push vendors toward service-bundled offers to preserve lifecycle economics.

Opportunities

Managed-Service & Pay-Per-Use Models

High utilization in public theatres (86,955 surgeries), heavy diagnostic traffic (~1.8 million X-rays; 15.3 million outpatient visits), and insurance claims paid (OMR 322.806 million for medical policies) create an immediate base for outcome-linked or per-scan commercial models. Internet usage at 95.3 per 100 and mobile-broadband at 116.8 per 100 support remote monitoring of uptime and tube life, automated meter reads, and predictive maintenance. These macro indicators allow vendors to shift capital to opex via managed-equipment services, guaranteeing availability while embedding training and consumables logistics in one SLA.

Refurbished Capital Equipment for Tier-2 Hospitals

Bed availability at 7,691 beds nationwide and 14.9 beds per 10,000 indicates pressure to equip secondary sites fast; MoH now lists active projects in Duqm, Sumail, Al Namaa, Mahoot, Khasab, Salalah, and Suwaiq, where turnkey packages must balance capability and budget. A 260-bed blueprint in Suwaiq on 47,357 m² built-up space illustrates demand for multi-modality imaging and OR fit-outs. Refurbished ultrasound, mobile X-ray, and patient monitoring fleets can accelerate commissioning while maintaining compliance, supported by public volumes of 15.3 million outpatient visits to justify near-term deployment.

Future Outlook

Over the coming years, the Oman medical devices market is expected to experience sustained and solid growth, supported by government-led expansion of healthcare infrastructure, the roll-out of digital and AI‑enabled diagnostic technologies, and rising demand for advanced imaging and monitoring solutions. Public sector capex, combined with increasing private healthcare investments and telehealth adoption, will drive modernization and decentralization across healthcare services.

Major Players

- Muscat Pharmacy & Stores LLC

- Al Zahrawi Medical Supplies LLC

- Bahwan Healthcare Centre

- Gulf Medical Supplies LLC

- Salalah Medical Supplies Manufacturing Co. LLC

- Deep Sterilization Technology LLC

- Badr Al Samaa Group – Procurement & Biomedical Division

- GE HealthCare – Oman channel

- Siemens Healthineers – Oman channel

- Philips – Oman channel

- Mindray – Oman channel

- Abbott Diagnostics – via distributors

- Becton Dickinson (BD) – via distributors

- Johnson & Johnson MedTech – via distributors

- Medtronic – via distributors

Key Target Audience

- Ministry of Health – Medical Supplies & Biomedical Engineering Departments

- Oman Free‑Zone Regulatory Bodies (e.g., OPAZ)

- Health Investment Funds & Sovereign Wealth Venture Capital Firms (Investments and Venture Capitalist Firms)

- Oman Health Insurance Regulatory Authority (Oman Insurance and Regulatory BODY)

- Capital Equipment Leasing Companies

- Hospital Procurement & Logistics Divisions (Public and Private Hospitals)

- Telehealth Program Directors (e‑health initiatives)

- Infrastructure Development Authorities (Health Vision 2050 Project Planners)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping all stakeholders in the Oman medical devices ecosystem—public hospitals, private chains, distributors, regulators—using proprietary databases and secondary sources to define critical variables influencing market size and dynamics.

Step 2: Market Analysis and Construction

We compiled and analyzed historical data on procurement volumes, pricing, and installed equipment bases, triangulating between government tenders and distributor records to ensure accuracy in revenue estimates and penetration rates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were tested through structured interviews with key opinion leaders—including hospital biomedical heads, MoH procurement officers, and distributor executives—to validate assumptions and glean operational insights.

Step 4: Research Synthesis and Final Output

The final stage involved verifying trends and data via direct consultation with major OEMs and hospitals, validating portfolio segmentation, installed base figures, and strategic priorities, thereby ensuring a rigorously verified and comprehensive analysis of the Oman medical devices market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Expansion of Public Hospital Capacity (ICU, OR, Imaging)

Insurance Penetration under Dhamani Driving Procedure Volumes

Rising NCD Burden Elevating IVD and Imaging Demand

PPP/Turnkey Projects in Secondary Cities

Digital Health & Remote Patient Monitoring Adoption - Market Challenges

Import Dependency and Logistics Lead Times

Price Compression in MoH eTendering

Biomedical Skill Gaps Outside Muscat

Multi-Vendor After-Sales Fragmentation

Regulatory Listing and Compliance Sequencing - Opportunities

Managed-Service & Pay-Per-Use Models

Refurbished Capital Equipment for Tier-2 Hospitals

Homecare Respiratory & Diabetes Devices

Integrated PACS/VNA and AI-Assisted Reporting

Local Stockholding and Light Manufacturing in Free-Zones - Trends

Point-of-Care Diagnostics and Miniaturized Ultrasound

Single-Use Shift in OR & Infection Control

IoMT-Enabled Uptime and Remote Diagnostics

Sustainability in Packaging and Reprocessing - Government Regulation

Device Registration & Listing (DGPA&DC)

Customs, Bayan Declarations & Radiation Permits

Labeling/Arabic IFU, UDI & Vigilance

Calibration, Metrology & Cold-Chain Expectations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Category (In Value %)

Diagnostic Imaging (CT, MRI, X-ray, Ultrasound)

In-Vitro Diagnostics (Clinical Chemistry, Immunoassay, Hematology, POC)

Patient Monitoring & Life Support (Multiparameter, ECG, Anesthesia, Ventilators)

Surgical & OR Equipment (Electrosurgery, OR Lights/Tables, Sterilization)

Consumables & Disposables (Syringes, IV Sets, Wound Care, Gloves)

Orthopedics & Trauma (Implants, Power Tools)

Cardiovascular & Interventional (Cath Lab Equipment, Stents, Disposables)

Dental Equipment & Consumables (Chairs, Imaging, Implants)

Homecare & RPM (Glucometers, CPAP/BiPAP, Nebulizers) - By Application (In Value %)

Tertiary Public Hospitals (Royal, Khoula, SQUH, Nizwa, Ibri)

Private Multispecialty Hospitals (Burjeel, Aster Al Raffah, Badr Al Samaa, Muscat Private)

Diagnostic & Imaging Centers

Clinics & Polyclinics

Homecare Settings - By End User (In Value %)

Ministry of Health Facilities

Royal Oman Police & Armed Forces Hospitals

Private Hospital Chains

Standalone Clinics and Day Surgery Centers

Reference Laboratories & Dental Practices - By Distribution Channel (In Value %)

Authorized Distributors

OEM Branch/Representative Offices

Free-Zone Stock & Re-Export (Sohar, Salalah, Khazaen)

Direct/Online - By Region (In Value %)

Muscat

Dhofar

Al Batinah North & South

Al Dakhiliyah

Al Sharqiyah North & South

Al Dhahirah

Al Buraimi

Musandam

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Product Category Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Product Category, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Service Network, Installed Base in MoH/Private Sites)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players in Oman Medical Devices Market

- Detailed Profiles of Major Companies

Muscat Pharmacy & Stores LLC

Al Zahrawi Medical Supplies LLC (Oman)

Bahwan Healthcare Centre

Gulf Medical Supplies LLC (Oman)

Salalah Medical Supplies Manufacturing Co. LLC

Deep Sterilization Technology LLC

Badr Al Samaa Group – Procurement & Biomedical Division

GE HealthCare – Oman Channel Landscape

Siemens Healthineers – Oman Channel Landscape

Philips – Oman Channel Landscape

Mindray – Oman Channel Landscape

Abbott Diagnostics – Oman Presence via Distributors

Becton Dickinson (BD) – Oman Presence via Distributors

Johnson & Johnson MedTech – Oman Presence via Distributors

Medtronic – Oman Presence via Distributors

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030