Market Overview

As of 2024, the Oman warehousing market is valued at USD ~ billion, with a growing CAGR of 8.4% from 2024 to 2030, based on a comprehensive analysis of current conditions and past five-year trends. This growth is driven by the expanding logistics infrastructure, increased e-commerce activities, and a burgeoning demand for sophisticated warehousing solutions. The market benefits from strategic geographic positioning and concerted efforts toward modernization in supply chain methodologies, making it a focal point for regional logistics.

Dominant cities in the Oman warehousing market include Muscat and Salalah, largely attributed to their well-established transportation networks and proximity to key port facilities. Muscat, being the capital, serves as a vital trade hub attracting local and international logistics firms. Salalah’s Free Zone has also emerged as a key player, supporting a variety of transportation and storage solutions to cater to growing import and export activities.

Market Segmentation

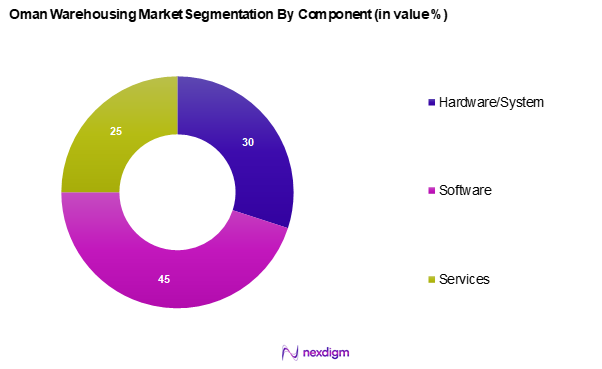

By Component

The Oman warehousing market is segmented into hardware / system, software, and services. The software component is currently dominating the market due to the increasing implementation of advanced warehouse management systems (WMS) that enhance operational efficiency and inventory accuracy. As businesses evolve with digital transformation, integrating real-time tracking and logistics optimization capabilities has become essential, thereby amplifying the demand for sophisticated software solutions.

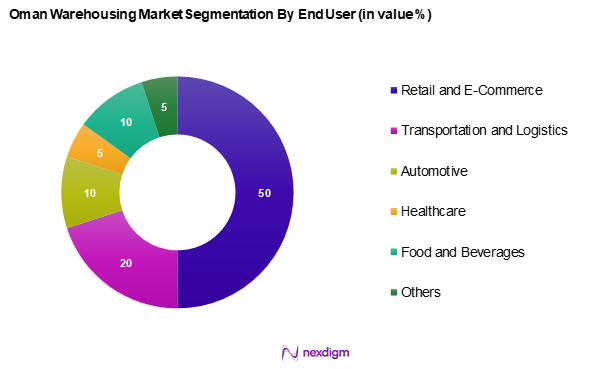

By End User

The Oman warehousing market is segmented into retail and e-commerce, transportation and logistics, automotive, healthcare, food and beverages, and others. The retail and e-commerce segment holds the largest market share due to the rapid growth in online shopping trends, especially boosted by the pandemic. The increasing consumer preference for convenience and quick delivery options has necessitated larger warehouse spaces and efficient logistics networks, leading to this segment’s dominance in the warehousing market.

Competitive Landscape

The Oman warehousing market is characterized by strong competition among several established players. The key competitors include a mix of local and international logistics firms that leverage their capabilities to capture market share. Companies like GGL Logistics and Oryx Logistics lead in operational scale and service offerings, contributing to a competitive landscape reflective of both innovative service delivery and strategic partnerships.

| Company | Establishment Year | Headquarters | Market Share (%) | Revenue (USD Million) | Major Segments | Geographic Reach |

| GGL Logistics | 2000 | Singapore | – | – | – | – |

| Oryx Logistics | 2005 | Muscat | – | – | – | – |

| GAC Logistics | 1956 | Dubai, UAE | – | – | – | – |

| AVVashya CCI Logistics | 2016 | Maharashtra, India | – | – | – | – |

| Enhance Oman | 1967 | Muscat, Oman | – | – | – | – |

Oman Warehousing Market Analysis

Growth Drivers

Surge in E-commerce Activities

The rapid expansion of e-commerce in Oman is significantly driving the warehousing market. According to the Ministry of Commerce, Industry, and Investment Promotion, the e-commerce market in Oman reached a value of USD 2.2 billion in 2023, This surge is primarily supported by a growing internet penetration and a growing preference for online shopping, there is a rising demand for warehousing facilities optimized for e-commerce logistics. Additionally, government initiatives aimed at diversifying the economy beyond oil dependency are fostering digital commerce, further contributing to the need for advanced storage and distribution solutions. As consumer demand for quick and efficient order fulfilment grows, warehouse operators must enhance capacity and efficiency to remain competitive.

Increasing Demand for Logistics Solutions

Oman’s strategic geographical location and improving trade infrastructure are propelling the logistics sector. Enhanced trade routes and port expansions have led to a surge in cargo handling, necessitating sophisticated warehousing capabilities. The government’s ongoing commitment to strengthening logistics infrastructure, particularly in key port cities, is expected to support increased warehousing demand. As the volume of goods transported continues to rise, efficient inventory management and distribution solutions are becoming essential for retailers and distributors.

Market Challenges

Regulatory Compliance Issues

Compliance with evolving regulatory requirements poses a major challenge for the warehousing industry in Oman. Recent updates to logistics and warehousing regulations have introduced stricter standards for safety, labour conditions, and operational protocols. Many logistics companies have reported difficulties in adapting to these regulatory changes, which have led to increased operational complexity and cost burdens. Frequent audits and stringent compliance measures particularly impact smaller warehouse operators, creating hurdles in maintaining seamless operations.

High Operational Costs

Rising operational expenses are a significant concern for the warehousing sector in Oman. Factors such as fluctuating fuel prices, increasing labour costs, and infrastructure maintenance requirements add to financial challenges. Additionally, investments in modern warehousing technologies to enhance efficiency further elevate expenses.

Opportunities

Government Initiatives to Boost Infrastructure

The Omani government is making substantial investments in logistics infrastructure to enhance the capabilities of the warehousing market. Development projects, including the establishment of logistics hubs and upgrades to key ports, are expected to expand warehousing capacity significantly. These initiatives also create a favourable environment for foreign investments, offering warehousing firms opportunities to scale operations and expand their market presence.

Expansion of Cold Chain Logistics

The increasing demand for cold storage solutions is opening new opportunities in Oman’s warehousing market. Growth in the food processing and pharmaceutical sectors is driving the need for temperature-controlled logistics to ensure product quality and shelf life. Given the region’s climatic conditions, investments in refrigerated warehousing and advanced cold chain management solutions are becoming a priority. This trend is expected to support the expansion of dedicated cold storage facilities, catering to the evolving needs of various industries.

Future Outlook

The Oman warehousing market is anticipated to witness significant growth fuelled by the continuous enhancement of logistics infrastructure, a surge in e-commerce activities, and government initiatives promoting trade and investment. With the growing focus on automation and smart warehouse technologies, the market is well-positioned for innovation and expansion, creating opportunities for both established players and new entrants.

Major Players

- GGL Logistics

- Oryx Logistics

- GAC Logistics

- AVVashya CCI Logistics

- Enhance Oman

- Sohar Shipping

- Al Nowras Logistics Solution

- Alsi For Marine Services LLC

- ASYAD

- Clarion Shipping Services L.L.C

- Ruzave Shipping and Logistic Directory

- Omani Integrated Logistic services

- Movguru

- Others

Key Target Audience

- Investors and venture capitalist firms

- Government and regulatory bodies (Ministry of Transport, Ministry of Commerce, Industry and Investment Promotion)

- Logistics and supply chain managers

- E-commerce businesses

- Retail companies

- Healthcare distributors

- Automotive manufacturers

- Food and beverage supply chain companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Oman Warehousing Market. This step relies on extensive desk research, utilizing a blend of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Oman warehousing market. This includes assessing market penetration, the ratio of warehouses to logistics providers, and resultant revenue generation. Additionally, we conduct an evaluation of service quality statistics to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing diverse companies in the logistics sector. These consultations will provide invaluable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple warehousing and logistics firms to acquire detailed insights into product segments, sales performance, consumer behaviours, and other relevant factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Oman warehousing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Data Sources, Consolidated Research Approach, Understanding Market Dynamics Through Expert Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Surge in E-commerce Activities

Increasing Demand for Logistics Solutions - Market Challenges

Regulatory Compliance Issues

High Operational Costs - Opportunities

Government Initiatives to Boost Infrastructure

Expansion of Cold Chain Logistics - Trends

Adoption of Automation Technologies

Growth of Warehouse as a Service (WaaS) - Government Regulation

Labor Regulations

Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Component, (In Value %)

Hardware/System

Software

Services - By Function, (In Value %)

Inventory Control and Management

Asset Tracking

Yard & Dock Management

Order Fulfilment

Workforce & Task (Process) Management

Shipping

Predictive Maintenance

Others - By Type, (In Value %)

Insource Warehousing

Outsource Warehousing - By Size, (In Value %)

Small

Medium

Large - By Ownership, (In Value %)

Public Warehouses

Private Warehouses

Bonded Warehouses

Consolidated Warehouse - By Warehousing Storage Nature, (In Value %)

Ambient Warehousing (Around 80°F)

Air Conditioned (56°F and 75°F)

Refrigerated (33°F and 55°F)

Cold/Frozen (Of or Below 32°F)

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Component Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Revenue Analysis, Operational Efficiency, Technology Utilization, Geographic Reach, Client Base)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

GGL Logistics

Oryx Logistics

GAC Logistics

AVVashya CCI Logistics

Logwin Logistics

Enhance Oman

Sohar Shipping

Al Nowras Logistics Solution

Alsi For Marine Services LLC

ASYAD

Clarion Shipping Services L.L.C

Ruzave Shipping and Logistic Directory

Omani Integrated Logistic services

Movguru

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030