Market Overview

The Peru copper mining market is valued at USD 18.2 billion in 2024, growing at a CAGR of 5.3% from 2024 to 2030. This robust market size is driven by the strong global demand for copper, fuelled by its essential role in electrical applications, renewable energy technologies, and construction activities. The copper industry in Peru benefits from a combination of rich mineral resources and well-established mining practices, contributing to its prominence in the global market.

The regions of Arequipa, Ancash, and Moquegua dominate the Peru copper mining market due to their mineral-rich geographies. These areas house significant copper reserves and have attracted substantial investments from both local and international mining companies. The favorable regulatory framework, along with the presence of established infrastructures such as roads and ports, enhances their competitive edge in the copper mining industry.

Market Segmentation

By Mining Method

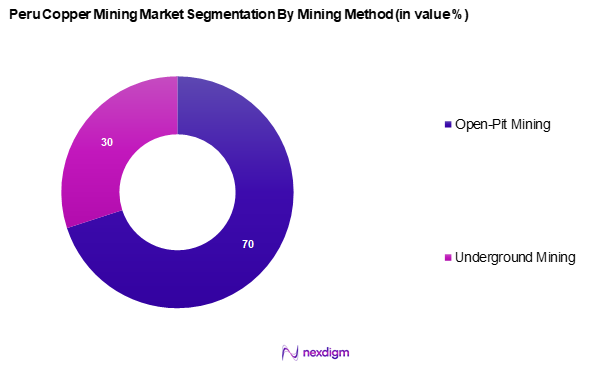

The Peru copper mining market is segmented into open-pit mining and underground mining. Open-pit mining holds a dominant market share due to its efficiency and lower operational costs. This method allows for the extraction of large volumes of ore at lower rates while minimizing mining wastage. Established mines such as Cerro Verde and Las Bambas utilize open-pit techniques, showcasing their economic viability, which further encourages its continued prevalence in production practices.

By Product Type

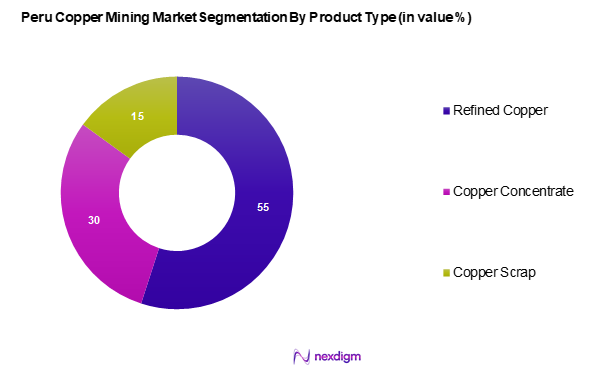

The Peru copper mining market is segmented into refined copper, copper concentrate, and copper scrap. Refined copper dominates the market share owing to its extensive usage across various industries, including electrical, electronics, and construction. Enhanced processing technologies coupled with rising consumer demand for high-purity copper products have driven the refinement of copper, establishing it as the primary product in the market and sustaining its growth trajectory.

Competitive Landscape

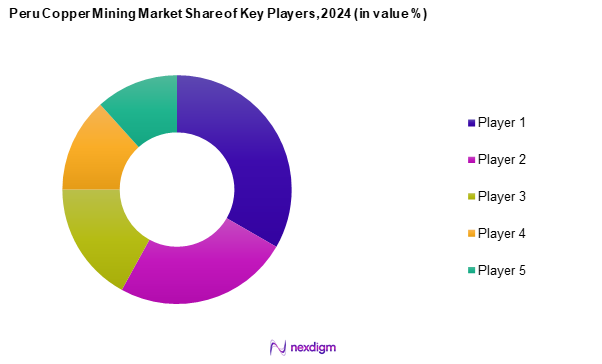

The Peru copper mining market is dominated by several major players, including Southern Copper Corporation and Anglo American. The presence of these leading companies highlights the consolidated nature of the industry, where a few major firms hold significant operational and market power. Established companies leverage their extensive resources, technological advancements, and market experience to maintain a competitive edge.

| Company | Establishment Year | Headquarters | Mining Method | Product Type | Market Focus |

| Southern Copper Corporation | 1965 | Phoenix, Arizona | – | – | – |

| Anglo American | 1917 | London, UK | – | – | – |

| Freeport-McMoRan | 1963 | Phoenix, Arizona | – | – | – |

| Hudbay Minerals | 1994 | Toronto, Canada | – | – | – |

| First Quantum Minerals | 1983 | Vancouver, Canada | – | – | – |

Peru Copper Mining Market Analysis

Growth Drivers

Global Demand for Copper

The growing reliance on copper across key global industries such as renewable energy, electric mobility, and infrastructure development is fueling steady demand. As countries continue to invest in clean energy transitions and advanced technologies, copper’s essential role in electrical conductivity and energy storage makes it a cornerstone resource. This enduring and expanding demand strengthens Peru’s position as a major supplier in the global copper market, offering sustained growth prospects.

Technological Advancements in Mining

Innovations in mining technologies are transforming operational capabilities in Peru’s copper sector. The integration of automation, AI-driven systems, and remote-controlled equipment has significantly enhanced productivity and resource management. These advancements have led to more precise extraction processes, reduced operational downtimes, and more efficient labor allocation. The adoption of data analytics and smart monitoring tools has also optimized decision-making, reinforcing Peru’s potential to become a benchmark for technologically advanced mining operations.

Challenges

Environmental Regulations

Environmental compliance has become increasingly rigorous, requiring mining companies to align with national and international sustainability standards. New regulatory frameworks are pushing for reduced emissions and more responsible waste management practices. While these measures promote long-term ecological sustainability, they also compel mining firms to invest in cleaner technologies and revamp operational protocols. Balancing environmental obligations with profitability poses a continuous challenge for the sector.

Political Stability and Policy Changes

Uncertainty in the political landscape continues to influence investor sentiment in Peru’s copper mining industry. Shifts in leadership and regulatory reforms—particularly those related to land rights, taxation, and licensing—can disrupt operational continuity and delay project timelines. This volatile environment has led mining companies to adopt more comprehensive risk mitigation and stakeholder engagement strategies. Long-term investment planning now increasingly hinges on policy predictability and effective government-industry collaboration.

Opportunity

Investment in Renewable Energy

The nationwide shift toward renewable energy offers promising synergies for the copper mining sector. As the government accelerates clean energy development, the demand for copper—integral to solar, wind, and battery technologies—continues to rise. This alignment between clean energy goals and mineral demand positions Peru to enhance its mining sustainability narrative while opening new avenues for international collaboration and green investments.

Expansion into Emerging Markets

Emerging markets are rapidly industrializing, creating a fertile ground for increased copper exports. Regions undergoing infrastructure expansion and energy modernization are driving global copper consumption trends. Peru’s advantageous trade routes and established export relationships make it well-positioned to meet this rising demand. By deepening ties with these dynamic economies, Peru can diversify its export base and strengthen its global market presence.

Future Outlook

Over the next five years, the Peru copper mining market is expected to show significant growth driven by an increasing global demand for copper and substantial investments in mining infrastructure. The ongoing transition to renewable energy sources will continue to fuel this demand, as will technological advancements that enhance mining efficiency and environmental sustainability.

Major Players

- Southern Copper Corporation

- Buenaventura

- Hudbay Minerals

- Anglo American

- Freeport-McMoRan

- First Quantum Minerals

- Glencore International

- Teck Resources

- MINERA Los Pelambres

- Barrick Gold Corporation

- Rio Tinto

- Antofagasta PLC

- Northern Dynasty Minerals

- Aurubis AG

- Vedanta Resources

Key Target Audience

- Mining Corporations

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Energy and Mines – Peru)

- Commodity Traders

- Environmental Agencies

- Equipment Manufacturers

- Industry Consultants

- Mining Industry Associations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Peru copper mining market. This step is supported by extensive desk research utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Peru copper mining market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple mining companies to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive and validated analysis of the Peru copper mining market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through Industry Analysis, Primary Research Approach, Limitations and Future Recommendations)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Market Growth Drivers

Global Demand for Copper

Technological Advancements in Mining - Challenges

Environmental Regulations

Political Stability and Policy Changes - Opportunities

Investment in Renewable Energy

Expansion into Emerging Markets - Trends

Increased Focus on Sustainability

Adoption of Advanced Extraction Technologies - Regulatory Landscape

Mining Codes and Regulations

Environmental Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Mining Method

Open-Pit Mining

– Heap Leaching Operations

– Solvent Extraction-Electrowinning (SX-EW)

– Large-scale open-pit mines (e.g., Cerro Verde, Las Bambas)

Underground Mining

– Block Caving

– Sublevel Stoping

– Cut and Fill Mining - By Region

Arequipa

Cusco

Ancash

Moquegua

Tacna

Apurímac

Puno and Ayacucho Regions - By End-User Industry

Electrical & Electronics

– Power Cables

– Printed Circuit Boards

– Electric Motors

Transportation

– Automotive Wiring

– Railway & Aviation Parts

– Electric Vehicle Components

Construction

– Plumbing & Fittings

– Roofing & Cladding

– Structural Components

Consumer Goods

– Appliances

– Cookware

– Decorative Items

Others

– Industrial Machinery

– Renewable Energy Infrastructure - By Ownership Structure

Private

– Multinational Mining Corporations

– Domestic Private Operators

Public

– Government-Owned Enterprises

– Public-Private Partnerships - By Product Type

Refined Copper

– Electrolytic Copper Cathodes

– Wire Rods & Billets

Copper Concentrate

– High-grade Sulfide Concentrate

– Bulk Concentrate for Export

Copper Scrap

– Post-Industrial Scrap

– Recycled Wire and Tubing

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Mining Method Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenue, Shareholder Participation, Operational Efficiency, Unique Value Proposition)

- SWOT Analysis of Major Players

- Pricing Analysis by Product Type for Major Players

- Detailed Profiles of Major Companies

Southern Copper Corporation

Buenaventura

Hudbay Minerals

Anglo American

Freeport-McMoRan

First Quantum Minerals

Glencore International

Teck Resources

MINERA Los Pelambres

Barrick Gold Corporation

Rio Tinto

Antofagasta PLC

Northern Dynasty Minerals

Aurubis AG

Vedanta Resources

- Demand Dynamics Across Industries

- Purchasing Power Analysis

- Regulatory Compliance Requirements

- Market Needs and Challenges

- Decision-Making Processes

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030