Market Overview

The Peru gold mining market is valued at USD 8.5 billion in 2024 with an approximated compound annual growth rate (CAGR) of 2% from 2024-2030, with significant growth attributed to rising global gold prices and increased demand across various applications, including investment and jewelry manufacturing. The market is primarily driven by foreign investments and advancements in mining technology, as well as regulatory support that boosts exploration and production activities. As a leading gold producer in Latin America, Peru continues to expand its mining capabilities, ensuring its position in the global gold market.

Peru is home to major mining regions, with cities such as Lima, Arequipa, and Cajamarca acting as pivotal hubs for gold production. These regions dominate due to their rich gold deposits, established mining infrastructure, and favorable geological conditions. Furthermore, the government’s commitment to promoting mining activities, along with a skilled workforce, enhances the country’s appeal as a key player in the global gold mining industry.

Market Segmentation

By Mining Method

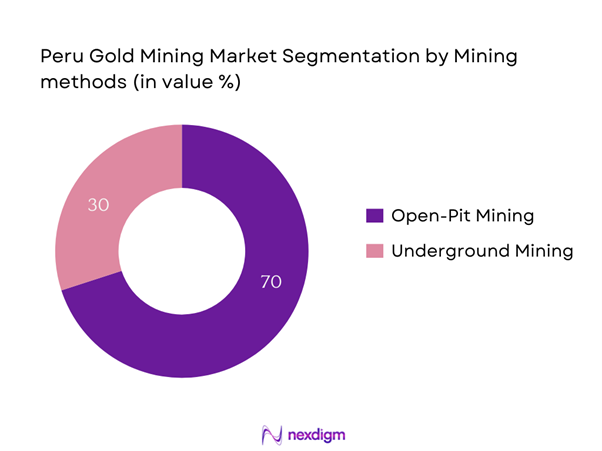

The Peru gold mining market is segmented by mining method into open pit mining and underground mining. Recently, open pit mining has emerged as the dominant method due to its cost-effectiveness and efficiency in extracting large quantities of gold ore. Open pit mining allows for the quick removal of overburden and provides better safety conditions compared to underground mining. Companies are increasingly adopting this method to maximize productivity and minimize operational costs, contributing to its dominance in the market.

By Application

The Peru gold mining market is segmented by application into jewelry, electronics, and investment. The jewelry segment continues to lead the market thanks to a robust demand for gold ornaments, particularly in Asian markets where gold jewelry holds significant cultural and economic value. The rise in disposable incomes and consumer spending on luxury goods has further fueled growth in this segment. Furthermore, the trend towards personalized jewelry has increased the demand for gold, reinforcing its dominant position within the application segmentation.

Competitive Landscape

The Peru gold mining market is characterized by the presence of several major players, including both local and international companies. The competitive landscape is consolidated, with key companies leveraging their operational efficiencies and established market presence to drive growth. Notable players include Barrick Gold Corporation and Buenaventura Mining Company, among others. These companies are pivotal to innovation and investment in mining technology and sustainable practices, which further enhances their competitive edge.

| Company | Establishment Year | Headquarters | Market Share (%) | Annual Revenue (USD) | Key Products/Services | Mining Method |

| Barrick Gold Corporation | 1983 | Toronto, Canada | – | – | – | – |

| Buenaventura Mining Company | 1953 | Lima, Peru | – | – | – | – |

| Southern Copper Corporation | 1966 | Phoenix, USA | – | – | – | – |

| Newmont Corporation | 1921 | Greenwood Village, USA | – | – | – | – |

| Hochschild Mining plc | 1910 | London, UK | – | – | – | – |

Peru Gold Mining Market Analysis

Growth Drivers

High Global Gold Prices

High global gold prices continue to be a significant driver for the Peru gold mining market. As of mid-2023, gold prices reached an average upper limit of USD 2,080 per ounce, reflecting strong investor sentiment in the face of global economic uncertainties such as inflation and geopolitical tensions. A stable upward trend in prices is anticipated to continue owing to shifts in monetary policies across major economies. For instance, gold has become increasingly favored as a hedge against inflation, leading to predictions of robust demand as global economic conditions evolve. The potential for gold prices to average USD 2,500 per ounce in response to sustained global uncertainty underscores the commodity’s attractiveness.

Increased Demand for Jewelry

The demand for gold jewelry has risen sharply, particularly in emerging markets. In 2022, global gold jewelry demand amounted to approximately 2,100 tons, with significant contributions from countries like India and China, where cultural factors and rising middle-class incomes bolster jewelry consumption. Peru, as a key player in gold mining, benefits from this trend, with an expectation of increased local and export demand for gold jewelry as consumer spending grows. In light of the world economy’s recovery, analysts predict that jewelry demand will maintain a strong trajectory through 2025, providing continued support for the mining sector.

Market Challenges

Regulatory Compliance Issues

The regulatory environment surrounding mining in Peru is complex and poses significant challenges to operators. The government enforces stringent regulations to ensure compliance with mining laws and social standards, which often delay project approvals. The Ministry of Energy and Mines reported that 75% of mining projects run into delays due to bureaucratic hurdles and regulatory examinations. Such conditions hinder investment and make it essential for mining companies to stay abreast of compliance requirements, which are subject to change. This regulatory complexity necessitates additional financial and legal resources, impacting the overall feasibility of mining operations.

Environmental Concerns

Environmental concerns continue to challenge the Peru gold mining industry. According to recent studies, mining activities have been linked to deforestation and habitat destruction, with an estimated loss of 23,000 hectares of forest attributed to illegal and poorly regulated mining operations. Additionally, the Ministry of the Environment has indicated that water pollution from mining activities continues to threaten local ecosystems, which has led to increasing public protests and legal actions that disrupt operations. Addressing these environmental issues is crucial for maintaining a sustainable mining industry in Peru, emphasizing the need for companies to adopt eco-friendly practices.

Opportunities

Expansion of Exploration Activities

There are significant opportunities for expansion in exploration activities within Peru, fueled by the country’s rich geological endowment. The National Institute of Statistics and Informatics reported that 47% of Peru’s territory remains underexplored for mineral resources, highlighting the potential for new discoveries. Mining companies are thus being encouraged to engage in exploratory drilling, particularly in regions such as Cajamarca and La Libertad, known for their promising geological conditions. These opportunities align with favorable government policies aimed at attracting foreign investments, thereby bolstering new mineral exploration initiatives.

Technological Advancements in Mining

Technological advancements are revolutionizing mining operations, offering enhanced efficiency and sustainability. The introduction of automated mining systems and artificial intelligence is already making waves in resource extraction practices, leading to improved safety and reduced operational costs. Reports indicate a notable decrease in manual labor requirements, enhancing productivity by approximately 35% in several mines. As companies invest in modernizing their operations, the potential to extract resources with minimal environmental impact is becoming a reality, providing a clear pathway for future growth in the Peru gold mining sector.

Future Outlook

Over the next five years, the Peru gold mining market is expected to show significant growth, driven by continuous foreign investments, advancements in mining technology, and increasing global demand for gold as a safe-haven asset. The stability of gold prices, paired with favorable regulatory policies promoting exploration and production activities, will further enhance the market scenario. Furthermore, the trend towards sustainable practices in mining is likely to gain traction, positioning Peru as a leader in responsible gold mining.

Major Players

- Barrick Gold Corporation

- Buenaventura Mining Company

- Southern Copper Corporation

- Newmont Corporation

- Hochschild Mining plc

- Minera Yanacocha

- Fortuna Silver Mines

- Cormark Securities

- IAMGOLD Corporation

- Gold Fields Limited

- Alamos Gold

- Chinalco

- Pan American Silver

- Anglo American plc

- Sanda Gold

Key Target Audience

- Investments and venture capital firms

- Government and regulatory bodies (Ministry of Energy and Mines, Environmental Impact Assessment Agency)

- Mining companies and operators

- Commodity traders and brokers

- Financial institutions and banks specializing in resource financing

- Industry associations and coalitions

- Private equity firms focused on natural resources

- International development agencies and organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Peru gold mining market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as production methods, regulatory frameworks, and market demand.

Step 2: Market Analysis and Construction

In this phase, historical performance data related to the Peru gold mining market is compiled and analyzed. This includes reviewing production volumes, market values, and the impact of fluctuations in gold prices. Additionally, the analysis assesses the ratio of mining operations to gold yield and the prevailing cost structures in extraction processes. Insights gained will contribute to establishing a reliable foundation for forecasting future market trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses formulated during earlier steps are validated through computer-assisted telephone interviews (CATIs) with industry experts representing a broad spectrum of companies involved in gold mining. Engaging with professionals allows for the acquisition of valuable insights concerning operational practices, challenges faced, and prevailing market sentiments, enabling a more nuanced understanding of the factors influencing market performance.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple gold mining companies, stakeholders, and government representatives to acquire detailed insights into production methodologies, sales performance, consumer trends, and other market-affecting factors. This interaction not only confirms and complements the statistics obtained through earlier analyses but ensures a comprehensive, accurate, and validated assessment of the Peru gold mining market, positioning stakeholders to make informed decisions.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Overview of Gold Mining in Peru

- Timeline of Major Gold Mining Projects

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

High Global Gold Prices

Increased Demand for Jewelry - Market Challenges

Regulatory Compliance Issues

Environmental Concerns - Opportunities

Expansion of Exploration Activities

Technological Advancements in Mining - Trends

Shift to Eco-Friendly Mining

Adoption of Artificial Intelligence in Mining - Government Regulations

Mining Laws and Policies

Environmental Protection Laws - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Mining Method (In Value %)

Open Pit Mining

– Heap Leaching Operations

– Cyanide Processing Plants

– Surface Blasting Sites

Underground Mining

– Shaft Mining

– Drift and Fill Mining

– Room and Pillar Mining - By Region (In Value %)

Southern Peru

Central Peru

Northern Peru - By Application (In Value %)

Jewelry

– Domestic Jewelry Manufacturers

– Export-Oriented Craftsmanship

Electronics

– Circuit Boards and Semiconductors

– Precision Components for Medical Devices

Investment

– Gold Bullion for Institutional Investors

– Gold ETFs and Sovereign Holdings - By Type of Gold (In Value %)

Bullion

– Bars (e.g., 1kg, 400 oz)

– Ingots (Various Grades)

Gold Coins

– Numismatic Coins

– Bullion Coins (e.g., minted by Central Bank) - By Environmental Compliance Category (In Value %)

Sustainable Mining Practices

– Certified Responsible Gold (e.g., Fairmined, IRMA)

– Water Recycling Systems

– Carbon Reduction Programs

Conventional Practices

– Legacy Mining Operations

– Non-certified Extraction

– High Water/Energy Footprint Sites

- Market Share of Major Players by Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenues, Production Capacities, Environmental Ratings, Reserves & Resources, Cost Metrics, Mine Life/Project Pipeline, Geographical Risk Exposure, Sustainability Practices, and Market Positioning)

- SWOT Analysis of Major Players

- Pricing Analysis of Gold Products

- Detailed Profiles of Major Companies

Barrick Gold Corporation

Newmont Corporation

Southern Copper Corporation

Buenaventura Mining Company

Anglo American plc

Gold Fields Limited

Alamos Gold

Fortuna Silver Mines

Minera Yanacocha

Hochschild Mining

IAMGOLD Corporation

Sanda Gold

Chinalco

Pan American Silver

Cormark Securities

- Consumption Patterns

- Market Demand and Utilization

- Budget Allocations

- Needs and Pain Points Analysis

- Decision-Making Processes

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030