Market Overview

The Philippines adaptive headlights market is growing steadily, driven by rising consumer demand for safety, enhanced driving experiences, and technological integration in modern vehicles. Adaptive headlight systems, which automatically adjust the direction and range of the vehicle’s headlights, have gained popularity due to their ability to improve night-time driving safety and road visibility. The market is mainly driven by the increasing adoption of Advanced Driver Assistance Systems (ADAS), urbanization, and the growing interest in premium vehicles equipped with the latest lighting technologies. In 2024, the market is expected to continue its upward trend, with significant investments in automotive innovation and rising consumer awareness of safety features.

Metro Manila is the dominant region in the Philippines adaptive headlights market due to its high concentration of automobile sales and rapid urbanization. Additionally, cities like Cebu and Davao are witnessing increased adoption of advanced automotive technologies as a result of improving infrastructure and rising disposable income. The demand for adaptive headlights is particularly high in these urban areas, where traffic conditions and road infrastructure challenges necessitate advanced lighting solutions for enhanced driver safety and comfort.

Market Segmentation

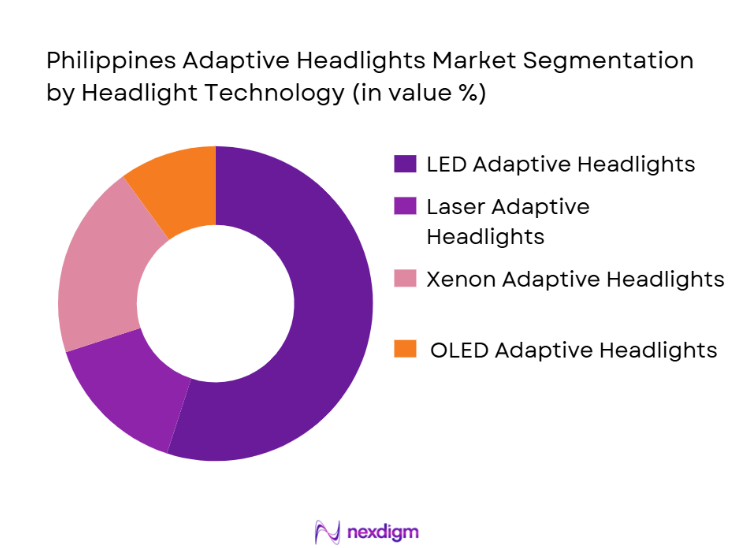

By Headlight Technology

The Philippines adaptive headlights market is segmented by headlight technology into various types including LED, laser, xenon, and OLED adaptive headlights. Among these, LED adaptive headlights dominate the market in terms of both revenue and adoption. This is primarily due to the cost-effectiveness, longevity, and efficiency of LED technology, which makes it the preferred choice for OEMs and consumers alike. Additionally, the rapid evolution of LED-based adaptive headlight systems, such as matrix LEDs and dynamic adaptive lighting, has made them the dominant technology. These systems offer better illumination, energy efficiency, and improved safety, all while reducing power consumption, making them highly attractive in a price-sensitive market like the Philippines.

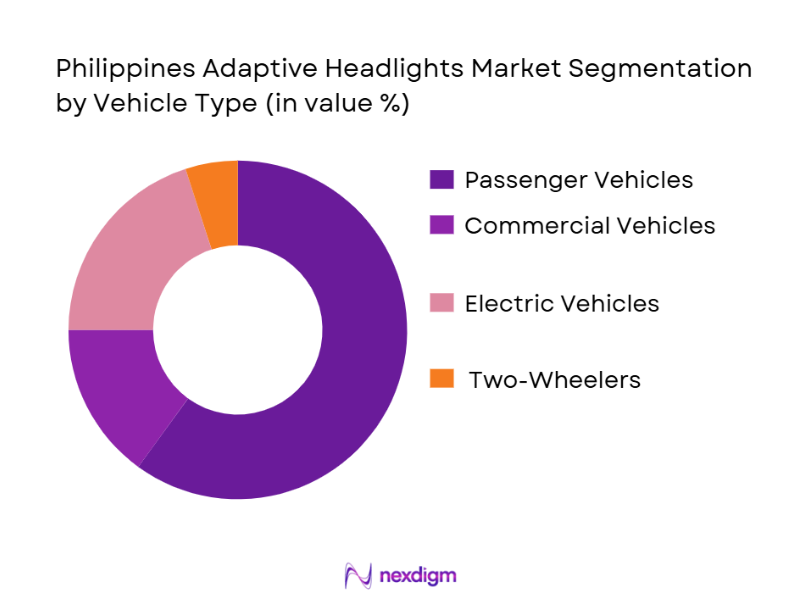

By Vehicle Type

The market is also segmented by vehicle type into passenger cars, commercial vehicles, electric vehicles (EVs), and two-wheelers. Passenger cars dominate the segment due to the increasing adoption of premium and mid-range vehicles equipped with advanced lighting systems. Electric vehicles, although still emerging in the market, are witnessing higher adoption rates in urban areas due to rising environmental awareness and government incentives for eco-friendly technologies. EVs are expected to see substantial growth, with more automakers integrating adaptive lighting systems into their electric models, which are gaining popularity in cities like Metro Manila.

Competitive Landscape

The Philippines adaptive headlights market is witnessing increased competition, with both local and international players vying for market share. The major players in the market include global companies like Bosch, Hella, Koito Manufacturing, and Valeo, who provide advanced adaptive lighting technologies to OEMs. These companies dominate due to their technological expertise, robust supply chains, and long-standing relationships with automotive manufacturers. Local players are also emerging, focusing on aftermarket solutions and cost-effective alternatives. The competitive landscape is also shaped by the integration of ADAS technologies and collaborations with automotive manufacturers to offer bundled solutions for improved driver safety.

| Company | Establishment Year | Headquarters | Technological Innovations | Partnerships | Revenue (2024) | Target Market Segments |

| Bosch Automotive Lighting | 1886 | Germany | ~ | ~ | ~ | ~ |

| Hella GmbH & Co. KGaA | 1899 | Germany | ~ | ~ | ~ | ~ |

| Koito Manufacturing Co., Ltd | 1915 | Japan | ~ | ~ | ~ | ~ |

| Valeo SA | 1923 | France | ~ | ~ | ~ | ~ |

| ZKW Group GmbH | 1994 | Austria | ~ | ~ | ~ | ~ |

Philippines Adaptive Headlights Market Analysis

Growth Drivers

Rising Demand for Vehicle Safety Features

The increasing emphasis on road safety and the adoption of Advanced Driver Assistance Systems (ADAS) in vehicles are key drivers for the growth of the adaptive headlights market in the Philippines. Consumers are becoming more aware of the importance of night-time driving safety, which boosts the demand for advanced lighting systems that improve road visibility and reduce accidents.

Government Regulations and Initiatives

The Philippines government is actively promoting vehicle safety and environmental standards, creating a favorable environment for the adoption of advanced lighting technologies. Policies encouraging the integration of eco-friendly and safe driving technologies are driving the demand for adaptive headlights, especially in premium and electric vehicle segments.

Market Challenges

High Initial Cost and Retrofit Challenges

One of the major challenges in the Philippines adaptive headlights market is the high cost of installing advanced adaptive headlight systems, especially in lower-cost vehicles. Retrofitting existing vehicles with adaptive lighting technologies can be expensive, limiting their widespread adoption among cost-conscious consumers.

Awareness Gap Among Consumers

Despite the growing interest in advanced automotive technologies, there is still a lack of widespread consumer awareness about the benefits of adaptive headlights. Many consumers do not fully understand the safety advantages or long-term cost savings, which can hinder the adoption of these systems.

Opportunities

Rising Electric Vehicle Adoption

The increasing adoption of electric vehicles (EVs) in the Philippines presents a significant opportunity for adaptive headlight systems. As more EV models hit the market, manufacturers are incorporating advanced lighting technologies as part of the overall push for eco-friendly and cutting-edge automotive features, providing a strong growth avenue for adaptive headlights.

Technological Advancements and Integration with Smart Systems

The integration of adaptive headlights with other smart vehicle systems, such as vehicle-to-infrastructure communication and autonomous driving technologies, offers substantial growth potential. These advancements provide an opportunity for the market to expand, particularly as automakers push towards smart, connected vehicles with improved safety features.

Future Outlook

Over the next five years, the Philippines adaptive headlights market is expected to see robust growth, driven by advancements in automotive lighting technology and an increasing focus on vehicle safety. The growing integration of ADAS in vehicles will further accelerate the adoption of adaptive headlights, especially in mid- to high-range vehicles. Moreover, with the Philippines’ rising middle-class population and greater urbanization, the demand for both OEM-fitted and aftermarket adaptive lighting solutions is anticipated to increase. The Philippines government’s push towards environmentally friendly and safe vehicle solutions will also likely play a pivotal role in this market’s future growth, as more EVs and hybrid models with adaptive headlight systems hit the road.

Major Players

- Bosch Automotive Lighting

- Hella GmbH & Co. KGaA

- Koito Manufacturing Co., Ltd.

- Valeo SA

- ZKW Group GmbH

- Magneti Marelli

- Osram Continental GmbH

- Samsung Electronics

- Denso Corporation

- STANLEY Electric Co., Ltd.

- Autoliv Inc.

- General Electric Company (GE)

- Aptiv PLC

- Philips Automotive Lighting

- Delphi Technologies

Key Target Audience

- Automobile Manufacturers (OEMs)

- Automotive Suppliers and Tier-1 Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Land Transportation Office, Philippines)

- Automotive Aftermarket Retailers

- Electric Vehicle Manufacturers

- Vehicle Fleet Operators

- Automotive Technology Integration Firms

Research Methodology

Step 1: Identification of Key Variables

This initial phase focuses on identifying the key factors that influence the Philippines adaptive headlights market. This involves reviewing secondary data from credible automotive and technology databases and utilizing proprietary research methods to create an ecosystem map of stakeholders.

Step 2: Market Analysis and Construction

Historical data on adaptive headlight adoption trends, market penetration, and regional sales will be analyzed to develop a comprehensive market construction. This phase also includes a deep dive into OEM market share and technological adoption rates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated by conducting primary research with industry experts, OEM representatives, and aftermarket distributors through interviews and surveys. This feedback will refine market projections and validate assumptions regarding growth drivers and restraints.

Step 4: Research Synthesis and Final Output

In the final phase, data will be synthesized to form a detailed market report, including forecasts, trends, and competitive analysis. This phase also includes interaction with key players and stakeholders to ensure data integrity and offer insights into market dynamics.

- Executive Summary

- Research Methodology (Definitions and market assumptions, Adaptive headlights technology taxonomy, Data triangulation framework, Philippines vehicle fleet profiling approach, Market sizing & forecasting models, Competitive intelligence and primary research protocols)

- Market introduction

- Market genesis & evolution within Philippines automotive electronics landscape

- Safety regulations & headlamp compliance (LTO safety standards influence)

- Integration with advanced driver assistance systems (ADAS interoperability)

- Value chain and supply ecosystem analysis (Tier 1, 2, OEM, import assembly)

- Growth Drivers

Rising safety awareness & night driving concerns

ADAS integration momentum

Electrification and premium vehicle adoption - Market Restraints

High ASP and retrofit cost implications

Awareness gap in midtier consumer segments - Market Opportunities

IoTconnected adaptive lighting solutions

Vehicle to infrastructure lighting synergies

EV safety lighting bundles - Market Trends

Shift from halogen to smart LED solutions

Feature differentiation as consumer buying trigger - Regulatory & Standards Landscape

ASEAN & Philippines headlamp safety regulations

Import duty & local content policies

Automotive lighting homologation standards

- Market value, 2019-2025

- Market volume, 2019-2025

- Average system ASP, 2019-2025

- By Headlight Technology (in Value%)

LED Adaptive Headlights

Laser Adaptive Headlights

Xenon Adaptive Headlights

Pixel LED Adaptive Headlights

OLED Adaptive Headlights - By Functional Capabilities (in Value%)

Dynamic Beam Control

Steering Responsive Lighting

Speed Adaptive Illumination

Auto Dimming High Beam

Road Sign / Object Recognition Integrated - By Vehicle Type (in Value%)

Passenger Cars

Commercial Vehicles (LCV / HCV)

Electric Vehicles (EV / Hybrid)

TwoWheelers & Scooter Segment

Specialty & OffRoad Vehicles - By Sales Channel (in Value%)

OEM Fitment (New Vehicle)

Aftermarket Solutions

Retrofit Kits

Tier 1 Suppliers Direct to OEM - By Application Use Case (in Value%)

Urban Driving Safety

Highway / LongDistance Navigation

OffRoad / Terrain Adaptive Lighting

RideSharing / Fleet Vehicles

- Market share analysis

- CrossComparison Parameters (Product portfolio breadth, R&D spend on adaptive lighting, Technology differentiation, OEM partnerships & supply contracts, Penetration across vehicle segments, Manufacturing footprint in AsiaPacific, Aftermarket distribution channels, Pricing strategy & ASP tiers)

- SWOT of Major Competitors

- Pricing analysis by SKU / tech tier

- Major Players Profiles

Bosch Automotive Lighting / Robert Bosch GmbH

HELLA GmbH & Co. KGaA

Valeo SA

Koito Manufacturing Co., Ltd.

Stanley Electric Co., Ltd.

ZKW Group GmbH

OSRAM Continental GmbH

Magneti Marelli / Marelli Holdings Co.

Denso Corporation

Varroc Lighting Systems

Philips Automotive Lighting (Signify)

Hyundai Mobis Adaptive Light Division

Nichia Corporation

Samsung LED Solutions

- Rising interest in safety features among consumers

- Fleet operators focusing on vehicle performance

- Government adoption of eco-friendly vehicle technologies

- Automotive manufacturers exploring innovative lighting solutions

- By value, 2026-2030

- By volume, 2026-2030

- By system ASP evolution, 2026-2030