Market Overview

The Philippines AI Algorithms in Healthcare Market is currently valued at approximately USD ~ million, and this market is expected to continue its growth trajectory. The primary growth drivers for this market include increased demand for more efficient healthcare services, improvements in AI-based diagnostic tools, and the rapid expansion of telemedicine. Moreover, the government’s focus on advancing healthcare infrastructure through AI adoption in hospitals and clinics further propels this market. In addition, the rise in healthcare expenditures, combined with a growing middle-class population, has amplified the demand for AI-enabled healthcare solutions.

Metro Manila, Cebu, and Davao lead the Philippines AI algorithms in healthcare market due to their strong healthcare infrastructure, highly concentrated urban populations, and a higher rate of AI adoption by medical institutions. Metro Manila, being the capital, is the central hub of AI innovation with many tech startups collaborating with hospitals to integrate AI technologies. Cebu and Davao follow closely, with increasing AI deployments in both public and private healthcare sectors. These cities are the focus of government initiatives to implement AI-driven HealthCare solutions, as part of the Digital Philippines program.

Market Segmentation

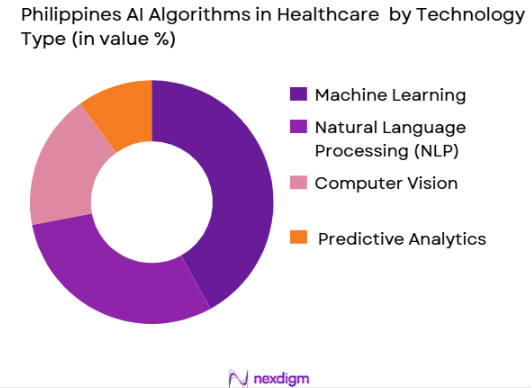

By Technology Type

The AI Algorithms in Healthcare market in the Philippines is divided into several key technologies: machine learning, natural language processing (NLP), computer vision, and predictive analytics. Machine learning-based algorithms are currently the dominant sub-segment in this market, accounting for a significant share due to their ability to improve diagnostic accuracy in clinical settings. These algorithms are being integrated into radiology departments for interpreting medical imaging data and are proving invaluable for enhancing patient outcomes.

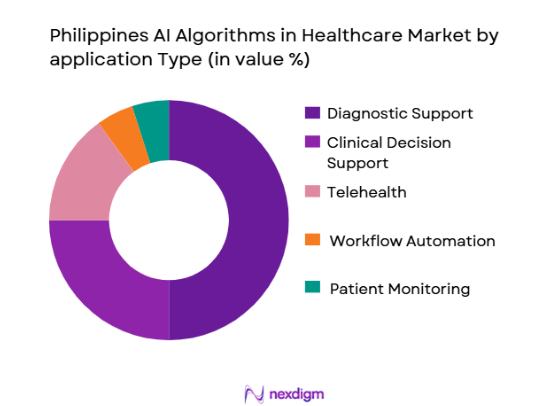

By Application

This market is also segmented by application, which includes diagnostic support, clinical decision support, telehealth, workflow automation, and patient monitoring. Diagnostic support has emerged as the most dominant application segment in the Philippines, particularly in the fields of radiology, pathology, and ophthalmology. AI algorithms are transforming these areas by enabling faster diagnosis and reducing human errors, thus improving healthcare delivery.

Competitive Landscape

The AI algorithms in healthcare market in the Philippines is highly competitive, with both local and international players working towards developing innovative AI-powered solutions. Several key players are providing cutting-edge AI tools that are increasingly adopted by hospitals and medical centers across the country. Companies like IBM Watson Health, Google Health, and local startups such as Senti AI and RedDot AI are at the forefront of this transformation.

The competitive landscape is shaped by a few major players who dominate the market, with their advanced technologies and extensive healthcare partnerships. These companies are strengthening their position through strategic collaborations with hospitals, research institutes, and AI technology providers, further pushing the boundaries of AI applications in healthcare.

| Company Name | Establishment Year | Headquarters | Technology Focus | Clinical Applications | AI Model Development | Healthcare Partnerships |

| IBM Watson Health | 2015 | ~ | ~ | ~ | ~ | ~ |

| Google Health | 2018 | ~ | ~ | ~ | ~ | ~ |

| Senti AI | 2017 | ~ | ~ | ~ | ~ | ~ |

| RedDot AI | 2019 | ~ | ~ | ~ | ~ | ~ |

| Philips Healthcare | 1891 | ~ | ~ | ~ | ~ | ~ |

Philippines AI Algorithms in Healthcare Market Analysis

Growth Drivers

Urbanization

Indonesia’s rapid urbanization remains a key driver for air quality monitoring system demand. The country’s urban population reached nearly 58% of its 281,190,067 total population, with an estimated 162 million people living in urban areas as of 2023 according to World Bank–aligned estimates. Rapid growth in cities like Jakarta, Surabaya, and Bandung has substantially increased combustion emissions—from transportation, power generation, and industry—leading to rising concerns over particulate matter and nitrogen oxide levels. Elevated PM2.5 exposure exceeded healthy air quality guidelines, making real‑time monitoring critical for public health and planning efforts.

Industrialization

Industrial activity in Indonesia, particularly on Java and Sumatra islands, has accelerated air pollution pressures, thereby driving investment in monitoring infrastructure. According to data on particulate pollution exposures, 44 out of 46 Indonesian cities exhibited PM2.5 above the WHO guideline (5 µg/m³) in 2023, underscoring the need for continuous monitoring near industrial zones. Industrial emissions from power plants, cement production, and heavy manufacturing contribute to ambient PM2.5 concentrations often exceeding 30–55 µg/m³ in urban airsheds like the Greater Jakarta area. This industrial footprint makes localized air quality monitoring systems essential for regulatory compliance and emissions control strategies.

Restraints

Technological Advancements

Advancements in sensor technology and data platforms present growth opportunities for this market. New generation low‑cost air quality sensors now provide near‑real‑time measurements of PM2.5 and gaseous pollutants with improving accuracy. Coupling these with cloud‑based analytics enables localized risk forecasting and timely health advisories. Integration with mobile networks supports remote monitoring across broader geographic regions. As technology costs decline and data infrastructure expands, environmental agencies and private operators can deploy dense networks that enhance spatial coverage, enabling more granular air quality insights that are essential for public health protection.

International Collaborations

International partnerships are facilitating capacity expansion for Indonesia’s air quality monitoring landscape. Collaboration between government entities and global environmental research organizations has led to shared technical expertise, funding support, and access to best practices in network design and data dissemination. Joint initiatives often focus on linking national air quality systems to global reporting platforms, improving transparency and benchmarking against World Health Organization air quality standards. These partnerships help transfer knowledge on advanced calibration protocols and open pathways for investments in monitoring infrastructure.

Opportunities

Technological Advancements

Advancements in sensor technology and data platforms present growth opportunities for this market. New generation low‑cost air quality sensors now provide near‑real‑time measurements of PM2.5 and gaseous pollutants with improving accuracy. Coupling these with cloud‑based analytics enables localized risk forecasting and timely health advisories. Integration with mobile networks supports remote monitoring across broader geographic regions. As technology costs decline and data infrastructure expands, environmental agencies and private operators can deploy dense networks that enhance spatial coverage, enabling more granular air quality insights that are essential for public health protection.

International Collaborations

International partnerships are facilitating capacity expansion for Indonesia’s air quality monitoring landscape. Collaboration between government entities and global environmental research organizations has led to shared technical expertise, funding support, and access to best practices in network design and data dissemination. Joint initiatives often focus on linking national air quality systems to global reporting platforms, improving transparency and benchmarking against World Health Organization air quality standards. These partnerships help transfer knowledge on advanced calibration protocols and open pathways for investments in monitoring infrastructure.

Future Outlook

Over the next 5 years, the Philippines AI algorithms in healthcare market is expected to experience substantial growth, driven by technological advancements, increasing investments from private and public sectors, and a shift towards more patient-centric healthcare delivery models. The rapid adoption of AI-powered diagnostic tools, especially in the areas of radiology and oncology, is expected to be a key contributor to this growth. Moreover, the expansion of telemedicine services, particularly in rural regions, will further drive the demand for AI algorithms tailored to remote patient monitoring and consultations. As AI technology continues to mature and regulatory frameworks become more supportive, the Philippines AI healthcare market will see more widespread implementation in everyday healthcare practices, providing a foundation for long-term growth.

Major Players in the Market

- IBM Watson Health

- Google Health

- Senti AI

- RedDot AI

- Philips Healthcare

- Siemens Healthineers

- Microsoft Healthcare

- GE Healthcare

- Tempus

- PathAI

- Aidoc

- Butterfly Network

- Zebra Medical Vision

- NVIDIA AI Healthcare

- H2O.ai

Key Target Audience

- Investments and Venture Capitalist Firms

- Philippine Department of Health (DOH)

- National Telehealth Service Providers

- Philippine Health Insurance Corporation (PhilHealth)

- Private Hospital Networks

- Healthcare System Integrators

- AI Technology Providers for Healthcare

- Government Regulatory Bodies (FDA Philippines)

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research involves identifying key variables within the AI algorithms in healthcare market, including technology types, major applications, and adoption rates. This involves in-depth secondary research, utilizing industry reports, healthcare publications, and government resources to define the landscape accurately.

Step 2: Market Analysis and Construction

This phase focuses on analyzing historical data related to AI adoption in the healthcare sector, including market penetration and growth trends. Data is gathered from hospitals, healthcare providers, and technology firms to build a comprehensive market analysis for future projections.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses, consultations will be conducted with AI healthcare experts, technology vendors, and healthcare executives through interviews and surveys. These expert insights will enhance the robustness of the data analysis and provide real-time market dynamics.

Step 4: Research Synthesis and Final Output

In the final phase, the research will be synthesized through primary data from healthcare providers and secondary data from existing market research. This ensures an integrated approach that provides a validated and comprehensive view of the AI algorithms in healthcare market in the Philippines.

- Executive Summary

- Research Methodology(Market Definitions (AI Algorithms, Clinical AI Platforms, Regulatory AI Classes), Assumptions and Constraints (Algorithms Safety, Data Privacy), Primary & Secondary Data Sources, Quantitative Sizing & Forecasting Model, Competitive Mapping Frameworks (Innovation Scorecard), Limitations & Validation Protocols)

- Definition & Scope (AI Algorithms, Predictive Analytics, Clinical Decision Support)

- Healthcare System Profile (Hospitals, Clinics, Telehealth Networks)

- Role of AI Algorithms in Care Delivery

- Market Genesis and Evolution

- Pilot Deployments (Triage, Imaging)

- Workflow Automation

- Integrated Clinical Predictive Systems

- Success Drivers

Operational Efficiency Gains

Accuracy Improvements in Diagnostics

Telehealth Expansion - Barriers

Data Fragmentation and Interoperability Gaps

Infrastructure Gaps in Rural Regions

Skilled AI Workforce Constraints

Algorithmic Bias & Trust Challenges - Opportunities for Scale

Government Digital Health Strategy

Public‑Private Algorithm Partnerships

Local Dataset Development & AI Training Hubs - Market Trends

Explainable AI Adoption

Real‑Time Clinical Decision Tools

Expansion of Tele‑Diagnostics

Convergence with mHealth & Wearables - Policy & Regulation

Philippines Health Data Governance

Responsible AI & Safety Classifications

Ethical Guidelines for Clinical AI Use - SWOT Analysis

- Ecosystem Mapping

Academic / Research Institutions

Startup & Innovation Clusters

Health Systems

- Porter’s Five Forces

- Total Market Value, 2019-2025

- Algorithm Segment Revenues,2019-2025

- Adoption Intensity Indices,2019-2025

- Pricing Benchmarks,2019-2025

- By Technology Parameter(In Value)

Machine Learning (ML) Algorithms

Natural Language Processing (NLP) Models

Computer Vision & Imaging AI

Predictive Analytics Models

Deep Learning Platforms - By Application(In Value)

Diagnostic Support (CT/MRI, X‑ray Interpretations)

Clinical Decision Support Systems

Patient Risk Scoring & Predictive Alerts

Telehealth & Virtual Care AI

Workflow Automation (Scheduling, Billing) - By End‑User(In Value)

Hospitals & Health Systems

Diagnostic Centers

Telemedicine Providers

Government/Public Health Programs

Health Insurers & Payers - By Delivery Model(In Value)

On‑Premise Integrated Systems

Cloud‑Hosted SaaS Platforms

Edge AI Devices (AI‑enabled Wearables & Sensors) - By Deployment Use(In Value)

Clinical Diagnostics

Population Health Forecasting

Drug & Treatment Recommendation Engines

Administrative Automation

Remote Monitoring Platforms

- Market Share Analysis

- Cross‑Comparison Parameters (Company Overview Focus Domain, AI Technology Stack ML / NLP / Vision, Algorithm Validation & Certifications, Clinical Efficacy Data / Performance Metrics, Integration Capabilities EHR/EMR Support, Data Privacy & Security, Compliance, Channel & Partner Ecosystem, Revenue Streams Licensing, SaaS, Outcomes‑Based)

- SWOT for Key Players

- Pricing Architecture (Per‑Use, Subscription, Outcomes)

- Detailed Profiles of Major Competitors

Aidoc (AI imaging & triage) Wikipedia

IBM Watson Health

Google Health / DeepMind AI

Microsoft Healthcare AI

NVIDIA AI Healthcare Solutions

Philips Healthcare AI

Siemens Healthineers AI

GE Healthcare AI

Oracle Healthcare AI

Tempus AI (oncology analytics)

Zebra Medical Vision

PathAI (pathology AI)

Babylon Health (tele‑triage)

Butterfly Network (AI imaging)

Local Philippines AI Health Innovators (e.g., Zennya Health, Senti AI, CirroLytix)

- Adoption Drivers & Barriers by User Group

- Budget & Investment Cycle Profiles

- Clinical Decision Workflows

- Pain Points & unmet needs

- Healthcare CIO & IT Strategy Insights

- By Market Value,2025-2030

- By Adoption Rate,2025-2030

- By Use‑Case Growth Curves,2025-2030