Market Overview

The Philippines’ eHealth market is valued at USD ~ million, supported by rising digitization of hospital workflows and demand for decision support embedded within EHR/HIS, medication safety, and diagnostics. The market reflects growing institutional demand for tools that assist clinicians in diagnostics, treatment selection, medication safety, and risk identification. Structural demand is driven by rising patient volumes, increasing complexity of clinical cases, and the need to standardize care quality across facilities. AI-enabled decision support is becoming a core layer within hospital IT investments, supporting productivity gains, reduction in clinical errors, and improved patient outcomes across both inpatient and outpatient care settings.

Within the Philippines, adoption is most concentrated in the National Capital Region, where the country’s largest private hospital networks, tertiary care centers, and specialist institutions are located. These facilities possess higher digital maturity, larger IT budgets, and stronger incentives to deploy advanced clinical technologies. Luzon outside NCR, followed by Visayas and Mindanao, represents emerging demand as private hospital expansion accelerates. On the supply side, technology influence is shaped by global health technology leaders from the United States and Europe, whose clinical platforms, imaging systems, and AI toolkits form the backbone of deployed solutions due to their regulatory readiness and proven integration capabilities.

Market Segmentation

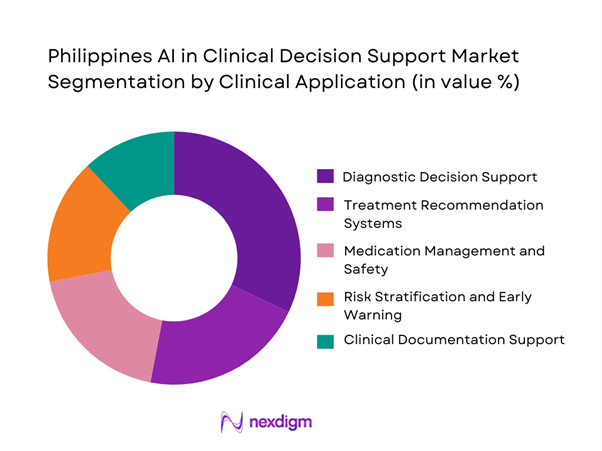

By Clinical Application

The diagnostic decision support sub-segment dominates the Philippines AI in Clinical Decision Support market due to the rapid growth in imaging volumes, pathology testing, and diagnostic complexity across hospitals. AI-driven diagnostic support tools help clinicians prioritize cases, flag anomalies, and reduce turnaround times in radiology and laboratory workflows. These solutions are often easier to deploy compared to broader treatment recommendation systems because they operate within well-defined clinical domains and generate immediate operational value. Diagnostic AI also aligns with hospital revenue priorities by improving asset utilization of imaging equipment and reducing repeat tests. As diagnostic demand continues to rise across both urban and regional facilities, this sub-segment remains the primary entry point for AI-based clinical decision support adoption.

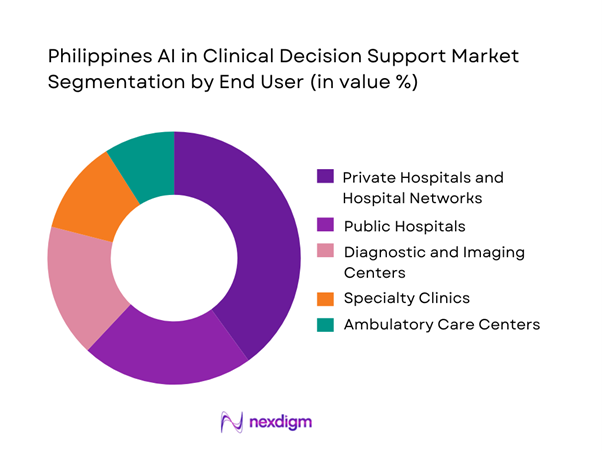

By End User

Private hospitals and hospital networks dominate the Philippines AI in Clinical Decision Support market because they combine financial capacity with operational urgency. These institutions face strong competitive pressure to deliver superior clinical outcomes, faster services, and differentiated patient experiences. Private hospital groups are also more advanced in adopting hospital information systems and electronic medical records, enabling smoother AI integration. Furthermore, multi-hospital networks benefit from standardizing clinical protocols across locations, making AI-driven decision support particularly valuable. While public hospitals represent significant long-term potential, constraints related to budgets and infrastructure slow adoption. Consequently, private hospitals remain the primary buyers and users of AI-enabled clinical decision support solutions.

Competitive Landscape

The Philippines AI in Clinical Decision Support market is dominated by a few major players, including IBM and global or regional brands like Philips, Siemens Healthineers, and Oracle Health. This consolidation highlights the significant influence of these key companies.

| Company | Established | Headquarters | Philippines Go-to-Market | Core AI-CDSS Strengths | Typical Deployment | Interoperability Posture | Clinical Focus Most Used | Implementation Model |

| Oracle Health (Cerner) | 1979 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Epic Systems | 1979 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 2017 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Wolters Kluwer (UpToDate) | 1836 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines AI in Clinical Decision Support Market Analysis

Growth Drivers

Increasing Clinical Workload Density

Hospitals across the Philippines are experiencing sustained increases in patient inflow driven by population growth, urban congestion, rising prevalence of chronic diseases, and higher healthcare utilization among aging demographics. This has led to denser clinical workloads per physician, particularly in emergency departments, outpatient clinics, and inpatient wards. Physicians are required to process growing volumes of diagnostic data, laboratory results, imaging reports, and patient histories within limited consultation times. AI-enabled clinical decision support systems (AI-CDSS) address this pressure by aggregating and contextualizing clinical information in real time, flagging abnormalities, prioritizing high-risk cases, and aligning treatment options with standardized clinical guidelines. By reducing manual data review and repetitive cognitive tasks, these systems directly lower decision fatigue and error risk. Over time, improved clinical throughput, reduced length of stay, and better utilization of physician time transform AI-CDSS from an efficiency enhancer into a core operational infrastructure for hospitals managing high patient density environments.

Physician Shortage and Decision Fatigue

The Philippine healthcare system faces persistent shortages of physicians and specialists, with maldistribution heavily skewed toward metropolitan centers while provincial and rural areas remain underserved. Even within urban hospitals, specialist-to-patient ratios are strained due to rising case complexity and administrative workload requirements such as documentation, compliance reporting, and insurance coordination. This environment increases decision fatigue, where clinicians must make high-stakes decisions repeatedly under time pressure, elevating the risk of variability in care quality. AI-based clinical decision support tools mitigate these challenges by embedding evidence-based recommendations, diagnostic pathways, and safety alerts directly into clinician workflows. For less experienced physicians or general practitioners handling complex cases, AI-CDSS acts as an augmented expertise layer that supports consistency and confidence in decision-making. For senior clinicians, it reduces cognitive overload and allows focus on critical judgment and patient interaction, thereby strengthening system resilience amid workforce constraints.

Challenges

Data Fragmentation Across Providers

Healthcare data in the Philippines remains highly fragmented across public hospitals, private hospital networks, stand-alone clinics, diagnostic laboratories, and imaging centers. Many facilities operate disparate electronic medical record systems or rely partially on paper-based processes, resulting in incomplete longitudinal patient histories. This fragmentation poses a fundamental challenge for AI-CDSS, which depends on high-quality, standardized, and comprehensive datasets to generate accurate clinical insights. Inconsistent coding practices, limited interoperability, and lack of unified patient identifiers restrict algorithm performance and increase integration complexity. As a result, AI models may operate on partial information, reducing clinical confidence and limiting use cases to narrow departmental deployments rather than enterprise-wide adoption. For hospital administrators, the cost and time required to normalize data, build interfaces, and ensure real-time synchronization across systems slow return on investment and delay scaling. Until interoperability and data governance maturity improve, data fragmentation remains a structural barrier to maximizing AI-CDSS effectiveness.

Limited AI Governance Frameworks

The absence of fully developed AI-specific governance frameworks in the Philippine healthcare sector creates uncertainty for providers considering clinical decision automation. Key concerns include accountability for AI-supported decisions, medico-legal liability, transparency of algorithm logic, bias management, and ongoing model validation. Existing health data privacy and IT regulations were not originally designed to address adaptive algorithms that evolve with new data, leaving gaps in oversight mechanisms. Hospital leadership and clinical committees are therefore cautious about deploying systems that directly influence diagnosis or treatment without clearly defined human-in-the-loop requirements and escalation protocols. Additionally, limited national standards for clinical AI certification and performance benchmarking complicate vendor selection and procurement decisions. This regulatory ambiguity often results in extended pilot phases, restricted use cases, or reliance on advisory-only AI tools rather than full clinical integration. Without clearer governance structures, adoption momentum may remain slower despite strong operational need.

Opportunities

Embedded AI within Hospital Platforms

Embedding AI-driven decision support directly into existing hospital information systems presents a significant opportunity to accelerate adoption and value realization. Clinicians are more likely to trust and use AI tools that function seamlessly within familiar interfaces such as electronic health records, computerized physician order entry systems, and radiology or laboratory platforms. Embedded AI minimizes workflow disruption by delivering insights at the point of care—during order placement, diagnosis review, or treatment selection—rather than requiring separate logins or parallel systems. For hospitals, this approach reduces training requirements and integration risk while improving data context and auditability. Embedded solutions also align well with procurement models that favor modular upgrades over wholesale system replacements. As hospitals continue investing in digital infrastructure, AI-CDSS positioned as an extension of core clinical platforms can scale more rapidly, achieve higher clinician adoption rates, and demonstrate measurable improvements in efficiency, safety, and standardization of care delivery.

Expansion into Provincial Healthcare Systems

The expansion of private and public healthcare infrastructure into provincial regions creates a strong opportunity for AI-based clinical decision support to address variability in care quality. Provincial hospitals and district facilities often operate with limited access to specialists, relying heavily on general practitioners to manage diverse and complex cases. AI-CDSS can help standardize clinical decision-making by providing guideline-based recommendations, early warning alerts, and referral support aligned with national and international best practices. This reduces dependence on on-site specialist availability and improves confidence among frontline clinicians. As healthcare networks extend their footprint beyond major cities, centralized AI-CDSS deployments enable consistent clinical governance across geographically dispersed facilities. Additionally, provincial adoption supports system-wide goals of equity and quality by narrowing outcome gaps between urban and non-urban populations. These dynamics position AI-CDSS as a foundational enabler for scalable, regionally balanced healthcare delivery in the Philippines.

Future Outlook

The Philippines AI in Clinical Decision Support market is expected to evolve from isolated use cases toward enterprise-wide clinical intelligence platforms. Hospitals will increasingly prioritize solutions that integrate seamlessly across diagnostics, treatment planning, and care coordination. Strategic partnerships between healthcare providers and technology vendors will shape long-term adoption, with emphasis on scalability, governance, and measurable clinical impact.

Major Players

- IBM

- Oracle Health

- Philips

- Siemens Healthineers

- GE Healthcare

- Microsoft

- Google Health

- Epic Systems

- Cerner

- Wolters Kluwer

- Elsevier

- Athenahealth

- Medtronic

- Optum

Key Target Audience

- Private hospital groups and hospital networks

- Public healthcare authorities and hospital administrators

- Diagnostic and imaging center operators

- Integrated care network operators

- Health insurance providers and HMOs

- Health technology vendors and system integrators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping the Philippines clinical decision support ecosystem, identifying stakeholders, technology layers, and clinical workflows. Secondary research is used to define variables influencing adoption and utilization.

Step 2: Market Analysis and Construction

Historical market behavior is analyzed through digital health spending patterns, hospital IT investments, and deployment models. Revenue attribution is aligned to clinical use cases and end-user demand.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through structured expert consultations with hospital IT leaders, clinicians, and solution providers to refine demand drivers and constraints.

Step 4: Research Synthesis and Final Output

All findings are synthesized through triangulation to deliver a coherent and validated market narrative aligned with client decision-making needs.

- Executive Summary

- Research Methodology

(Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Clinical Decision Support Usage and Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- Philippines Healthcare Delivery and Digital Architecture

- Growth Drivers

Increasing Clinical Workload Density

Physician Shortage and Decision Fatigue

Hospital Digitalization and HIS Expansion

Rising Diagnostic Complexity

Quality and Patient Safety Mandates - Challenges

Data Fragmentation Across Providers

Limited AI Governance Frameworks

Infrastructure Gaps Outside Urban Centers

Clinical Trust and Adoption Resistance

Budget Constraints in Public Healthcare - Opportunities

Embedded AI within Hospital Platforms

Expansion into Provincial Healthcare Systems

Clinical Workflow Automation

Population Health and Preventive Care

Public–Private Digital Health Partnerships - Trends

Integration with Electronic Medical Records

Explainable and Auditable AI Models

AI-Augmented Diagnostics

Workflow-Oriented Clinical AI

Vendor–Hospital Co-Development Models - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Solution Value, 2019–2024

- By Deployment Footprint, 2019–2024

- By Healthcare Utilization Intensity, 2019–2024

- By Clinical Application (in Value %)

Diagnostic Decision Support

Treatment Recommendation Systems

Medication Management and Safety

Risk Stratification and Early Warning

Clinical Documentation Support - By End User (in Value %)

Private Hospitals and Hospital Networks

Public Hospitals

Diagnostic and Imaging Centers

Specialty Clinics

Ambulatory Care Centers - By AI Technology Type (in Value %)

Machine Learning Models

Deep Learning Models

Natural Language Processing

Computer Vision

Hybrid AI Models - By Deployment Model (in Value %)

On-Premise

Cloud-Based

Hybrid - By End-Use Customer Type (in Value %)

Large Tertiary Hospitals

Mid-Sized Hospitals

Independent Clinics

Diagnostic Service Providers

Integrated Care Networks - By Region (in Value %)

National Capital Region

Luzon (Non-NCR)

Visayas

Mindanao

- Competition ecosystem overview

- Cross Comparison Parameters (clinical accuracy, explainability of algorithms, EHR integration depth, deployment flexibility, data privacy readiness, scalability across facilities, local implementation support, total cost of ownership)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

IBM

Oracle Health

Philips

Siemens Healthineers

GE Healthcare

Microsoft

Google Health

Epic Systems

Cerner

Wolters Kluwer

Elsevier

Athenahealth

Medtronic

Optum

SAS Institute

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Solution Value, 2025–2030

- By Deployment Footprint, 2025–2030

- By Healthcare Utilization Intensity, 2025–2030