Market Overview

The Philippines air defense systems market is valued at approximately USD ~ billion in 2025, reflecting a significant increase from the previous years due to heightened defense modernization initiatives. The market is largely driven by the Philippines’ growing security concerns in the South China Sea and the need to secure its airspace amidst rising regional tensions. The government’s shift towards acquiring advanced defense systems, such as the SPYDER Ground-Based Air Defense System (GBADS) and radar solutions, along with partnerships with foreign manufacturers, has spurred market expansion. This growth is also supported by the growing investments in defense infrastructure, especially following the Philippines’ engagement in joint defense exercises with the US and other allies.

The Philippines’ air defense systems market is primarily dominated by Metro Manila and nearby military hubs like Subic Bay and Clark Air Base. Metro Manila is home to government agencies such as the Department of National Defense (DND) and the Armed Forces of the Philippines (AFP), which play key roles in defense procurement and strategic planning. Subic Bay and Clark Air Base serve as critical locations for air defense exercises, system deployments, and logistical support for defense imports. Additionally, the Philippines maintains a close defense cooperation with countries like the United States, Israel, and South Korea, who are influential in supplying advanced air defense systems and technology.

Market Segmentation

By System Type

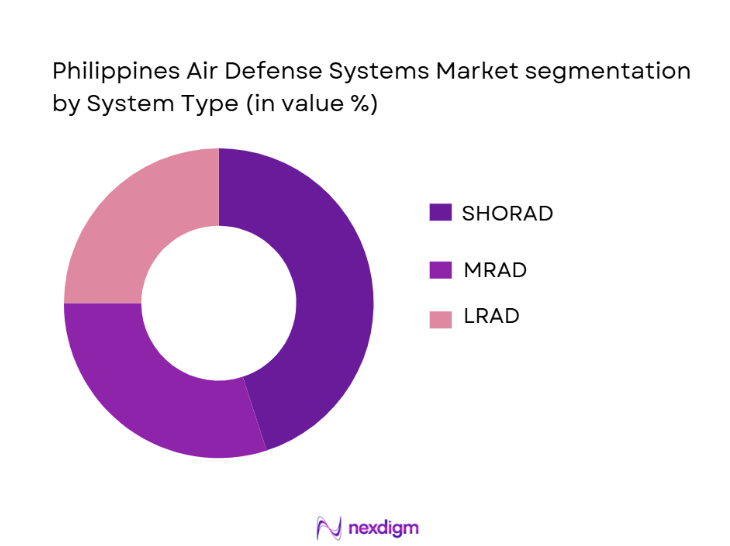

The air defense systems market in the Philippines is segmented into short-range air defense (SHORAD), medium-range air defense (MRAD), and long-range air defense (LRAD) systems. Among these, the short-range air defense (SHORAD) segment is expected to dominate the market share in 2024 due to the growing emphasis on protecting critical infrastructures like airports, government buildings, and naval bases from missile and drone attacks. SHORAD systems like the SPYDER GBADS and C-RAM (Counter Rocket, Artillery, and Mortar) systems provide quick, mobile responses and are ideal for protecting short-range airspace. Their mobility, low-cost nature, and high efficiency in intercepting tactical threats have made them popular with the Philippine military.

The dominance of SHORAD is a reflection of the growing necessity for defense against smaller, swifter airborne threats like drones, missiles, and aircraft that pose a local, immediate threat to the Philippines’ strategic assets. Additionally, the Philippines has invested heavily in systems like the SPYDER, which combine both surface-to-air missile and radar systems to deliver optimal SHORAD capabilities.

By Procurement Route

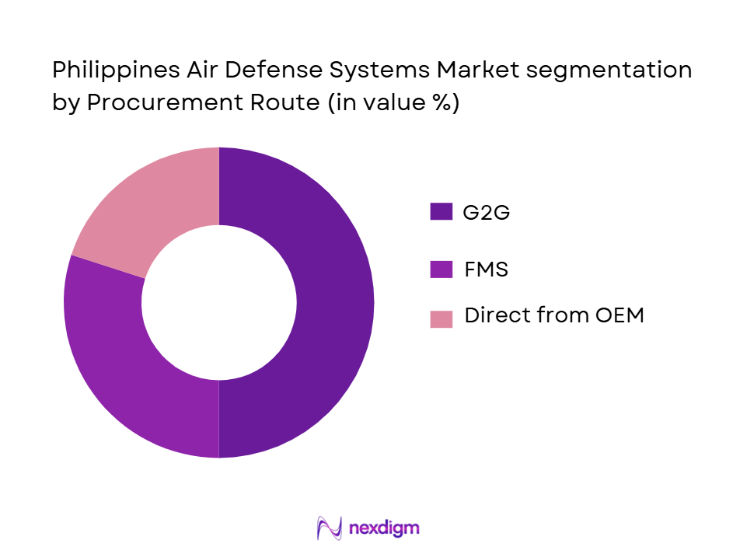

The air defense systems market in the Philippines is segmented into government-to-government (G2G) deals, foreign military sales (FMS), and direct procurement from original equipment manufacturers (OEMs). Among these, government-to-government (G2G) deals represent the largest procurement route, making up the majority of the market share in 2024. This dominance is primarily due to the strategic defense alliances the Philippines maintains with the United States, Japan, Israel, and South Korea, who prefer negotiating directly with governments rather than private companies. These G2G arrangements allow for faster procurement cycles, ease of technology transfer, and cost-sharing mechanisms in terms of defense aid and financing. G2G deals have been the preferred method for acquiring advanced air defense systems due to the flexibility they offer in terms of support and long-term cooperation. Systems such as the SPYDER GBADS and advanced radar systems, typically supplied through G2G agreements, provide the Philippines with not only the technology but also ongoing training and maintenance, ensuring sustained operational readiness.

Competitive Landscape

The Philippines air defense systems market is consolidated, with a few key players dominating the defense systems and air defense solutions sector. This includes international players like Rafael Advanced Defense Systems, Lockheed Martin, and MBDA, along with regional suppliers from Japan and South Korea. These companies have established long-term contracts with the Philippine government, helping to address the country’s evolving defense needs. The market is highly competitive with these key players leveraging their technological expertise, long-standing relationships with the Philippine military, and the strategic geopolitical positioning of the country.

| Company | Establishment Year | Headquarters | Key System | Technology Integration | Strategic Alliances | Local Partnerships |

| Rafael Advanced Defense | 1990 | Israel | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ |

| MBDA | 2001 | France | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

| Samsung Techwin | 1977 | South Korea | ~ | ~ | ~ | ~ |

Philippines Air Defense Systems Market Analysis

Growth Drivers

Increasing Geopolitical Tensions in the South China Sea

Rising territorial disputes and security concerns in the South China Sea have prompted the Philippines to strengthen its air defense capabilities. These tensions, especially with neighboring China, drive increased defense budgets and a demand for advanced air defense systems to protect vital national airspace.

Government Modernization Programs (AFP Modernization Act)

The Philippines has committed to modernizing its armed forces under the AFP Modernization Program. This initiative focuses on improving air defense capabilities, which has led to substantial investments in advanced radar systems, surface-to-air missiles, and integration of new technologies to enhance national security.

Market Challenges

Budget Constraints and Defense Procurement Delays

Despite growing defense needs, the Philippines faces budgetary constraints that delay the procurement of essential air defense systems. Political factors, economic challenges, and budget prioritization can lead to slower deployment of critical systems.

Technological Integration and Compatibility Issues

Integrating advanced air defense systems with existing military infrastructure and ensuring compatibility with allied nations’ systems (such as the U.S. and Israel) can pose challenges. These integration hurdles can affect operational efficiency and extend the timeline for full operational capability.

Opportunities

Local Defense Industry Development

The Philippines has a growing interest in building a local defense industrial base. This offers opportunities for domestic manufacturers and technology integrators to play a role in the development and maintenance of air defense systems, providing cost-effective solutions and long-term sustainability.

Collaboration with Foreign Defense Contractors

The Philippines’ defense sector has strong collaborative ties with countries like the U.S., Israel, and South Korea. By continuing these partnerships, the Philippines can gain access to cutting-edge technologies, training programs, and maintenance support, all of which can enhance its air defense capabilities while strengthening bilateral defense ties.

Future Outlook

Over the next five years, the Philippines air defense systems market is expected to show significant growth driven by continuous government support, advancements in air defense technologies, and increasing consumer demand for advanced military defense systems. The Philippines will continue its military modernization efforts under the AFP Modernization Program, with a specific focus on enhancing its air defense capabilities. Collaborative projects with countries like the United States, Israel, and South Korea will further drive this growth, as these nations provide both the technology and the necessary training to the Philippine armed forces. Technological advancements, including integrated command and control (C2) systems and next-generation missile systems, will play a crucial role in securing the Philippines’ airspace.

Major Players

- Rafael Advanced Defense Systems

- Lockheed Martin

- MBDA

- Thales Group

- Samsung Techwin

- Israel Aerospace Industries (IAI)

- Northrop Grumman

- Raytheon Technologies

- Leonardo S.p.A.

- Saab Group

- Hyundai Heavy Industries

- Bharat Dynamics

- Elbit Systems

- Mitsubishi Electric Corporation

- Kongsberg Gruppen

Key Target Audience

- Government and Regulatory Bodies

- Defense Contractors

- Investments and Venture Capitalist Firms

- Defense Procurement and Military Planning Agencies

- Local and International Military Technology Integrators

- Strategic Defense Alliances

- Philippine Navy and Air Force Procurement Divisions

- Defense Industry Suppliers and Manufacturers

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify the core market variables including defense spending, regional airspace security needs, and air defense systems deployment. This involves comprehensive secondary data collection, including government publications, defense reports, and publicly available procurement data.

Step 2: Market Analysis and Construction

We analyze market size, demand, and key drivers through historical and present data regarding defense contracts, military expenditures, and system requirements. Detailed assessments of each sub-segment, such as SHORAD and MRAD, are conducted to refine understanding.

Step 3: Hypothesis Validation and Expert Consultation

Key industry stakeholders, including defense ministry officials and procurement officers, are consulted through structured interviews. These consultations validate hypotheses about market drivers, system demand, and defense budget allocation, ensuring that insights are aligned with real-world practices.

Step 4: Research Synthesis and Final Output

The final output incorporates the synthesis of market data with expert feedback to present a validated report. Data is cross-verified with market forecasts to ensure robustness and accuracy in final insights on future trends and emerging opportunities in the Philippines air defense systems market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Defense Budget Allocation and Forecasting Approach, Capability Gap Analysis Framework, Primary Military Stakeholder Engagement, GovernmenttoGovernment (G2G) Procurement Mapping, Defense Technology Life Cycle Assessment, Limitations and Future Research, Risk and Sensitivity Analysis)

- Market Definition and Scope

- Strategic Importance

- Historical Capability Gap and Modernization Imperatives

- Defense Policy and Procurement Doctrine

- Air Defense Value Chain

- Supply Chain Dynamics

- Growth Drivers

Geopolitical Tension & Scarborough/West Philippine Sea Threats

Modernization Imperative

Strategic Alliances - Market Challenges

Budget Constraints & Procurement Timelines

Integration Complexity

Technology Transfer and Local Production Bottlenecks - Key Opportunities

CounterUAS Expansion

AEW&C and Sensor Fusion Investments

Local Defense Industrial Base Development - Technology and Innovation Trends

Networked IAMD Architectures

AIAssisted Targeting & Decision Support

MultiSensor Fusion Radar Systems - Regulatory & Compliance Environment

- Defense Doctrine & Strategic Posture

- SWOT Analysis

- Porter’s Five Forces Analysis

- Defense Procurement Ecosystem

- By Value 2020-2025

- By Units/Deployments 2020-2025

- By Capability Tier 2020-2025

- By Funding Source 2020-2025

- By System Type (In Value%)

ShortRange Air Defense (SHORAD)

MediumRange Air Defense (MRAD)

LongRange Air Defense (LRAD)

CounterUAS / Drone Defense

Integrated Air Surveillance and Command & Control Systems - By Platform (In Value%)

LandBased Mobile Systems

Fixed/Stationary Installations

Airborne Early Warning & Control (AEW&C)

Naval Air Defense Solutions

Joint Sensor Network - By End User Segment (In Value%)

Philippine Air Force (PAF) (GBADS, AEW&C)

Philippine Army (GroundBased AD Forces)

Philippine Navy (Ship Air Defense)

Integrated Air and Missile Defense (IAMD) Command Nodes

Allied/Joint Task Group Components - By Procurement Route (In Value%)

GovernmenttoGovernment (G2G) Deals

Direct OEM Contracts

Foreign Military Financing / Aid

Foreign Military Sales (FMS) and Offsets

Local Defense Industry Partnerships

- Market Share by System Deployment & Value

- Cross Comparison Parameters (System Engagement Envelope, Detection & Tracking Capability, Network & C2 Interoperability Score, Integration with Joint/Allied Forces, Sustainment Footprint & Logistics Support, Technology Transfer/Offset Agreements, Production Facility Presence or Licensed Local Assembly, AfterSales Training & Support)

- Key Players

Rafael Advanced Defense Systems

BrahMos Aerospace

MBDA

Israel Aerospace Industries

Mitsubishi Electric

Raytheon Technologies

Lockheed Martin

Northrop Grumman

Thales Group

Korea Aerospace Industries

Bharat Dynamics / DRDO

Leonardo

SAAB

ELTA Systems

Hensoldt