Market Overview

The Philippines anti-inflammatory topical creams market sits within a dermatology drugs segment that has attained a value of USD ~ million, based on a multi-year analysis of national dermatology prescriptions and spending. This niche is supported by a population of 115,843,670 and GDP of USD ~ billion in the most recent World Bank dataset, alongside health spending per capita rising from USD 182.93 to USD 194.06 across the latest two annual readings, which collectively underpin expanding demand for prescription and OTC anti-inflammatory topicals.

Within the country, demand is concentrated in Metro Manila and other highly urbanized growth corridors. Expert Market Research notes that the National Capital Region leads the dermatology drugs market due to dense pharmacy networks and mature digital pharmacy adoption. Manila’s large, economically stronger consumer base, high dermatologist density, and strong presence of chains such as Mercury Drug, Watsons, Southstar, and Generika concentrate anti-inflammatory topical cream volumes there, while emerging hubs like Cebu and other Visayas and Mindanao cities gain traction as healthcare infrastructure expands.

Market Segmentation

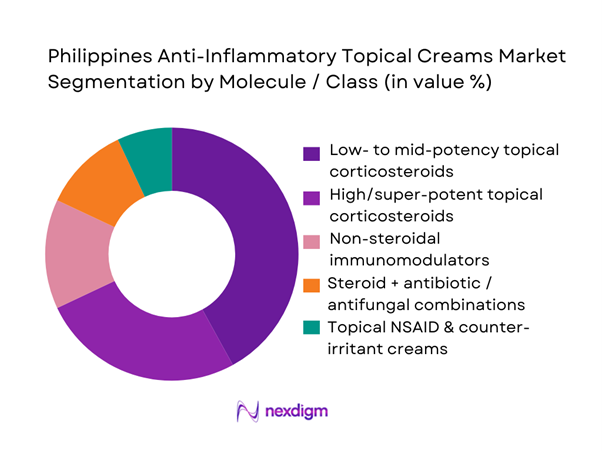

By Molecule / Class

The Philippines anti-inflammatory topical creams market is segmented into low- to mid-potency topical corticosteroids, high-potency and super-potent corticosteroids, non-steroidal immunomodulators, fixed-dose steroid–plus–antibiotic/antifungal combinations, and topical NSAID/counter-irritant creams. Low- to mid-potency corticosteroid creams such as hydrocortisone (for example, Eczacort) and desonide dominate this segmentation because they are first-line for dermatitis, eczema, and mild inflammatory dermatoses and can be prescribed safely across age groups. They are widely available through major chains and generics pharmacies, carry strong physician familiarity, and are reimbursed or self-paid at accessible price points. In contrast, very potent steroids (clobetasol, betamethasone), non-steroidal immunomodulators, and combination creams are reserved for more complex or refractory cases, limiting their overall share even as specialist dermatology clinics expand usage.

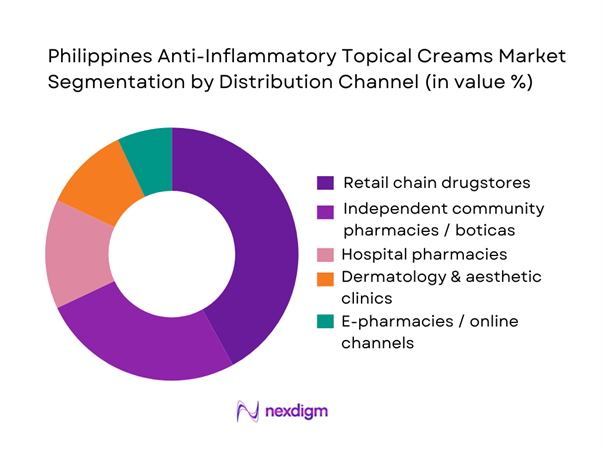

By Distribution Channel

The Philippines anti-inflammatory topical creams market is segmented into retail chain drugstores, independent community pharmacies, hospital pharmacies, dermatology and aesthetic clinics, and e-pharmacy / online channels. Retail chain drugstores such as Mercury Drug, Watsons, Southstar, Generika, and The Generics Pharmacy command the largest share, driven by their nationwide footprint and top-of-mind positioning for first-line skin flare management. These outlets stock a full range of topical corticosteroids, combination creams and OTC anti-itch formulations, often under aggressive generic and private-label strategies. Hospital pharmacies and in-clinic dispensing concentrate more potent steroids and prescription-only brands, while independent boticas remain vital in semi-urban and rural areas. E-pharmacies are rapidly scaling but still contribute a smaller share, constrained by prescription requirements for many steroid products.

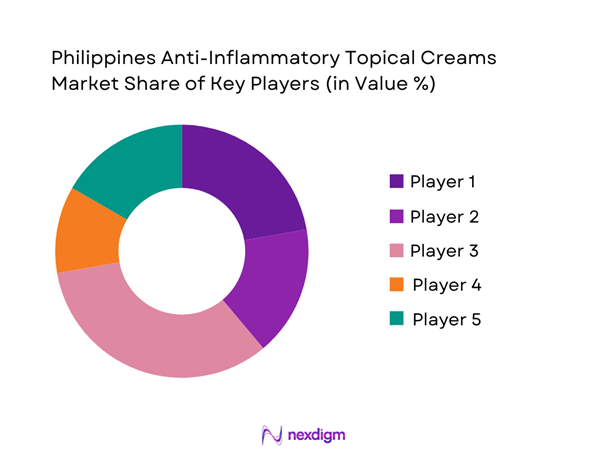

Competitive Landscape

The Philippines anti-inflammatory topical creams market is characterized by a blend of strong domestic manufacturers and distributors, alongside multinational innovators supplying potent corticosteroids, immunomodulators, and topical NSAIDs. Unilab and large generics chains anchor volume in everyday hydrocortisone and mid-potency steroids, while international firms such as GSK, Galderma, Pfizer, and Sanofi shape higher-end prescription portfolios and clinical practice guidelines. The market remains moderately fragmented at SKU level, but highly consolidated at channel level, with a handful of drugstore chains and hospital systems controlling formulary access, promotional visibility, and substitution practices.

| Company | Establishment Year | Headquarters | Core Anti-inflammatory Topical Focus (PH) | Key Brands / Molecules (Illustrative) | Primary Channels in PH | Local Manufacturing / Partnership Model | Differentiation in Topical Anti-inflammatory Segment |

| Unilab, Inc. | 1945 | Mandaluyong, PH | ~ | ~ | ~ | ~ | ~ |

| The Generics Pharmacy (TGP) | 2001 | Quezon City, PH | ~ | ~ | ~ | ~ | ~ |

| GSK plc | 1715 | London, UK / PH office | ~ | ~ | ~ | ~ | ~ |

| Galderma | 1981 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Pfizer Inc. | 1849 | New York, USA | ~ | ~ | ~ | ~ | ~ |

Philippines Anti-Inflammatory Topical Creams Market Analysis

Growth Drivers

DOH burden-of-disease trends

Limited specialist capacity and rising health utilization are pushing more inflammatory skin conditions into the self-care / topical-cream space. The Philippines’ population is estimated at around 115,843,670 people in the mid-2020s, creating strong absolute burden even at modest disease prevalence levels. Per-capita current health spending rose from PHP 10,238.0 in 2022 to PHP 11,083.5 in 2023, indicating growing resource allocation to care episodes that often start with primary care and dermatology consultations. PhilHealth reports ~ million members and ~ million dependents, covering ~ million beneficiaries as of May 31, 2024, within a total population of 112.89 million Filipinos under national health insurance. At the same time, a 2024 baseline survey in three primary care sites found average out-of-pocket outpatient consult spending of PHP 571.92 per capita in a remote site, reinforcing why many patients rely on relatively lower-cost anti-inflammatory topical creams as a first response before, between, or instead of specialist visits.

OTC skincare adoption

The consumer base for anti-inflammatory topical creams is amplified by strong self-medication and generics culture plus very high digital reach. Digital 2024 data show 86.98 million internet users, 86.7 million social media users, and 117.4 million mobile connections in the Philippines at the start of 2024. This connectivity underpins rapid information flow around rashes, dermatitis, and joint pain, and makes OTC anti-inflammatory creams highly discoverable via search, social commerce and online pharmacy storefronts. Drugstore chains like The Generics Pharmacy, with more than 2,000 outlets nationwide as of 2023, provide ubiquitous access to steroidal and non-steroidal topicals in both urban and secondary towns, while PhilHealth data indicating 87.22 million beneficiaries under national insurance coverage in 2024 highlight how a large insured population still supplements their reimbursed care with OTC creams for mild flares between physician visits. Together, dense offline pharmacy networks and very high mobile/internet penetration create fertile ground for sustained OTC adoption in anti-inflammatory topical formats.

Market Challenges

Steroid misuse

Regulators and clinicians in the Philippines explicitly flag misuse of potent topical corticosteroids as a public-health risk, complicating the anti-inflammatory creams market. An awareness study in Quezon City involving 100 topical corticosteroid users found that less than half (44 respondents) recognized known adverse effects, while 48 respondents strongly agreed that enhanced patient, prescriber and pharmacist efforts are needed to curb abuse. Building on such findings, the Food and Drug Administration (FDA) issued Advisory No. 2024-0197, re-classifying all topical corticosteroid products as prescription drugs and warning about “Topical Steroid Withdrawal” and “Red Skin Syndrome” following misuse. The FDA further reinforced this shift through Circular No. 2024-002, which recalls the prior OTC classification of topical corticosteroids. For manufacturers and marketers of anti-inflammatory creams, these moves mean tighter prescription gating, increased pharmacovigilance and reformulation pressure toward non-steroidal or lower-risk profiles.

Pharmacist-led substitutions, Rx compliance, counterfeit issues

A vast and fragmented provider and retail base makes it hard to enforce prescribing intent and quality standards across all anti-inflammatory topical creams. PhilHealth accredited 10,897 health care facilities nationwide in 2022, encompassing hospitals, infirmaries, ambulatory clinics and other specialized centers. By 2023, accredited healthcare professionals numbered 49,179, including 45,150 physicians. On the retail side, The Generics Pharmacy alone operates 2,000+ branches nationwide, while many independent drugstores serve peri-urban and rural populations. This environment encourages pharmacist-driven brand substitution and, in the absence of strong counseling, under-dosing or abrupt discontinuation of anti-inflammatory topicals. Counterfeit and unregistered creams further cloud safety: a 2024 advisory highlighted 17 unregistered drug products, including topical formulations, that should not be purchased or used. Multiple 2022–2023 FDA advisories also targeted unregistered or adulterated skin products containing prescription-strength steroids like betamethasone and clobetasol in cosmetic formats. Together, these dynamics create persistent risks around inappropriate substitution, non-adherence and product quality.

Opportunities

Steroid-sparing innovation

Regulatory pressure on topical corticosteroids is creating clear space for steroid-sparing and non-steroidal anti-inflammatory creams. Internationally, the US FDA’s 2022 approval of steroid-free tapinarof 1% cream (Vtama) for plaque psoriasis provides a reference for new small-molecule pathways that may eventually be licensed in Southeast Asian markets. Locally, the Department of Science and Technology has supported development of Guaviderm, a topical ointment based on guava extract shown to be effective against methicillin-resistant Staphylococcus aureus (MRSA) in preclinical work, offering an indigenous anti-infective and anti-inflammatory option for wound and skin infection care (DOST-PCHRD Guaviderm project). On the financing side, per-capita current health expenditure increased from PHP 10,238.0 in 2022 to PHP 11,083.5 in 2023, and IMF estimates place overall health spending per capita at about USD 142.08 in recent years. These figures suggest growing fiscal headroom for payers and households to adopt newer, premium steroid-sparing creams—especially for chronic dermatoses where long-term safety is critical.

Pediatric-safe topical development

The demographic structure and insurance coverage profile of the Philippines make pediatric-safe anti-inflammatory creams a particularly attractive opportunity. As of May 31, 2024, PhilHealth covers ~ million beneficiaries out of ~ million Filipinos, with membership categories explicitly encompassing sponsored children, dependents of direct contributors, and senior citizens. Mid-2023 data show ~ million members and ~ million dependents, totaling ~ million beneficiaries under PhilHealth’s Konsulta and other benefit packages. In a 2024 primary-care survey of three sites, average out-of-pocket spending for outpatient consults in a remote area reached PHP 571.92 per capita per year, indicating that families still shoulder meaningful costs alongside insurance. For household-level inflammatory conditions such as atopic dermatitis, insect-bite reactions, diaper dermatitis and contact allergies—where safety margins in infants and children are paramount—this combination of large insured dependent populations and residual OOP burden supports strong demand for well-tolerated, pediatric-labelled anti-inflammatory topicals that can reduce clinic visits and prevent escalation to systemic therapy.

Future Outlook

Over the next six years, the Philippines anti-inflammatory topical creams market is expected to expand steadily, supported by rising health expenditures per capita, growing dermatology awareness, and expansion of organized pharmacy and e-pharmacy networks. The Asia-Pacific dermatological drugs market alone generated USD ~ million recently, highlighting the region’s robust pipeline and innovation spill-over into smaller markets such as the Philippines. Within this context, increasing screening for eczema, psoriasis, and contact dermatitis is likely to sustain demand for both mild hydrocortisone-based creams and more advanced non-steroidal anti-inflammatory topicals.

Anchored on the Philippines dermatology drugs baseline of USD ~ million and Asia-Pacific benchmarks for topical penetration, we estimate that the Philippines anti-inflammatory topical creams market stood at about USD ~ million in 2024, including prescription corticosteroids, fixed-dose steroid combinations, non-steroidal immunomodulators, and dermatology-relevant topical NSAIDs. Under this model, the market is projected to grow at an estimated CAGR of around 7.8% during 2024–2030, outpacing headline pharmaceutical growth as prescribers favor localized therapy for chronic inflammatory dermatoses and as patient preference shifts toward steroid-sparing regimens, combination creams, and digitally enabled adherence and refill programs.

Major Players

- Unilab, Inc.

- Mercury Drug Corporation

- Southstar Drug

- Generika Drugstore

- Watsons Philippines

- The Generics Pharmacy

- GSK plc

- Pfizer Inc.

- Sanofi

- Johnson & Johnson

- Novartis AG

- Amgen Inc.

- Eli Lilly and Company

- AstraZeneca

Key Target Audience

- Local pharmaceutical manufacturers and formulators

- Multinational dermatology and immunology drug companies

- Retail pharmacy chains and drugstore groups

- Hospital systems, dermatology departments, and integrated health networks

- Dermatology, allergy, and primary-care clinic networks and franchise-based skin centers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Health-insurance providers and HMOs

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping the full ecosystem for the Philippines anti-inflammatory topical creams market, covering manufacturers, importers, dermatology clinics, hospital systems, and pharmacy channels. Extensive desk research drew on Philippines-specific dermatology drug studies, Asia-Pacific dermatology market reports, national FDA registrations for hydrocortisone and other topical steroids, and World Bank health-spending indicators. This enabled us to define key variables such as molecule mix, channel structure, and prescription vs. OTC split.

Step 2: Market Analysis and Construction

We then compiled historical data for dermatology drugs in the Philippines, including Expert Market Research’s quantified dermatology drugs baseline, Asia-Pacific dermatology drug valuations, and local health-expenditure trends. Using a bottom-up approach, we allocated shares to topical routes and then to anti-inflammatory sub-classes (corticosteroids, combinations, immunomodulators, topical NSAIDs), triangulating with SKU-level presence on major Philippine pharmacy platforms. This allowed construction of a coherent revenue model for anti-inflammatory topical creams with 2024 as the anchor year.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses on molecule-class shares, channel weighting, and growth trajectories were tested through structured conversations with dermatologists, general practitioners, and pharmacists in Metro Manila and key regional hubs, focusing on prescribing habits, step-up/step-down steroid use, and e-pharmacy adoption. Where direct interviews were not feasible, proxy insights were derived from published clinical practice summaries, national dermatology society guidance, and observational analysis of product availability and pricing across multiple retail chains and online pharmacies.

Step 4: Research Synthesis and Final Output

Finally, we reconciled top-down macro indicators (pharmaceutical and dermatology market values, health-spending benchmarks) with bottom-up product and channel estimates to arrive at an integrated view of the Philippines anti-inflammatory topical creams market. Country-specific regulatory information from the Philippine FDA and product-level data for hydrocortisone, clobetasol, and other key actives were used to validate segment sizing and competitive positioning. The result is a market model and qualitative narrative tailored specifically for strategic, commercial, and investment decisions in this niche.

- Executive Summary

- Research Methodology (Market Definitions & Inclusion Criteria, Therapeutic Class Mapping, ATC Code L01/L02/L03 Relevance, Assumptions & Limitations, Market Modelling Approach, Bottom-Up SKU Aggregation, Dermatology KOL Inputs, Pharmacy Audit Triangulation, Regulatory Data Mapping, Procurement Dataset Validation, Rx-OTC Split Estimation Model)

- Definition and Scope

- Overview Genesis

- Therapy Adoption Timeline in Philippines

- Business Cycle

- Supply Chain & Value Chain Mapping

- Growth Drivers

DOH burden-of-disease trends

OTC skincare adoption

Rising dermatology footfall

Chronic skin condition prevalence

Online pharmacy acceleration - Market Challenges

Steroid misuse

Pharmacist-led substitutions,

Rx compliance, counterfeit issues

Regulatory tightening

Import dependency for APIs - Opportunities

Steroid-sparing innovation

Pediatric-safe topical development

Cosmetic-medical segment convergence

Premium derma-cosmetic line adoption - Trends

Barriology science

Microbiome-supportive formulations

Ceramide-linked anti-inflammatory blends

Ultra-mild steroid combinations - Government Regulations

- SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Realized Price, 2019-2024

- By Molecule Class (in Value %)

Low-potency corticosteroids (Hydrocortisone, Desonide

Medium-potency corticosteroids (Betamethasone Valerate, Mometasone Furoate)

High-potency corticosteroids (Clobetasol Propionate)

Non-steroidal anti-inflammatories (Diclofenac, Piroxicam, Ketoprofen)

Calcineurin inhibitors (Tacrolimus, Pimecrolimus) - By Therapeutic Indication (in Value %)

Acute dermatitis

Chronic eczema

Psoriasis-related inflammation

Musculoskeletal inflammation

Post-procedure anti-inflammation (laser/chemical peel recovery) - By Distribution Channel (in Value %)

Hospital pharmacies

Retail chain drugstores

Independent pharmacies

Dermatology clinics

E-commerce / online pharmacies - By Format / Dosage Form (in Value %)

Creams

Ointments

Gels

Lotions

Sprays

- By End User (in Value %)

Adult patients

Pediatric patients

Geriatric population

Athletes and sports-related inflammation users

Cosmetic dermatology users

- Market Share of Major Players

Market Share by Molecule Class

Market Share by Distribution Channel - Cross-Comparison Parameters (Regulatory Classification (Rx/OTC/GSL), Dermatologist Adoption Index, Anti-Inflammatory Potency Mapping, Steroid-Sparing Technology Advancement, Cold-Chain / Stability Requirements, Distribution Depth Across Luzon–Visayas–Mindanao, SKU Range & Formulation Versatility, Institutional Procurement Penetration)

- SWOT Analysis for Major Players

- Pricing Analysis

- Detailed Profiles of Major Companies

Galderma

L’Oréal

Kenvue

GSK Philippines

Pfizer / Viatris

Bayer Consumer Health

Johnson & Johnson Philippines

Unilab

Pascual Laboratories

DermAsia Pharma

P&G Healthcare

Menarini Philippines

Sanofi Consumer Healthcare

JT Pharma

Torrent Pharma

- Purchasing Power & Income Cluster Analysis

- Pain-Point Analysis Across Patient Groups

- Dermatologist & GP Prescription Behaviour

- Treatment Decision-Making Pathway

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Realized Price, 2025-2030