Market Overview

The Philippines autoimmune marker testing market is valued at USD ~, reflecting the consolidated value generated by diagnostic laboratories, hospitals, and specialty clinics through autoimmune-related serological testing. The market is structurally important to the national healthcare ecosystem as it supports early disease detection, long-term disease management, and treatment pathway optimization for chronic autoimmune conditions. Demand is anchored in the rising clinical emphasis on differential diagnosis for inflammatory disorders, increasing referrals from rheumatology and endocrinology practices, and the gradual integration of advanced immunoassay platforms into routine diagnostic workflows across urban healthcare facilities.

Within the country, diagnostic activity is concentrated in the National Capital Region, CALABARZON, and major metropolitan healthcare hubs where tertiary hospitals and reference laboratories dominate advanced immunodiagnostics. These regions lead due to higher specialist density, better access to automated platforms, and stronger patient awareness of autoimmune conditions. Market influence is also shaped by global diagnostic technology leaders whose platforms, reagents, and quality benchmarks define clinical practice standards locally, driving adoption of high-sensitivity immunoassays and shaping procurement preferences across public and private laboratory networks.

Market Segmentation

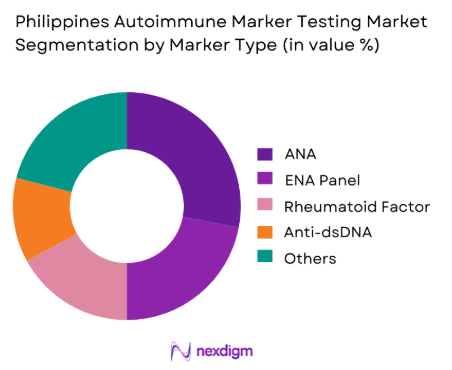

By Marker Type

The Philippines autoimmune marker testing market is segmented by marker type into ANA testing, ENA panel testing, anti-dsDNA testing, rheumatoid factor testing, anti-CCP testing, and thyroid autoantibody testing. Among these, ANA testing dominates due to its role as the primary screening tool for a broad spectrum of autoimmune disorders. Clinicians rely on ANA as the first diagnostic step for patients presenting with nonspecific symptoms such as chronic fatigue, joint pain, and unexplained rashes. Its widespread clinical acceptance, relatively standardized protocols, and compatibility with both immunofluorescence and automated immunoassay platforms make it the most frequently ordered autoimmune test. Laboratories also favor ANA testing because of predictable demand patterns from outpatient and inpatient settings, enabling efficient reagent procurement and workflow optimization. This combination of clinical necessity, operational efficiency, and broad disease coverage positions ANA testing as the leading sub-segment within the marker type segmentation.

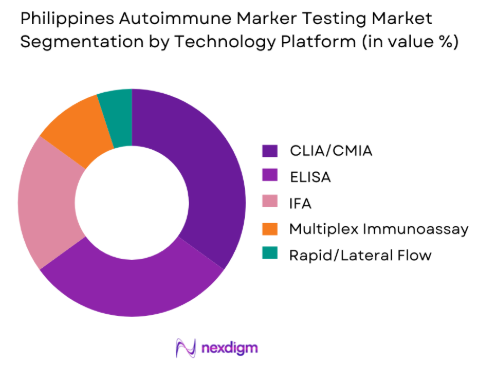

By Technology Platform

The market is segmented into CLIA based immunoassays, ELISA based immunoassays, immunofluorescence assays, multiplex immunoassays, and rapid autoimmune screening tests. CLIA based immunoassays hold the dominant position due to their ability to deliver high sensitivity and specificity while supporting large testing volumes in centralized laboratories. These platforms integrate seamlessly with automated laboratory systems, enabling faster turnaround times and consistent result quality, which are critical for managing chronic autoimmune diseases. Hospitals and independent diagnostic chains increasingly prioritize CLIA systems to standardize testing protocols across multiple sites and reduce manual errors associated with traditional methods. The scalability of CLIA platforms also supports bundled autoimmune panels, improving clinical efficiency and cost predictability. As healthcare providers continue to modernize laboratory infrastructure, the preference for automated, high-throughput technologies reinforces CLIA’s leadership in the Philippine autoimmune diagnostics landscape.

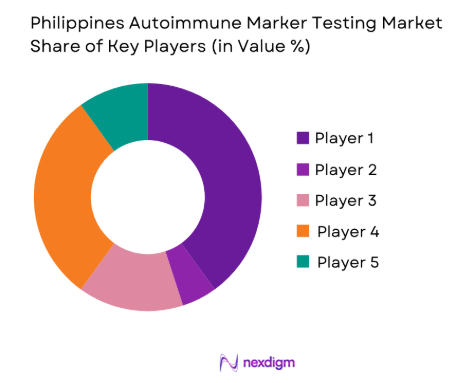

Competitive Landscape

The Philippines autoimmune marker testing market is dominated by a few major players, including Roche Diagnostics and global or regional brands like Abbott Diagnostics, Siemens Healthineers, and Thermo Fisher Scientific. This consolidation highlights the significant influence of these key companies.

| Company | Est. Year | HQ | Philippines Footprint | Autoimmune Portfolio Breadth | Regulatory Approved Tests | Labs/Hospitals Covered | Service & Support Presence |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Abbott Diagnostics | 1888 | USA | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ |

| Thermo Fisher Scientific | 2006 | USA | ~ | ~ | ~ | ~ | ~ |

| Bio-Rad Laboratories | 1952 | USA | ~ | ~ | ~ | ~ | ~ |

Philippines Autoimmune Marker Testing Market Analysis

Growth Drivers

Rising autoimmune disease burden

The increasing prevalence of autoimmune disorders across the country is creating sustained demand for reliable diagnostic solutions. As more patients present with chronic inflammatory symptoms, clinicians are prioritizing early and accurate identification of autoimmune etiologies to guide long-term treatment strategies. This growing clinical need directly translates into higher testing volumes for screening markers such as ANA and confirmatory assays like ENA panels. Over time, the expanding patient pool strengthens laboratory investment in specialized immunodiagnostic platforms, reinforcing market growth and encouraging broader test menu expansion across hospital and independent laboratory networks.

Expansion of private diagnostic chains

The rapid growth of private diagnostic chains is transforming access to advanced autoimmune testing beyond tertiary hospitals. These organizations are investing in centralized laboratories equipped with automated immunoassay systems, enabling them to process high volumes of specialized tests at competitive cost structures. As these chains extend their footprint into secondary cities, they bring standardized autoimmune testing services closer to patients, reducing referral delays and increasing diagnostic throughput. This expansion not only widens market reach but also drives competition, service quality improvements, and technology upgrades across the diagnostic ecosystem.

Challenges

High out-of-pocket diagnostic costs

Despite improvements in healthcare access, many autoimmune marker tests remain financially burdensome for patients due to limited reimbursement coverage. High out-of-pocket expenses discourage timely testing, particularly for individuals requiring repeated monitoring for chronic conditions. This cost barrier slows early diagnosis, contributes to delayed treatment initiation, and restricts testing volumes in lower-income segments. For laboratories, pricing sensitivity limits the ability to introduce advanced technologies rapidly, creating a tension between quality improvement and affordability that continues to constrain market potential.

Shortage of trained immunodiagnostic staff

Advanced autoimmune testing relies heavily on skilled laboratory professionals capable of handling complex immunoassays and result interpretation. However, the supply of trained technologists and clinical immunologists remains uneven across regions. This skills gap affects laboratory productivity, increases turnaround times, and restricts the adoption of sophisticated platforms such as multiplex immunoassays. Without systematic investment in workforce training, the pace of technological diffusion and service expansion in autoimmune diagnostics is likely to remain uneven.

Opportunities

Decentralization of testing services

There is a growing opportunity to decentralize autoimmune marker testing from major urban centers to secondary cities and regional hospitals. By deploying compact automated immunoassay platforms and strengthening sample logistics networks, diagnostic providers can significantly expand market reach. This decentralization reduces patient travel burden, shortens diagnostic timelines, and enhances continuity of care for chronic autoimmune conditions. For investors and service providers, regional expansion offers untapped demand pools and the potential to build long-term relationships with local healthcare institutions.

Bundled autoimmune panel adoption

The shift from single-marker testing to bundled autoimmune panels represents a major commercial and clinical opportunity. Bundled testing improves diagnostic accuracy by providing comprehensive disease profiling in a single workflow, while laboratories benefit from higher per-patient revenue and optimized reagent utilization. As clinicians increasingly favor evidence-based, protocol-driven diagnostics, bundled panels are becoming integral to care pathways in rheumatology and endocrinology. This trend supports both revenue growth and clinical value creation across the autoimmune diagnostics market.

Future Outlook

The Philippines autoimmune marker testing market is positioned for steady strategic expansion as diagnostic services become more integrated into chronic disease management frameworks. Continued modernization of laboratory infrastructure, wider insurance acceptance of specialized tests, and growing clinical reliance on comprehensive autoimmune panels will collectively strengthen market depth. Over the medium term, the convergence of automation, decentralized testing, and bundled diagnostics is expected to reshape service delivery models, enabling broader access while improving diagnostic consistency and long-term care outcomes.

Major Players

- Roche Diagnostics

- Abbott Diagnostics

- Siemens Healthineers

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Beckman Coulter

- Ortho Clinical Diagnostics

- Trinity Biotech

- Fujirebio

- DiaSorin

- Mindray

- Snibe Diagnostics

- Randox Laboratories

- Werfen Group

- BD Diagnostics

Key Target Audience

- Hospital procurement and supply chain heads

- Independent diagnostic laboratory owners

- Specialty clinic networks in rheumatology and endocrinology

- Medical device and in vitro diagnostics distributors

- Healthcare investors and private equity groups

- Investments and venture capitalist firms

- Government and regulatory bodies including the Department of Health and PhilHealth

- Healthcare system planners and hospital administrators

Research Methodology

Step 1: Identification of Key Variables

This phase involved mapping the autoimmune diagnostics ecosystem across hospitals, laboratories, and specialty clinics to define the boundaries of the market. Extensive desk research and proprietary data sources were used to identify demand drivers, service models, and technology adoption patterns shaping market dynamics.

Step 2: Market Analysis and Construction

Historical diagnostic volumes, service mix, and platform penetration were analyzed to construct a coherent market framework. This step combined bottom-up laboratory data with top-down healthcare expenditure indicators to ensure consistency in revenue attribution.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary market assumptions were validated through structured interviews with laboratory directors, pathologists, and procurement heads. These consultations provided operational insights that refined demand estimates and competitive positioning analysis.

Step 4: Research Synthesis and Final Output

The final phase integrated quantitative findings with qualitative insights to develop a comprehensive and validated market narrative. Cross-verification ensured alignment between service delivery realities and strategic market projections.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, autoimmune marker taxonomy and test menu mapping, market sizing logic by test volume and reagent consumption, revenue attribution across assays analyzers controls and service, primary interview program with hospitals labs distributors and clinicians, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Autoimmune Diagnostics in the Philippines

- Clinical Pathway Mapping Across Rheumatology Endocrinology Neurology and Dermatology

- Lab Network Structure and Referral Flow for Specialized Immunology Testing

- Import Dependence and Distributor Managed Reagent Supply Ecosystem

- Growth Drivers

Rising awareness and diagnosis rates for autoimmune disorders

Growth of private diagnostics and expanding test menus

Physician demand for earlier rule out and stratification testing

Expansion of specialist clinics in urban centers

Increasing use of multiplex panels for faster diagnostic workups - Challenges

High cost of specialized assays and limited reimbursement coverage

Sample referral delays and cold chain constraints for provinces

Limited availability of trained immunology lab specialists

Method variability and result interpretation complexity for IFA

Supply continuity risk for imported reagents and controls - Opportunities

Expansion of centralized reference testing capacity for specialty assays

Distributor led automation upgrades and reagent rental models

Clinical education programs for standardized ANA and ENA interpretation

Growth of autoimmune thyroid and diabetes related marker testing

Digital reporting and decision support tools for specialist clinics - Trends

Shift toward automated CLIA platforms for higher throughput testing

Growth in multiplex line assays for ENA and vasculitis panels

Increasing use of reflex testing algorithms for ANA positive cases

Greater emphasis on internal QC and accreditation readiness

Rising demand for shorter turnaround time through hub lab expansion - Regulatory & Policy Landscape

SWOT Analysis

Stakeholder & Ecosystem Analysis

Porter’s Five Forces Analysis

Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Test Volume, 2019–2024

- By Hospital vs Independent Lab Revenue Split, 2019–2024

- By Routine vs Specialized Autoimmune Panel Split, 2019–202

- By Fleet Type (in Value %)

Public tertiary hospitals

Private hospital networks

Independent reference laboratories

Specialty clinics and physician office labs

Academic medical centers and teaching hospitals - By Application (in Value %)

Systemic autoimmune disease screening and diagnosis

Thyroid autoimmune disorder testing

Inflammatory arthritis and connective tissue disease workup

Neurological autoimmune and demyelinating workup

Dermatology and celiac related autoimmune testing - By Technology Architecture (in Value %)

ELISA and microplate immunoassay systems

CLIA and automated immunoassay analyzers

Indirect immunofluorescence and ANA pattern testing

Multiplex and line immunoassay platforms

Rapid test kits for select autoimmune markers - By Connectivity Type (in Value %)

Standalone analyzers with local reporting

LIS integrated laboratory workflows

Hub and spoke referral testing networks

Cloud enabled QC analytics and inventory management

Remote service monitoring and uptime support - By End-Use Industry (in Value %)

Clinical laboratories and pathology networks

Hospitals and specialty centers

Rheumatology and endocrinology clinics

Diagnostic distributors and reference testing partners

Public health and screening program operators - By Region (in Value %)

NCR

CALABARZON

Central Luzon

Visayas

Mindanao

- Competitive ecosystem structure across IVD majors specialty assay providers and distributors

- Positioning driven by test menu breadth automation level and service footprint

- Partnership models between distributors hospital groups and reference labs

- Cross Comparison Parameters (test menu breadth and panel coverage, sensitivity and specificity performance, turnaround time and reflex algorithm support, analyzer throughput and automation fit, reagent stability and cold chain needs, LIS connectivity and reporting capability, QC and calibration burden, cost per reportable result)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Porter’s Five Forces

- Detailed Profiles of Major Companies

Roche Diagnostics

Abbott

Siemens Healthineers

Beckman Coulter

bioMérieux

Thermo Fisher Scientific

DiaSorin

QuidelOrtho

Sysmex

Hologic

Bio Rad Laboratories

Inova Diagnostics

Euroimmun

Randox Laboratories

Mindray

- Lab director priorities for menu breadth QC burden and reagent cost

- Clinician preferences for turnaround time and interpretive reporting

- Procurement models for public hospitals and private lab networks

- Distributor selection criteria for service reliability and training support

- Total cost of ownership drivers across reagents calibrators and service

- By Value, 2025–2030

- By Test Volume, 2025–2030

- By Hospital vs Independent Lab Revenue Split, 2025–2030

- By Routine vs Specialized Autoimmune Panel Split, 2025–2030