Market Overview

The Philippines automated data analysis solutions market is valued at approximately USD ~ billion, reflecting the adoption of advanced analytics, predictive modeling, machine learning, and AI-driven decision support platforms across industries such as BFSI, healthcare, retail, and IT-BPM. Demand is driven by the need to convert rapidly growing enterprise data volumes into operational and strategic insights, reduce manual analytics effort, and support faster decision-making. Automated analytics solutions have become structurally important for sectors such as BFSI, telecom, retail, and shared services, where real-time reporting, predictive intelligence, and workflow automation directly influence productivity, risk management, and revenue performance.

Within the Philippines, Metro Manila dominates demand due to its concentration of headquarters, shared services centers, and large enterprises with advanced digital maturity. Cebu and Davao follow as secondary hubs supported by IT-BPM expansion and regional enterprise growth. On the supply and technology side, global technology providers influence the market through cloud infrastructure, analytics platforms, and AI frameworks that are localized and deployed within Philippine enterprises. Their dominance stems from strong product ecosystems, enterprise-grade security, and integration with widely used business software stacks.

Market Segmentation

By Solution Category

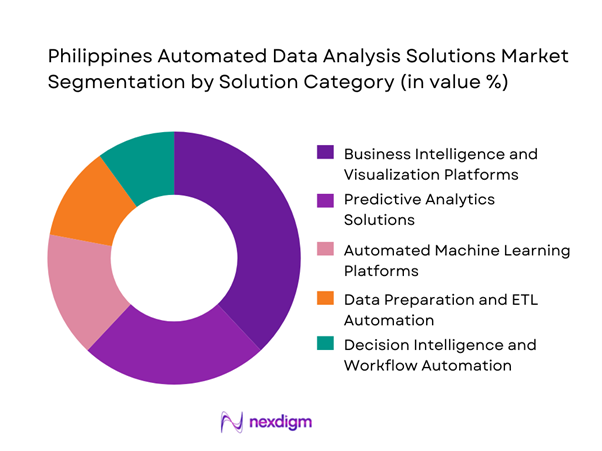

The Philippines Automated Data Analysis Solutions Market is segmented by solution category into business intelligence and visualization platforms, predictive analytics solutions, automated machine learning platforms, data preparation and ETL automation, and decision intelligence and workflow automation. Business intelligence and visualization platforms dominate this segmentation because they form the foundational analytics layer for most Philippine enterprises. Organizations prioritize automated dashboards, reporting, and self-service analytics to support management visibility and regulatory reporting. These solutions are easier to deploy, integrate with existing enterprise systems, and deliver immediate value without extensive data science expertise. Their dominance is reinforced by widespread adoption across banking, telecommunications, retail, and government-related enterprises, where standardized reporting and automated insights are critical for daily operations and performance monitoring.

By Deployment Model

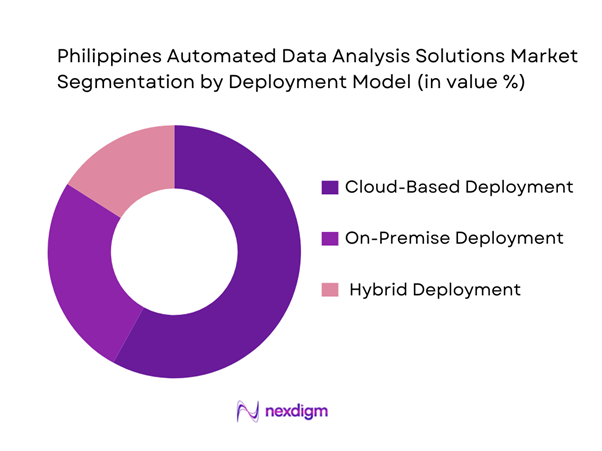

The market is segmented into cloud-based deployment, on-premise deployment, and hybrid deployment. Cloud-based deployment holds the dominant position due to its scalability, lower upfront infrastructure requirements, and alignment with enterprise digital transformation strategies. Philippine enterprises increasingly favor cloud environments to enable remote access, rapid deployment, and integration with modern data sources. Cloud platforms also support automated updates, advanced analytics services, and elastic compute capabilities, which are critical for handling variable analytics workloads. On-premise solutions remain relevant for organizations with strict data control requirements, while hybrid models serve enterprises transitioning legacy systems to cloud environments without disrupting core operations.

Competitive Landscape

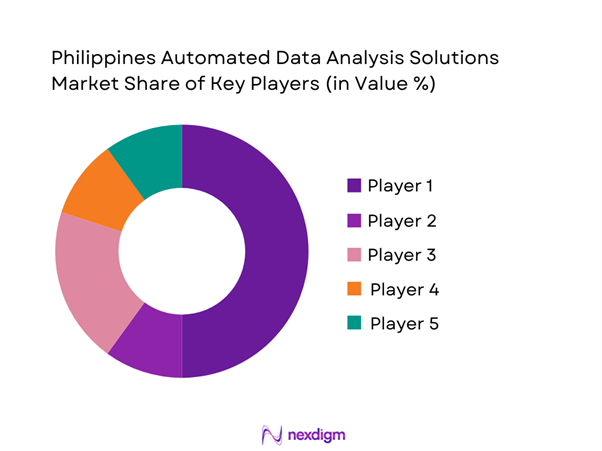

The Philippines Automated Data Analysis Solutions market is dominated by a few major players, including Microsoft and global or regional brands like IBM, SAP, Oracle, and SAS. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | Cloud Integration Support | AI/ML Automation | Local Partner Ecosystem | Sector Focus | Deployment Footprint | Training & Certification Support |

| Microsoft (Power BI) | 1975 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| IBM Analytics | 1911 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| SAP Analytics | 1972 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Oracle Analytics | 1977 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| SAS Institute | 1976 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Automated Data Analysis Solutions Market Analysis

Growth Drivers

Enterprise Digital Transformation Programs

The acceleration of enterprise digital transformation programs across the Philippines is a critical driver for the adoption of automated data analysis solutions. Organizations are actively digitizing core business processes such as customer onboarding, payments, supply chain management, compliance reporting, and internal operations. These initiatives significantly increase the volume, velocity, and variety of data generated across enterprise systems. Manual analytics approaches are no longer sufficient to handle this complexity, creating strong demand for automated platforms that can ingest data, identify patterns, and generate insights with minimal human intervention. Automated analytics supports faster decision-making, improves operational visibility, and enables proactive business management. As digital transformation expands beyond pilot projects into organization-wide programs, enterprises increasingly view automated data analysis as a foundational capability required to sustain efficiency, competitiveness, and innovation across departments.

Cloud Infrastructure Expansion

The rapid expansion of cloud infrastructure adoption among Philippine enterprises is a major catalyst for automated data analysis solution deployment. Cloud environments enable centralized data storage, seamless integration across applications, and access to scalable compute resources, making advanced analytics more accessible than traditional on-premise systems. As organizations migrate enterprise resource planning systems, customer platforms, and operational databases to cloud environments, they seek analytics solutions that can automatically process cloud-native data streams. Automated data analysis tools complement cloud strategies by offering rapid deployment, elastic scalability, and continuous insight generation without the need for extensive infrastructure management. Additionally, cloud ecosystems provide pre-built analytics services, AI engines, and integration tools that accelerate automation. This alignment between cloud migration strategies and analytics automation makes cloud infrastructure expansion a direct and sustained growth driver for the market.

Challenges

Data Fragmentation and Legacy Systems

Data fragmentation remains a significant challenge limiting the effectiveness of automated data analysis solutions in the Philippines. Many enterprises operate legacy systems alongside newer digital platforms, resulting in disconnected data silos across departments such as finance, operations, sales, and compliance. These fragmented environments hinder automated analytics by complicating data ingestion, integration, and standardization processes. Automated platforms depend on consistent, high-quality data pipelines to deliver reliable insights, yet legacy architectures often lack interoperability and standardized data models. Resolving these issues requires system integration, data cleansing, and governance alignment, which increases implementation complexity and timelines. Without addressing fragmentation, organizations face partial automation outcomes, reduced accuracy of insights, and slower realization of analytics benefits, making legacy system dependency a persistent obstacle to widespread automation adoption.

Shortage of Advanced Analytics Talent

Despite increasing automation capabilities, the shortage of advanced analytics and data engineering talent presents a notable challenge in the Philippine market. Automated data analysis solutions still require skilled professionals to design architectures, configure models, manage data pipelines, and ensure compliance with governance standards. Competition for analytics talent across IT services, shared service centers, and multinational enterprises makes recruitment and retention difficult. This skills gap often forces organizations to rely on external vendors or system integrators, increasing dependency and limiting internal capability development. Additionally, lack of in-house expertise can restrict organizations from fully leveraging advanced automation features such as predictive modeling, real-time analytics, and AI-driven decision workflows. Talent constraints therefore slow adoption, restrict scalability, and reduce the long-term strategic impact of automated analytics investments.

Opportunities

Industry-Specific Analytics Solutions

The growing demand for industry-specific automated analytics solutions presents a strong opportunity within the Philippine market. Enterprises increasingly prefer platforms that address their unique operational, regulatory, and performance requirements rather than generic analytics tools. Industry-focused solutions for banking, telecommunications, retail, healthcare, and manufacturing can significantly reduce deployment complexity by offering pre-configured data models, domain-specific KPIs, and automated workflows aligned with industry processes. Localization of compliance requirements and reporting standards further enhances adoption potential. Vendors that deliver sector-tailored solutions enable faster implementation, quicker insight generation, and improved user adoption across business functions. As organizations prioritize measurable outcomes and faster return on analytics initiatives, industry-specific automation offerings are well-positioned to gain traction among enterprises seeking practical, ready-to-deploy analytics capabilities.

SME Analytics Adoption

Small and medium enterprises represent a substantial growth opportunity for automated data analysis solutions in the Philippines. Historically constrained by limited budgets and technical resources, SMEs are now increasingly adopting digital tools as cloud platforms lower barriers to technology access. Automated analytics solutions with subscription-based pricing, simplified interfaces, and managed service options allow SMEs to leverage data insights without investing in large IT teams or infrastructure. As SMEs digitize sales channels, customer engagement, and financial operations, they generate data that can drive better decision-making if analyzed effectively. Automated analytics empowers SMEs to monitor performance, optimize operations, and respond quickly to market changes. This expanding SME digital ecosystem creates sustained demand for affordable, scalable, and easy-to-deploy analytics automation solutions.

Future Outlook

The Philippines Automated Data Analysis Solutions Market is expected to evolve toward deeper automation, AI-augmented insights, and tighter integration with enterprise workflows. Enterprises will increasingly embed analytics into operational processes, moving beyond reporting toward predictive and prescriptive decision support. Cloud-native platforms, governance-ready architectures, and industry-focused solutions will define competitive differentiation, while sustained digitalization across sectors will continue to support long-term market expansion.

Major Players

- Microsoft

- IBM

- SAP

- Oracle

- SAS

- Salesforce

- Qlik

- Snowflake

- Databricks

- Palantir

- TIBCO

- Alteryx

- Informatica

- Teradata

- Cloudera

Key Target Audience

- Chief Information Officers

- Chief Data and Analytics Officers

- Enterprise IT and Digital Transformation Heads

- Investments and venture capitalist firms

- Government and regulatory bodies

- BFSI Technology Leadership

- Telecommunications Digital Strategy Teams

- Large Enterprise Procurement Heads

Research Methodology

Step 1: Identification of Key Variables

This step involved mapping the automated data analysis ecosystem in the Philippines, identifying solution types, deployment models, industries, and regions. Secondary research sources and proprietary databases were used to define market boundaries and key variables.

Step 2: Market Analysis and Construction

Historical adoption patterns, enterprise spending behavior, and analytics use cases were analyzed to construct market size and segmentation. Revenue attribution logic was applied across software, services, and deployment models.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through structured discussions with industry practitioners, technology vendors, and system integrators operating in the Philippines to ensure alignment with real-world deployment dynamics.

Step 4: Research Synthesis and Final Output

Quantitative findings and qualitative insights were synthesized to produce a validated, client-ready market analysis reflecting enterprise demand, competitive positioning, and future market direction.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Automated Analytics Usage and Value-Chain Mapping

- Business Cycle and Demand Seasonality

- Philippines Enterprise Data and Digital Service Architecture

- Growth Drivers

Enterprise Digital Transformation Programs

Cloud Infrastructure Expansion

Rising Data Volumes and Complexity

Demand for Real-Time Decision Support

Automation of Business Intelligence Workflows - Challenges

Data Fragmentation and Legacy Systems

Shortage of Advanced Analytics Talent

Data Privacy and Compliance Complexity

Integration with Core Enterprise Systems

Unclear ROI Measurement - Opportunities

Industry-Specific Analytics Solutions

SME Analytics Adoption

AI-Augmented Decision Platforms

Public Sector Digital Analytics

Analytics-as-a-Service Models - Trends

- Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- Installed Base / Active Usage Metric, 2019–2024

- Service / Revenue Mix, 2019–2024

- By Solution Category (in Value %)

Business Intelligence and Visualization Platforms

Predictive Analytics Solutions

Automated Machine Learning Platforms

Data Preparation and ETL Automation

Decision Intelligence and Workflow Automation - By Deployment Model (in Value %)

Cloud-Based Deployment

On-Premise Deployment

Hybrid Deployment - By Technology Platform Type (in Value %)

Rule-Based Analytics Engines

Machine Learning-Based Analytics

Natural Language Query and Generation

Real-Time Streaming Analytics

Embedded Analytics Platforms - By Delivery Model (in Value %)

Subscription Software

Usage-Based Consumption

Managed Analytics Services

Platform Licensing - By End-Use Industry (in Value %)

BFSI

Telecommunications

Retail and E-Commerce

Healthcare

IT-BPM and Shared Services

Manufacturing and Logistics - By Region (in Value %)

Metro Manila

Luzon (Non-Metro)

Visayas

Mindanao

- Competition ecosystem overview

- Cross Comparison Parameters (automation depth, data integration breadth, AI model lifecycle support, governance and compliance readiness, scalability, deployment flexibility, total cost of ownership, local support ecosystem)

- SWOT analysis of major players

Pricing and commercial model benchmarking - Detailed Profiles of Major Companies

Microsoft

IBM

SAP

Oracle

SAS

Salesforce

Qlik

Snowflake

Databricks

Palantir

TIBCO

Alteryx

Informatica

Teradata

Cloudera

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- Installed Base / Active Usage Metric, 2025–2030

- Service / Revenue Mix, 2025–2030