Market Overview

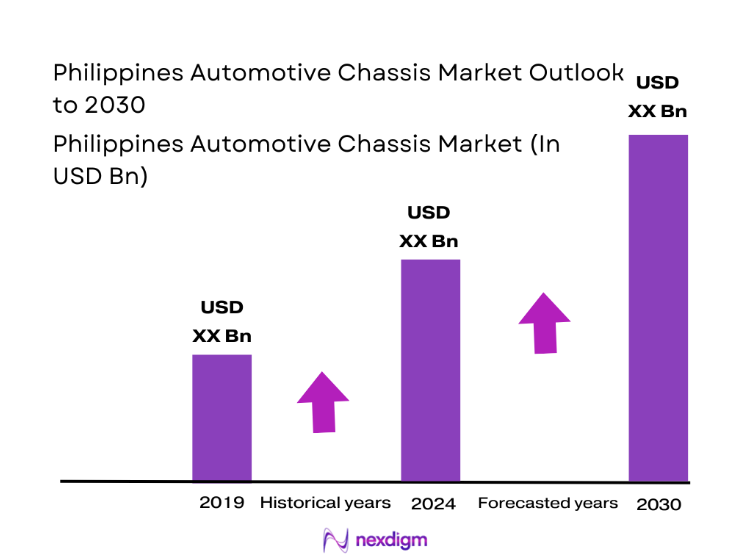

The Philippines Automotive Chassis Market is valued at USD ~, defines as a structurally critical segment of the national automotive ecosystem, underpinning every passenger and commercial vehicle produced or assembled in the country. Market scale is intrinsically linked to domestic vehicle sales, local assembly output, and replacement demand from aging fleets. Demand is driven by rising urban mobility needs, expanding logistics operations, and sustained investment in road infrastructure. Chassis platforms are increasingly viewed not only as structural components but as enablers of safety, durability, and future powertrain integration, making them central to OEM competitiveness and long term manufacturing strategies.

Within the Philippines, dominant demand centers include major urban and industrial regions where vehicle ownership density, fleet operations, and dealership networks are concentrated. These regions drive continuous turnover of passenger vehicles and sustained procurement of commercial units, reinforcing steady chassis demand. On the supply side, technology leadership and advanced platform design are influenced by overseas manufacturing hubs that serve as sources of engineering standards and production practices. Their dominance stems from mature automotive ecosystems, scale driven efficiencies, and early adoption of modular and electrification ready chassis architectures that shape domestic product offerings.

Market Segmentation

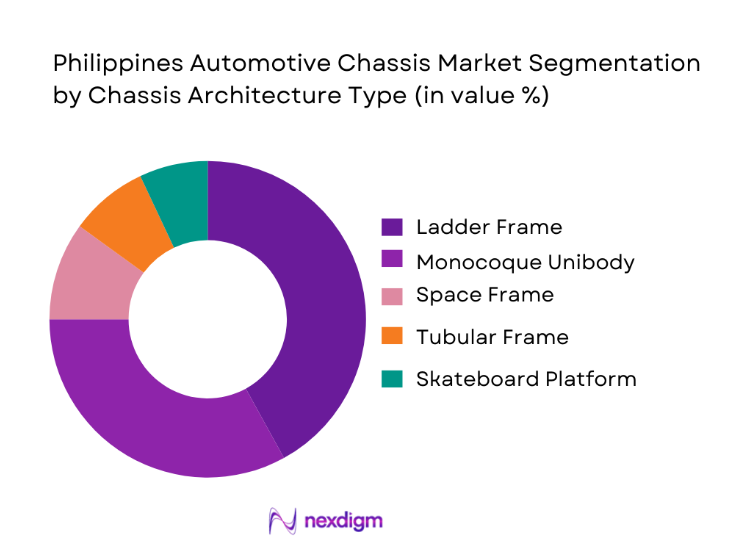

By Chassis Architecture Type

Within the Philippines Automotive Chassis Market, ladder frame platforms continue to dominate this segmentation due to their entrenched use in light commercial vehicles, pickup trucks, and utility focused passenger models. Their dominance is rooted in durability, ease of repair, and adaptability to rough road conditions that remain common across many parts of the country. Fleet operators and commercial buyers consistently favor ladder frame designs because of their higher load bearing capacity and longer service life, which translates into lower total cost of ownership. In addition, local body builders and modification specialists find ladder frames more compatible with customization requirements, further strengthening their market presence. While monocoque structures are expanding in urban passenger vehicles, the ladder frame remains the backbone of segments where robustness and flexibility outweigh weight reduction priorities, securing its leadership position in the overall architecture mix.

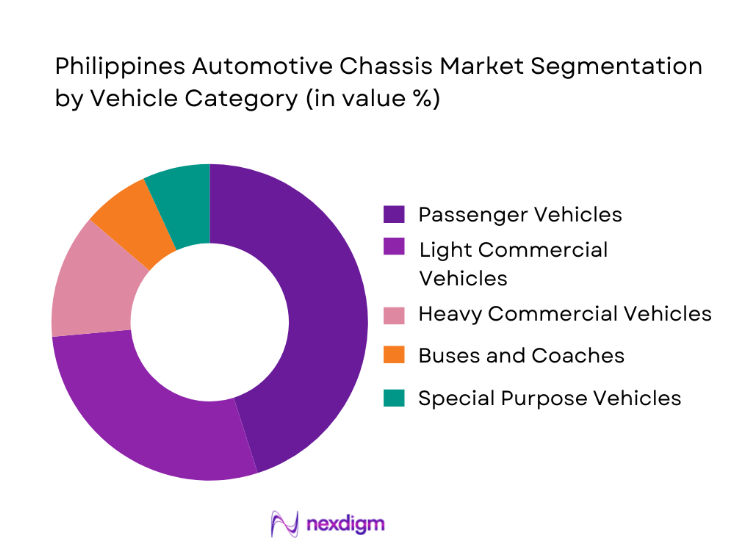

By Vehicle Category

In the segmentation by vehicle category, passenger vehicles dominate chassis demand due to the sheer scale of private car ownership and the continued aspiration for personal mobility across urban and peri urban populations. The dominance of this sub segment is reinforced by strong dealership networks, aggressive financing schemes, and consistent model refresh cycles by major automotive brands. Passenger vehicle buyers place growing emphasis on ride comfort, safety, and brand reputation, all of which depend heavily on chassis engineering and platform stability. Furthermore, as urban congestion increases, demand for compact and mid size cars continues to rise, sustaining high volume production of passenger vehicle chassis. Although commercial vehicles play a critical economic role, their purchase cycles are more investment driven and episodic, whereas passenger vehicle demand maintains a steady and predictable flow that secures its leading share in the overall market structure.

Competitive Landscape

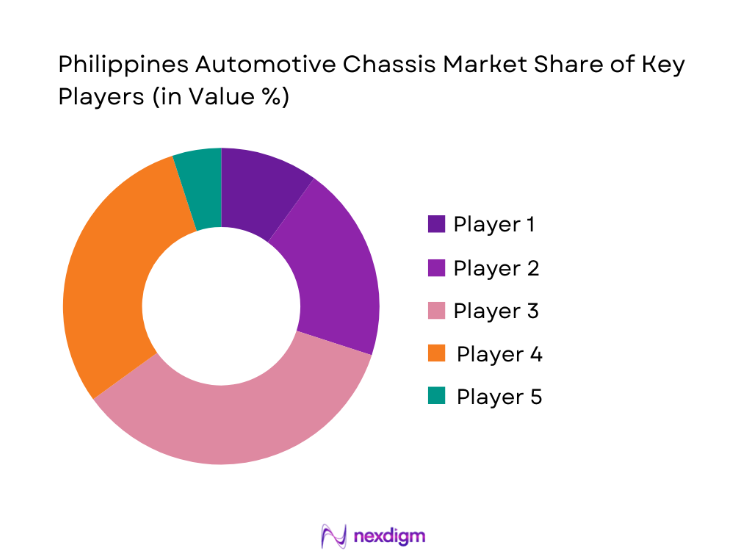

The Philippines Automotive Chassis market is dominated by a few major players, including Toyota Motor Philippines and global or regional brands like Mitsubishi Motors Philippines, Isuzu Philippines Corporation, and Nissan Philippines. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | Chassis Material Focus | Local Assembly Presence | EV/Hybrid Platform Readiness | Dealer Network Coverage | After-Sales Support |

| Toyota Motor Philippines | 1988 | Philippines | ~ | ~ | ~ | ~ | ~ |

| Mitsubishi Motors Philippines | 1980 | Philippines | ~ | ~ | ~ | ~ | ~ |

| Isuzu Philippines | 1974 | Philippines | ~ | ~ | ~ | ~ | ~ |

| Nissan Philippines | 1969 | Philippines | ~ | ~ | ~ | ~ | ~ |

| Ford Philippines | 1997 | Philippines | ~ | ~ | ~ | ~ | ~ |

Philippines Automotive Chassis Market Analysis

Growth Drivers

Expansion of Commercial Fleets and Logistics Infrastructure

The steady expansion of logistics, e commerce, and construction activities across the Philippines has significantly increased demand for durable and high load bearing vehicle platforms. As businesses scale delivery operations and infrastructure projects accelerate, fleet operators prioritize vehicles that can withstand intensive usage cycles. This directly elevates the importance of robust chassis architectures capable of supporting higher payloads and prolonged service life. OEMs respond by reinforcing ladder frame and heavy duty platform offerings, while suppliers align production to meet volume requirements. The outcome is a structurally reinforced market environment where chassis demand grows in parallel with national economic activity, positioning the segment as a core enabler of industrial and commercial mobility.

OEM Platform Modernization and Safety Compliance

The continuous evolution of vehicle safety standards and consumer expectations has driven OEMs to modernize chassis platforms across product lines. Advanced crash management systems, improved rigidity, and enhanced corrosion resistance have become integral design priorities. These upgrades require sustained investment in engineering, testing, and supplier collaboration, elevating the strategic value of chassis development. As manufacturers refresh model portfolios, chassis redesign becomes a central component of lifecycle planning. The result is a market dynamic where replacement cycles shorten, technology content increases, and chassis suppliers gain greater influence in shaping vehicle competitiveness and long term brand positioning.

Challenges

Dependence on Imported Raw Materials

A major challenge for the Philippines Automotive Chassis Market is the continued reliance on imported steel and advanced alloys, which exposes manufacturers to supply disruptions and cost volatility. Fluctuations in global commodity markets and logistics constraints directly affect production planning and pricing stability. For local assemblers and component suppliers, this dependence limits margin flexibility and complicates long term capacity investments. The impact extends across the value chain, as OEMs must balance cost pressures with the need to maintain quality and safety standards. Over time, this structural dependency underscores the need for deeper localization strategies that remain complex and capital intensive.

Limited Advanced Manufacturing Capabilities

While the Philippines has made progress in automotive assembly, advanced chassis manufacturing such as high precision stamping, lightweight material forming, and modular platform integration remains constrained. This limits the ability of domestic suppliers to fully participate in next generation vehicle programs, particularly those involving electrified or highly digitalized architectures. As global OEMs increasingly standardize platforms, local facilities face pressure to upgrade equipment and skills. The gap between current capabilities and future requirements creates operational challenges that could slow technology transfer and delay the adoption of innovative chassis solutions across the domestic market.

Opportunities

Localization of Modular Chassis Manufacturing

The growing emphasis on modular vehicle platforms presents a strategic opportunity for the Philippines Automotive Chassis Market to attract localized manufacturing investments. Modular chassis systems allow OEMs to share components across multiple models, improving economies of scale and simplifying supply chains. By positioning local facilities as capable partners in modular production, the country can strengthen its role within regional automotive networks. This shift would reduce dependency on fully imported platforms while creating pathways for technology transfer, workforce upskilling, and supplier ecosystem development, ultimately enhancing long term industrial resilience.

Development of EV Ready Chassis Platforms

As electrification gradually gains momentum, the demand for chassis platforms capable of accommodating battery systems and electric drivetrains will increase. This transition offers an opportunity for domestic assemblers and suppliers to participate early in EV platform adaptation, even before large scale adoption materializes. By investing in structural redesigns and safety reinforcements specific to electric vehicles, the local industry can future proof its manufacturing base. Such proactive positioning enhances competitiveness and ensures that the Philippines Automotive Chassis Market remains relevant as global vehicle technologies continue to evolve.

Future Outlook

The Philippines Automotive Chassis Market is positioned for steady strategic evolution as vehicle demand aligns with broader economic development and infrastructure expansion. Over the coming years, the market will increasingly balance the need for durable conventional platforms with the gradual introduction of electrification ready architectures. Success will depend on the ability of OEMs and suppliers to localize production capabilities, strengthen supply chain resilience, and integrate advanced engineering standards. As public transport modernization and commercial fleet growth continue, chassis platforms will remain central to mobility solutions, shaping long term competitiveness across the national automotive landscape.

Major Players

- Toyota Motor Philippines

- Mitsubishi Motors Philippines

- Isuzu Philippines Corporation

- Nissan Philippines

- Ford Philippines

- Suzuki Philippines

- Honda Cars Philippines

- Hyundai Motor Philippines

- Kia Philippines

- Foton Motor Philippines

- Hino Motors Philippines

- UD Trucks Philippines

- Tata Motors Philippines

- BYD Philippines

- JAC Motors Philippines

Key Target Audience

- Automotive OEM procurement and sourcing divisions

- Tier one and tier two chassis and component suppliers

- Commercial fleet operators and logistics companies

- Public transport authorities and fleet modernization agencies

- Automotive financing and leasing corporations

- Investments and venture capitalist firms

- Government and regulatory bodies

- Infrastructure and construction companies with vehicle fleets

Research Methodology

Step 1: Identification of Key Variables

The research process begins with mapping the full automotive ecosystem, identifying OEMs, suppliers, distributors, and end users that influence the Philippines Automotive Chassis Market. Secondary research across industry publications and proprietary databases is used to define demand drivers, technology trends, and structural dependencies. This step establishes the analytical framework for the entire study.

Step 2: Market Analysis and Construction

Historical production and sales indicators are analyzed to construct the market baseline. Chassis demand is derived from vehicle output, replacement cycles, and aftermarket activity. Segmentation logic is applied to align architecture types, vehicle categories, and customer use cases with revenue flows.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary market hypotheses are validated through structured interviews with industry executives, supply chain managers, and technical specialists. These interactions provide qualitative depth on procurement behavior, platform strategies, and future investment priorities, ensuring real world relevance of the analysis.

Step 4: Research Synthesis and Final Output

All quantitative and qualitative findings are integrated into a unified market model. Cross verification across multiple data sources ensures internal consistency. The final output reflects a balanced perspective that aligns operational realities with strategic market insights.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, chassis system taxonomy and module mapping, market sizing logic by vehicle production and chassis content value, revenue attribution across modules materials and service parts, primary interview program with OEMs assemblers Tier 1s and material suppliers, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Chassis Architectures in the Philippines

- Local Assembly Footprint and Import Dependence of Chassis Modules

- Chassis Value Chain Mapping Across Assemblers Tier Suppliers and Aftermarket

- Impact of Road Conditions and Load Profiles on Chassis Specification Choices

- Growth Drivers

Growth in commercial vehicle and logistics demand

Public transport modernization and fleet replacement activity

Rising SUV and pickup preference in mass market segments

Aftermarket demand for suspension and steering replacements

Infrastructure development driving vehicle utilization and wear - Challenges

Import dependency for major chassis modules and components

Steel price volatility and supply constraints for castings and forgings

Quality variation in aftermarket parts and counterfeit risks

Tooling investment barriers for local module manufacturing

Vehicle durability issues due to road condition stress profiles - Opportunities

Localization of stamping and fabrication for frames and brackets

Growth of bus and truck body builder ecosystems

Chassis upgrades for electrified jeepneys and e buses

Aftermarket premiumization through durability and warranty offerings

Partnerships for local assembly of steering and suspension modules - Trends

Shift toward modular chassis assemblies to improve serviceability

Increased focus on corrosion protection in coastal and humid environments

Adoption of electronic stability and chassis control features

Growth of lightweighting in select passenger vehicle programs

Supplier consolidation and strategic sourcing by assemblers - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Vehicle Production Linked Chassis Content, 2019–2024

- By OEM vs Aftermarket Revenue Split, 2019–2024

- By Module Mix and ASP Waterfall, 2019–2024

- By Fleet Type (in Value %)

Passenger cars

SUVs and crossovers

Light commercial vehicles

Buses and coaches

Trucks and vocational vehicles - By Application (in Value %)

Frame and body structures

Suspension and subframe assemblies

Steering systems and columns

Braking systems and corner modules

Chassis electronics and control units - By Technology Architecture (in Value %)

Body on frame architectures

Unibody chassis platforms

Multi material chassis structures

Heavy duty reinforced chassis systems

Integrated chassis control and stability systems - By Connectivity Type (in Value %)

OEM assembler direct sourcing and nomination

Tier 1 module supply and integration

Sub tier forging casting and stamping supply

Aftermarket service parts distribution

Local fabrication and contract manufacturing partnerships - By End-Use Industry (in Value %)

Vehicle assemblers and OEMs

Commercial vehicle OEMs and body builders

Tier 1 chassis module suppliers

Aftermarket parts and service networks

Material suppliers and fabricators - By Region (in Value %)

NCR

CALABARZON

Central Luzon

Visayas

Mindanao

- Competitive ecosystem structure across assemblers Tier suppliers and aftermarket brands

- Positioning driven by durability localization footprint and channel coverage

- Partnership models between assemblers Tier suppliers and body builders

- Cross Comparison Parameters (chassis content value per vehicle, localization share and local manufacturing footprint, durability performance under road load conditions, module integration capability, aftermarket fitment coverage breadth, warranty and return policy strength, lead time and parts availability, cost competitiveness)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Toyota Motor Philippines

Mitsubishi Motors Philippines

Isuzu Philippines

Hyundai Motor Philippines

Nissan Philippines

Honda Cars Philippines

Foton Motor Philippines

Hino Motors Philippines

Suzuki Philippines

Ford Philippines

Bosch

ZF Friedrichshafen

Dana Incorporated

Aisin

Nexteer Automotive

- Assembler sourcing criteria for cost durability and localization

- Fleet operator priorities for uptime and maintenance economics

- Aftermarket buyer preferences for fitment coverage and warranty

- Dealer and service network influence on parts selection

- Total cost of ownership drivers across wear parts and repair cycles

- By Value, 2025–2030

- By Vehicle Production Linked Chassis Content, 2025–2030

- By OEM vs Aftermarket Revenue Split, 2025–2030

- By Module Mix and ASP Waterfall, 2025–2030