Market Overview

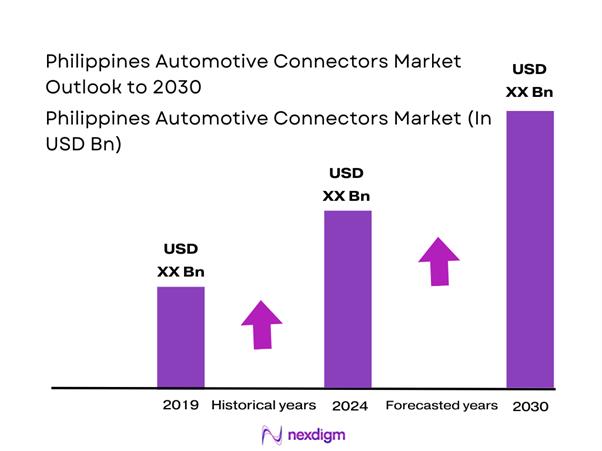

The Philippines Automotive Connectors Market (scope-aligned to automotive wiring harness assemblies and the connector/terminal content embedded within them) is valued at USD ~ million, based on country-level market sizing for the Philippines automotive wiring harness ecosystem. The market’s momentum is reinforced by rising electronic content per vehicle and expanding local harness capability investments. On the vehicle demand side, new-vehicle sales increased from ~ units to ~ units, lifting connector demand across OEM and tier supply chains.

Dominance within the Philippines value chain is led by Luzon-centric manufacturing and consumption corridors, anchored by NCR–CALABARZON logistics density, export gateways, and supplier parks that support just-in-time harness/connector feeding to assemblers and tier-1s. The market’s external pull is shaped by Japan and wider ASEAN automotive supply networks, where Philippine-based harness and sub-assembly operations plug into regional platforms; this favors high-throughput, automotive-grade connectorization. At the regional benchmark level, Asia-Pacific remains the largest automotive connector hub due to dense electronics supply chains and vehicle output—an influence that cascades into Philippine sourcing and qualification norms.

Market Segmentation

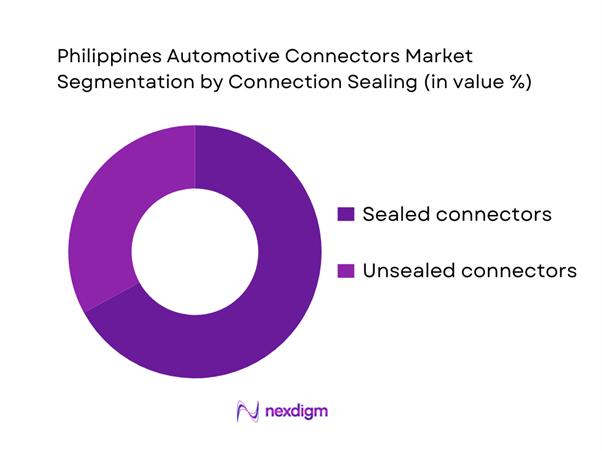

By Connection Sealing

Sealed connectors lead because Philippine operating conditions and duty cycles strongly reward protection against moisture ingress, road splash, flooding exposure, coastal salinity, dust, vibration, and thermal cycling—all of which accelerate fretting corrosion and intermittent faults in unsealed interfaces. OEM platform strategies also increasingly standardize sealed families to reduce SKU sprawl and improve warranty outcomes across multiple trims. The rise in sensor-rich harnessing (camera/radar interfaces, wheel-speed, IMU, body control, and power distribution nodes) increases the number of exposed connection points, expanding the sealed addressable base. In parallel, fleet uptime requirements (LCVs, logistics vans, buses) push demand toward higher IP-rated designs, secondary locks, and CPA/TPA features that prevent back-out under vibration. These factors collectively sustain sealed connector preference in both OEM harness builds and higher-grade aftermarket replacements.

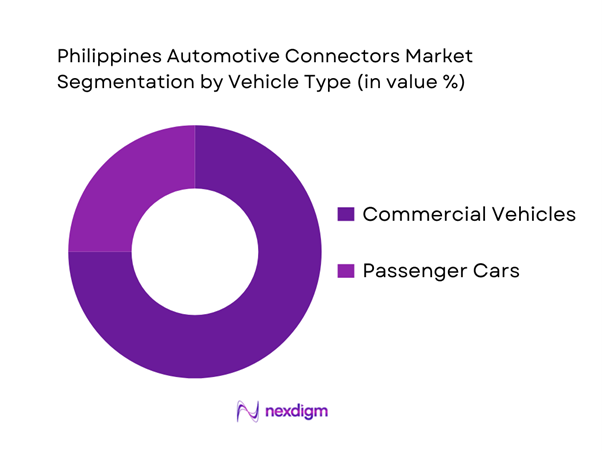

By Vehicle Type

Commercial vehicles dominate connector demand in the Philippines because the sales mix is structurally weighted toward utility-driven purchases—fleet replenishment, last-mile delivery expansion, SME logistics, public transport modernization, and construction-linked mobility. Commercial platforms also carry higher harness complexity per operating hour, as fleets add telematics, GPS trackers, camera systems, driver monitoring, auxiliary lighting, refrigeration interfaces (where applicable), and rugged power distribution—each adding connector count and more frequent replacement cycles. Operators prioritize durability and serviceability, supporting recurring demand for terminals, housings, seals, and repair kits through distributor networks. Additionally, LCV and UV variants often run in harsher environments (stop-go, heat, water exposure), accelerating connector wear and making sealed, vibration-resistant connectors more common. This combination of volume-led dominance and higher “connector touchpoints per vehicle lifecycle” keeps commercial vehicle-linked connector demand structurally ahead.

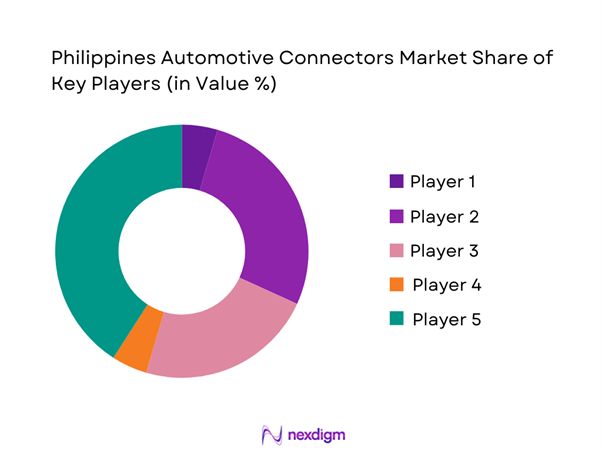

Competitive Landscape

The Philippines automotive connectors ecosystem is influenced by global connector OEMs and harness-focused tier-1s that control platform qualification, tooling, and PPAP-grade crimp/termination systems. Competitive intensity is shaped by OEM cost-down programs, localization/dual-sourcing mandates, and fast-evolving requirements for sealed interfaces, mixed-signal connectors, and EV-ready high-voltage interconnects. At the broader industry level, major connector leaders include Aptiv, Yazaki, TE Connectivity, among others—reflecting a consolidated core with specialized players expanding through capability investments and acquisitions.

| Company | Est. year | HQ | Philippines / ASEAN supply role (market-specific) | Core connector focus (LV/HV/Data) | Sealing & robustness capability | Typical vehicle applications | Manufacturing / tooling strength | Quality & compliance posture |

| Yazaki Corporation | 1941 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Sumitomo Electric / Sumitomo Wiring Systems | 1897 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| TE Connectivity | 1941 | Switzerland/Ireland (legal), global ops | ~ | ~ | ~ | ~ | ~ | ~ |

| Aptiv PLC | 1994 (as Aptiv spin) | Ireland | ~ | ~ | ~ | ~ | ~ | ~ |

| Amphenol (Automotive interconnect divisions) | 1932 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Automotive Connectors Market Dynamics and Performance Analytics

Growth Drivers

Rising electrical and electronic content per vehicle

Rising vehicle production imports and higher-feature trim demand are pushing connector intensity upward in the Philippines—more ECUs, sensors, infotainment modules, and networked actuators translate into higher pin-counts, sealed interfaces, and more harness branches per platform. The local “pull” is visible in the scale of new-vehicle throughput: total industry sales reached ~ units and then increased to ~ units, which expands the installed base that returns for warranty work, collision repair, and electrical replacements (terminals, housings, backshells, grommets). Macro conditions also support higher electronics penetration: the economy reached USD ~ billion in output and grew by ~ (annual growth, indicator value), sustaining consumer lending and fleet refresh cycles that tend to favor higher-spec variants. On the demand side, connectivity-linked usage is structurally high: mobile cellular subscriptions totaled ~, and internet use reached ~ (indicator value), encouraging OEMs and distributors to differentiate with connected head units, cameras, and telematics-ready wiring—each raising connector count and specification stringency (CPA locks, secondary locks, polarization keys).

Expansion of wiring harness exports

Connector demand grows disproportionately when wiring-harness activity scales, because harnesses convert commodity wire into value-added assemblies that require terminals, seals, housings, and testing. The Philippines’ export structure is electronics-heavy, and that matters because harnessing sits inside the broader electrical/electronics export ecosystem. In trade terms, total exports moved from USD ~ to USD ~ while total imports reached USD ~—a scale that keeps factories operating in global supply networks where harness sub-assemblies and cable sets are frequently traded across borders before final vehicle integration. In monthly performance, electronics exports were reported at USD ~ out of total exports of USD ~ , reinforcing that connector-adjacent industries remain a major foreign-exchange earner and therefore attract sustained operational capacity and compliance investment. As domestic vehicle volumes rise (units sold above), distributors and tier suppliers typically rationalize connector part numbers and adopt more standardized connector families (e.g., sealed series for engine bay, unsealed for interior), increasing local pull-through for harness and connector services (crimp validation, pull-force checks, continuity and insulation tests).

Challenges

High import dependency

Automotive connectors in the Philippines are heavily exposed to import dependency because key inputs—precision terminals, engineered polymer housings, seals, and plating chemicals—are typically sourced through regional manufacturing hubs and distributed via importer networks. The macro trade structure highlights the scale of reliance: imports totaled USD ~, while exports totaled USD ~, which implies a persistent import-heavy supply position that affects lead times, FX sensitivity, and MOQ constraints for connector SKUs. At the industry level, domestic demand is substantial: new-vehicle sales increased from ~ to ~ units, which expands immediate replacement demand (collision repair, accessory installs, warranty wiring fixes) and forces local distributors to broaden inventories—often achieved through imports rather than local conversion. Import dependency also affects standardization and traceability: when the channel fragments across multiple importers, workshops may substitute non-equivalent parts, raising failure risks (water ingress, intermittent contacts). A logistics-performance angle matters too: the Philippines ranked ~ with an LPI score of ~, indicating that while trade movement is functional, variability can still translate into sporadic availability of specialized sealed connector series. For business buyers, the import profile turns connector procurement into a working-capital problem—broader SKU coverage requires deeper inventories to protect service-level targets.

Extended global lead times

Lead-time risk for connectors in the Philippines is amplified by two measurable realities: the country’s large import throughput and logistics variability that can delay replenishment of high-mix, low-volume connector SKUs. Imports totaled USD ~, meaning the connector ecosystem competes for container capacity and clearance attention with broader industrial inputs. From a logistics benchmark perspective, the Philippines ranked ~ with an LPI score of ~, and sub-dimensions (customs, infrastructure, international shipments, logistics competence, tracking, timeliness) shape how quickly high-priority electronics parts can move from port to plant or distributor. When vehicle sales rise from ~ to ~ units, the “service urgency” increases: workshops and fleet operators cannot wait weeks for a specific sealed connector or terminal family needed to return a vehicle to operation. The practical impact is that distributors increase safety stock, but the SKU breadth in connectors is extreme (different keying, cavity counts, sealing levels, terminal gauges), making it hard to buffer everything. This pushes buyers toward alternates, which can create compatibility issues (incorrect mating geometry, CPA mismatch) and raise rework rates. Operationally, longer replenishment cycles also complicate PPAP-aligned sourcing because any upstream delay can push out qualification builds and production readiness timelines.

Opportunities

High-voltage connector localization

High-voltage connector localization is a high-upside opportunity because the EV charging ecosystem is being formalized and scaled through official accreditation—creating predictable demand for HV-rated interconnects, sealed power connectors, and charging inlet assemblies. Official authorities cited ~ accredited EV charging station providers and later cited ~ accredited EVCS providers, signaling accelerating infrastructure participation (providers, projects, deployments) that pulls through connectors not only in vehicles but also in chargers (power modules, contactors, monitoring, and communication interfaces). The macroeconomic base supports investment feasibility: GDP at USD ~ billion and growth at ~ (indicator value) sustain capex cycles among energy players, property developers, and fleets. Localization logic strengthens when trade dependence is high (imports USD ~): local conversion of HV harnesses and connector assemblies can reduce lead times, improve compliance control, and enable faster service response. Importantly, localization does not require full polymer or terminal metallurgy immediately—near-term steps include local assembly of accredited connector families, kitting, overmolding, and testing services (hipot, insulation resistance) aligned to EV safety requirements. As new vehicle sales rise (units above), OEMs can justify introducing additional electrified trims, raising steady-state demand for HV service parts and validated repair kits—an attractive niche for Philippine manufacturers already embedded in electronics supply chains.

Sealed connectors for tropical operating conditions

The Philippines’ climate and disaster profile creates a durable demand case for sealed connectors (IP67/IP68-class families, improved grommets, rear seals, and CPA-secured housings) because moisture ingress, corrosion, and vibration are persistent failure drivers—especially for engine bay, underbody, and exterior sensor locations. Government weather context highlights that the Philippines sits in a high tropical-cyclone exposure zone; an average of ~ tropical cyclones enter the Philippine Area of Responsibility annually (a planning-relevant baseline used by industry for design and maintenance schedules). Safety and continuity pressures are also visible in road impact: fatalities increased from ~ to ~, a context in which sensor reliability and lighting and ECU integrity matter (poor electrical integrity can disable safety features and lighting). As vehicle sales rose from ~ to ~ units, the number of vehicles operating in heavy rainfall, floods, and coastal corrosion environments rises, increasing total connector failure incidents and pushing fleets and workshops toward higher-quality sealed repair kits rather than generic unsealed substitutes. Macro capability supports premiumization: GDP at USD ~ billion enables higher-spec replacement behaviors in commercial fleets (delivery, ride-hailing, logistics) where downtime costs exceed part costs. The near-term opportunity is therefore not future forecasts but current-condition-driven product migration: more sealed connectors specified in aftermarket harness repairs, accessories, and sensor retrofits, supported by training and tooling ecosystems that ensure seals are correctly assembled and verified.

Future Outlook

Over the next five years, the Philippines automotive connectors ecosystem is expected to expand steadily as vehicles add more electronic nodes per platform and as supply chains demand higher reliability interconnects suited to tropical operating conditions. The market’s evolution will be shaped by deeper adoption of sealed architectures, growth in ADAS-linked sensor harnessing, and broader fitment of connectivity and infotainment modules. At the global benchmark level, the automotive connector industry is projected to advance at ~ CAGR, with mix-shift toward high-voltage and high-speed data interconnects.

Major Players

- Yazaki Corporation

- Sumitomo Electric Industries / Sumitomo Wiring Systems

- Furukawa Electric / Furukawa Automotive Systems

- Aptiv PLC

- TE Connectivity

- Amphenol Corporation

- Molex

- Japan Aviation Electronics

- Lear Corporation

- LEONI AG

- DRÄXLMAIER Group

- Yazaki-Torres Manufacturing

- Kyocera AVX

- Littelfuse

Key Target Audience

- Vehicle OEMs and local assemblers

- Tier-1 wiring harness manufacturers and module integrators

- Tier-2 connector and terminal manufacturers and molding and tooling suppliers

- Automotive electronics and ADAS module suppliers

- Aftermarket distributors for electrical parts

- Fleet owners and fleet maintenance procurement teams

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We build a Philippines-specific ecosystem map across OEM and assembler nodes, harness tiering, connector OEMs, distributors, and tooling partners. Desk research consolidates platform architectures, connector sealing needs, and duty-cycle requirements to define variables such as sealed penetration, termination complexity, and qualification depth.

Step 2: Market Analysis and Construction

We compile historical demand indicators (vehicle sales mix, production and assembly indicators, electronics feature penetration) and map them to connector “touchpoints” per vehicle system (body, powertrain, chassis, safety and control, infotainment). This constructs a bottom-up demand model aligned to harness assemblies and connector content.

Step 3: Hypothesis Validation and Expert Consultation

We validate segmentation logic and demand drivers through CATI-style interviews with harness production managers, quality heads, and aftermarket channel operators. Inputs focus on failure modes, replacement cycles, SKU velocity, and OEM qualification and PPAP barriers impacting connector sourcing.

Step 4: Research Synthesis and Final Output

We triangulate findings with supplier capability reviews (tooling, stamping, molding, plating, test and inspection) and compile the final market narrative covering segmentation, competition, and forward-looking connector technology shifts (sealed, HV, mixed-signal, zonal E and E).

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Scope Boundaries, Currency and Inflation Treatment, Market Sizing Logic, Primary Interview Framework, Demand-Supply Triangulation, Quality Control Checks, Data Validation and Reconciliation, Limitations and Future Considerations)

- Definition and Scope

- Market Genesis and Evolution of Vehicle Electrical and Electronic Architectures

- Philippines Automotive Manufacturing and Export Linkages Context

- Business Cycle and Demand Seasonality

- Automotive Electrical Value Chain Mapping

- Growth Drivers

Rising electrical and electronic content per vehicle

Expansion of wiring harness exports

ADAS feature penetration

Infotainment and connectivity proliferation

Electrification and EV-readiness - Challenges

High import dependency

Extended global lead times

Counterfeit and grey-market exposure

Crimping and quality consistency issues

Lengthy qualification and PPAP cycles - Opportunities

High-voltage connector localization

Sealed connectors for tropical operating conditions

Advanced data and RF connectivity demand

Standardized repair and service connector kits

Value-added distributor kitting and assembly - Trends

Shift toward zonal and domain architectures

Miniaturization and higher pin-density designs

High-temperature and corrosion-resistant polymers

Enhanced connector safety locking mechanisms - Regulatory & Policy Landscape

Automotive quality and supplier standards

Electrical safety and material compliance

Environmental and reliability testing norms

Aftermarket and counterfeit control mechanisms - SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Realized Price, 2019–2024

- By Technology Architecture (in Value %)

Sealed wire-to-wire connectors

Unsealed wire-to-wire connectors

Wire-to-board and board-to-board connectors

Terminals, lugs, splices and ferrules

High-voltage connectors - By Application (in Value %)

Powertrain and thermal systems

Body electronics

Chassis and safety systems

Infotainment and connectivity systems

ADAS and sensing systems - By Connectivity Type (in Value %)

Low-voltage power connectors

Signal and data connectors

RF and coax connectors

Battery and high-voltage connectors

Hybrid mechatronics connectors - By End-Use Industry (in Value %)

OEM and vehicle assemblers

Tier-1 wiring harness manufacturers

Tier-1 module manufacturers

Aftermarket service and repair

Fleet and commercial upfitters - By Region (in Value %)

Luzon

Visayas

Mindanao

- Market share analysis of major players

- Cross Comparison Parameters (local Philippines footprint and support model, program qualification and PPAP readiness, sealed connector capability for tropical exposure, high-voltage and EV connector portfolio depth, data and RF connectivity capability, lead-time and supply resiliency model, tooling and crimp ecosystem support, channel strength and authorized distribution coverage)

- Competitive benchmarking matrix

- Pricing analysis by reference SKUs

- Key Company Profiles

Yazaki

Sumitomo Wiring Systems

TE Connectivity

Aptiv

Lear Corporation

Molex

Amphenol

JST

Hirose Electric

Japan Aviation Electronics

Korea Electric Terminal

Rosenberger

Fujikura

Nexans Autoelectric Systems

- Demand and utilization patterns

- Procurement and sourcing decision framework

- Needs, desires, and pain-point assessment

- Channel switching triggers

- Buying and qualification journey

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Realized Price, 2025–2030